- China

- /

- Electronic Equipment and Components

- /

- SZSE:300567

3 High Insider Ownership Stocks With Minimum 45% Earnings Growth

Reviewed by Simply Wall St

As global markets show signs of resilience, with major indices like the Dow Jones and S&P 500 reaching new highs amid cooling inflation fears, investors are keenly observing market trends and economic indicators for strategic opportunities. In this context, growth companies with high insider ownership present a compelling narrative, as they often signal strong confidence from those who know the company best—its leaders—especially in an environment where earnings growth remains robust.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

| Vow (OB:VOW) | 31.8% | 99.4% |

| Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Nordic Halibut (OB:NOHAL) | 29.9% | 90.7% |

| EHang Holdings (NasdaqGM:EH) | 33% | 98.1% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

| Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Let's dive into some prime choices out of from the screener.

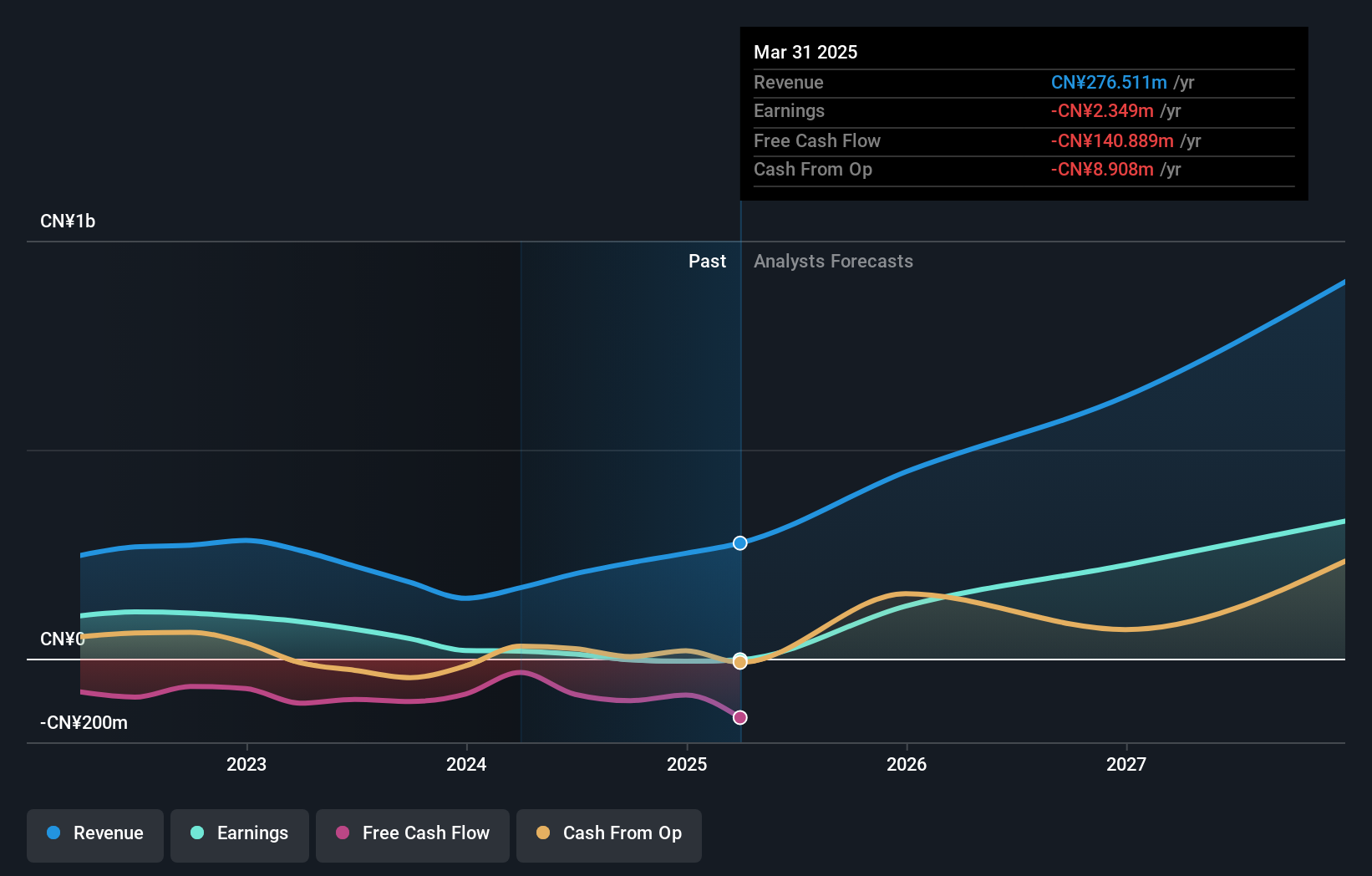

WG TECH (Jiang Xi) (SHSE:603773)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WG TECH (Jiang Xi) Co., Ltd. operates in the photoelectric glass finishing sector in China, with a market capitalization of approximately CN¥5.33 billion.

Operations: The company generates its revenue primarily from the optoelectronics segment, totaling CN¥1.99 billion.

Insider Ownership: 35%

Earnings Growth Forecast: 78.4% p.a.

WG TECH (Jiang Xi) has demonstrated significant revenue growth, with a recent increase from CNY 345.6 million to CNY 525.4 million in Q1 2024, despite transitioning from a net profit to a net loss during the same period. The company's revenue is expected to grow by 37.1% annually, outpacing the Chinese market average of 14%. Although currently unprofitable, WG TECH is forecasted to achieve profitability within three years with an anticipated earnings growth of 78.35% per year. This performance occurs amidst substantial fluctuations in share price and no recent insider trading activity reported over the past three months.

- Dive into the specifics of WG TECH (Jiang Xi) here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of WG TECH (Jiang Xi) shares in the market.

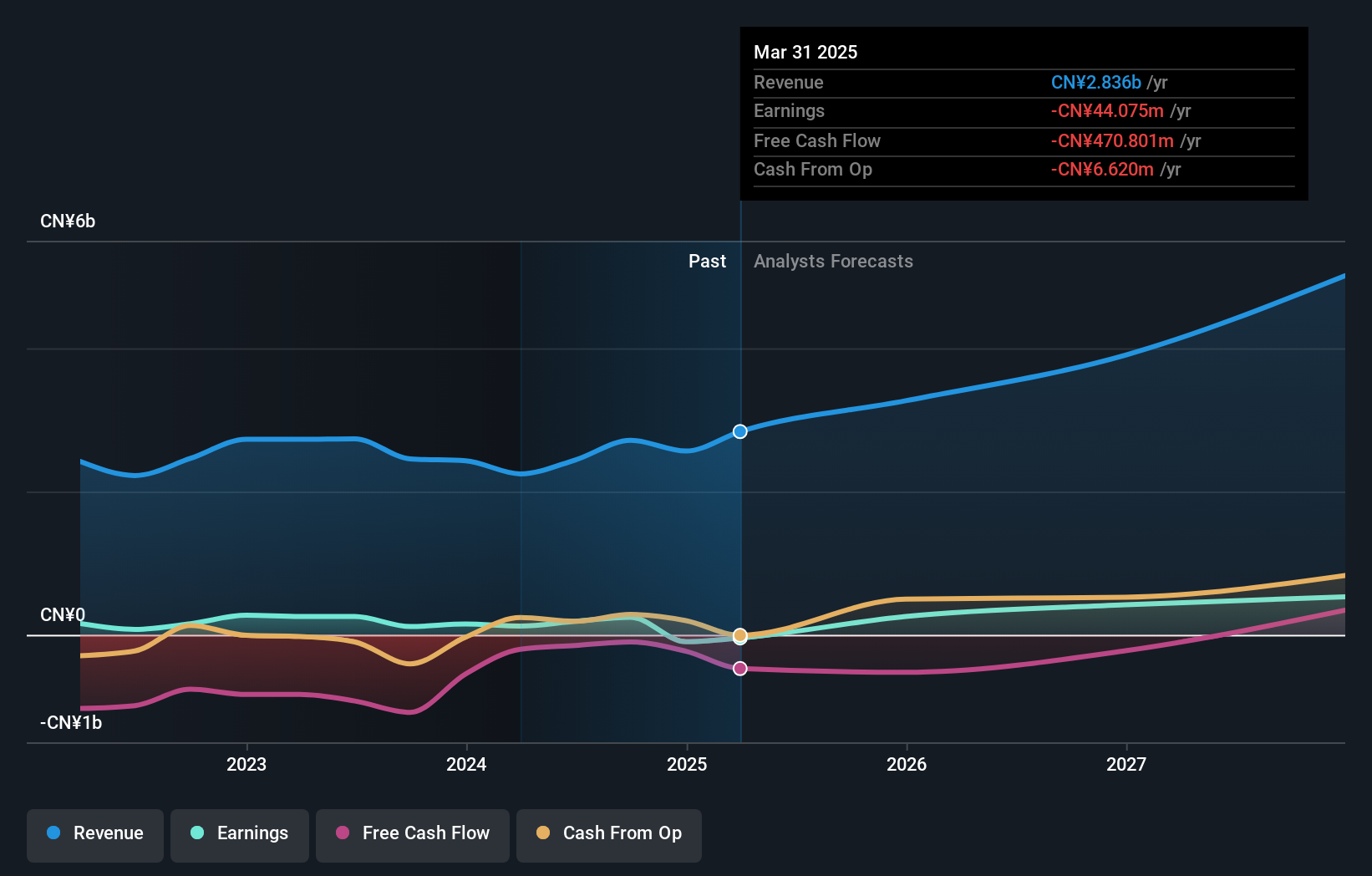

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. is a company specializing in the development and manufacturing of semiconductor materials, with a market capitalization of approximately CN¥12.60 billion.

Operations: The company generates its revenue from the development and manufacturing of semiconductor materials.

Insider Ownership: 27.7%

Earnings Growth Forecast: 62.1% p.a.

Yuanjie Semiconductor Technology is experiencing robust earnings growth, with forecasts indicating a 62.06% annual increase, significantly outpacing the Chinese market's average. Despite high revenue growth of 42% annually, the company faces challenges with a volatile share price and declining profit margins from 34.2% to 10.7%. Recent activities include a share buyback of CNY 37.23 million and lower year-over-year net income reported in Q1 2024 at CNY 10.53 million compared to CNY 11.85 million previously, reflecting some concerns about its financial health despite growth prospects.

- Click to explore a detailed breakdown of our findings in Yuanjie Semiconductor Technology's earnings growth report.

- Our valuation report here indicates Yuanjie Semiconductor Technology may be overvalued.

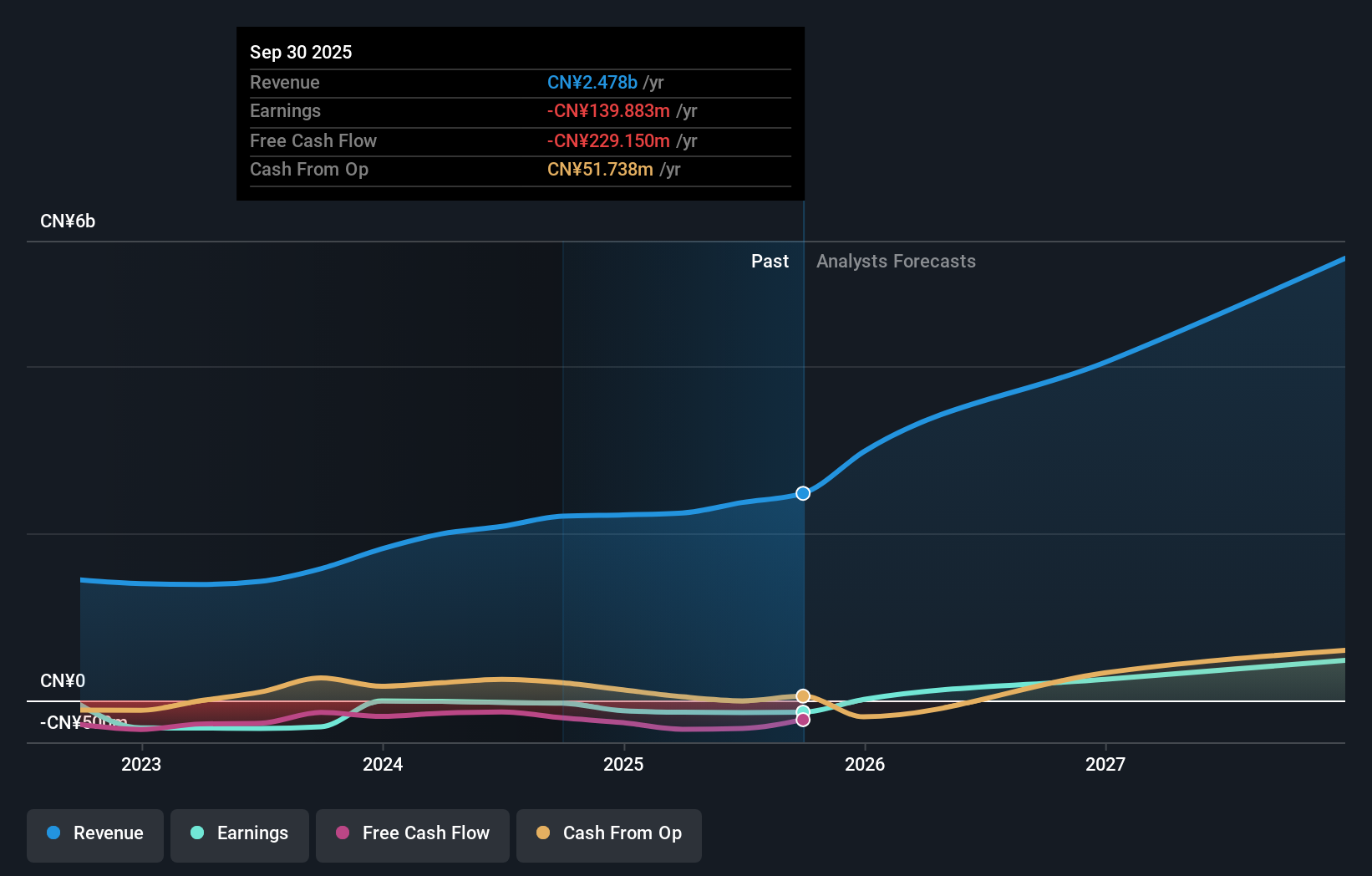

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd. specializes in researching, developing, producing, and selling display, semiconductor, and new energy detection systems with a market capitalization of approximately CN¥16.37 billion.

Operations: The company generates revenue primarily from its electron product segment, totaling CN¥2.25 billion.

Insider Ownership: 37.3%

Earnings Growth Forecast: 46% p.a.

Wuhan Jingce Electronic Group Ltd. is poised for substantial growth with earnings expected to increase by 46% annually, outperforming the broader Chinese market. However, recent financials reveal challenges such as a significant net loss of CNY 15.93 million in Q1 2024 and a reduced dividend payout, indicating potential concerns about its short-term financial health despite strong growth forecasts. Moreover, amendments to the company's articles of association suggest strategic adjustments which could impact future operations and governance.

- Take a closer look at Wuhan Jingce Electronic GroupLtd's potential here in our earnings growth report.

- Our valuation report unveils the possibility Wuhan Jingce Electronic GroupLtd's shares may be trading at a premium.

Where To Now?

- Unlock our comprehensive list of 1496 Fast Growing Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Jingce Electronic GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300567

Wuhan Jingce Electronic GroupLtd

Researches, develops, produces, and sells display, semiconductor, and new energy detection systems.

High growth potential with mediocre balance sheet.