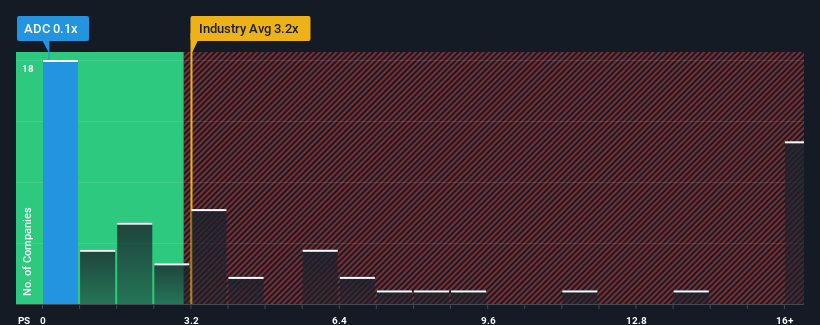

AdCapital AG's (FRA:ADC) price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the Capital Markets industry in Germany, where around half of the companies have P/S ratios above 3.2x and even P/S above 9x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for AdCapital

How Has AdCapital Performed Recently?

Revenue has risen at a steady rate over the last year for AdCapital, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on AdCapital will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, AdCapital would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 2.8%. Revenue has also lifted 18% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 3.2% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that AdCapital's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Bottom Line On AdCapital's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at the figures, it's surprising to see AdCapital currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with AdCapital (at least 2 which are significant), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:ADC

AdCapital

An industrial holding company, invests in electrical engineering, metal and plastics processing, machine and tool construction, and automotive businesses in Germany and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives