Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:603236

Exploring Quectel Wireless Solutions And Two More High Growth Tech Stocks

Reviewed by Simply Wall St

Global markets have recently experienced a notable rally, with the U.S. small-cap Russell 2000 Index leading gains and the S&P 500 achieving its best weekly performance in nearly a year, driven by investor optimism over potential economic growth and tax reforms following recent political developments. In this environment of heightened market activity, identifying high-growth tech stocks like Quectel Wireless Solutions can be particularly appealing for investors seeking opportunities that align with current trends in deregulation and technological advancement.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 26.75% | 31.99% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Quectel Wireless Solutions (SHSE:603236)

Simply Wall St Growth Rating: ★★★★☆☆

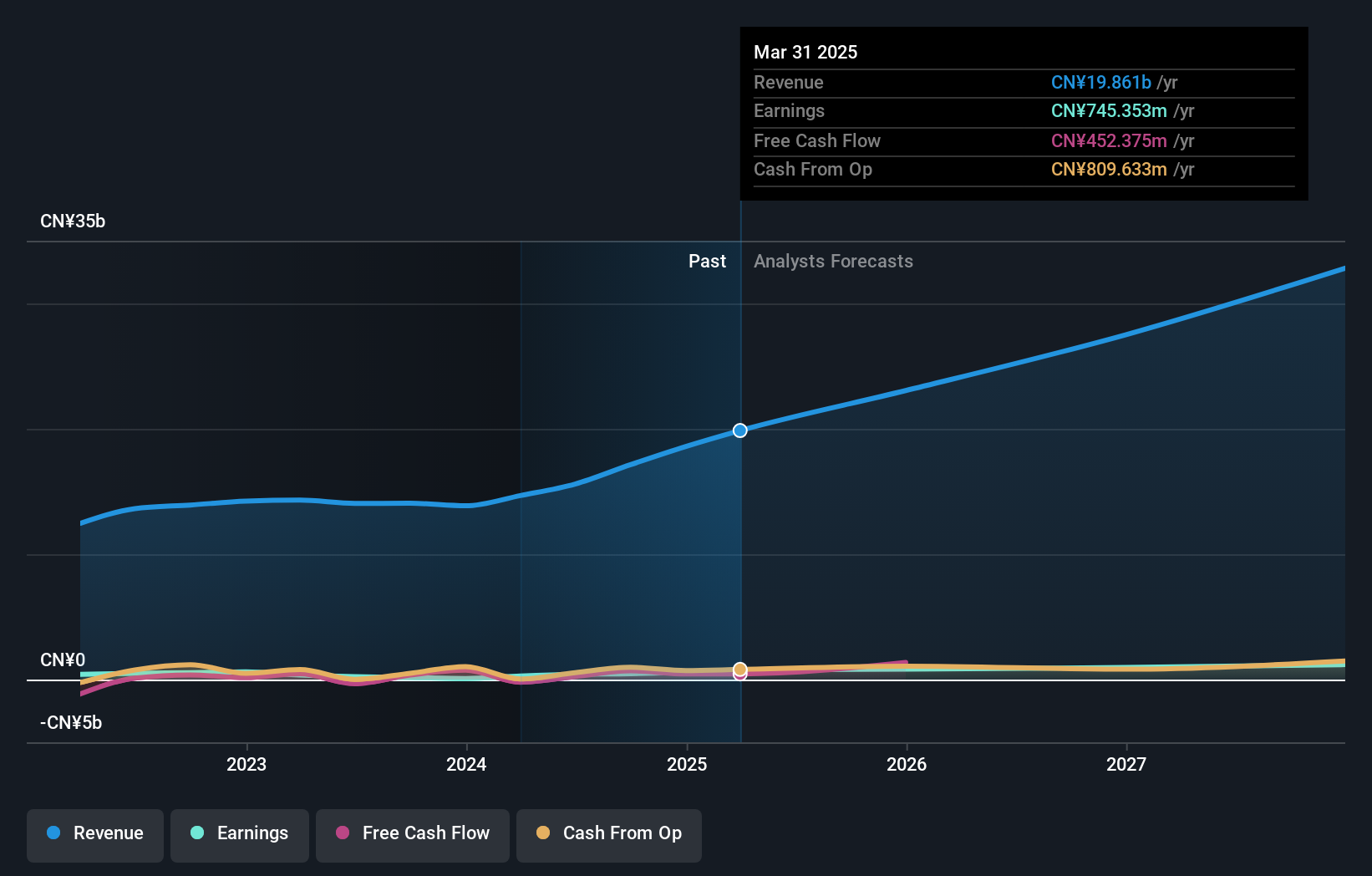

Overview: Quectel Wireless Solutions Co., Ltd. is involved in the global research, development, design, production, and sales of wireless communication modules and solutions with a market cap of CN¥14.24 billion.

Operations: Quectel Wireless Solutions focuses on the development and sale of wireless communication modules and solutions internationally. The company generates revenue primarily from these modules, which are integral to various IoT applications.

Quectel Wireless Solutions, amidst a robust 174.7% earnings growth over the past year, continues to innovate in the IoT sector with its recent launch of the SC682A smart module. This product supports multi-mode LTE Cat 4 and dual-band GNSS capabilities, crucial for enhancing multimedia functionalities across diverse applications such as POS systems and safety devices. Notably, Quectel's commitment to R&D is evident with a significant allocation of resources amounting to 19% of its revenue towards developing cutting-edge technologies that ensure compliance with stringent security standards like EU RED DA cybersecurity regulation. This strategic focus not only underscores their adaptability in meeting evolving market demands but also fortifies their position in the high-growth tech landscape by promising enhanced connectivity solutions through advanced modules and antennas that cater to a wide array of industrial needs.

- Delve into the full analysis health report here for a deeper understanding of Quectel Wireless Solutions.

Gain insights into Quectel Wireless Solutions' past trends and performance with our Past report.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★☆

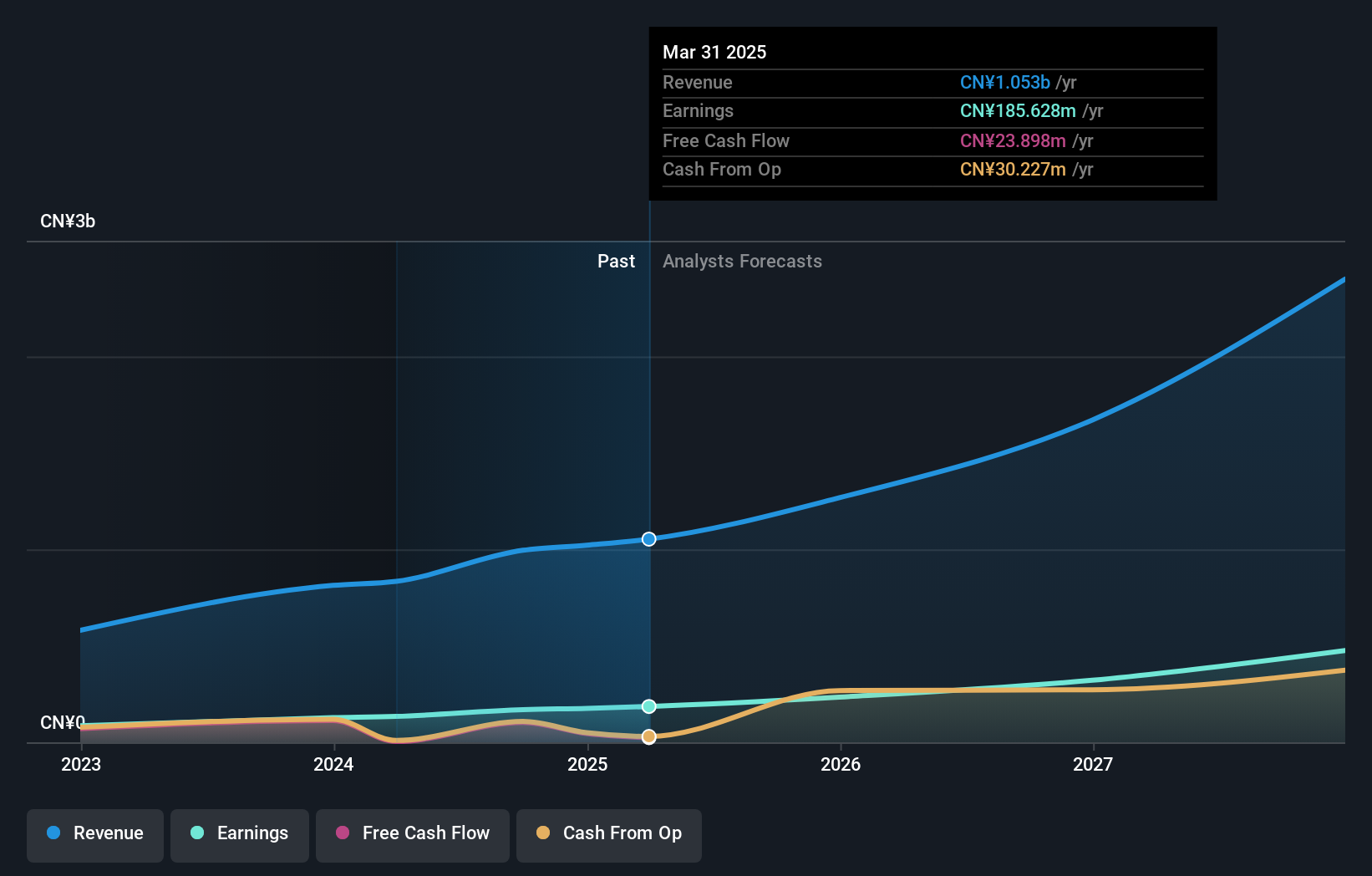

Overview: Flaircomm Microelectronics, Inc. focuses on developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥5.68 billion.

Operations: Flaircomm Microelectronics generates revenue primarily from its wireless communications equipment segment, which accounts for CN¥995.17 million. The company focuses on the automotive and M2M sectors in China, offering a range of products including communication modules and embedded software solutions.

Flaircomm Microelectronics has demonstrated robust financial performance with a 44.7% earnings growth surpassing the communications industry's average. This growth trajectory is supported by an aggressive R&D investment strategy, where 28% of its revenue is channeled into research and development, reflecting a commitment to innovation in microelectronics. The company's recent IPO raised CNY 699.2 million, underscoring market confidence and providing capital to fuel further advancements. With revenue expected to grow at 22.5% annually, Flaircomm is strategically positioned to capitalize on expanding tech demands, particularly in high-speed wireless communication and IoT solutions.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trend Micro Incorporated is a company that specializes in developing and selling security-related software and services for computers, with a market capitalization of ¥1.08 trillion.

Operations: The company generates revenue through its security-related software and services, with significant contributions from the Asia Pacific region (¥125.59 billion) and Japan (¥85.04 billion). The Americas and Europe also contribute notable amounts of ¥70.30 billion and ¥65.17 billion, respectively.

Trend Micro, with its recent announcement to partner at the Paris Peace Forum, underscores its commitment to shaping global AI security standards. This initiative is part of Trend's broader strategy to integrate safety in tech innovation, evidenced by a substantial 28% of revenue directed towards R&D efforts. Financially, Trend has shown resilience with a 72% earnings growth over the past year and forecasts suggest a continued upward trajectory at 17.2% annually. These figures not only highlight Trend's robust market position but also its proactive approach in addressing emerging tech threats through both product development and strategic alliances like that with the Paris Peace Forum for enhancing AI governance globally.

- Click here and access our complete health analysis report to understand the dynamics of Trend Micro.

Explore historical data to track Trend Micro's performance over time in our Past section.

Make It Happen

- Take a closer look at our High Growth Tech and AI Stocks list of 1279 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quectel Wireless Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603236

Quectel Wireless Solutions

Engages in the research and development, design, production, and sales of wireless communication modules and solutions worldwide.