- China

- /

- Electronic Equipment and Components

- /

- SZSE:301387

High Growth Tech Stocks In Asia For November 2025

Reviewed by Simply Wall St

As global markets face heightened scrutiny around artificial intelligence spending and concerns about elevated valuations, Asian tech stocks are drawing attention for their potential amidst easing U.S.-China trade tensions. In such a dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and adaptability to changing market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.13% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.08% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 30.75% | 31.56% | ★★★★★★ |

| ASROCK Incorporation | 28.86% | 31.40% | ★★★★★★ |

| Fositek | 36.92% | 48.42% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

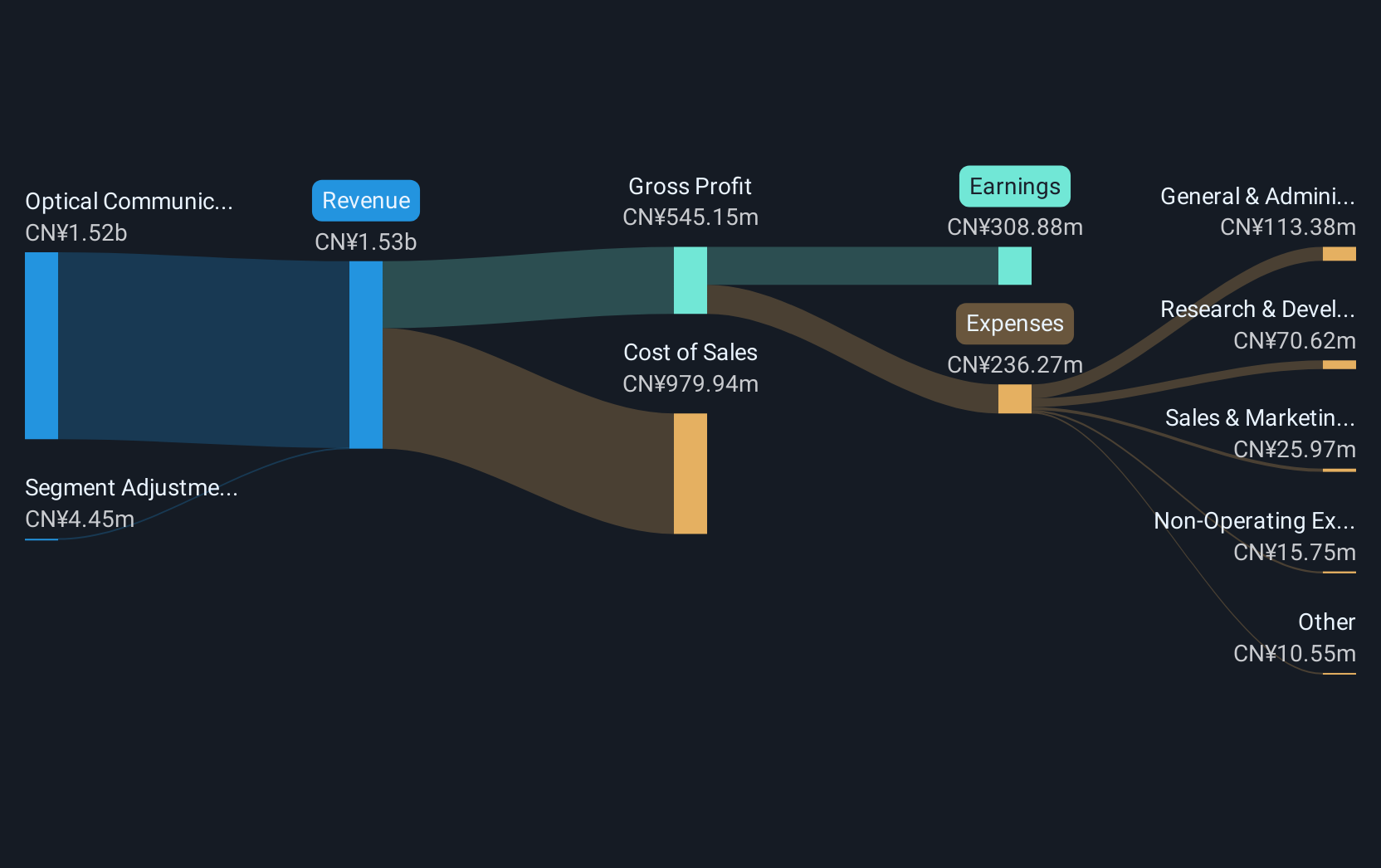

Overview: T&S Communications Co., Ltd. is a company that develops, manufactures, and sells fiber optics communication products in China with a market capitalization of CN¥22.20 billion.

Operations: The primary revenue stream for T&S Communications comes from Optical Communication Components, generating CN¥1.67 billion.

T&S CommunicationsLtd. has demonstrated robust financial performance with a significant uptick in revenue, rising from CNY 915.87 million to CNY 1,214.29 million year-over-year as of September 2025, paralleling a net income surge from CNY 145.81 million to CNY 260.33 million in the same period. This growth trajectory is underscored by an annualized revenue increase of approximately 43.9% and earnings growth forecast at about 47.6% per year, outpacing the broader Chinese market's projections significantly. The firm's commitment to innovation is evident from its R&D investments which are strategically aligned with its expansion goals in the high-growth tech sector in Asia, positioning it well for sustained future growth amidst evolving technological landscapes.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Growth Rating: ★★★★★☆

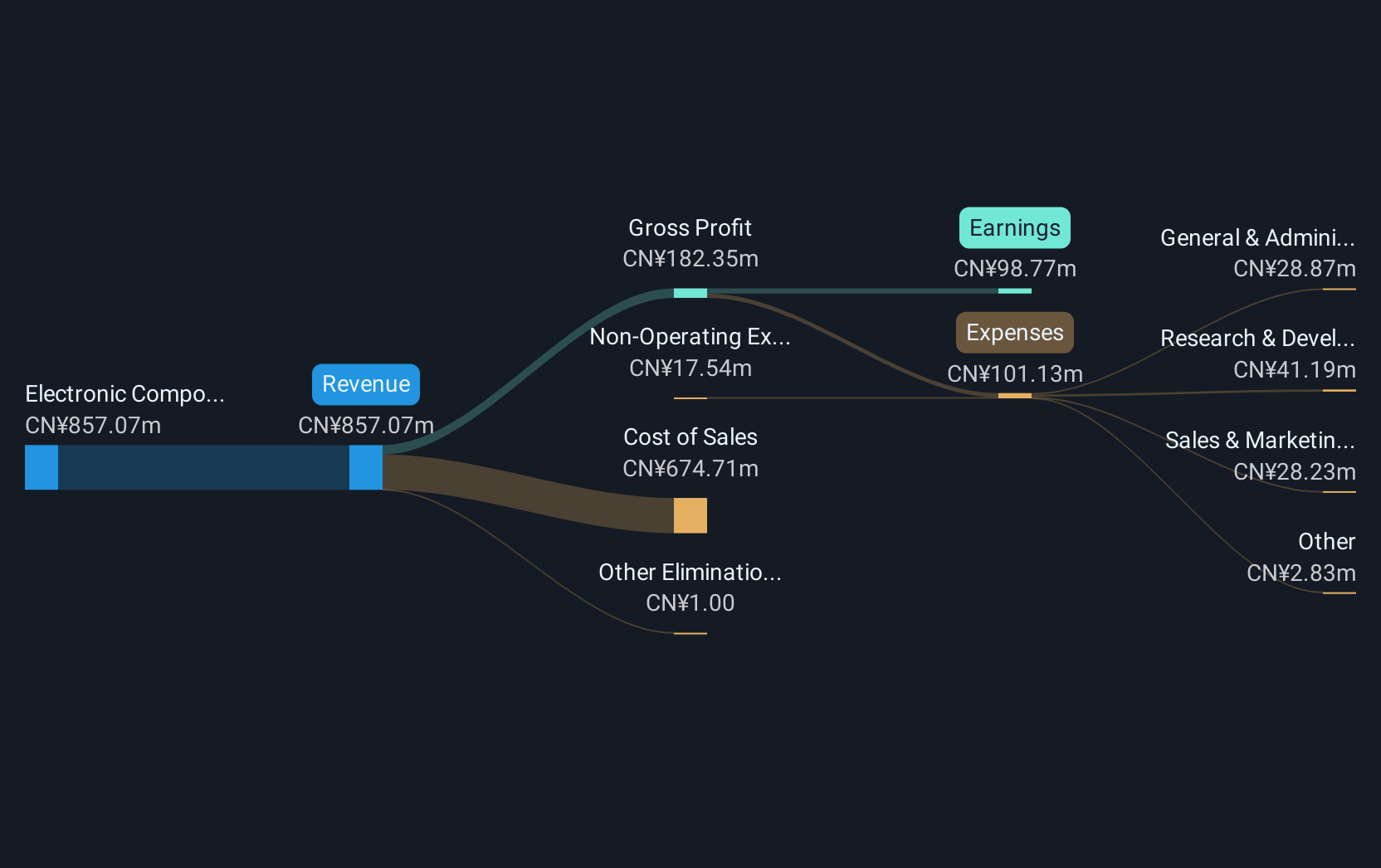

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. manufactures and sells liquid crystal displays and display modules both in China and internationally, with a market capitalization of CN¥3.14 billion.

Operations: Smartwin focuses on the production and sale of electronic components and parts, generating revenue primarily from this segment, which amounted to CN¥908.81 million. The company's operations span both domestic and international markets in the liquid crystal display sector.

Jiangsu Smartwin Electronics TechnologyLtd. has shown a promising trajectory in the high-growth tech sector, with its revenue climbing from CNY 602.8 million to CNY 686.53 million year-over-year as of September 2025, marking an annualized growth rate of 35.1%. This uptick is complemented by a steady net income increase to CNY 78.8 million, reflecting an earnings growth forecast of nearly 49.9% annually, significantly outpacing the broader Chinese market's average. The company's recent stake acquisition by major asset management firms for CNY 66.1 million underscores growing investor confidence and strategic positioning within Asia’s tech landscape, further bolstered by substantial R&D investments aimed at sustaining innovation and competitive edge in evolving markets.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

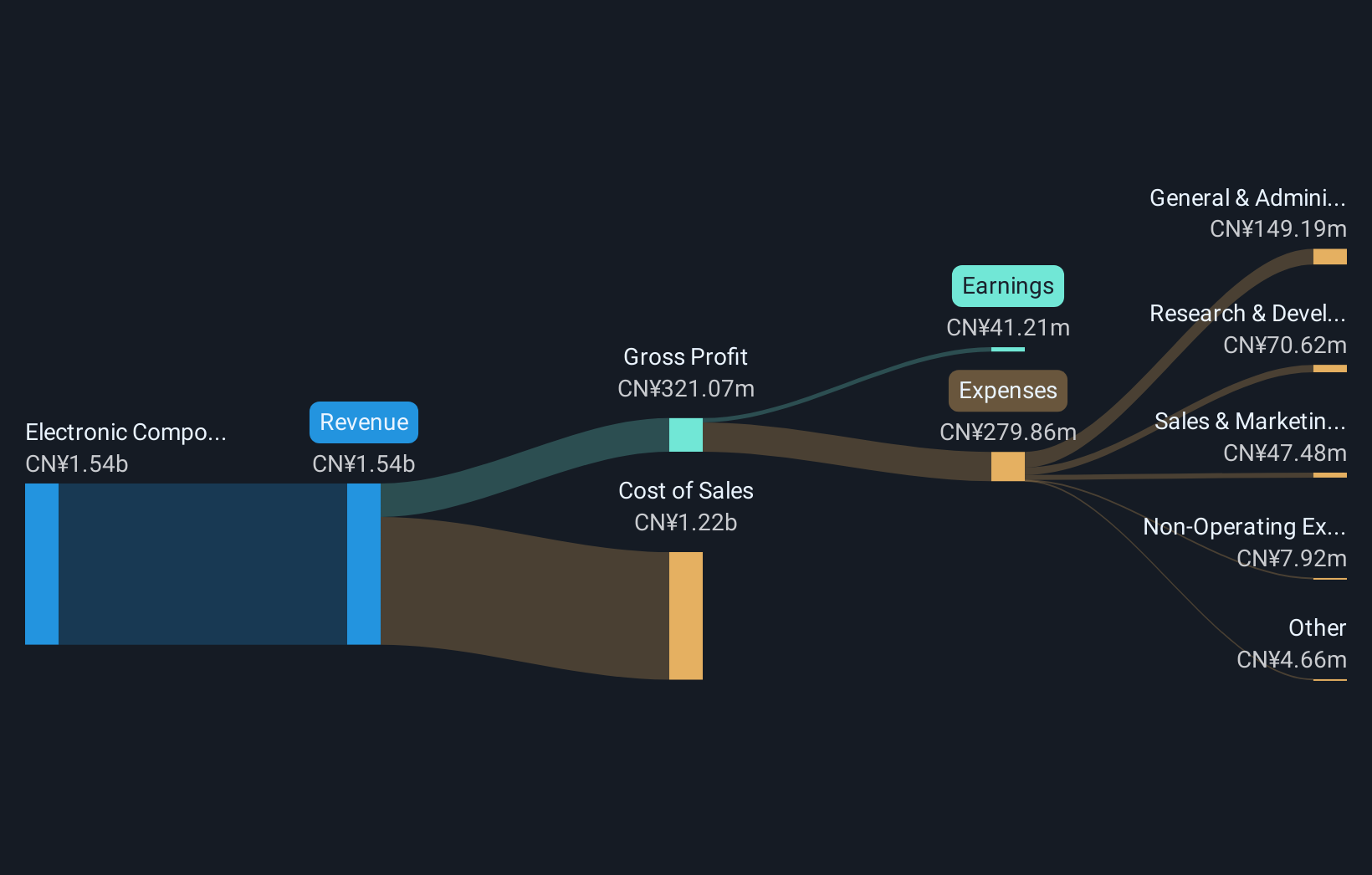

Overview: Shenzhen Bromake New Material Co., Ltd. focuses on the research, development, production, and sale of consumer electronics protective and functional products with a market cap of CN¥4.04 billion.

Operations: Shenzhen Bromake New Material generates revenue primarily from electronic components and parts, amounting to CN¥1.54 billion. The company is involved in the research, development, production, and sale of these products within the consumer electronics sector.

Shenzhen Bromake New Material's recent performance underscores its upward trajectory in Asia's tech sector, with revenue soaring to CNY 1.16 billion, up from CNY 841.36 million last year—a robust annual growth of 32.3%. This surge is accompanied by a significant earnings increase, with net income escalating to CNY 28.16 million from just CNY 7.41 million, reflecting an impressive annualized earnings growth rate of 96.2%. The company has also intensified its focus on innovation through substantial R&D investments, which have grown consistently as a strategic move to cement its competitive position in the market for new materials and technologies.

Summing It All Up

- Navigate through the entire inventory of 183 Asian High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301387

Shenzhen Bromake New Material

Engages in the research, development, production, and sale of consumer electronics protective and functional products.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives