- China

- /

- Entertainment

- /

- SZSE:300467

Discovering Hidden Potential In These 3 Undiscovered Gems

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, with U.S. stocks experiencing volatility due to AI competition fears and mixed corporate earnings, investors are increasingly looking toward small-cap opportunities as the Federal Reserve maintains steady interest rates. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; these undiscovered gems often thrive in niches overlooked by larger market players.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yashima Denki | 2.71% | -1.00% | 18.12% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Kuo Yang Construction | 83.40% | -32.54% | -39.68% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Sichuan Xunyou Network Technology (SZSE:300467)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Xunyou Network Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.33 billion.

Operations: The company generates revenue primarily from its technology-related services. It has a market capitalization of CN¥3.33 billion, reflecting its position within the sector.

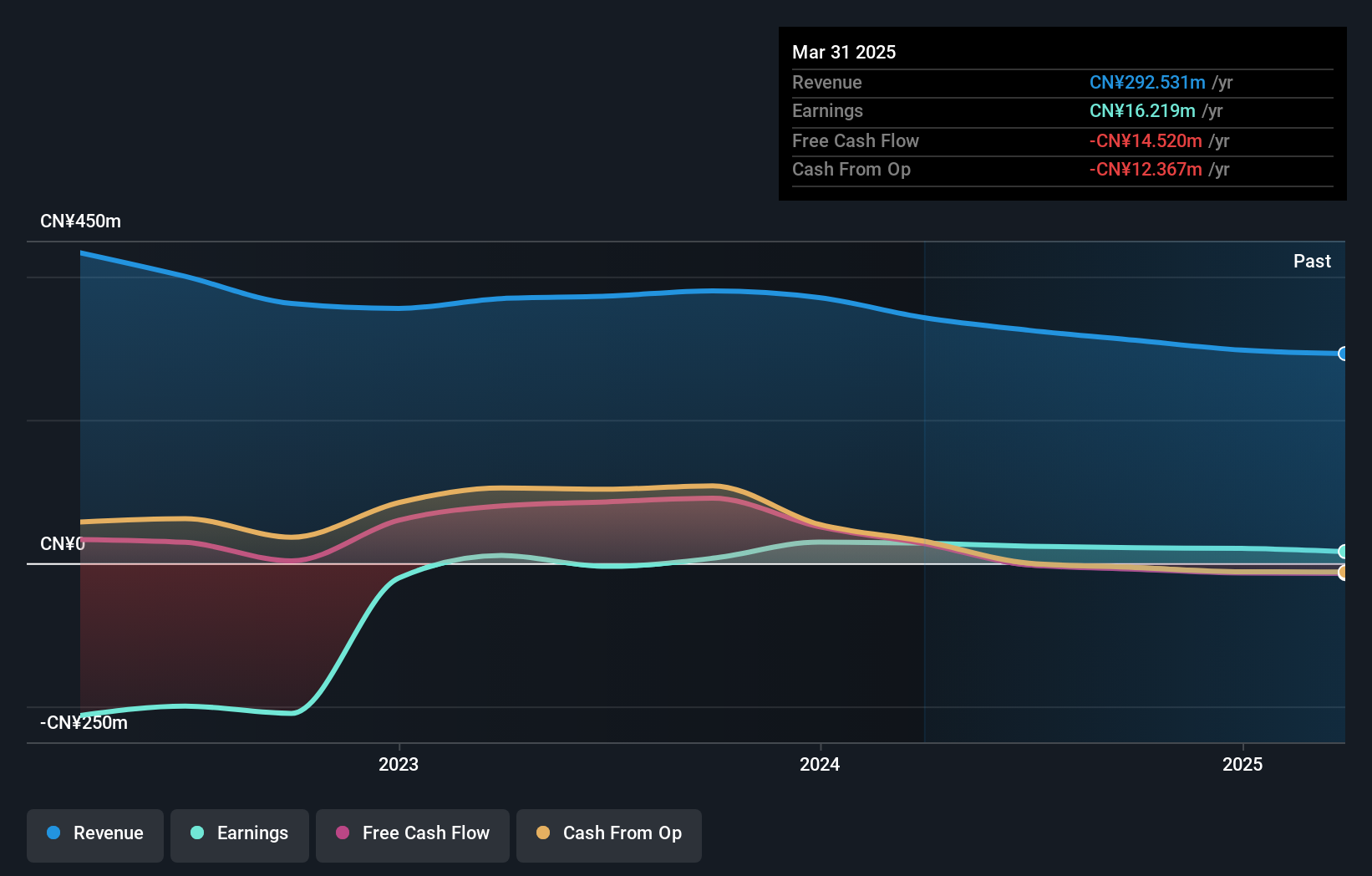

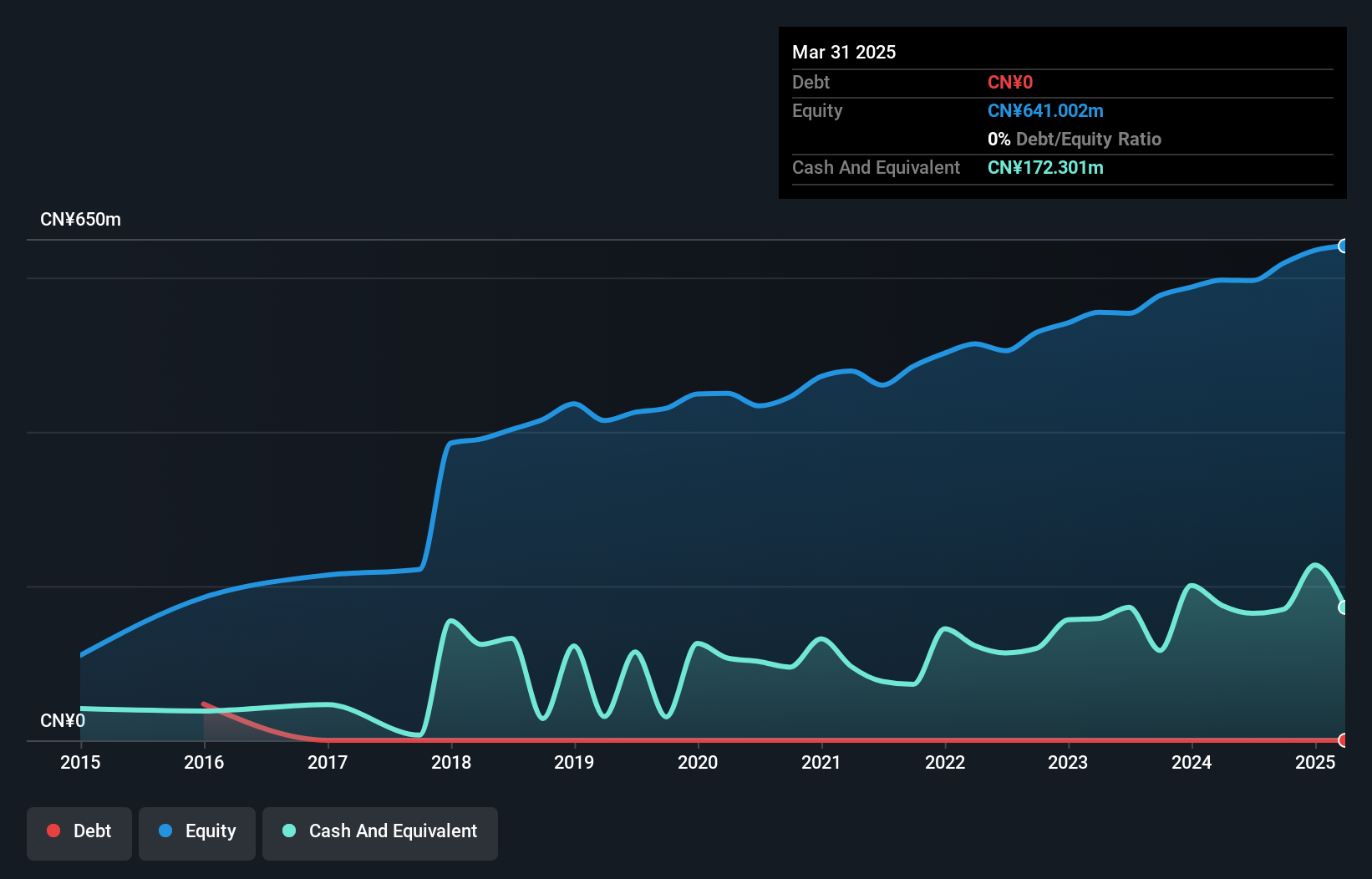

Sichuan Xunyou Network Technology, a relatively small player in the tech space, demonstrates impressive financial health with high-quality earnings and no debt, which eliminates concerns over interest payments. In the past year, its earnings surged by 211.8%, significantly outpacing the Entertainment industry's -16.1% performance. Despite not being free cash flow positive recently, this growth indicates strong operational capabilities. The company has also managed to eliminate its debt over five years from a prior debt-to-equity ratio of 6.9%. This combination of factors suggests potential for sustained performance in an evolving industry landscape.

Jiangxi Xinyu Guoke Technology (SZSE:300722)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Xinyu Guoke Technology Co., Ltd is engaged in the manufacturing and sale of military products, with a market cap of CN¥7.16 billion.

Operations: Xinyu Guoke Technology focuses on generating revenue through the sale of military products. The company has a market capitalization of CN¥7.16 billion, indicating its valuation in the financial market.

Jiangxi Xinyu Guoke Technology, a smaller player in its field, has demonstrated notable financial health with no debt over the past five years. Its earnings grew by 7% last year, outpacing the Aerospace & Defense industry's -13.4%. The company showcases high-quality earnings and is free cash flow positive with a recent figure of US$91.02 million as of September 2024. Capital expenditure was recorded at US$14.17 million during the same period, indicating ongoing investments in growth initiatives. These factors suggest a solid foundation for potential future advancements within its industry niche.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China, with a market cap of CN¥8.38 billion.

Operations: Tongxingbao generates revenue primarily from smart transportation platform solutions in China. The company has a market capitalization of CN¥8.38 billion.

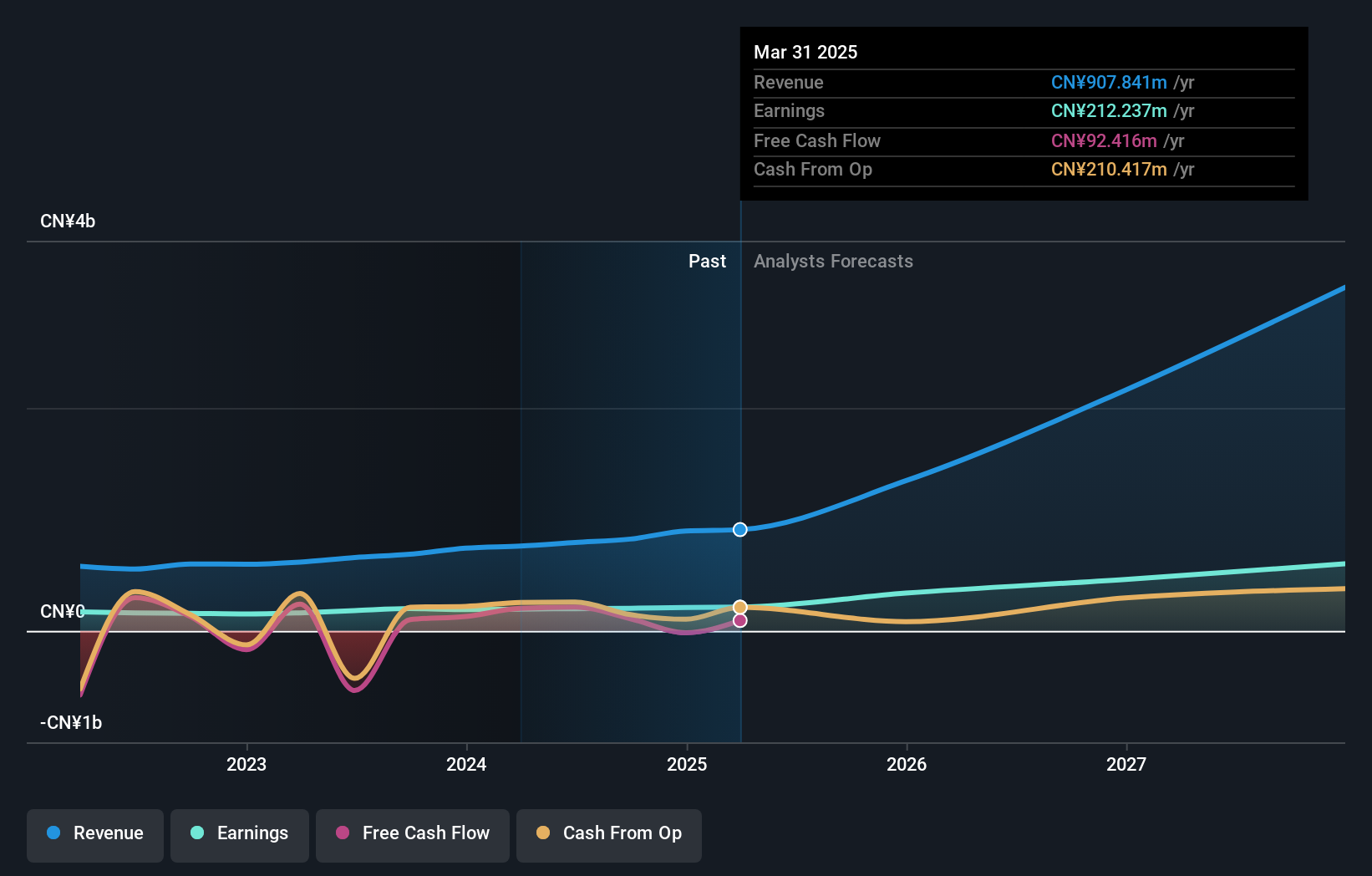

Jiangsu Tongxingbao, a player in the intelligent transportation sector, shows promising growth. Over the past year, its earnings grew by 10%, outpacing the electronic industry's average of 2%. The company is debt-free and boasts high-quality past earnings. Recent results highlight a sales increase to CNY 895 million from CNY 742 million and net income rising to CNY 211 million from CNY 191 million. With a price-to-earnings ratio of 41x below industry standards, it appears undervalued. Earnings per share improved to CNY 0.52 from CNY 0.47, indicating strong performance momentum moving forward.

Make It Happen

- Unlock our comprehensive list of 4717 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300467

Sichuan Xunyou Network Technology

Sichuan Xunyou Network Technology Co., Ltd.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives