- Switzerland

- /

- Consumer Durables

- /

- SWX:VZUG

Undiscovered Gems in Europe for April 2025

Reviewed by Simply Wall St

As of April 2025, European markets have shown resilience with the pan-European STOXX Europe 600 Index rising by nearly 4% over a week, buoyed by the European Central Bank's rate cuts and a delay in U.S. tariff impositions. This positive sentiment highlights opportunities for small-cap stocks that can capitalize on favorable monetary policies and improving investor confidence. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors looking to unearth undiscovered gems in Europe's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 22.54% | 13.65% | 13.80% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

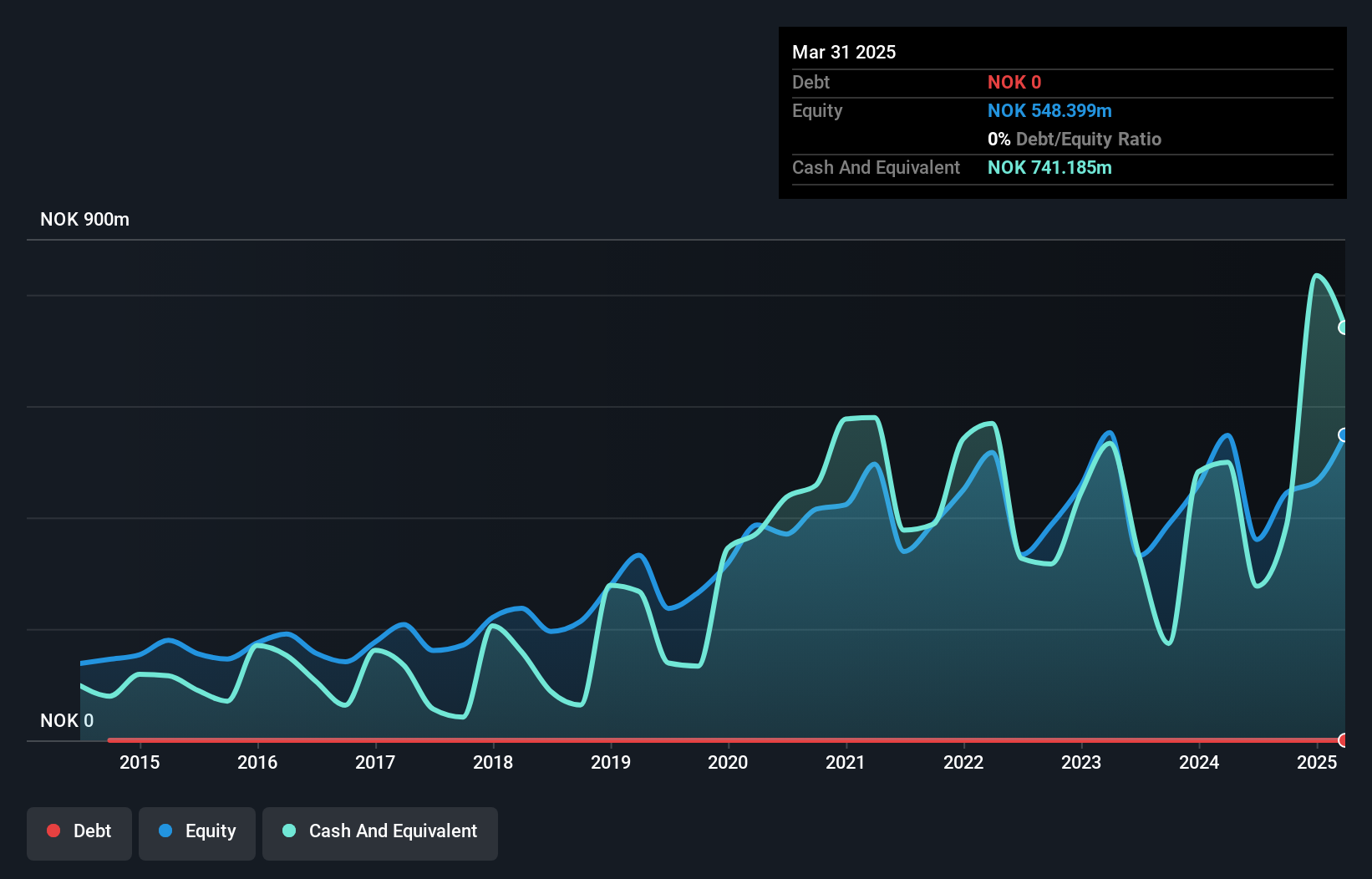

Bouvet (OB:BOUV)

Simply Wall St Value Rating: ★★★★★★

Overview: Bouvet ASA is an IT and digital communication consultancy firm serving both public and private sectors in Norway, Sweden, and internationally with a market cap of NOK8.11 billion.

Operations: Bouvet ASA generates revenue primarily from IT consultancy services, amounting to NOK3.92 billion.

Bouvet, a nimble player in the European market, has shown robust financial health with earnings growing at 13% annually over the past five years. The company is debt-free, which enhances its financial stability and positions it well against industry peers. Recently, Bouvet announced a share buyback program worth NOK 90 million to repurchase up to 1 million shares, indicating confidence in its valuation. Additionally, for the full year ending December 2024, sales reached NOK 3.92 billion with net income of NOK 383.44 million and basic earnings per share of NOK 3.72—up from the previous year's figures—highlighting consistent growth momentum.

- Take a closer look at Bouvet's potential here in our health report.

Explore historical data to track Bouvet's performance over time in our Past section.

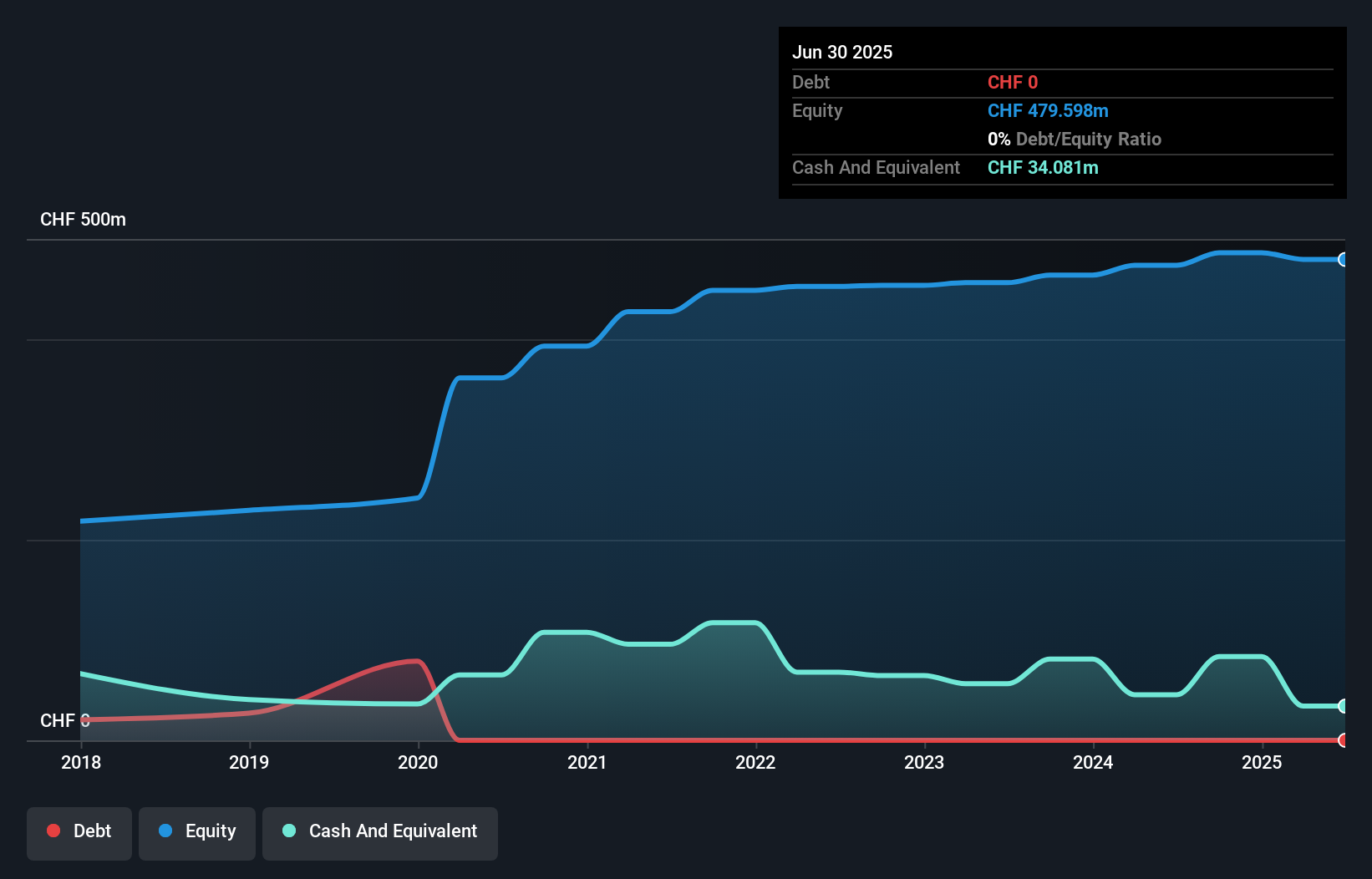

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG is a company that develops, manufactures, sells, and services kitchen and laundry appliances for private households across Switzerland and internationally, with a market capitalization of CHF425.57 million.

Operations: The primary revenue stream for V-ZUG Holding AG comes from its Household Appliances segment, generating CHF591.72 million.

V-ZUG Holding, a compact player in the Consumer Durables sector, has been making waves with its impressive financial performance. The company's earnings surged by 83% last year, outpacing the industry average of -13%. With no debt to its name now compared to a debt-to-equity ratio of 33% five years ago, V-ZUG seems well-positioned financially. Trading at nearly 53% below estimated fair value adds another layer of appeal for potential investors. Recent results showed net income climbing to CHF 21 million from CHF 12 million previously while basic earnings per share increased from CHF 1.82 to CHF 3.33.

- Click here to discover the nuances of V-ZUG Holding with our detailed analytical health report.

Understand V-ZUG Holding's track record by examining our Past report.

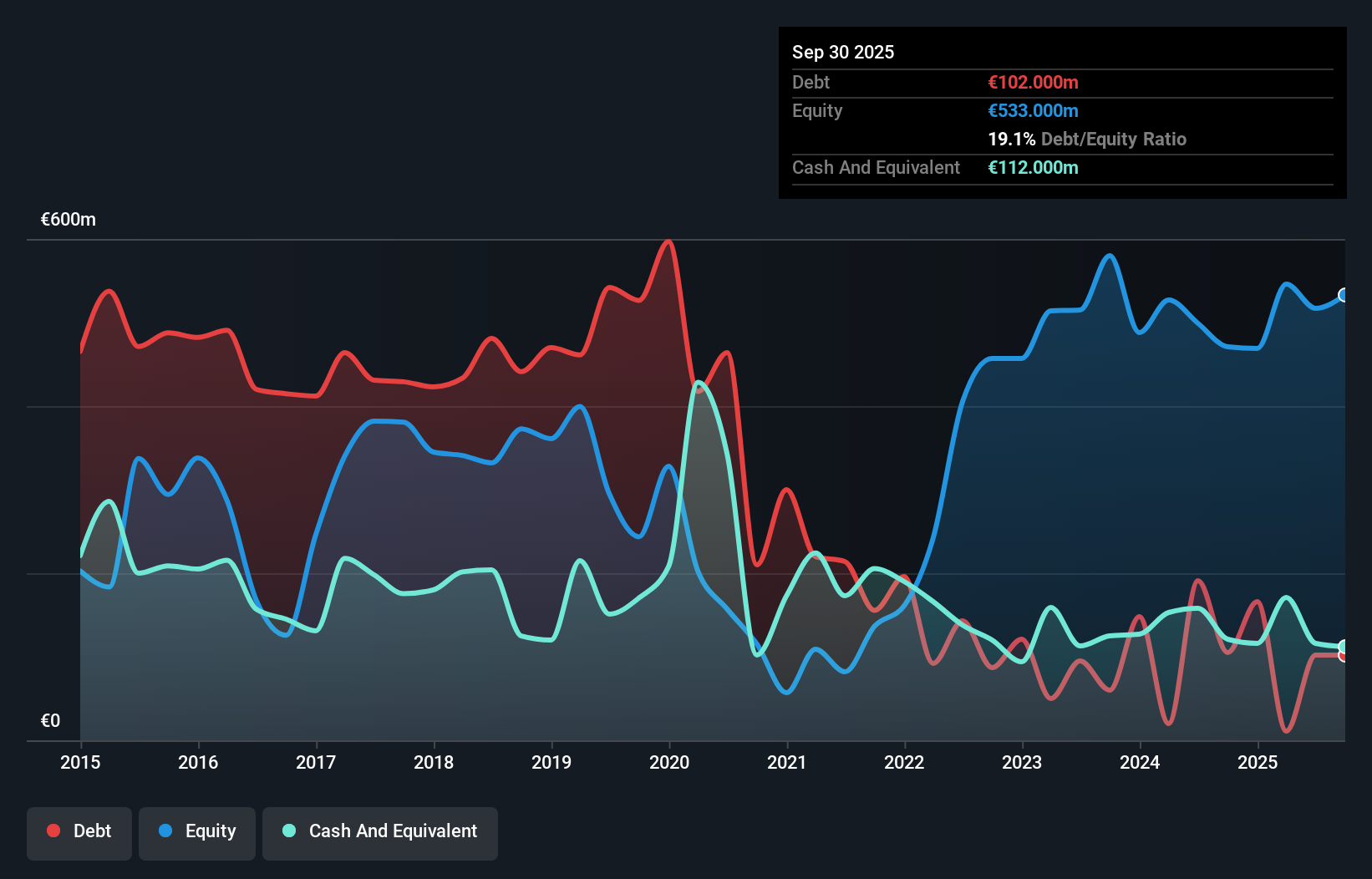

Heidelberger Druckmaschinen (XTRA:HDD)

Simply Wall St Value Rating: ★★★★★★

Overview: Heidelberger Druckmaschinen Aktiengesellschaft, with a market cap of approximately €330.51 million, operates globally in the manufacturing and sales of printing presses and related products for the print media industry.

Operations: Heidelberger Druckmaschinen generates revenue primarily from its Print Solutions (€1.22 billion) and Packaging Solutions (€1.34 billion) segments, with a smaller contribution from Technology Solutions (€13 million).

Heidelberger Druckmaschinen, a notable player in the printing machinery sector, has shown significant financial restructuring over the past five years. Its debt to equity ratio impressively decreased from 182% to 35.4%, indicating robust financial management. Trading at around 88% below its estimated fair value, it offers a compelling valuation compared to peers. Despite becoming profitable recently, earnings are forecasted to shrink by about 5% annually over the next three years. The company’s interest payments are well-covered with an EBIT coverage of 13x, reflecting solid operational performance despite recent executive changes and reported net losses for the latest fiscal periods.

- Click here and access our complete health analysis report to understand the dynamics of Heidelberger Druckmaschinen.

Learn about Heidelberger Druckmaschinen's historical performance.

Make It Happen

- Dive into all 357 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VZUG

V-ZUG Holding

Engages in the development, manufacture, sale, and services of kitchen and laundry appliances for private households in Switzerland, rest of Europe, North America, the Asia Pacific, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives