- China

- /

- Auto Components

- /

- SHSE:603048

Undiscovered Gems in Asia for March 2025

Reviewed by Simply Wall St

In the midst of global market fluctuations and economic uncertainties, the Asian markets are capturing attention with their resilience and potential for growth. As investors navigate through these challenging times, identifying stocks that demonstrate strong fundamentals and adaptability to changing conditions becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Time Publishing and Media | 2.49% | 7.52% | 18.20% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 6.86% | 2.90% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| Shanghai Haixin Group | 0.77% | 1.60% | 8.25% | ★★★★★☆ |

| Kappa Create | 81.94% | 0.91% | 25.82% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 141.86% | 2.81% | 3.53% | ★★★★☆☆ |

| Bank of Iwate | 119.19% | 1.75% | 7.64% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Vtech Holdings (SEHK:303)

Simply Wall St Value Rating: ★★★★★★

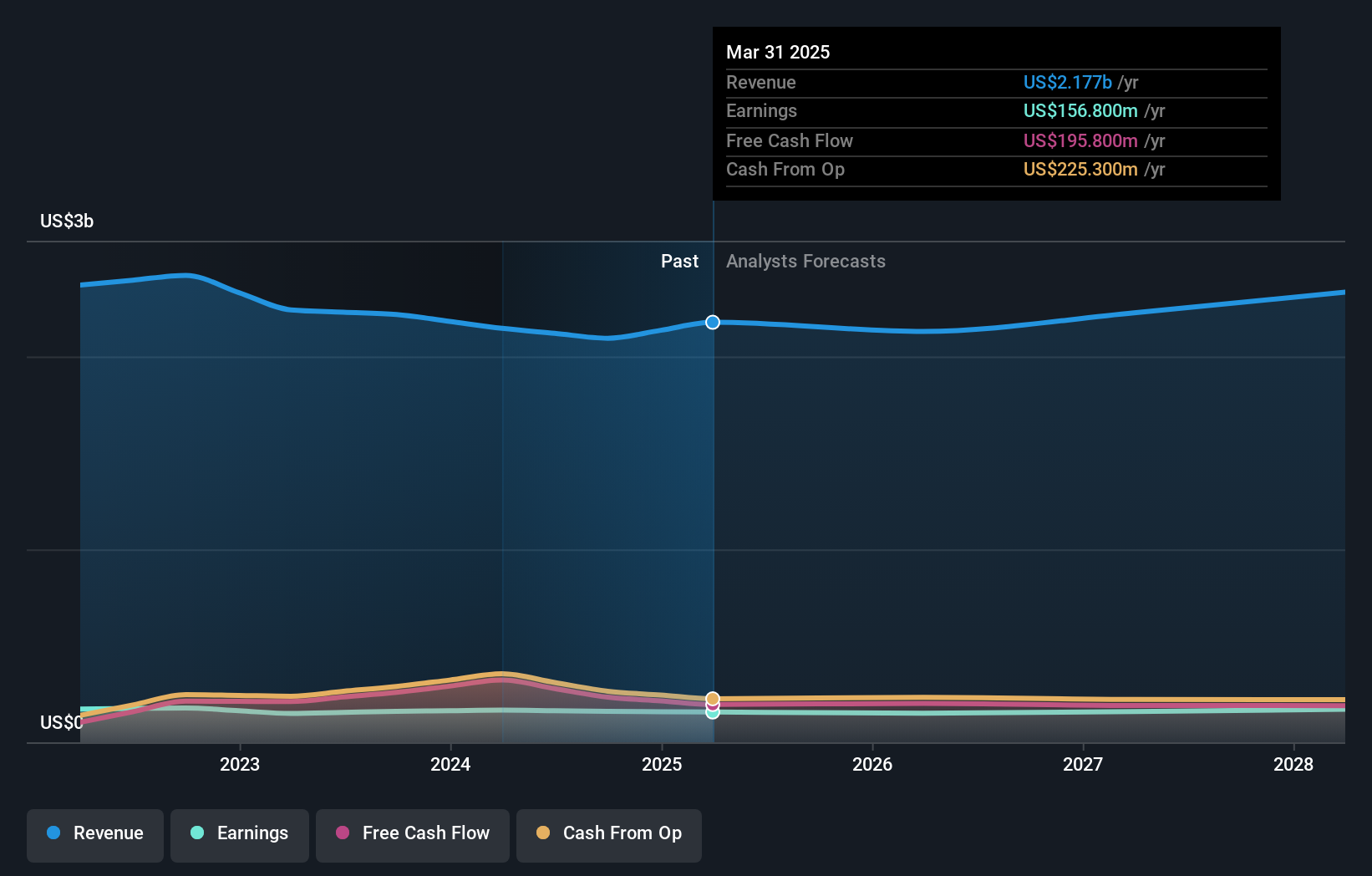

Overview: Vtech Holdings Limited is a company that designs, manufactures, and distributes electronic products globally with a market cap of approximately HK$14.57 billion.

Operations: The primary revenue stream for Vtech Holdings comes from the design, manufacture, and distribution of consumer electronic products, generating approximately $2.09 billion.

Vtech Holdings, a smaller player in the electronics space, is currently trading at 52.6% below its estimated fair value, which might catch the eye of investors seeking undervalued opportunities. Despite being debt-free for over five years and boasting high-quality past earnings, Vtech has faced challenges with earnings declining by 5.9% annually over the last five years. The company is profitable and has positive free cash flow; however, recent negative growth of 0.2% contrasts sharply with an industry average decline of 15.6%. This mixed performance suggests potential but requires careful consideration by investors.

- Navigate through the intricacies of Vtech Holdings with our comprehensive health report here.

Gain insights into Vtech Holdings' historical performance by reviewing our past performance report.

Zhejiang Liming Intelligent ManufacturingLtd (SHSE:603048)

Simply Wall St Value Rating: ★★★★★☆

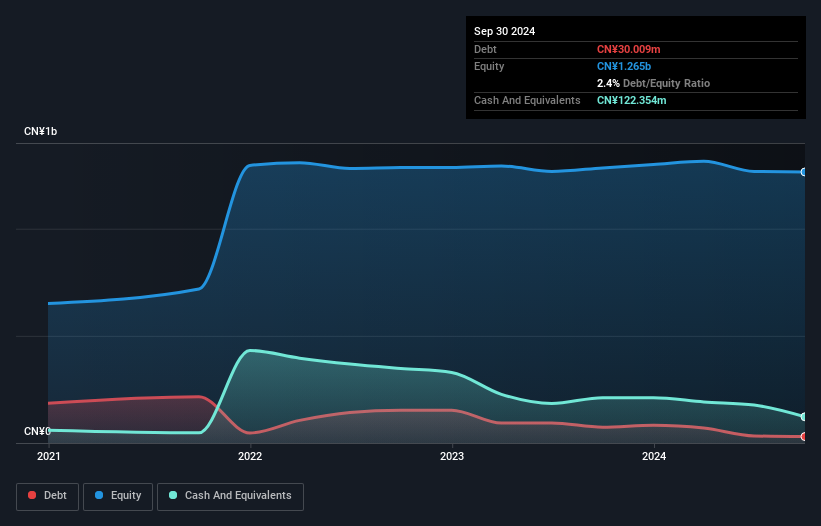

Overview: Zhejiang Liming Intelligent Manufacturing Co., Ltd. specializes in the production of automotive components and has a market capitalization of CN¥3.05 billion.

Operations: The company generates revenue primarily from its car parts segment, amounting to CN¥638.68 million.

Zhejiang Liming Intelligent Manufacturing Ltd. has seen a significant 75.2% earnings growth over the past year, outpacing the Auto Components industry average of 11%. Despite this impressive growth, the company's earnings have declined by an average of 34.8% annually over the last five years, indicating some volatility in its financial performance. With a recent one-off gain of CN¥13.7M impacting its financial results as of September 2024, it's crucial to consider these non-recurring items when evaluating profitability quality. The company also completed a share buyback program in early February 2025, purchasing shares worth CN¥10 million which may reflect confidence in its valuation and future prospects.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Value Rating: ★★★★★★

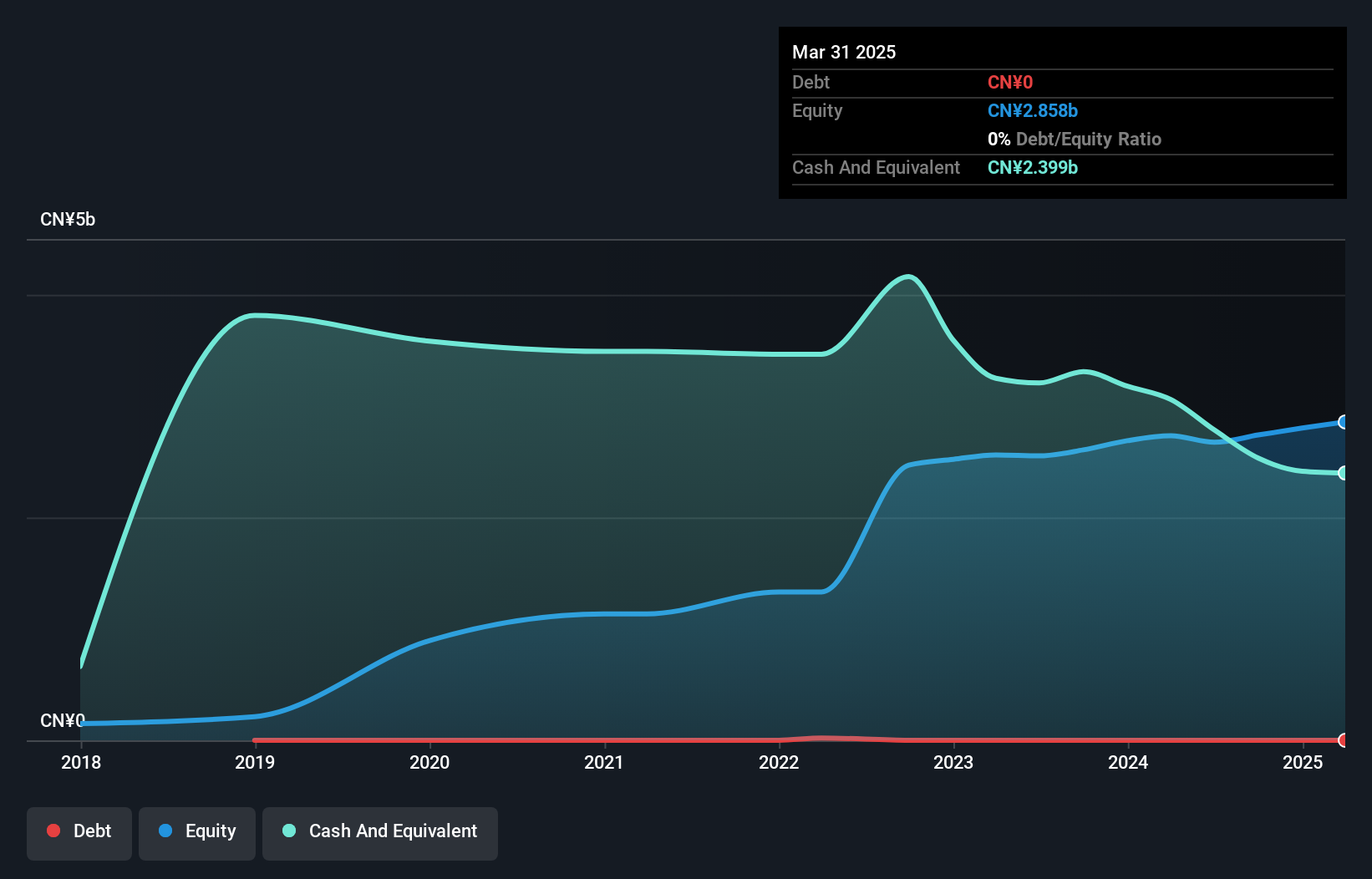

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China, with a market cap of CN¥10.57 billion.

Operations: Tongxingbao generates revenue primarily from its smart transportation platform solutions, focusing on highways, trunk roads, and urban transportation within China. The company's financial performance is highlighted by a market cap of CN¥10.57 billion.

Jiangsu Tongxingbao, a promising player in intelligent transportation, showcases robust growth with earnings climbing 10.3% last year, outpacing the electronic industry's 2.6%. The company is debt-free and boasts high-quality past earnings, while its price-to-earnings ratio of 50.2x remains attractive compared to the industry average of 51.9x. Recent financials reflect sales rising to CNY 895 million from CNY 742 million in the previous year, alongside net income increasing to CNY 211 million from CNY 191 million. With earnings per share at CNY 0.52 up from CNY 0.47, prospects appear bright for continued expansion and value creation.

Summing It All Up

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2577 more companies for you to explore.Click here to unveil our expertly curated list of 2580 Asian Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Liming Intelligent ManufacturingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603048

Zhejiang Liming Intelligent ManufacturingLtd

Zhejiang Liming Intelligent Manufacturing Co.,Ltd.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives