Stock Analysis

Three Undiscovered Gems In Germany With Strong Potential

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts have boosted expectations for further monetary policy easing, Germany's DAX index has seen a modest increase, reflecting a broader positive sentiment in European markets. This environment creates an intriguing backdrop for small-cap stocks, which often thrive in periods of economic stimulus and lower borrowing costs. In this context, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

FRoSTA (DB:NLM)

Simply Wall St Value Rating: ★★★★★★

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, is involved in the development, production, and marketing of frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market capitalization of €412.16 million.

Operations: FRoSTA generates revenue primarily from the sale of frozen food products across several European countries. The company's financial performance includes a focus on its net profit margin, which reflects its profitability after accounting for all expenses.

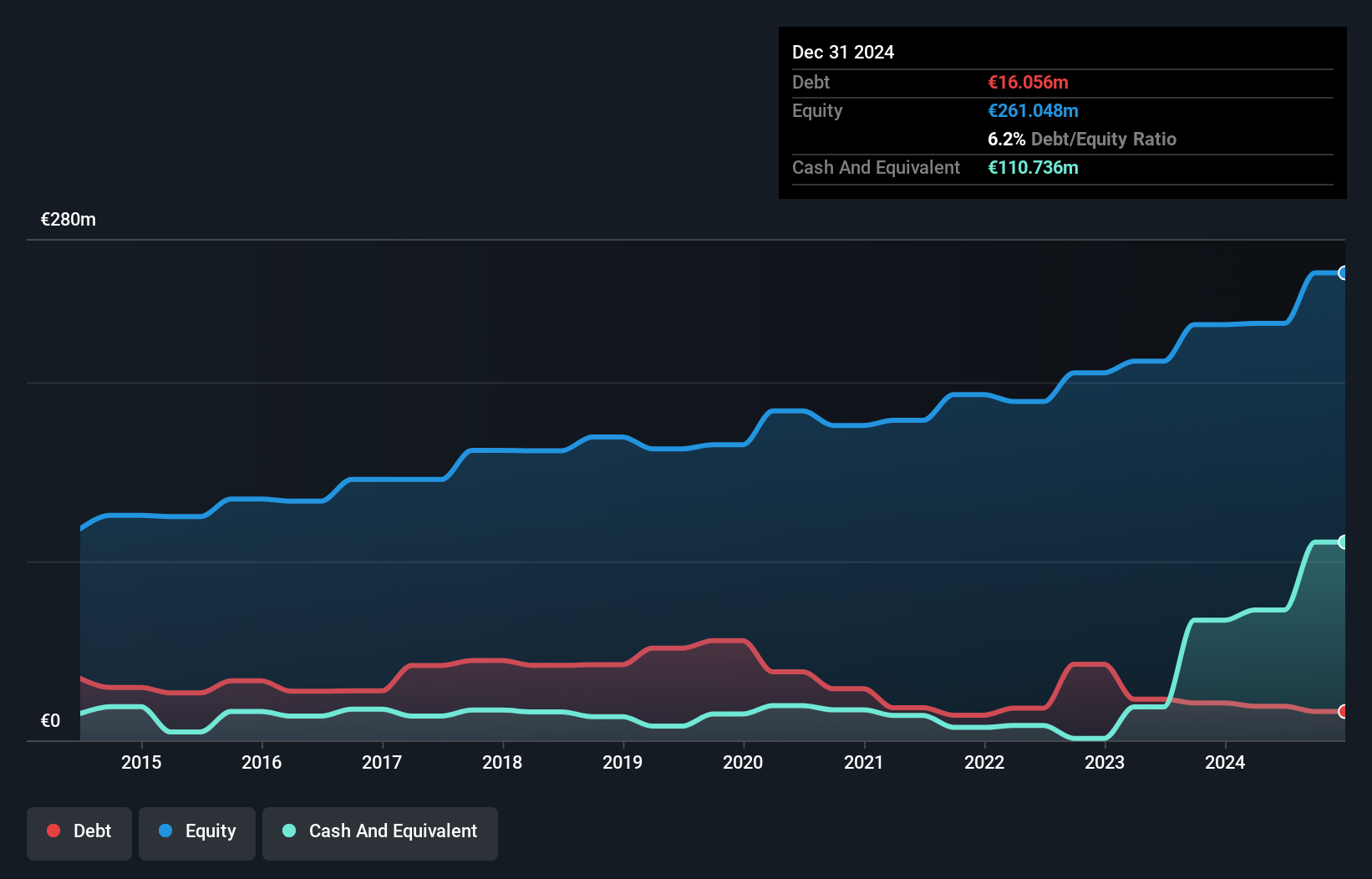

FRoSTA, a notable player in the frozen food sector, offers an intriguing investment case with its debt to equity ratio decreasing significantly from 31.6% to 8.2% over five years, indicating prudent financial management. Despite a modest earnings growth of 7.6% last year, which lagged behind the broader food industry's 26.8%, it boasts high-quality past earnings and robust free cash flow generation at €70.63 million as of June 2024. The company also trades at a substantial discount of 96.1% below estimated fair value, suggesting potential undervaluation in the market despite slower industry growth rates recently observed.

- Delve into the full analysis health report here for a deeper understanding of FRoSTA.

Assess FRoSTA's past performance with our detailed historical performance reports.

CropEnergies (HMSE:CE2)

Simply Wall St Value Rating: ★★★★★★

Overview: CropEnergies AG is a company that manufactures and distributes bioethanol and other biofuels from agricultural raw materials in Germany and internationally, with a market cap of €1.17 billion.

Operations: CropEnergies generates revenue primarily from the sale of bioethanol, amounting to €3.82 billion.

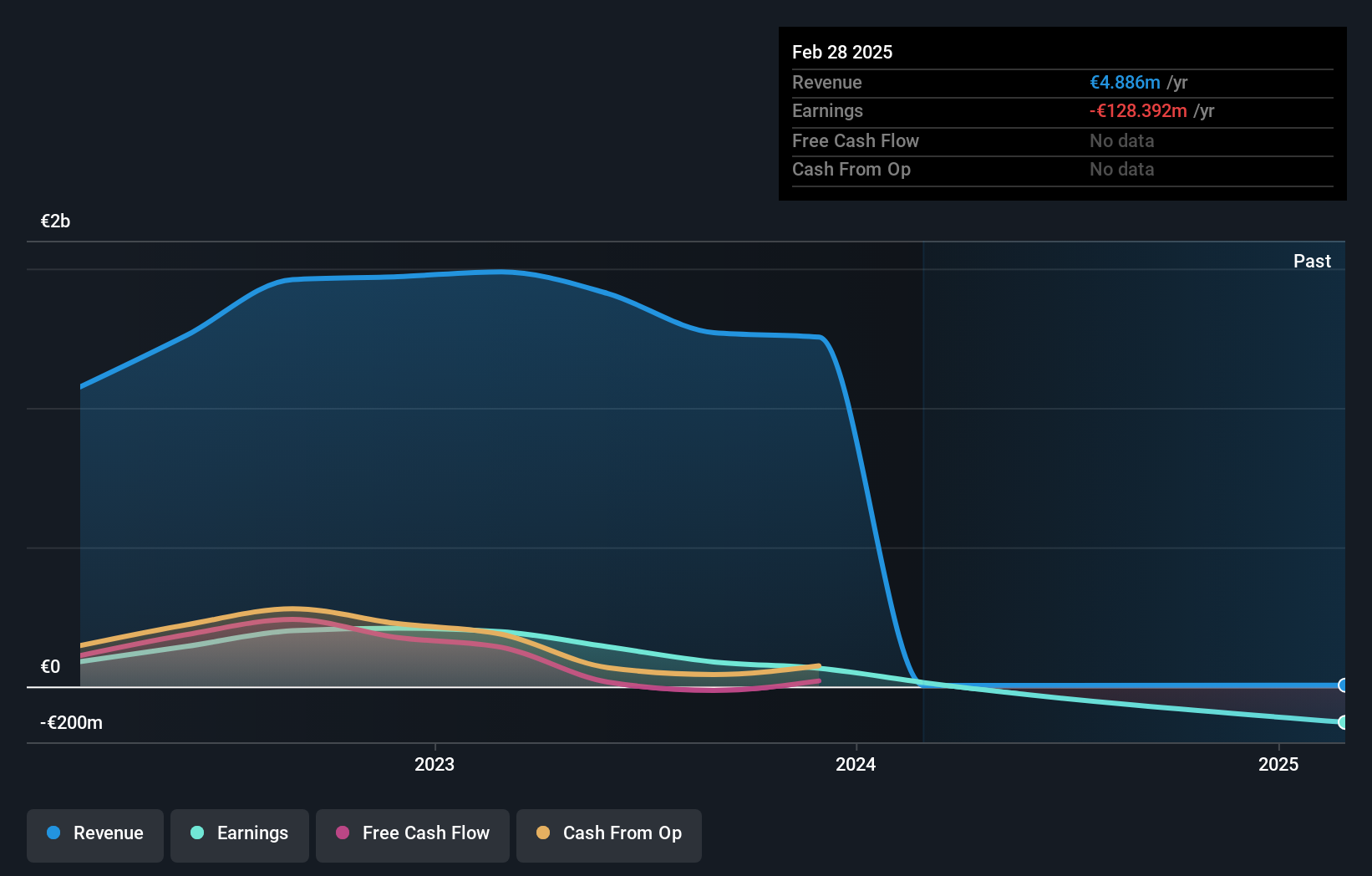

With a focus on sustainable bioenergy, CropEnergies operates within the renewable energy sector and is characterized by its nimble operations. The company reported a net profit margin of 7% in recent times, reflecting its ability to manage costs effectively despite industry challenges. Notably, CropEnergies has maintained a debt-free status for the past five years, which underscores financial discipline. However, earnings growth took a significant hit with negative earnings growth of -92.8%, contrasting sharply with the broader oil and gas industry's average decline of -16.5%. Despite these hurdles, CropEnergies' high-quality past earnings suggest resilience in navigating market fluctuations.

- Click here and access our complete health analysis report to understand the dynamics of CropEnergies.

Evaluate CropEnergies' historical performance by accessing our past performance report.

OHB (XTRA:OHB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: OHB SE is a space and technology company operating in Germany, the rest of Europe, and internationally with a market capitalization of approximately €865.46 million.

Operations: OHB SE generates revenue primarily from its Space Systems segment, contributing €878.71 million, followed by Aerospace at €123.04 million and Digital at €118.28 million. The company experiences a negative impact from Consolidation adjustments amounting to -€58.84 million.

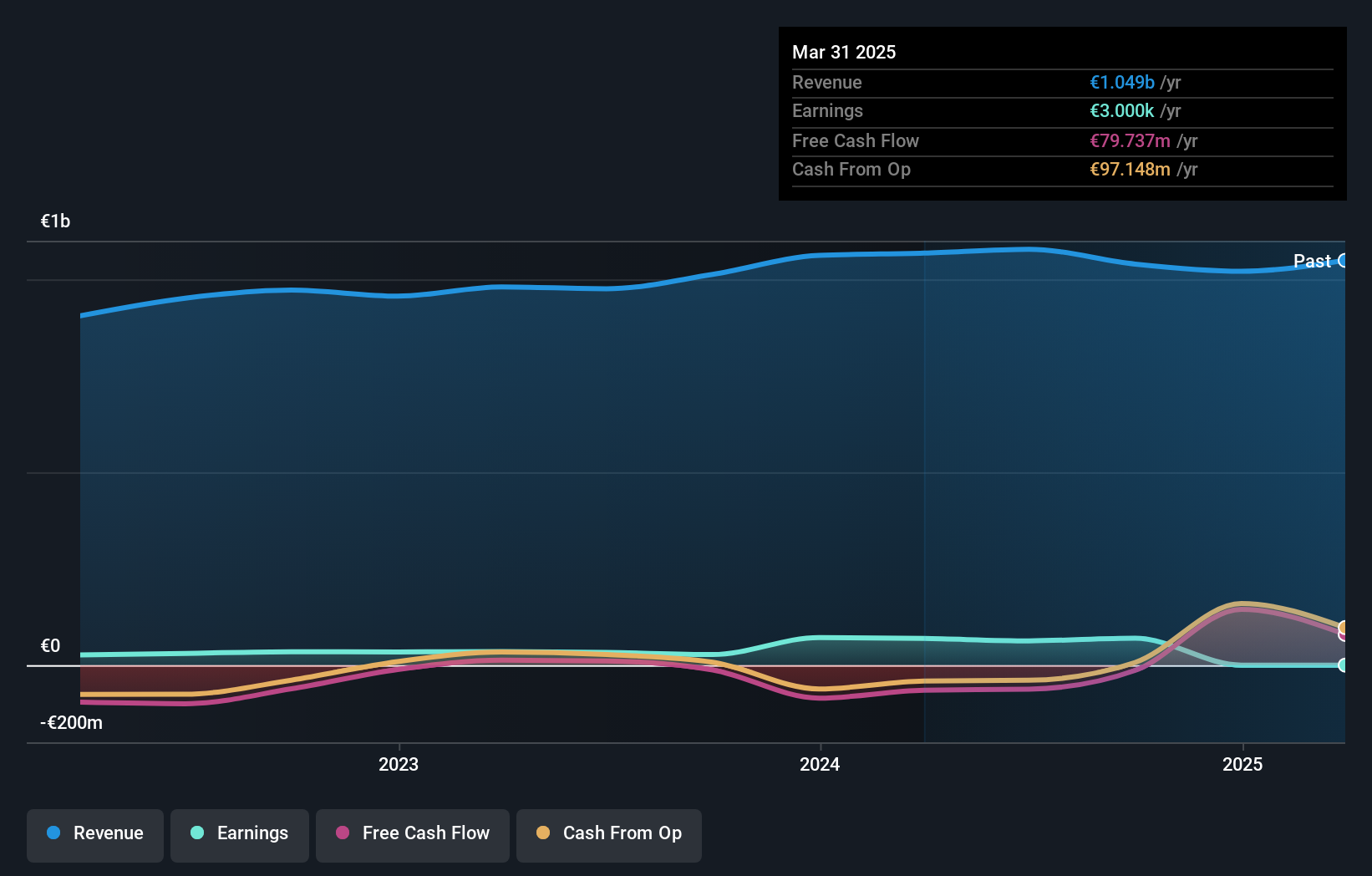

OHB, a notable player in Germany's space industry, is navigating an intriguing phase with the recent KKR takeover. This transaction sees KKR acquiring 28.6% of shares while the Fuchs family retains a significant 65.4%, ensuring OHB remains a family-run enterprise. Despite this structural change, OHB's financials reveal mixed signals: earnings surged by 91.9% last year, outpacing industry growth of 15.3%, yet net income for Q2 dropped to €0.59 million from €6.62 million previously, indicating potential challenges ahead in profitability despite robust revenue figures at €263 million for the quarter compared to last year's €254 million.

Where To Now?

- Click this link to deep-dive into the 52 companies within our German Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NLM

FRoSTA

Develops, produces, and markets frozen food products in Germany, Poland, Austria, Italy, and Eastern Europe.