- Germany

- /

- Industrials

- /

- XTRA:MBB

EnviTec Biogas And 2 Other Undiscovered Gems In Germany

Reviewed by Simply Wall St

The German market has shown resilience, with the DAX climbing 3.38% recently amid growing hopes for interest rate cuts. This optimistic sentiment provides a fertile ground for small-cap companies to thrive, making it an opportune time to explore lesser-known stocks. In this environment, a good stock often combines strong fundamentals with growth potential in niche markets. Here are three undiscovered gems in Germany, starting with EnviTec Biogas.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 1.59% | 4.58% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★★

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across various countries including Germany, Italy, Great Britain, and the United States, with a market cap of €493.02 million.

Operations: EnviTec Biogas AG generates revenue primarily from three segments: Service (€48.58 million), Plant Engineering (€132.13 million), and Own Operation including Energy (€236.10 million).

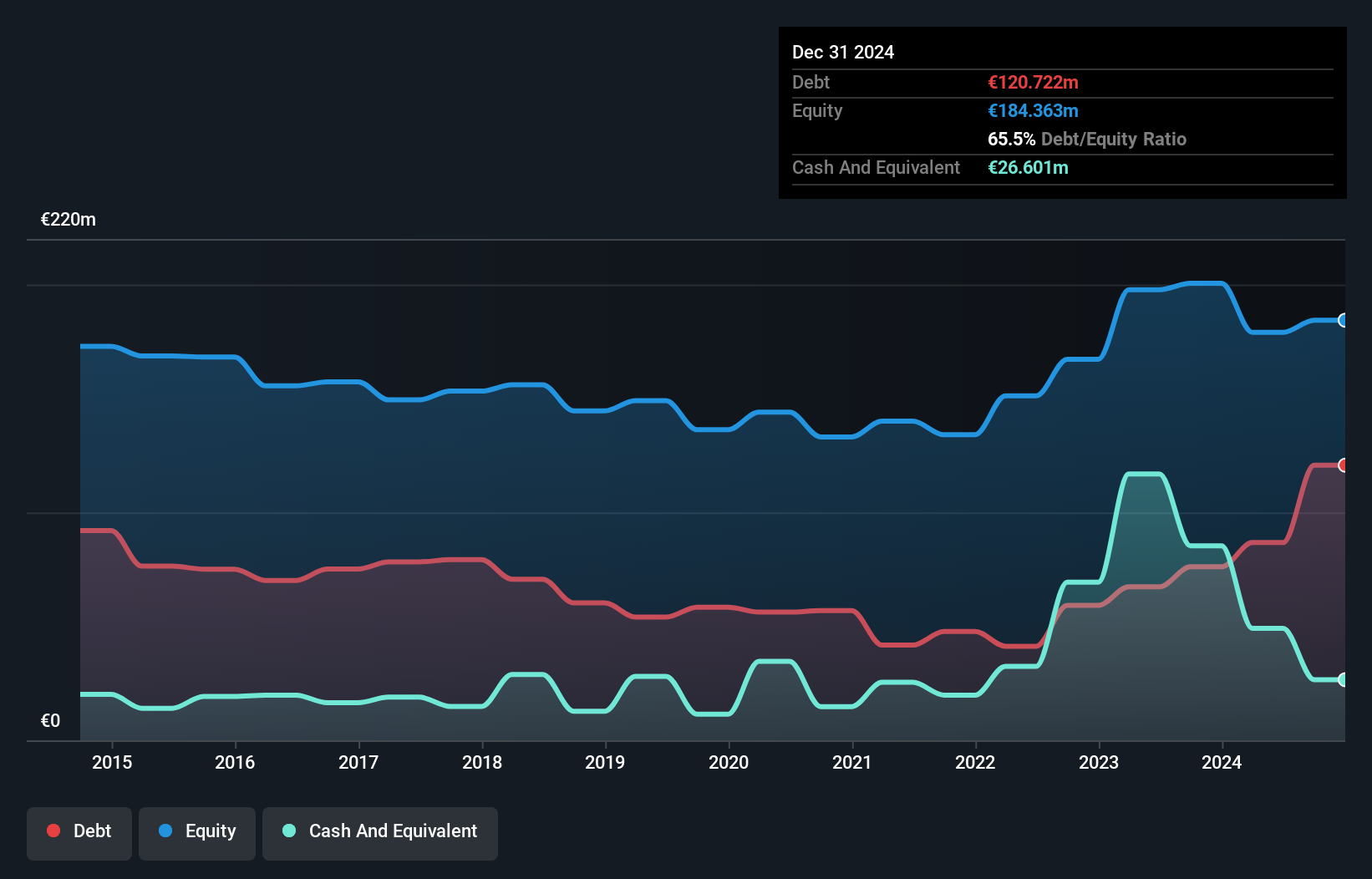

EnviTec Biogas, a small player in the renewable energy sector, has shown impressive earnings growth of 27.6% over the past year, outpacing the broader Oil and Gas industry. The company's debt to equity ratio has improved from 41.7% to 38% over five years, indicating better financial health. With an EBIT coverage of interest payments at 419.7x and a price-to-earnings ratio of 8.4x compared to the German market's 17.2x, EnviTec appears undervalued relative to its peers.

- Click here and access our complete health analysis report to understand the dynamics of EnviTec Biogas.

Gain insights into EnviTec Biogas' historical performance by reviewing our past performance report.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, with a market cap of €1.13 billion, manufactures and supplies pumps, valves, and related services worldwide through its subsidiaries.

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million). The company's market cap stands at €1.13 billion.

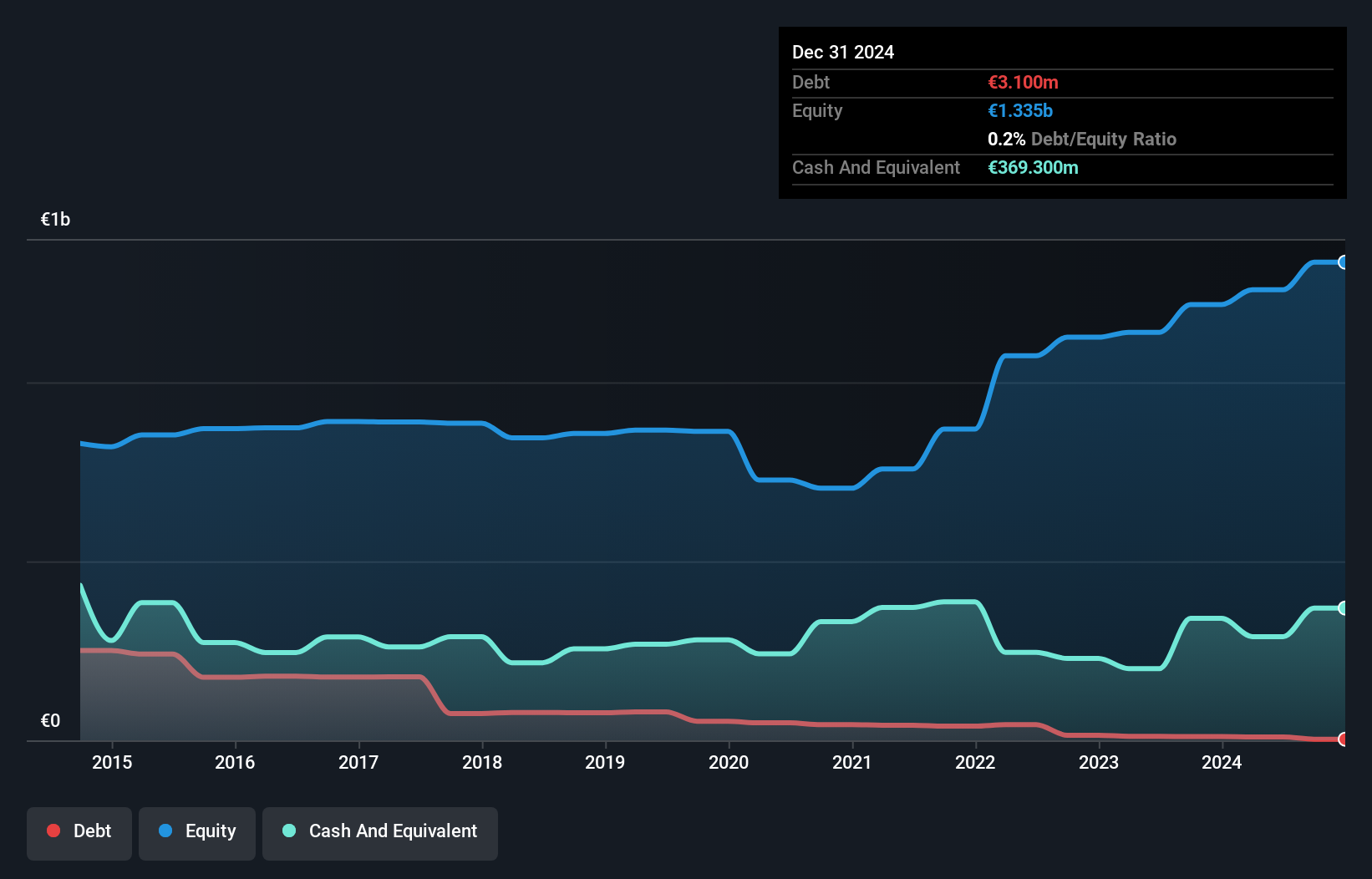

KSB SE KGaA, a small-cap German machinery firm, has seen its debt to equity ratio drop from 9.2% to 2.1% over the past five years. Despite a one-off loss of €102.5M impacting recent results, earnings grew by 16.8% last year, outpacing the industry average of 3.2%. Trading at roughly 77% below estimated fair value and with more cash than total debt, KSB appears well-positioned for continued growth with forecasted annual earnings growth of about 10.74%.

- Dive into the specifics of KSB SE KGaA here with our thorough health report.

Review our historical performance report to gain insights into KSB SE KGaA's's past performance.

MBB (XTRA:MBB)

Simply Wall St Value Rating: ★★★★★★

Overview: MBB SE, with a market cap of €610.51 million, acquires and manages medium-sized companies primarily in the technology and engineering sectors in Germany and internationally.

Operations: MBB SE generates revenue from three primary segments: Consumer Goods (€92.53 million), Technical Applications (€386.64 million), and Service & Infrastructure (€515.75 million).

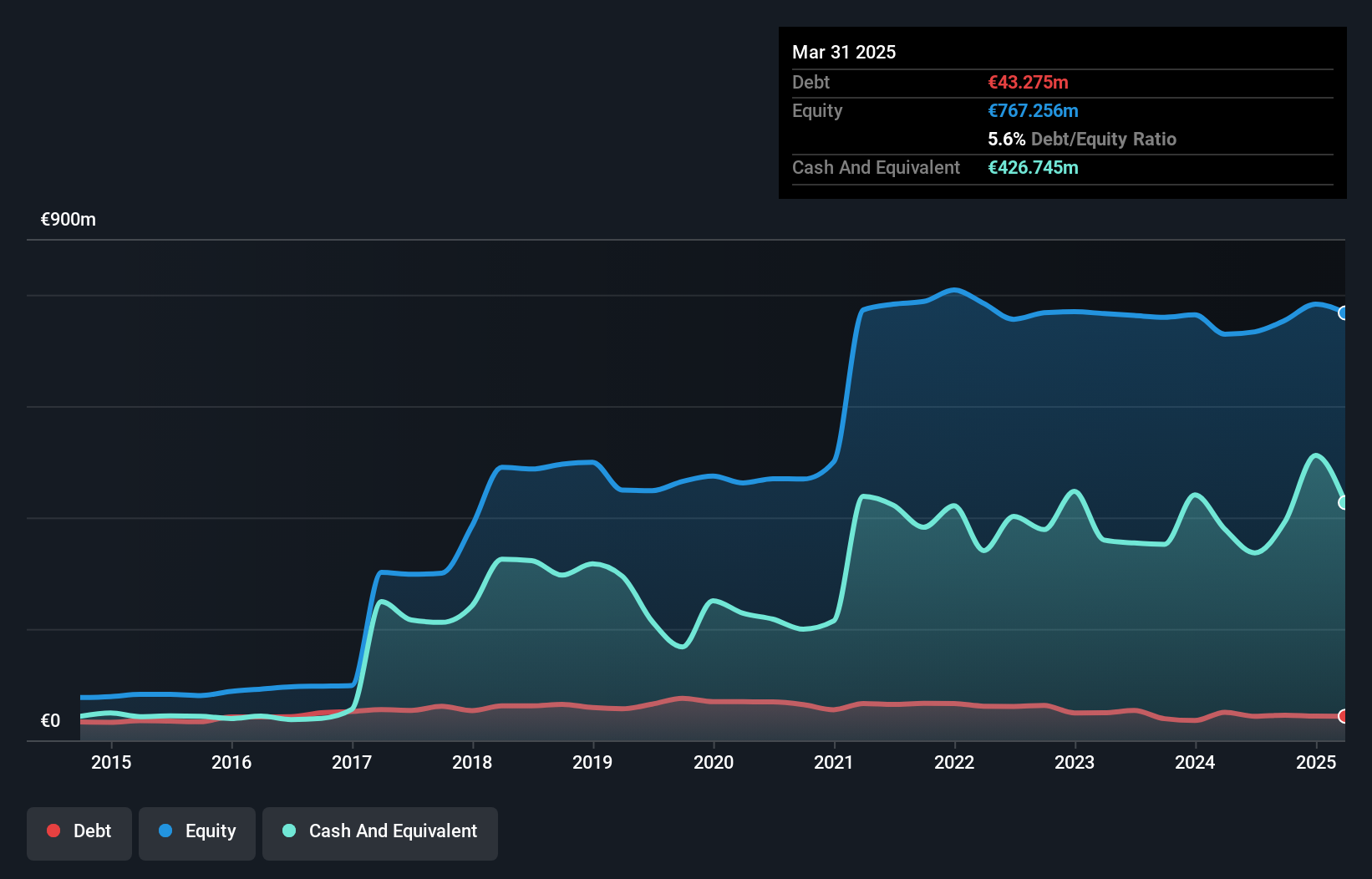

MBB SE has demonstrated impressive growth, with earnings surging by 156.5% over the past year, far outpacing the Industrials industry’s 0.7%. The company’s debt to equity ratio has improved significantly from 14.5% to 5.9% in five years, indicating better financial health. Recent results show net income for Q2 at €7.47 million compared to €1.77 million a year ago, and revenue reaching €266.77 million from €233.61 million previously, reflecting robust operational performance and strategic investments in its portfolio.

- Unlock comprehensive insights into our analysis of MBB stock in this health report.

Gain insights into MBB's past trends and performance with our Past report.

Taking Advantage

- Access the full spectrum of 46 German Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBB

MBB

Engages in the acquisition and management of medium-sized companies primarily in the technology and engineering sectors in Germany and internationally.

Flawless balance sheet with reasonable growth potential.