- Germany

- /

- Capital Markets

- /

- XTRA:DB1

Deutsche Börse (XTRA:DB1): Assessing Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Deutsche Börse (XTRA:DB1) has seen its shares slip over the past month, as investors take stock of recent performance. The company’s year-to-date return is also behind broader market averages, prompting new conversations about valuation.

See our latest analysis for Deutsche Börse.

After a notably tough 90 days with a 19.8% share price pullback, Deutsche Börse is feeling the sting of fading momentum. The 1-year total shareholder return, however, is essentially flat. This underlines how near-term price pressure has overshadowed what had been a fairly resilient stretch for long-term investors.

If you’re reassessing your own portfolio, this could be the perfect chance to branch out and discover fast growing stocks with high insider ownership

But after this recent slide and with the stock trading well below analyst targets, could Deutsche Börse be presenting a discounted entry point? Or is the market already factoring in all the future growth ahead?

Most Popular Narrative: 18.8% Undervalued

With Deutsche Börse’s fair value set well above its latest closing price, the narrative signals optimism for future gains if projections hold. This sets the stage for a closer look at the logic behind this valuation.

Ongoing expansion into high-margin, recurring software and data services (via SimCorp, Axioma, and ISS STOXX) and the growth of SaaS/ARR revenues, especially outside the core European region, will diversify and stabilize group earnings, reduce reliance on cyclical trading fees, and support elevated net margins.

Want to know what quantifiable factors are boosting this valuation? The heart of this narrative is bold profit margin expansion and a compelling shift in how Deutsche Börse earns its money. Discover which surprising business moves and financial forecasts underpin the anticipated upside. See what could change the story for investors.

Result: Fair Value of €257.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost pressures and potential slowdowns in market activity remain watchpoints. These factors could dampen Deutsche Börse’s expected margin improvements and revenue trajectory.

Find out about the key risks to this Deutsche Börse narrative.

Another View: What Do the Multiples Say?

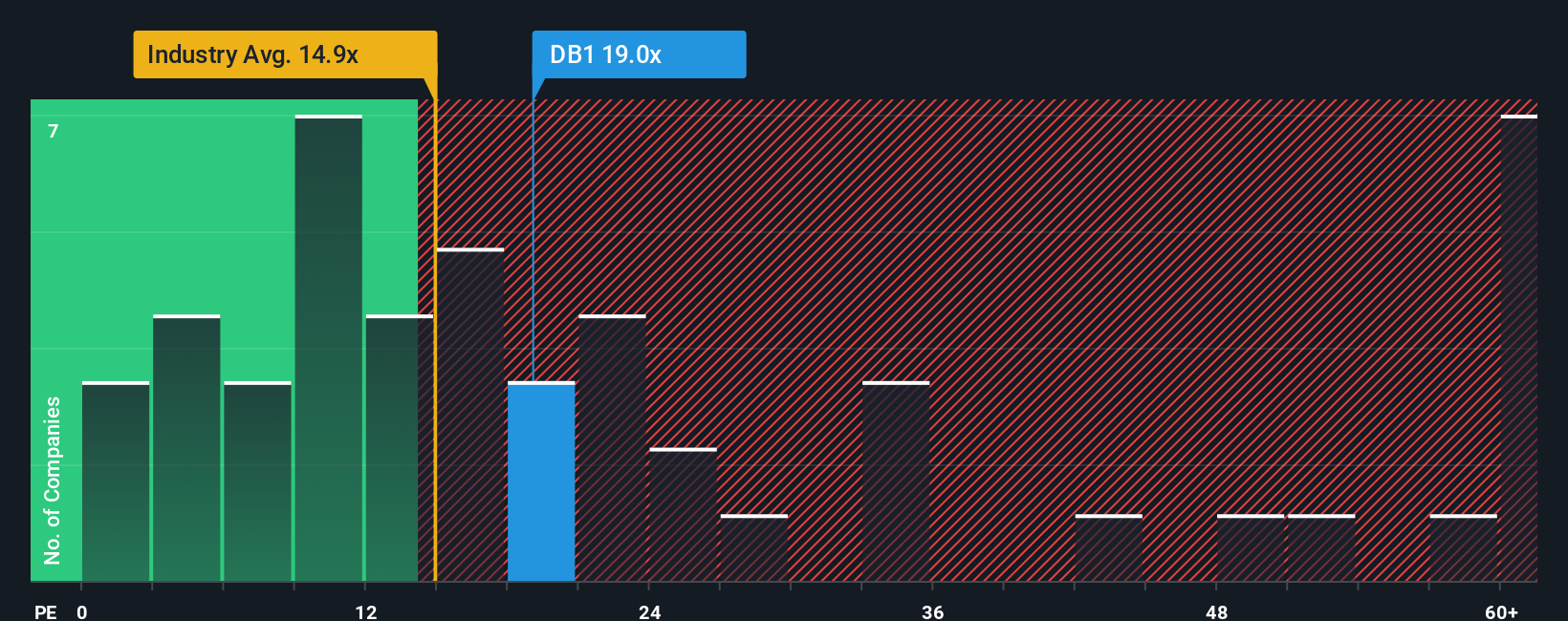

Taking a different angle, Deutsche Börse trades at a price-to-earnings ratio of 19x. That is a premium to the German Capital Markets industry average of 14.9x, yet remains modestly below the peer group’s 20.9x. The current level trails the fair ratio of 22x, suggesting some valuation headroom, but also highlighting risk if sector sentiment turns. Could the market’s next move surprise investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Deutsche Börse Narrative

If you see the numbers differently or want to dig deeper, you can shape your own view with just a few minutes of hands-on analysis. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Deutsche Börse.

Looking for more investment ideas?

Gain an edge on your next move by searching for unique opportunities beyond Deutsche Börse. The Simply Wall Street Screener highlights standout stocks in growing sectors and emerging trends. Don’t leave your next big winner to chance. See what’s out there now.

- Start building passive income by sifting through these 16 dividend stocks with yields > 3% with consistent yields of over 3% and robust payout histories.

- Catch the momentum in cutting-edge tech by surveying these 24 AI penny stocks pushing boundaries in artificial intelligence and automation right now.

- Capitalize on overlooked bargains with these 875 undervalued stocks based on cash flows priced attractively compared to their underlying cash flows and future growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DB1

Deutsche Börse

Operates as an international exchange organization in Germany, rest of Europe, the United States, and the Asia-Pacific.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives