- Germany

- /

- Oil and Gas

- /

- XTRA:VBK

MTU Aero Engines And 2 Other German Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

In the midst of mixed signals from global markets, Germany's DAX Index has shown resilience with a modest gain of 0.35%. As economic indicators suggest both strengths and weaknesses within the Eurozone, investors are increasingly on the lookout for undervalued opportunities that may offer long-term value. Identifying stocks trading below their fair value can be particularly rewarding in volatile market conditions. In this article, we will explore MTU Aero Engines and two other German stocks that are estimated to be trading below their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bertrandt (XTRA:BDT) | €23.80 | €42.52 | 44% |

| Gerresheimer (XTRA:GXI) | €96.60 | €191.22 | 49.5% |

| M1 Kliniken (XTRA:M12) | €14.20 | €23.69 | 40.1% |

| ecotel communication ag (XTRA:E4C) | €13.20 | €22.25 | 40.7% |

| Verbio (XTRA:VBK) | €16.32 | €29.31 | 44.3% |

| RENK Group (DB:R3NK) | €24.755 | €43.28 | 42.8% |

| MTU Aero Engines (XTRA:MTX) | €262.40 | €493.94 | 46.9% |

| Dr. Hönle (XTRA:HNL) | €16.95 | €29.05 | 41.7% |

| LPKF Laser & Electronics (XTRA:LPK) | €8.27 | €12.45 | 33.6% |

| Vectron Systems (XTRA:V3S) | €11.05 | €17.61 | 37.3% |

Here's a peek at a few of the choices from the screener.

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG, with a market cap of €14.12 billion, develops, manufactures, markets, and maintains commercial and military aircraft engines as well as aero-derivative industrial gas turbines globally.

Operations: MTU Aero Engines generates revenue primarily from its Commercial Maintenance Business (MRO) at €4.45 billion and its Commercial and Military Engine Business (OEM) at €1.32 billion.

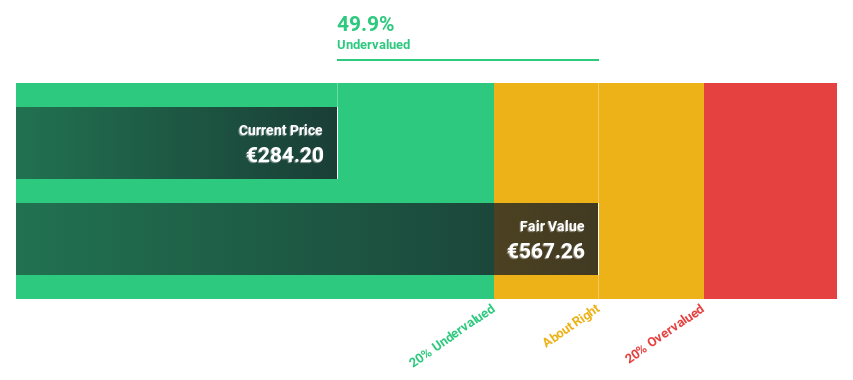

Estimated Discount To Fair Value: 46.9%

MTU Aero Engines is trading at €262.4, significantly below its estimated fair value of €493.94, suggesting it is undervalued based on cash flows. The company's earnings are forecast to grow 34.15% annually, with revenue growth expected at 12.2% per year, outpacing the German market's 5.2%. Recent half-year results show sales increased to €3.39 billion from €3.09 billion and net income rose to €285 million from €255 million year-over-year, reflecting strong financial performance and potential for future profitability above market averages.

- According our earnings growth report, there's an indication that MTU Aero Engines might be ready to expand.

- Take a closer look at MTU Aero Engines' balance sheet health here in our report.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally and has a market cap of approximately €223.46 billion.

Operations: The company's revenue segments include Applications, Technology & Services, generating €32.54 billion.

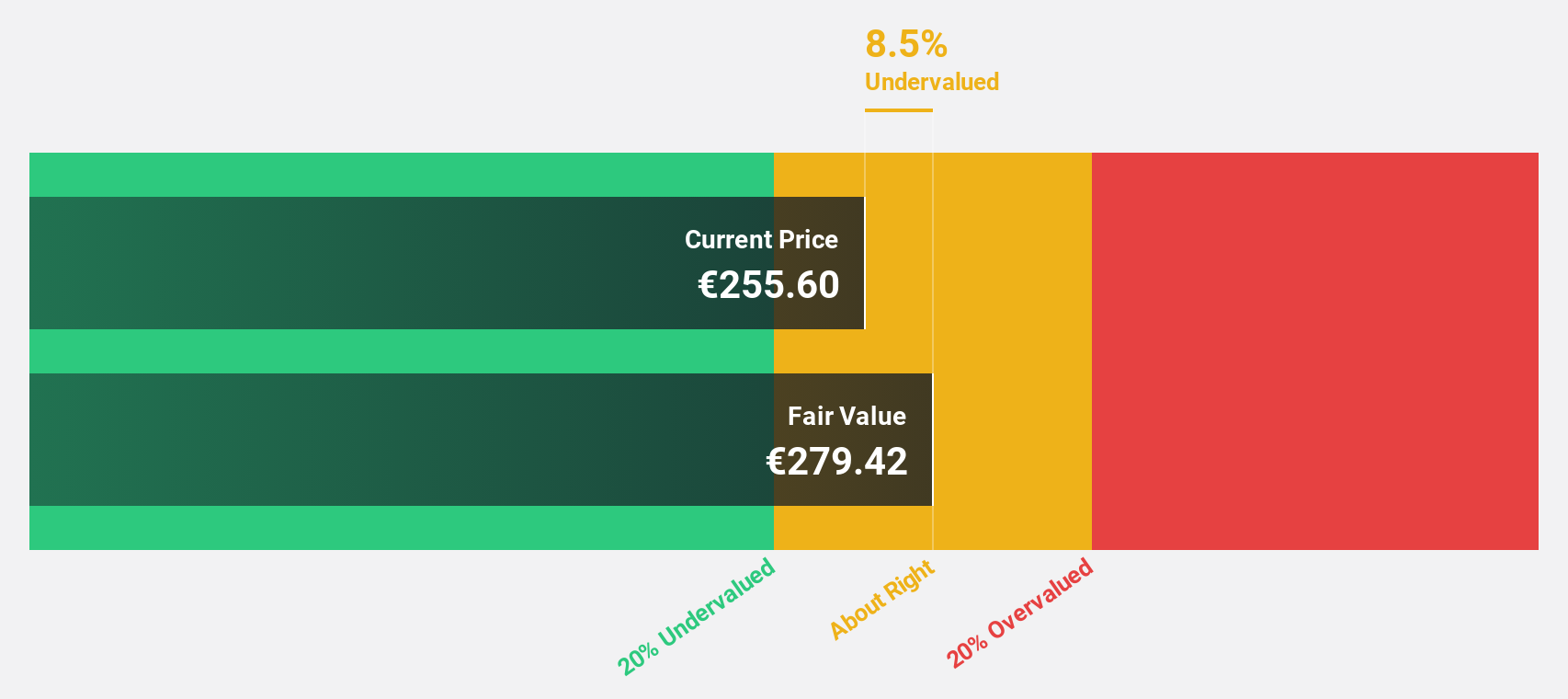

Estimated Discount To Fair Value: 33.4%

SAP is trading at €191.58, well below its estimated fair value of €287.85, indicating it is undervalued based on cash flows. The company's earnings are forecast to grow 37.88% annually, significantly outpacing the German market's 19.2%. Recent client wins like Xerox and Kyndryl adopting SAP solutions highlight strong demand for its cloud offerings, despite a dip in net income to €918 million from €2.98 billion year-over-year due to large one-off items impacting results.

- The analysis detailed in our SAP growth report hints at robust future financial performance.

- Click here to discover the nuances of SAP with our detailed financial health report.

Verbio (XTRA:VBK)

Overview: Verbio SE produces and supplies fuels and finished products in Germany and the rest of Europe, with a market cap of €1.04 billion.

Operations: The company's revenue segments include Biodiesel (€1.06 billion) and Bioethanol (including Biomethane) (€704.92 million).

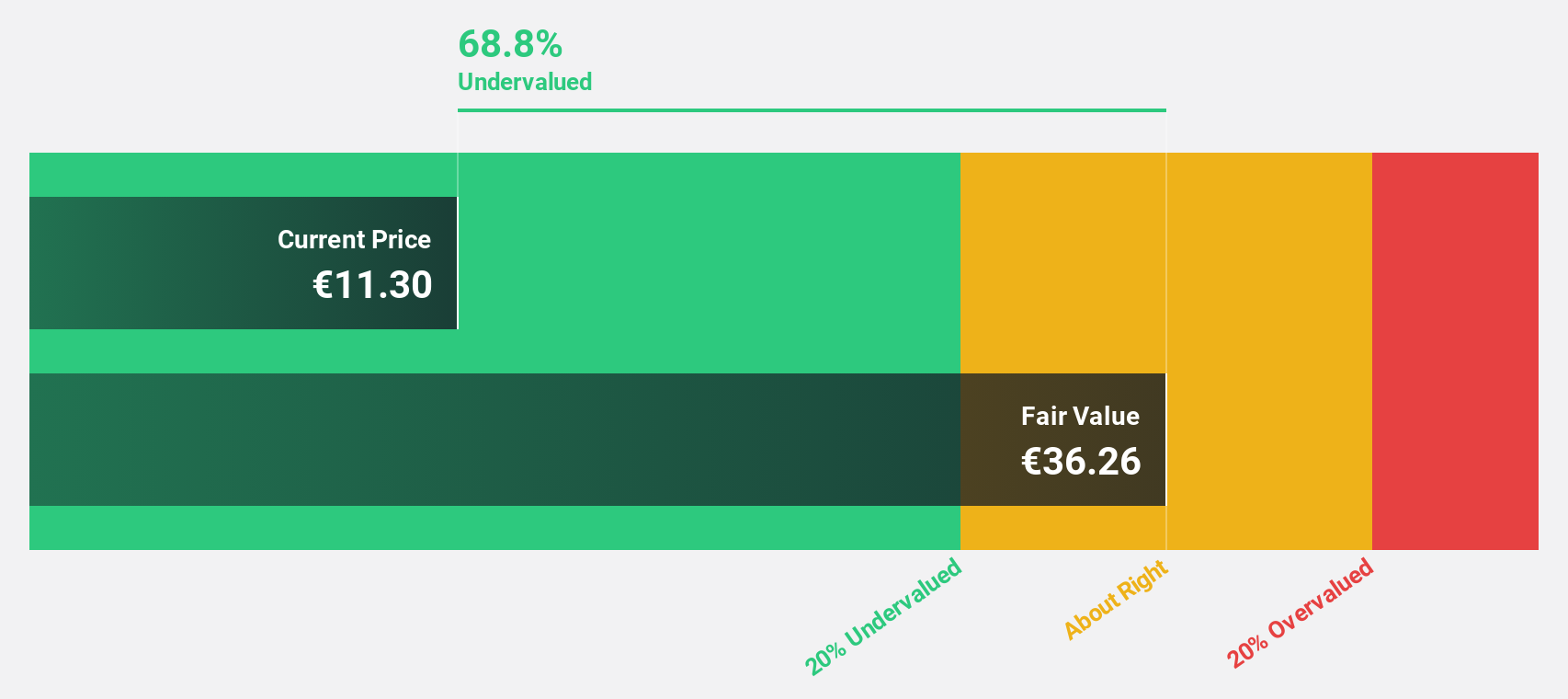

Estimated Discount To Fair Value: 44.3%

Verbio SE, trading at €16.32, is significantly undervalued compared to its estimated fair value of €29.31. Despite recent earnings showing a net loss of €11.16 million for Q3 and a decline in nine-month sales to €1.33 billion from €1.53 billion year-over-year, the company’s earnings are forecast to grow 68.73% annually over the next three years, outpacing the German market's growth rate of 19.2%.

- Our expertly prepared growth report on Verbio implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Verbio with our comprehensive financial health report here.

Turning Ideas Into Actions

- Reveal the 17 hidden gems among our Undervalued German Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VBK

Verbio

Produces and supplies fuels and finished products in Germany and rest of Europe.

Excellent balance sheet with reasonable growth potential.