- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

European Growth Stocks With Strong Insider Ownership In September 2025

Reviewed by Simply Wall St

As European markets navigate a period of cautious optimism amid interest rate assessments and trade uncertainties, major indices like Germany's DAX and Italy's FTSE MIB have shown modest gains. In this environment, growth companies with strong insider ownership can be particularly appealing to investors seeking confidence in management alignment and potential resilience against market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 91.4% |

| KebNi (OM:KEBNI B) | 38% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Envipco Holding N.V. is involved in the development, manufacturing, assembly, leasing, sales, marketing, and servicing of reverse vending machines (RVMs) across the Netherlands, the United States, North America, and Europe with a market cap of €378.45 million.

Operations: Envipco Holding N.V. generates revenue through the development, production, leasing, sales, and servicing of reverse vending machines across various regions including the Netherlands, the United States, North America, and Europe.

Insider Ownership: 25.8%

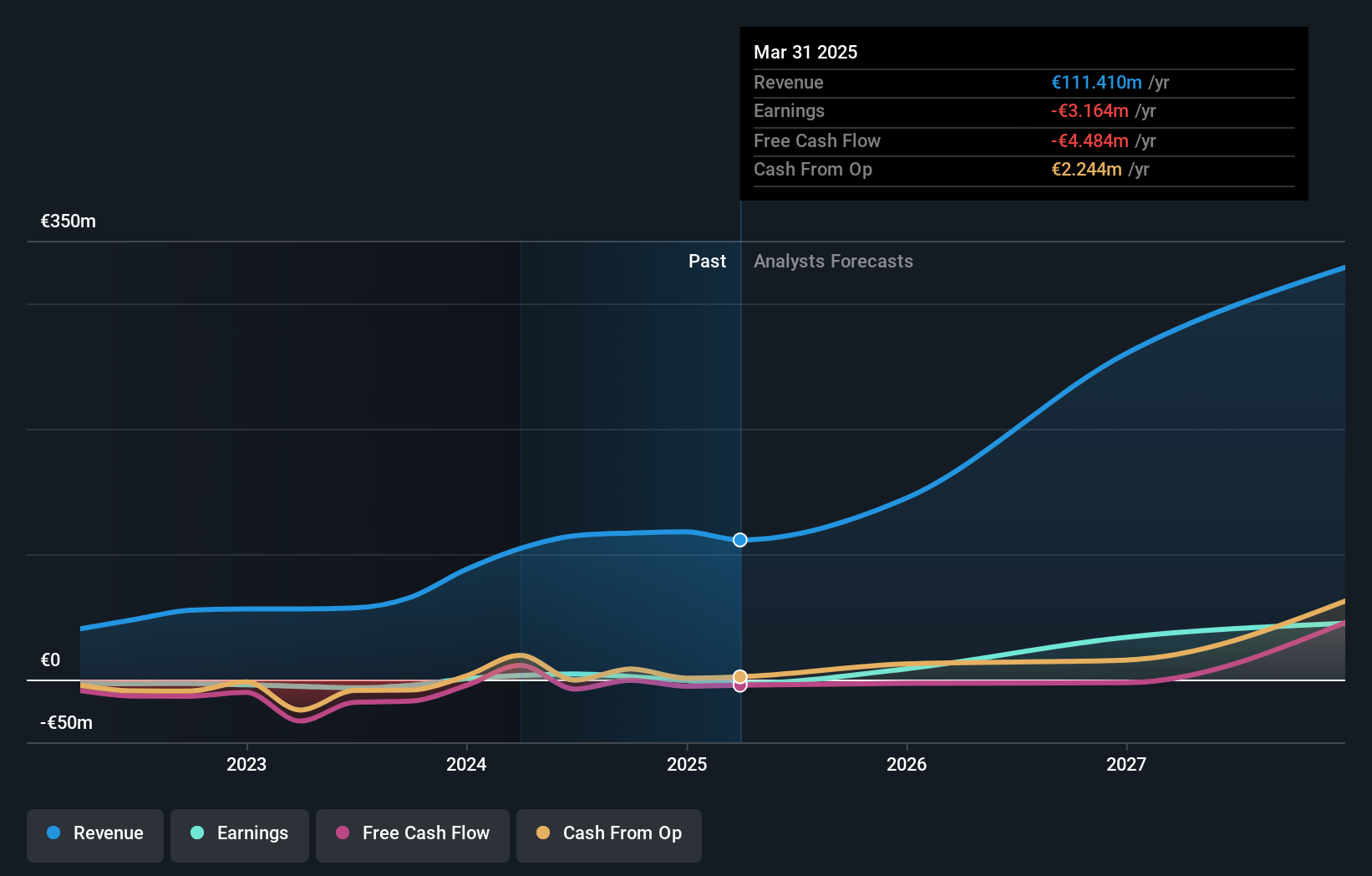

Envipco Holding has seen significant insider selling over the past three months, despite forecasts of high revenue growth at 21.7% annually, outpacing the Dutch market. Recent financial performance shows a net loss increase to EUR 2.52 million for Q2 2025 compared to last year, with sales declining to EUR 23.06 million. The company completed a NOK 630 million equity offering and secured an agreement with Statiegeld Nederland for RVM deliveries, potentially bolstering future growth prospects.

- Click to explore a detailed breakdown of our findings in Envipco Holding's earnings growth report.

- In light of our recent valuation report, it seems possible that Envipco Holding is trading behind its estimated value.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG develops, produces, sells, and services sensor systems, modules, and components across various regions including the Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF947.24 million.

Operations: The company's revenue from sensor systems, modules, and components amounts to CHF333.08 million.

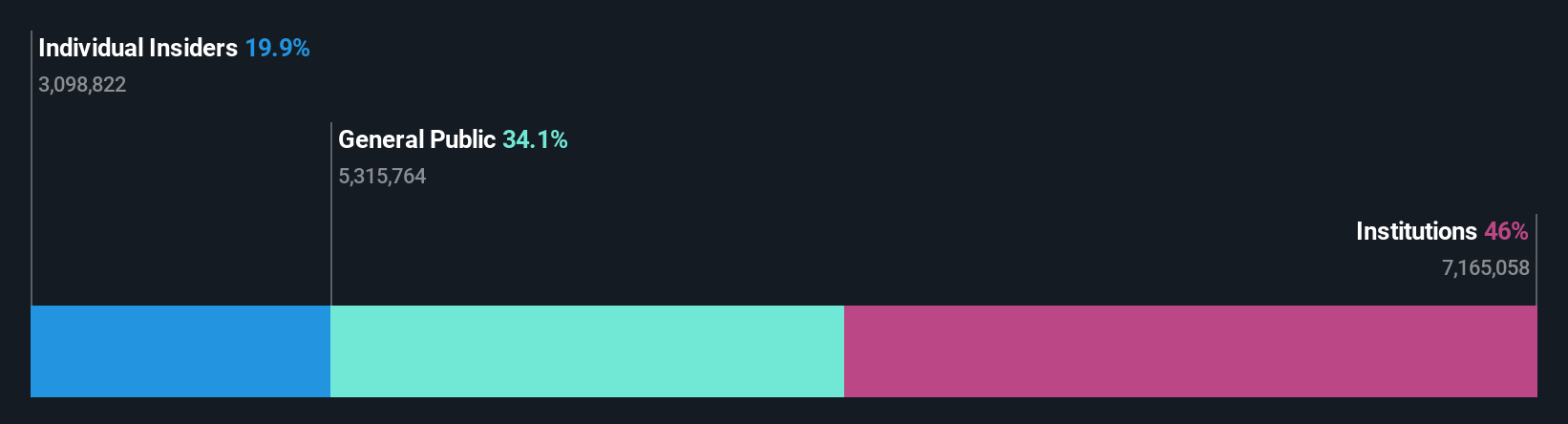

Insider Ownership: 19.9%

Sensirion Holding's recent product launch of the STCC4 sensor highlights its innovation in CO2 monitoring, potentially boosting growth. The company reaffirmed earnings guidance for 2025, projecting revenue between CHF 320 million and 340 million, indicating organic growth of up to 23% from last year. Despite high expected earnings growth of 30.2% annually, insider trading activity is limited over the past three months. Analysts anticipate a stock price increase of approximately 43.1%.

- Get an in-depth perspective on Sensirion Holding's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Sensirion Holding shares in the market.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG is a biotechnology company that develops biosimilar drugs in Germany and Switzerland, with a market cap of €390.38 million.

Operations: The company's revenue is primarily derived from its biotechnology segment, amounting to €51.78 million.

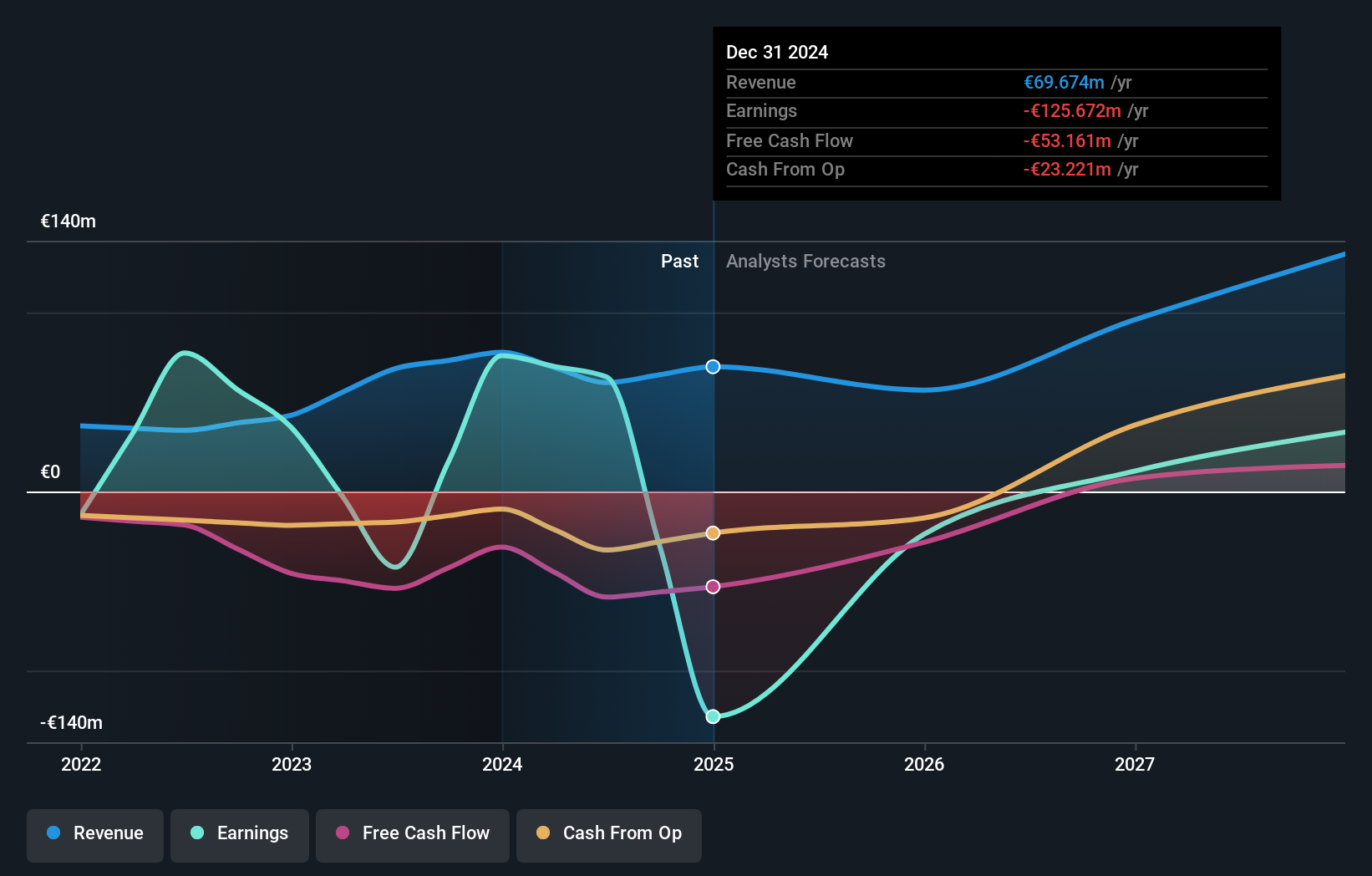

Insider Ownership: 14.2%

Formycon is poised for significant growth, with revenue expected to increase by 27.4% annually, outpacing the German market. Despite a current unprofitable status and recent removal from the TECDAX Index, Formycon's strategic focus on biosimilars like FYB206 positions it well in the biotech sector. The company reported a net loss of €54.19 million for H1 2025 but aims to achieve full-year revenues between €55 million and €65 million, reflecting ambitious growth targets amidst financial challenges.

- Dive into the specifics of Formycon here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Formycon's share price might be too optimistic.

Seize The Opportunity

- Click through to start exploring the rest of the 217 Fast Growing European Companies With High Insider Ownership now.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Develops, manufactures, assembles, leases, sells, markets, and services a line of reverse vending machines (RVMs) in the Netherlands, the United States, North America, and Europe.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives