Chinese Exchange Growth Companies With High Insider Ownership October 2024

Reviewed by Simply Wall St

In recent weeks, Chinese stocks have experienced a notable surge, driven by Beijing's announcement of comprehensive stimulus measures aimed at revitalizing the economy. This positive momentum in the market provides a conducive environment for investors looking at growth companies with high insider ownership, as such firms often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's explore several standout options from the results in the screener.

PharmaBlock Sciences (Nanjing) (SZSE:300725)

Simply Wall St Growth Rating: ★★★★☆☆

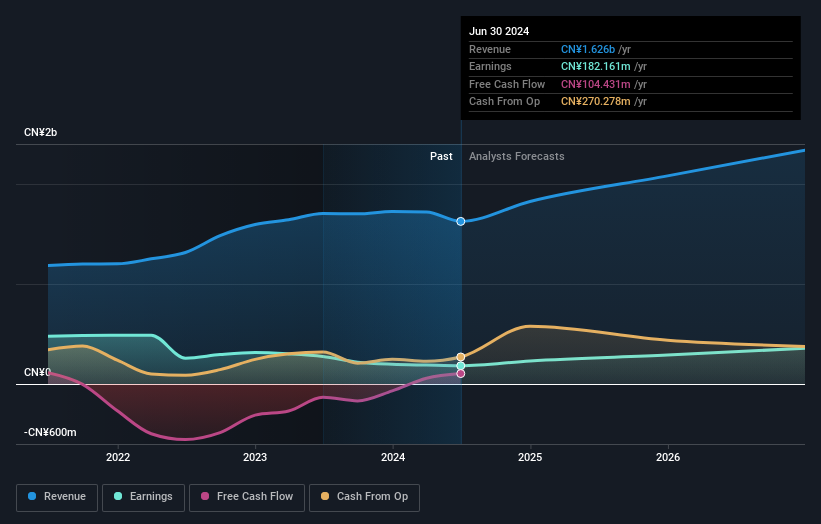

Overview: PharmaBlock Sciences (Nanjing), Inc. offers chemistry products and services for pharmaceutical research, development, and commercial production, with a market cap of CN¥7.52 billion.

Operations: The company generates revenue of CN¥1.63 billion from its drug research and development and production-related business segment.

Insider Ownership: 25%

Earnings Growth Forecast: 25.7% p.a.

PharmaBlock Sciences (Nanjing) exhibits high insider ownership, aligning with its growth potential despite recent revenue and profit declines. The company's earnings are forecast to grow significantly at 25.7% annually, outpacing the broader Chinese market's growth rate of 23.2%. Revenue is expected to increase by 14.2% per year, slightly above market averages but below the 20% benchmark for high growth. Profit margins have contracted from last year, reflecting some operational challenges.

- Delve into the full analysis future growth report here for a deeper understanding of PharmaBlock Sciences (Nanjing).

- Our comprehensive valuation report raises the possibility that PharmaBlock Sciences (Nanjing) is priced higher than what may be justified by its financials.

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Simply Wall St Growth Rating: ★★★★☆☆

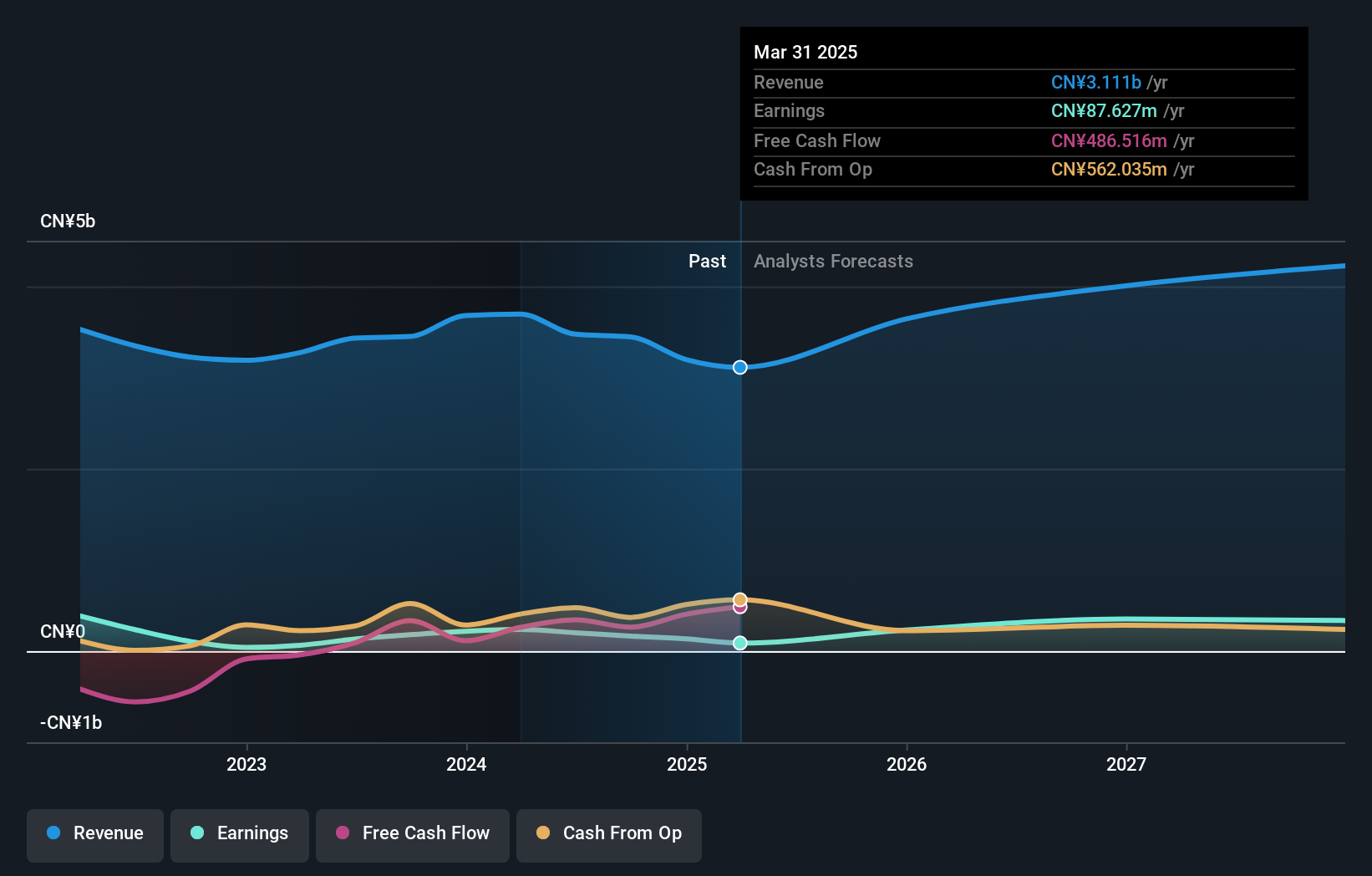

Overview: Wuhan Raycus Fiber Laser Technologies Ltd (SZSE:300747) specializes in the development and manufacturing of fiber laser technologies, with a market cap of CN¥10.57 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 16.1%

Earnings Growth Forecast: 42.5% p.a.

Wuhan Raycus Fiber Laser Technologies shows strong growth potential with expected annual earnings growth of 42.5%, surpassing the Chinese market's average. Despite a recent dip in revenue and profit, insider ownership remains high, suggesting confidence in its strategic direction. The company's forecasted revenue growth of 19.3% annually is above the market average but below high-growth benchmarks. Recent shareholder meetings indicate active governance, while dividends remain unstable due to fluctuating financials influenced by large one-off items.

- Click to explore a detailed breakdown of our findings in Wuhan Raycus Fiber Laser TechnologiesLtd's earnings growth report.

- The valuation report we've compiled suggests that Wuhan Raycus Fiber Laser TechnologiesLtd's current price could be quite moderate.

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★★

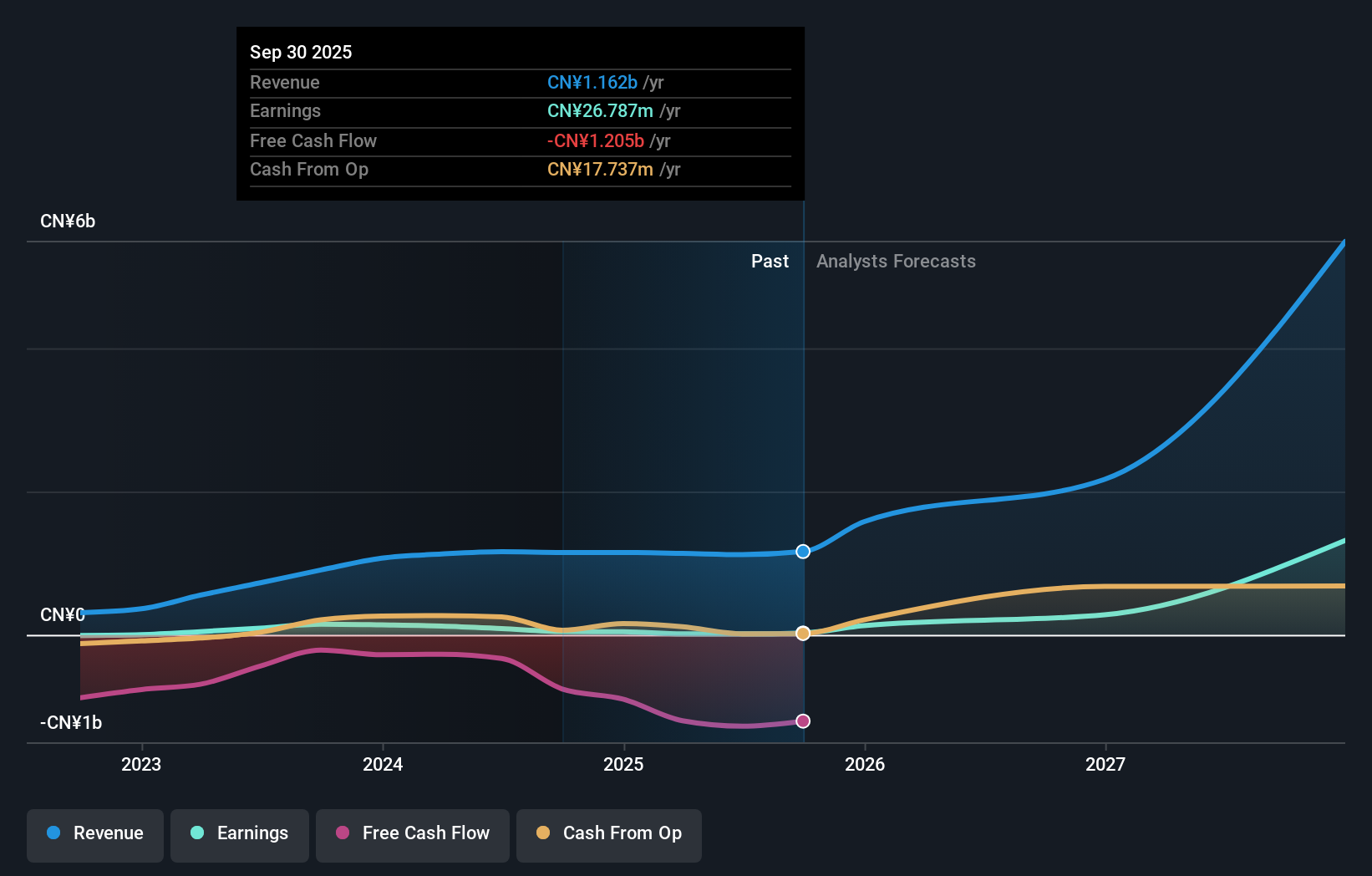

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. operates in the environmental technology sector and has a market capitalization of CN¥12.29 billion.

Operations: Qingdao Huicheng Environmental Technology Group Co., Ltd. has a market capitalization of CN¥12.29 billion, but specific revenue segments are not provided in the available data.

Insider Ownership: 32%

Earnings Growth Forecast: 58.5% p.a.

Qingdao Huicheng Environmental Technology Group demonstrates significant growth potential, with earnings expected to increase by 58.47% annually, outpacing the Chinese market. Despite a recent decline in net income to CNY 34.96 million and volatile share prices, insider ownership remains substantial, as evidenced by Zhang Min's acquisition of a 5% stake for CNY 300 million. The company was recently added to the S&P Global BMI Index, reflecting its growing prominence in the industry.

- Dive into the specifics of Qingdao Huicheng Environmental Technology Group here with our thorough growth forecast report.

- The analysis detailed in our Qingdao Huicheng Environmental Technology Group valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Navigate through the entire inventory of 381 Fast Growing Chinese Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300725

PharmaBlock Sciences (Nanjing)

Provides chemistry products and services throughout the pharmaceutical research and development, and commercial production.

Reasonable growth potential with adequate balance sheet.