Can Porsche (XTRA:P911) Localize Innovation in China Without Diluting Its Global Brand Identity?

Reviewed by Sasha Jovanovic

- Porsche recently opened its first integrated overseas R&D center in Shanghai's Hongqiao CBD, combining engineering, digital, and procurement functions in a 10,000-square-meter facility with over 300 engineers as part of its "In China, for China" strategy.

- The Shanghai hub has already produced a China-exclusive next-generation infotainment system and consolidates key local operations, reflecting Porsche's focus on tailoring technology for the Chinese market.

- We’ll review how Porsche’s new Shanghai R&D center, driving local innovation, influences its overall investment narrative and growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Dr. Ing. h.c. F. Porsche Investment Narrative Recap

At a high level, investors in Dr. Ing. h.c. F. Porsche must believe the company can sustain its position as a premium, innovative automotive leader while navigating significant challenges in its most important markets. The recent launch of the Shanghai R&D center aligns with Porsche’s need to tailor offerings for China and may help address short-term volume declines there, but it does not materially offset the immediate risks tied to weak demand and intensifying competition in China.

Of Porsche’s recent company developments, the appointment of Dr. Michael Leiters as CEO (effective January 2026) is particularly relevant. Leadership with a strong engineering background could further accelerate the company’s push for innovation through regional R&D initiatives like the new Shanghai hub, potentially supporting future product launches that serve as key growth catalysts.

In contrast, investors should remain mindful that even as Porsche expands its China-focused R&D, persistent underperformance and ongoing structural decline in the Chinese market remain a core risk...

Read the full narrative on Dr. Ing. h.c. F. Porsche (it's free!)

Dr. Ing. h.c. F. Porsche's narrative projects €41.7 billion revenue and €3.5 billion earnings by 2028. This requires 2.4% yearly revenue growth and a €1.3 billion earnings increase from the current €2.2 billion.

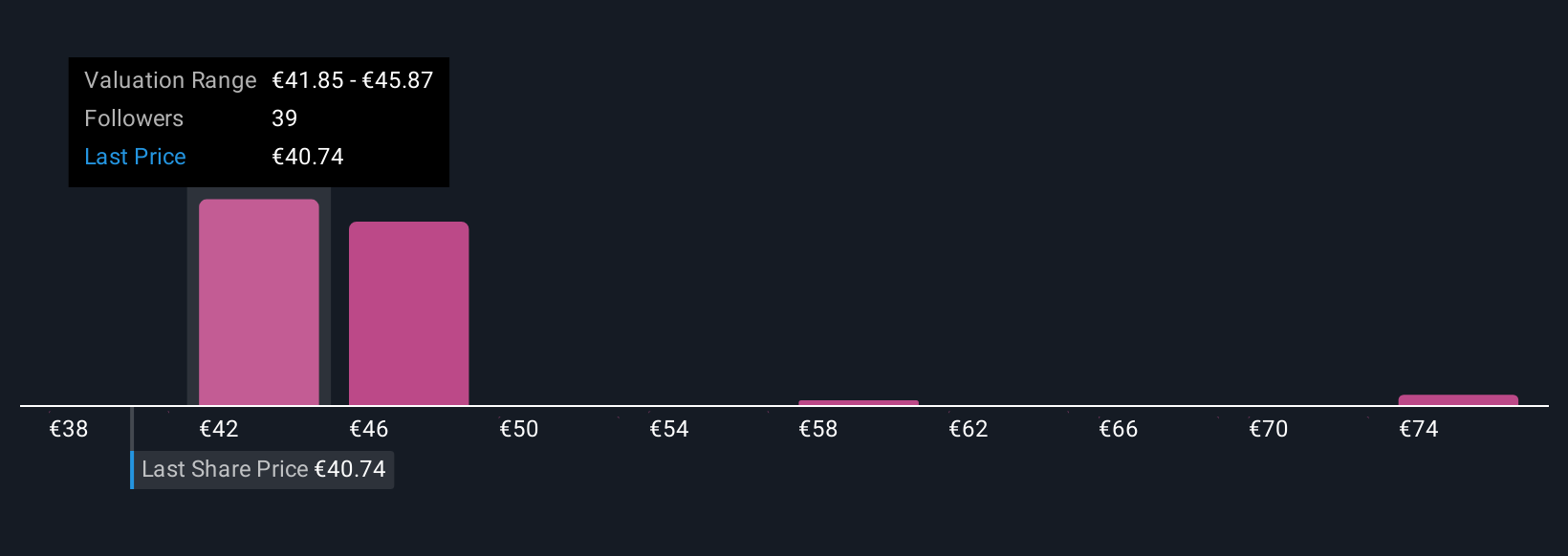

Uncover how Dr. Ing. h.c. F. Porsche's forecasts yield a €44.53 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community for Porsche range from €37.82 to €78.09 per share. While opinions vary widely, ongoing contraction in China raises real questions about Porsche’s ability to deliver sustained growth; it is worth considering several viewpoints before making any decision.

Explore 12 other fair value estimates on Dr. Ing. h.c. F. Porsche - why the stock might be worth as much as 66% more than the current price!

Build Your Own Dr. Ing. h.c. F. Porsche Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dr. Ing. h.c. F. Porsche research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dr. Ing. h.c. F. Porsche research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dr. Ing. h.c. F. Porsche's overall financial health at a glance.

No Opportunity In Dr. Ing. h.c. F. Porsche?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:P911

Dr. Ing. h.c. F. Porsche

Engages in automotive and financial services business in Germany, rest of Europe, North America, China, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives