KION GROUP's Lowered Revenue Outlook Might Change The Case For Investing In KION (XTRA:KGX)

Reviewed by Sasha Jovanovic

- KION GROUP AG recently announced its third-quarter and nine-month 2025 earnings, with Q3 net income rising to €114.3 million, while sales for the nine-month period slightly declined year over year and full-year revenue guidance was narrowed and lowered to €11.1 billion–€11.4 billion.

- Despite improved quarterly net income, the updated annual outlook reflects a more cautious view on sales growth for the remainder of the year.

- We'll assess how KION's revised 2025 revenue guidance may influence the company's broader investment narrative and earnings expectations.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

KION GROUP Investment Narrative Recap

To be a shareholder in KION GROUP today, you need to believe in the company’s ability to convert record-high e-commerce-related orders into sustainable sales, while navigating customer hesitancy and rising competition. The recent revision to the 2025 revenue outlook reinforces near-term caution but doesn’t appear to materially reshape the most critical catalyst: growing automation and digitalization demand from the e-commerce sector. The main risk, reliance on this vertical, remains firmly in focus, especially with revenue guidance narrowed on softer nine-month sales.

Of particular relevance is KION’s news this quarter showcasing its AI-powered Omniverse solution with NVIDIA and Accenture, which aligns with the ongoing catalyst of warehouse automation. This innovation underscores KION’S intent to differentiate its offering in response to margin pressure from competitors, supporting the long-term case for higher-margin, service-driven growth amid tighter sales expectations.

Yet, in contrast, investors should be aware of how concentrated exposure to the e-commerce sector might leave revenues vulnerable if...

Read the full narrative on KION GROUP (it's free!)

KION GROUP's outlook anticipates €12.9 billion in revenue and €802.8 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 4.7% and represents an increase of €572.8 million in earnings from the current €230.0 million.

Uncover how KION GROUP's forecasts yield a €62.57 fair value, in line with its current price.

Exploring Other Perspectives

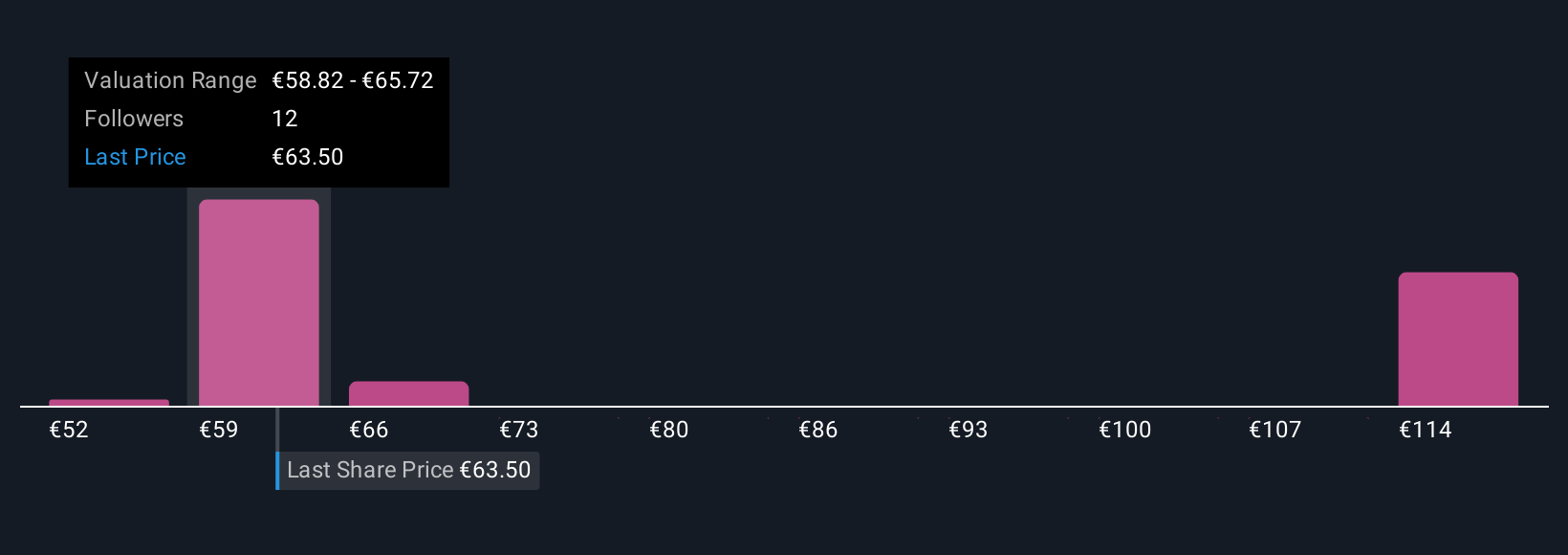

Simply Wall St Community members produced five fair value estimates for KION ranging widely from €51.92 to €119.56 per share. Opinions differ sharply even as reliance on e-commerce–driven order growth puts sales visibility and risk in the spotlight for all.

Explore 5 other fair value estimates on KION GROUP - why the stock might be worth as much as 94% more than the current price!

Build Your Own KION GROUP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KION GROUP research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KION GROUP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KION GROUP's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KION GROUP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KGX

KION GROUP

Provides industrial trucks and supply chain solutions in Western and Eastern Europe, the Middle East, Africa, North America, Central and South America, China, and the rest of the Asia Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives