As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite recent economic concerns such as the Chicago PMI's contraction and revised GDP forecasts, investors are closely monitoring high-growth tech stocks that have shown resilience amid fluctuating indices. In today's market, identifying promising tech companies involves assessing their ability to innovate and adapt within an environment marked by both economic challenges and opportunities for technological advancement.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Wanma Technology (SZSE:300698)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wanma Technology Co., Ltd. specializes in the research and development, production, system integration, and sales of communication and medical information equipment with a market cap of CN¥4.49 billion.

Operations: The company generates revenue primarily through the sale of communication and medical information equipment. It focuses on system integration and production, leveraging its research and development capabilities to enhance product offerings.

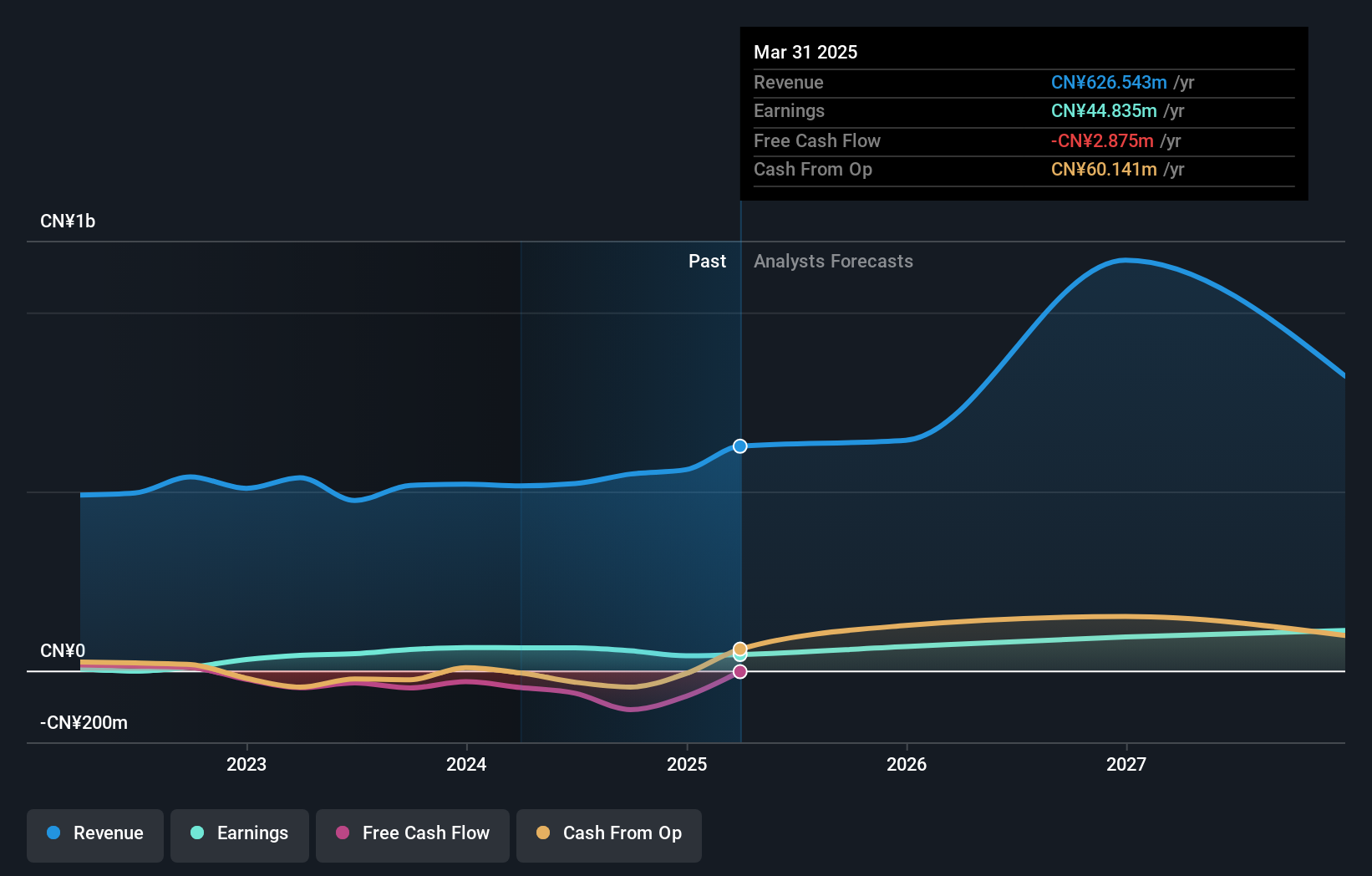

Wanma Technology, amidst a robust tech landscape, has demonstrated a promising trajectory with an annual revenue growth rate of 37.3%, outpacing the Chinese market's average of 13.6%. This growth is underpinned by significant R&D investments, reflecting in their innovative product offerings and market expansion strategies. Despite a recent dip in net income to CNY 31.22 million from CNY 40.39 million year-over-year as per the latest earnings report, the company's strategic maneuvers including a notable M&A transaction where Jinzheng Hongsheng acquired a 5% stake suggest proactive efforts to bolster market position and shareholder value. With earnings expected to surge by approximately 53.8% annually, Wanma is poised for impactful advancements within the tech sector.

Guangzhou Frontop Digital Creative Technology (SZSE:301313)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Frontop Digital Creative Technology Corporation focuses on the exploration and research of digital multimedia display services and technology both in China and internationally, with a market cap of CN¥2.55 billion.

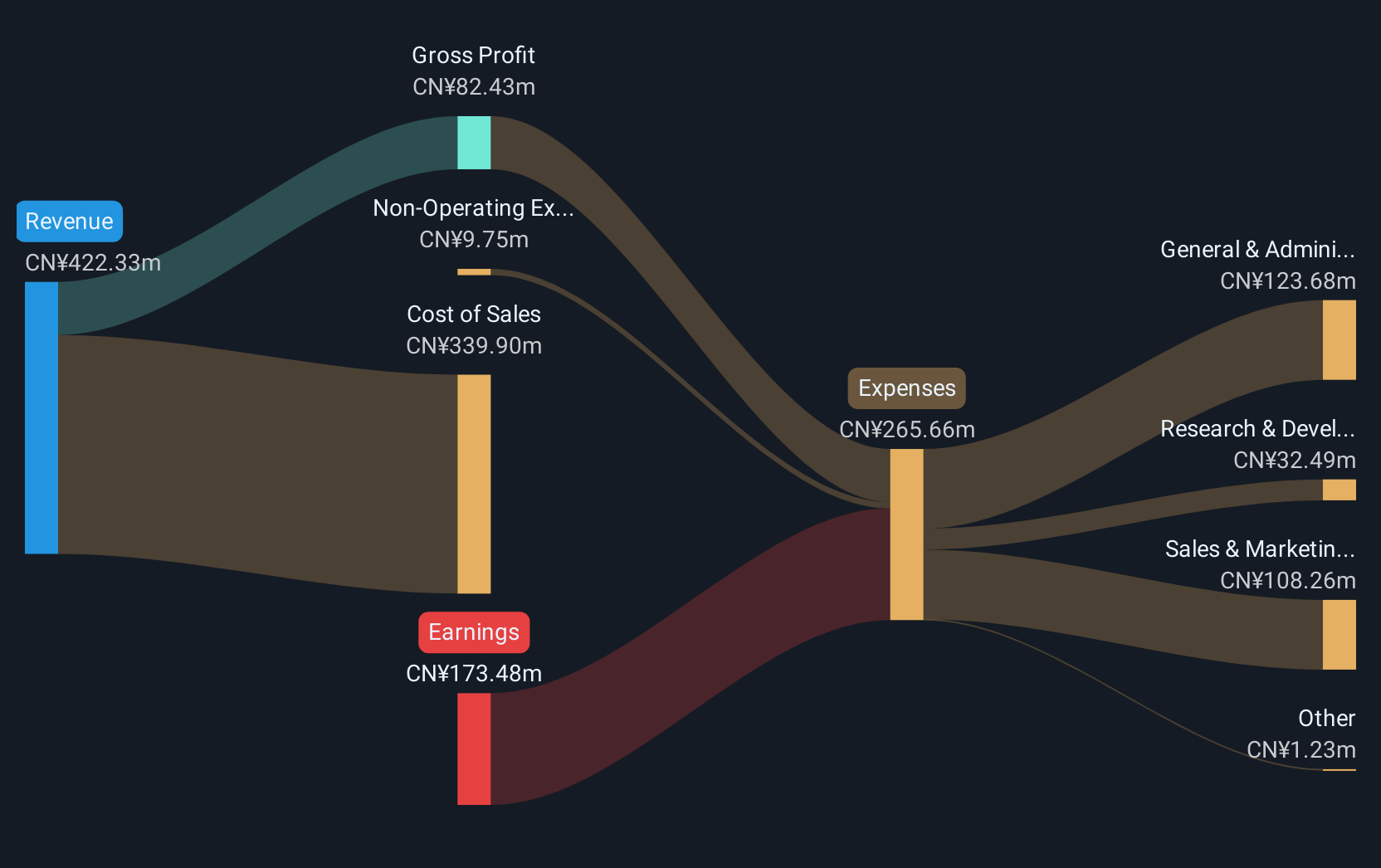

Operations: Frontop Digital Creative Technology specializes in digital multimedia display services and technology, targeting both domestic and international markets. The company generates revenue through its innovative solutions in the digital creative sector.

Guangzhou Frontop Digital Creative Technology has faced significant challenges, as evidenced by a sharp decline in revenue from CNY 314.82 million to CNY 243.53 million and an increased net loss of CNY 127.15 million compared to the previous year's CNY 22.88 million. Despite these setbacks, the company is forecasted to pivot towards profitability with an expected annual profit growth of 74%. This potential turnaround is underpinned by its strategic focus on enhancing its technological offerings and optimizing operations, aiming for a competitive edge in the rapidly evolving tech landscape.

Digital Garage (TSE:4819)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital Garage, Inc. is a context company operating in Japan and internationally with a market capitalization of approximately ¥175.69 billion.

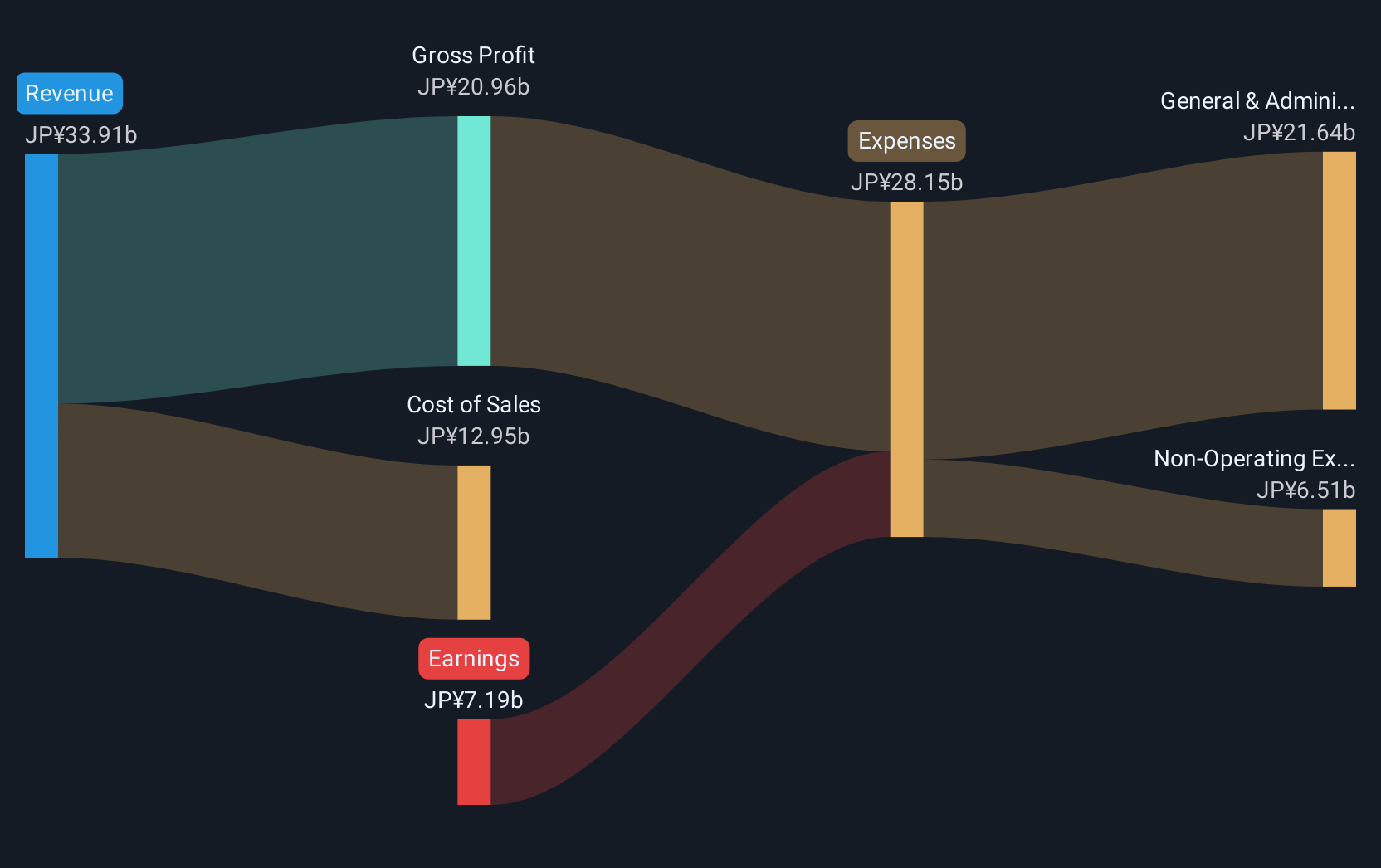

Operations: Digital Garage generates revenue primarily through its Platform Solutions segment, contributing ¥23.29 billion, and Long-Term Incubation segment with ¥11.93 billion. The Global Investment Incubation segment adds a smaller portion at ¥72 million.

Digital Garage is navigating the competitive tech landscape with a strategic emphasis on innovation and market adaptation. With a robust annual revenue growth of 16.1%, the company outpaces the Japanese market's average of 4.2%. This growth is bolstered by an impressive forecast for earnings, expected to surge by 99.3% annually, positioning Digital Garage well for future profitability. The firm's commitment to R&D is evident from its significant investment, amounting to $120 million last year, which represents a substantial proportion of its revenue, underscoring its dedication to technological advancement and competitive edge in software and AI domains.

- Navigate through the intricacies of Digital Garage with our comprehensive health report here.

Examine Digital Garage's past performance report to understand how it has performed in the past.

Make It Happen

- Explore the 1258 names from our High Growth Tech and AI Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301313

Guangzhou Frontop Digital Creative Technology

Engages in the exploration and research of digital multimedia display services and technology in China and internationally.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives