- Germany

- /

- Healthcare Services

- /

- XTRA:V3V

VITA 34 (ETR:V3V investor three-year losses grow to 69% as the stock sheds €8.7m this past week

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of VITA 34 AG (ETR:V3V) have had an unfortunate run in the last three years. Unfortunately, they have held through a 69% decline in the share price in that time. The more recent news is of little comfort, with the share price down 30% in a year. More recently, the share price has dropped a further 16% in a month.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for VITA 34

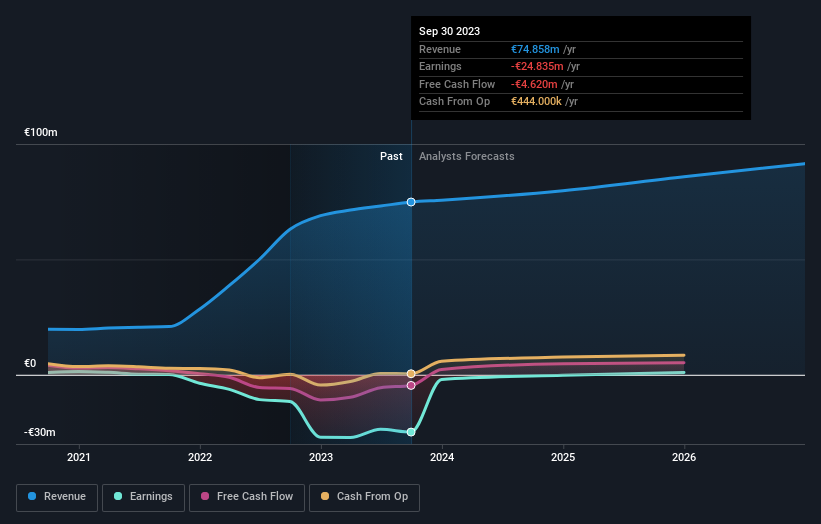

Because VITA 34 made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, VITA 34 grew revenue at 53% per year. That is faster than most pre-profit companies. In contrast, the share price is down 19% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

VITA 34 shareholders are down 30% for the year, but the market itself is up 4.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand VITA 34 better, we need to consider many other factors. Take risks, for example - VITA 34 has 2 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:V3V

VITA 34

Engages in the collection, processing, cryopreservation, and storage of stem cells from umbilical cord blood and tissue and postnatal tissue in Germany, Poland, Portugal, and internationally.

Fair value with moderate growth potential.