- China

- /

- Electronic Equipment and Components

- /

- SZSE:301328

WCON Electronics (Guangdong) (SZSE:301328) Is Reducing Its Dividend To CN¥0.30

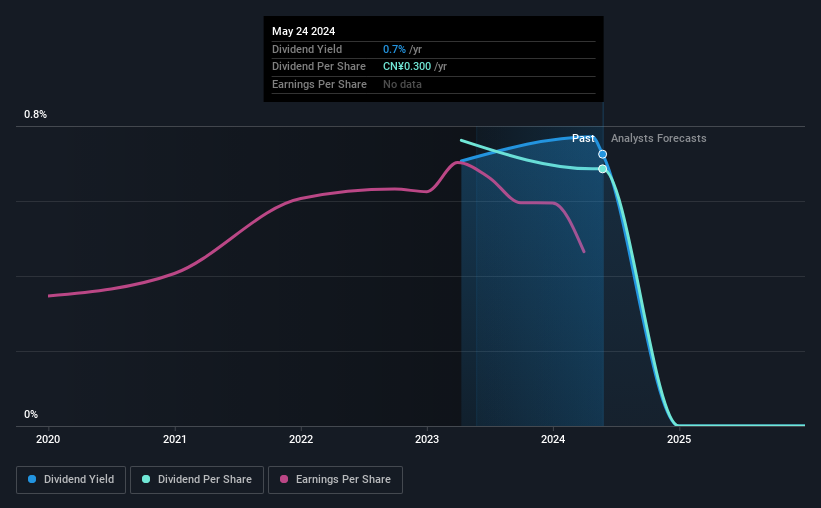

WCON Electronics (Guangdong) Co., Ltd.'s (SZSE:301328) dividend is being reduced from last year's payment covering the same period to CN¥0.30 on the 29th of May. Based on this payment, the dividend yield will be 0.7%, which is lower than the average for the industry.

Check out our latest analysis for WCON Electronics (Guangdong)

WCON Electronics (Guangdong)'s Earnings Easily Cover The Distributions

If it is predictable over a long period, even low dividend yields can be attractive. WCON Electronics (Guangdong) is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Looking forward, earnings per share is forecast to rise by 54.0% over the next year. If the dividend continues on this path, the payout ratio could be 21% by next year, which we think can be pretty sustainable going forward.

WCON Electronics (Guangdong) Is Still Building Its Track Record

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend's Growth Prospects Are Limited

The company's investors will be pleased to have been receiving dividend income for some time. Earnings per share has been crawling upwards at 4.5% per year. While EPS growth is quite low, WCON Electronics (Guangdong) has the option to increase the payout ratio to return more cash to shareholders.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for WCON Electronics (Guangdong) (of which 2 don't sit too well with us!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if WCON Electronics (Guangdong) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301328

WCON Electronics (Guangdong)

Engages in the research and development, manufacturing, and marketing of connectors and cable assemblies in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives