- China

- /

- Communications

- /

- SZSE:002446

High Growth Tech Stocks in Asia to Watch This April 2025

Reviewed by Simply Wall St

As of mid-April 2025, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have shown resilience by posting gains, even as large-cap tech stocks in the U.S. faced headwinds due to new trade restrictions with China. In this environment of mixed market signals and ongoing trade tensions, investors might consider focusing on high-growth tech stocks in Asia that demonstrate strong fundamentals and adaptability to global economic shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.60% | 30.22% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 41.36% | 38.20% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Ascentage Pharma Group International (SEHK:6855)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ascentage Pharma Group International is a clinical-stage biotechnology company focused on developing therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China, with a market cap of HK$17.64 billion.

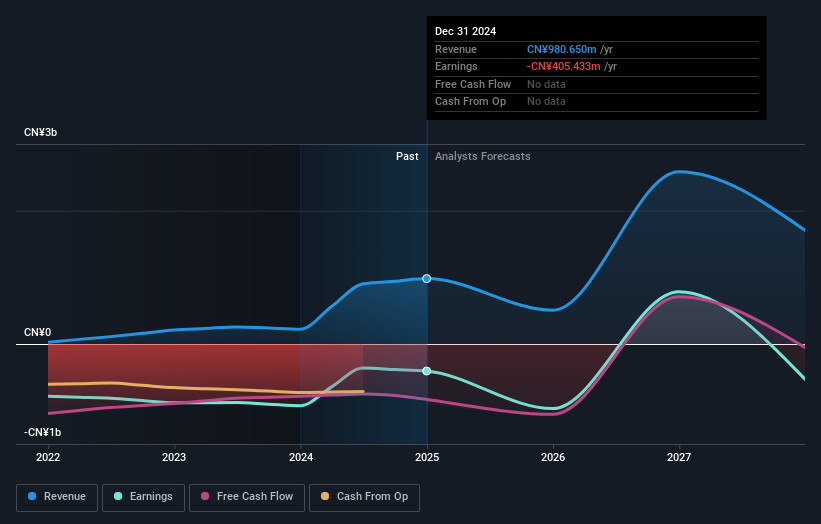

Operations: The company generates revenue primarily from the development and sale of novel small-scale therapies, totaling CN¥980.65 million.

Ascentage Pharma Group International, a key player in the high-growth sector of biotechnology in Asia, has demonstrated significant strides in innovation and market penetration. Recently included in the 2025 Chinese Society of Clinical Oncology Guidelines, its novel drugs lisaftoclax and olverembatinib have set new benchmarks for treatment efficacy. Despite a volatile share price and current unprofitability, revenue growth projections remain robust at 22.2% annually, outpacing the Hong Kong market's 8.1%. This performance is underpinned by an R&D focus that aligns with expected earnings growth of 65.07% per year over the next three years. Ascentage's strategic advancements in drug approvals and inclusion on China's National Reimbursement Drug List suggest a promising horizon despite short-term financial pressures.

Guangdong Shenglu Telecommunication Tech (SZSE:002446)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenglu Telecommunication Tech is a company engaged in the design, development, and manufacturing of telecommunication equipment with a market cap of CN¥6.11 billion.

Operations: The company specializes in producing telecommunication equipment, generating significant revenue from its design and development operations. With a market cap of CN¥6.11 billion, the firm focuses on delivering innovative solutions within the telecommunications sector.

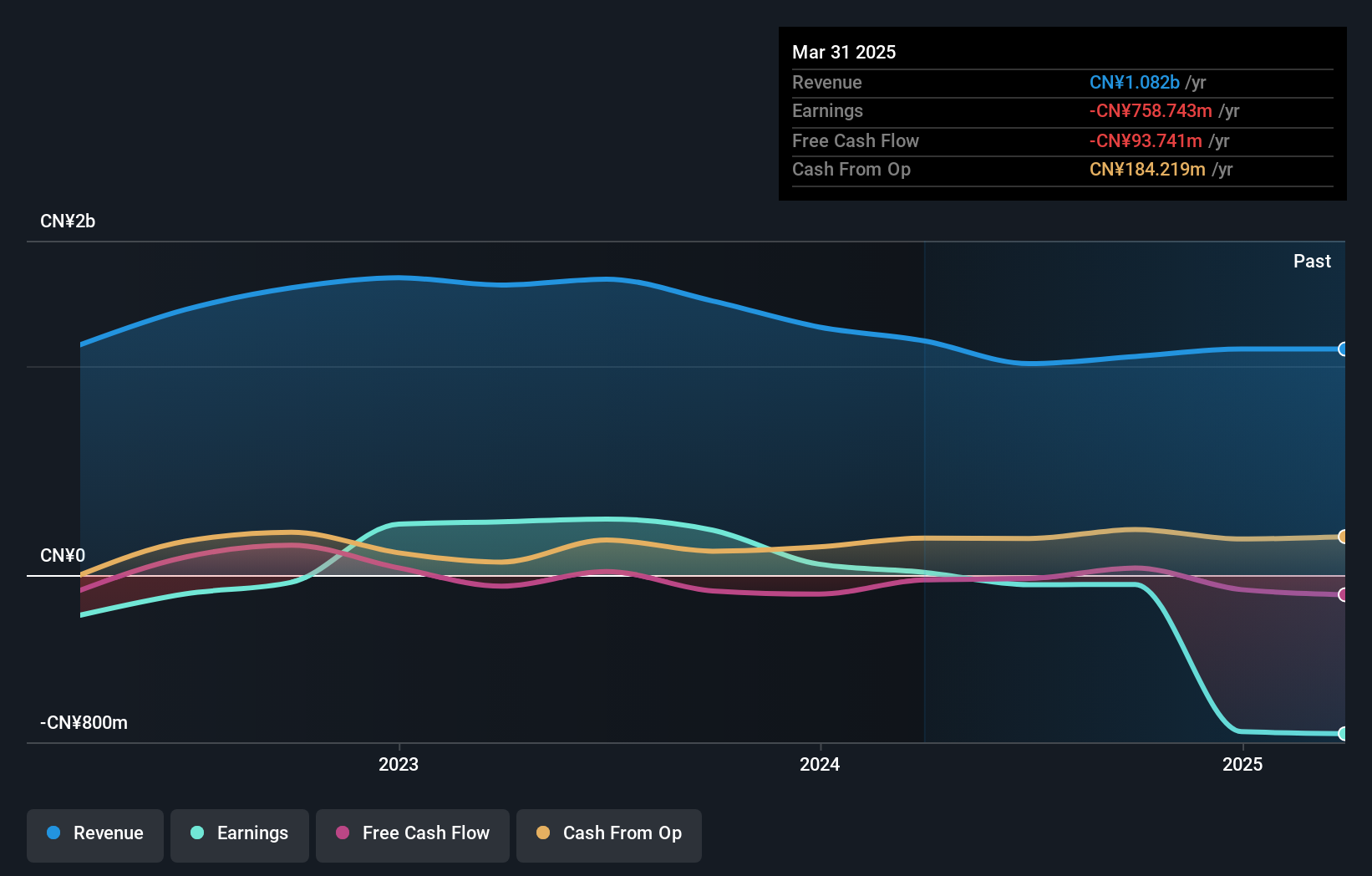

Guangdong Shenglu Telecommunication Tech has emerged as a noteworthy contender in Asia's tech landscape, particularly with its robust annual revenue growth of 29.2%. Despite recent fluctuations, including a net loss reported for the full year ended December 31, 2024, the company is expected to pivot towards profitability with an anticipated earnings growth of 139.49% per annum over the next three years. This optimistic outlook is further supported by substantial R&D investments that align closely with its strategic goals in telecommunications technology. The firm's commitment to innovation and market expansion underpins potential future success despite current financial challenges.

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Ampron Technology Co., Ltd. focuses on the research and development, manufacture, sale, and service of sensors in China, with a market capitalization of approximately CN¥9.17 billion.

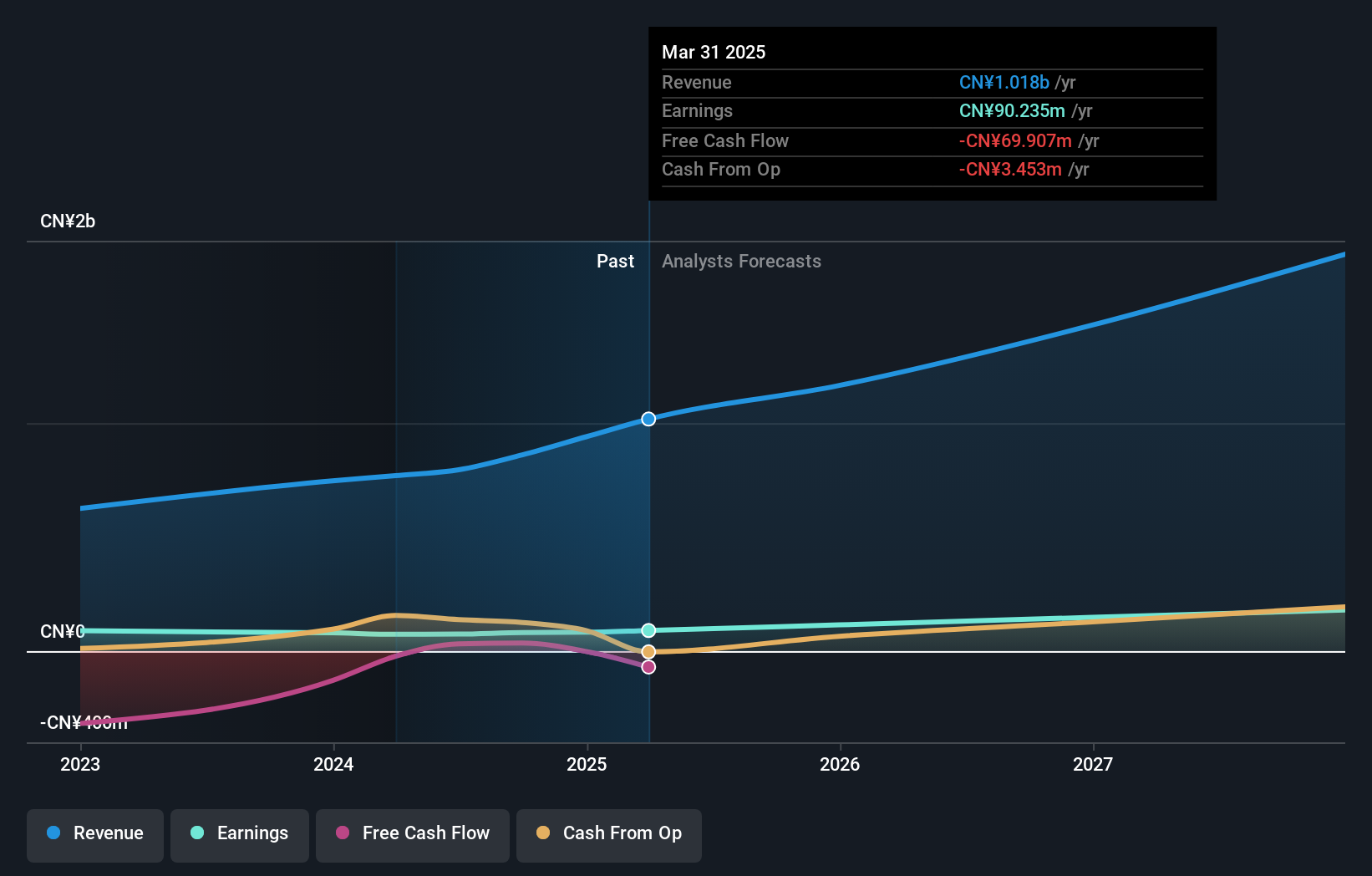

Operations: Ampron Technology generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥860.91 million. The company's operations are centered around the development and sale of sensor-related products within China.

Shenzhen Ampron Technology has demonstrated resilience with its latest earnings, posting a 26% increase in annual sales to CNY 940.16 million and maintaining stable net income around CNY 82.64 million despite a slight dip in EPS from CNY 1.08 to CNY 0.84 year-over-year. This performance is underpinned by significant R&D spending, crucial for sustaining its competitive edge in the fast-evolving tech sector of Asia. Looking ahead, the company's revenue and earnings are expected to outpace the broader Chinese market, with forecasts suggesting a robust annual growth rate of 24.1% in revenue and an impressive 35.6% in earnings per year, highlighting its potential amidst a volatile market environment.

- Click here to discover the nuances of Shenzhen Ampron Technology with our detailed analytical health report.

Learn about Shenzhen Ampron Technology's historical performance.

Make It Happen

- Investigate our full lineup of 495 Asian High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002446

Guangdong Shenglu Telecommunication Tech

Guangdong Shenglu Telecommunication Tech.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives