- Japan

- /

- Trade Distributors

- /

- TSE:8061

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a tumultuous period marked by cautious earnings reports and mixed economic signals, investors are seeking stability amidst the volatility. With major indices like the Nasdaq Composite and S&P MidCap 400 experiencing fluctuations, dividend stocks offer an attractive option for those looking to balance growth with income. In such uncertain times, a good dividend stock is one that not only provides consistent payouts but also demonstrates resilience in its financial health and market positioning.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.77% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.46% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.33% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.23% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Qingdao Citymedia Co (SHSE:600229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Citymedia Co., Ltd. operates in China focusing on the publication and distribution of books, periodicals, journals, and electronic audio-visual publications, with a market cap of CN¥4.86 billion.

Operations: Qingdao Citymedia Co., Ltd. generates its revenue through the publication and distribution of various media formats, including books, periodicals, journals, and electronic audio-visual publications within China.

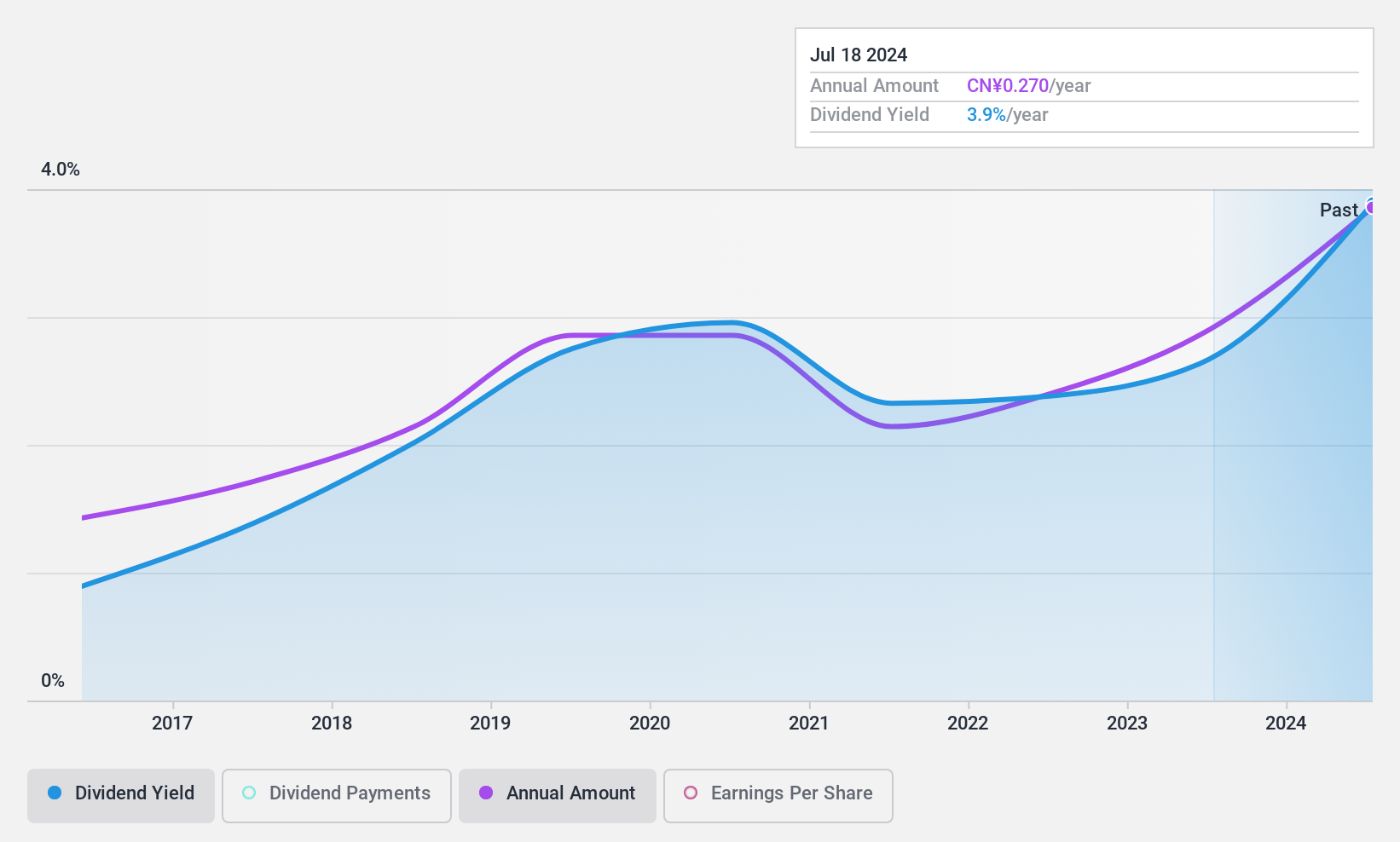

Dividend Yield: 3.7%

Qingdao Citymedia Co.'s dividend yield is attractive, ranking in the top 25% of CN market payers. The dividends are covered by earnings and cash flows with payout ratios of 62.6% and 56.4%, respectively, indicating sustainability. However, the company's dividend history is less reliable due to volatility over its eight-year payment period. Recent earnings results show a decline in net income to CNY 131.89 million for nine months ended September 2024, which may impact future payouts.

- Get an in-depth perspective on Qingdao Citymedia Co's performance by reading our dividend report here.

- According our valuation report, there's an indication that Qingdao Citymedia Co's share price might be on the cheaper side.

Yealink Network Technology (SZSE:300628)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yealink Network Technology Co., Ltd. offers voice conferencing, voice communications, and collaboration solutions globally with a market cap of CN¥50.23 billion.

Operations: Yealink Network Technology Co., Ltd.'s revenue from Internet Telephone is CN¥5.23 billion.

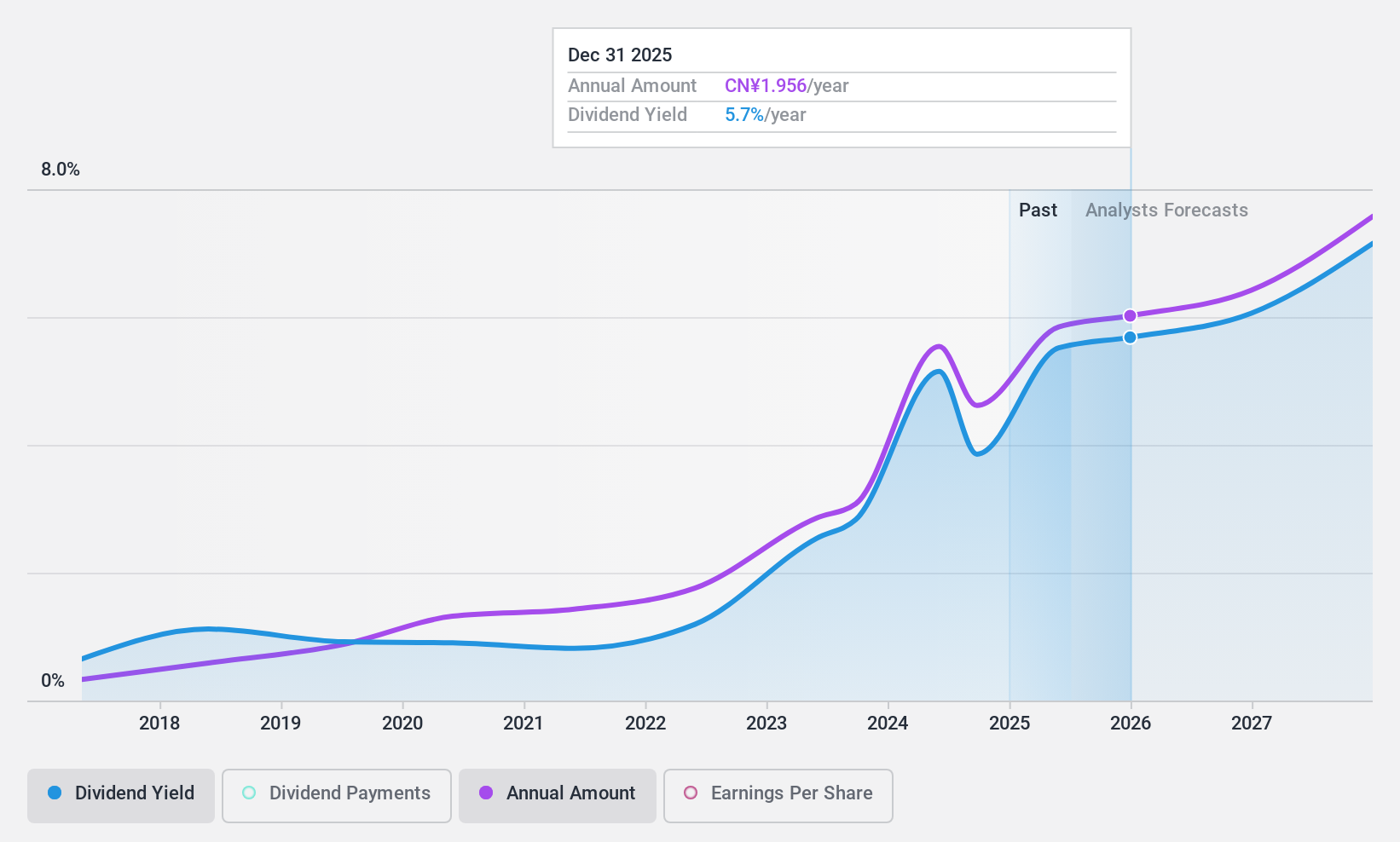

Dividend Yield: 3.7%

Yealink Network Technology's dividend yield is among the top 25% in the CN market. Despite a volatile eight-year dividend history, current payouts are supported by earnings and cash flows with payout ratios of 77%. The company trades below estimated fair value, suggesting potential for capital appreciation. Recent earnings show robust growth, with net income rising to CNY 2.06 billion for nine months ended September 2024, indicating strong financial performance amidst dividend increases.

- Click to explore a detailed breakdown of our findings in Yealink Network Technology's dividend report.

- The analysis detailed in our Yealink Network Technology valuation report hints at an deflated share price compared to its estimated value.

Seika (TSE:8061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Seika Corporation engages in the import, sale, and export of plants, machinery, and environmental protection and electronic information system equipment across Asia, Europe, the United States, and internationally with a market cap of ¥48.09 billion.

Operations: Seika Corporation's revenue segments include the import, sale, and export of plants, machinery, environmental protection equipment, and electronic information systems across various international markets.

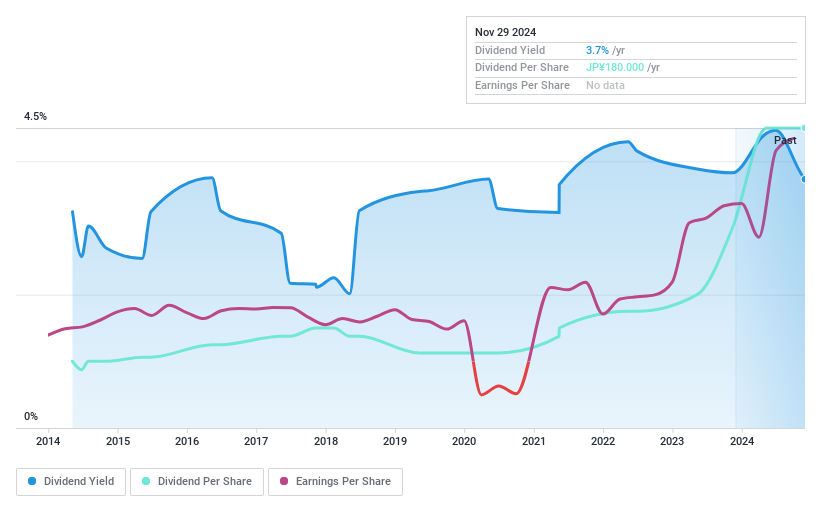

Dividend Yield: 4.5%

Seika Corporation's dividend yield is among the top 25% in the JP market, yet its dividends have been volatile over the past decade. Despite a low payout ratio of 23.7%, indicating coverage by earnings, cash flow coverage is inadequate with a high cash payout ratio of 114.3%. Recent guidance shows expected net sales of ¥90 billion and net income of ¥5.4 billion for fiscal year ending March 2025, reflecting strong financial performance amidst dividend increases.

- Unlock comprehensive insights into our analysis of Seika stock in this dividend report.

- Upon reviewing our latest valuation report, Seika's share price might be too optimistic.

Taking Advantage

- Click this link to deep-dive into the 1950 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8061

Seika

Imports, sells, and exports plants, machinery, and environmental protection and electronic information system equipment in Asia, Europe, the United States, and internationally.

Flawless balance sheet established dividend payer.