- Germany

- /

- Auto Components

- /

- XTRA:AMV0

Assessing Aumovio (XTRA:AMV0) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Aumovio.

Aumovio’s 14.2% 1-month share price return signals growing momentum, with the stock now up for the year despite only modest sales growth. Investors appear increasingly optimistic, perhaps anticipating catalysts to justify the recent surge and resilience in price.

If you’re weighing other dynamic opportunities as momentum builds, now is a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

With the recent rally, is Aumovio now trading below its fair value, or has the market already priced in any potential upside and future growth, leaving little room for further gains?

Price-to-Sales of 0.2x: Is it justified?

Aumovio trades at a price-to-sales (P/S) ratio of just 0.2x, with the last close price at €39.4. This compares to European Auto Components peers and makes the stock look undervalued on this metric.

The price-to-sales ratio measures how much investors are willing to pay per euro of revenue. For auto component companies, a lower P/S can signal either market pessimism about future sales or an opportunity if the outlook is improving.

Aumovio’s P/S of 0.2x is well below both the industry average of 0.3x and the peer average of 0.5x. This highlights a significant valuation gap. If the company’s prospects or fundamentals improve, the market may close this gap over time.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.2x (UNDERVALUED)

However, if sluggish annual revenue growth and ongoing net losses persist or worsen, these trends could limit Aumovio's upside.

Find out about the key risks to this Aumovio narrative.

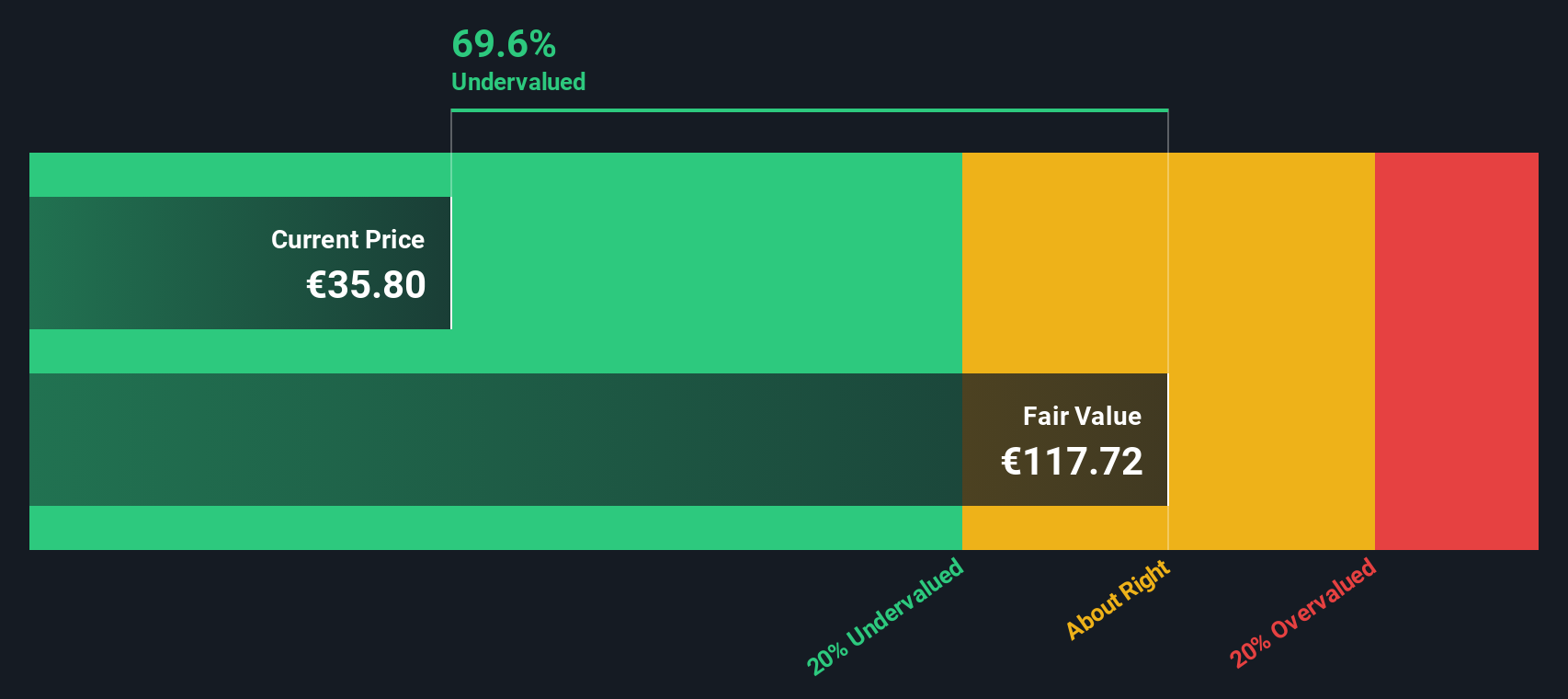

Another View: SWS DCF Model Suggests a Larger Upside

While the price-to-sales ratio points to a bargain, our DCF model offers an even more bullish perspective, estimating Aumovio’s fair value at €127.6, which is well above the current share price of €39.4. This suggests the market could be severely underestimating future earnings potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aumovio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aumovio Narrative

If you have a different perspective, or want to analyze the numbers for yourself, building your own view takes just a few minutes, so why not Do it your way?

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Aumovio.

Looking for More Smart Investment Ideas?

Don't limit your potential gains to just one stock. Take the next step with these high-impact opportunities and catch tomorrow’s leaders before the crowd does.

- Capture growth by finding established companies trading below their true worth. See which could be tomorrow’s standouts with these 874 undervalued stocks based on cash flows.

- Unlock steady income streams for your portfolio by checking out these 16 dividend stocks with yields > 3% offering robust yields above 3%.

- Ride the momentum in technology by following the surge of companies advancing artificial intelligence through these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AMV0

Aumovio

Develops, produces, and supplies hardware, software, and mobility solutions in Germany, Europe, North America, Asia-Pacific, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives