- South Korea

- /

- Pharma

- /

- KOSE:A326030

Asian Value Stocks Trading Below Estimated Worth In September 2025

Reviewed by Simply Wall St

As of late August 2025, Asian markets have shown mixed signals with China's stock market rallying on domestic liquidity, while Japan's indices remain steady amid economic uncertainties. Amidst these fluctuating conditions, identifying undervalued stocks can be crucial for investors seeking opportunities; such stocks often exhibit strong fundamentals and potential for growth despite current market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| West Holdings (TSE:1407) | ¥1663.00 | ¥3274.33 | 49.2% |

| Taiwan Union Technology (TPEX:6274) | NT$320.50 | NT$634.37 | 49.5% |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥29.76 | CN¥59.16 | 49.7% |

| Star Micronics (TSE:7718) | ¥1669.00 | ¥3336.49 | 50% |

| Pansoft (SZSE:300996) | CN¥17.09 | CN¥34.13 | 49.9% |

| King Yuan Electronics (TWSE:2449) | NT$153.50 | NT$306.99 | 50% |

| Hangzhou Zhongtai Cryogenic Technology (SZSE:300435) | CN¥17.40 | CN¥34.56 | 49.7% |

| EmbedWay Technologies (Shanghai) (SHSE:603496) | CN¥27.93 | CN¥55.50 | 49.7% |

| Cosmax (KOSE:A192820) | ₩211000.00 | ₩418292.75 | 49.6% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.27 | CN¥59.95 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on researching and developing drugs for central nervous system disorders, with a market cap of ₩8.22 trillion.

Operations: The company's revenue primarily stems from its New Pharmaceutical Business, generating approximately ₩620.28 million.

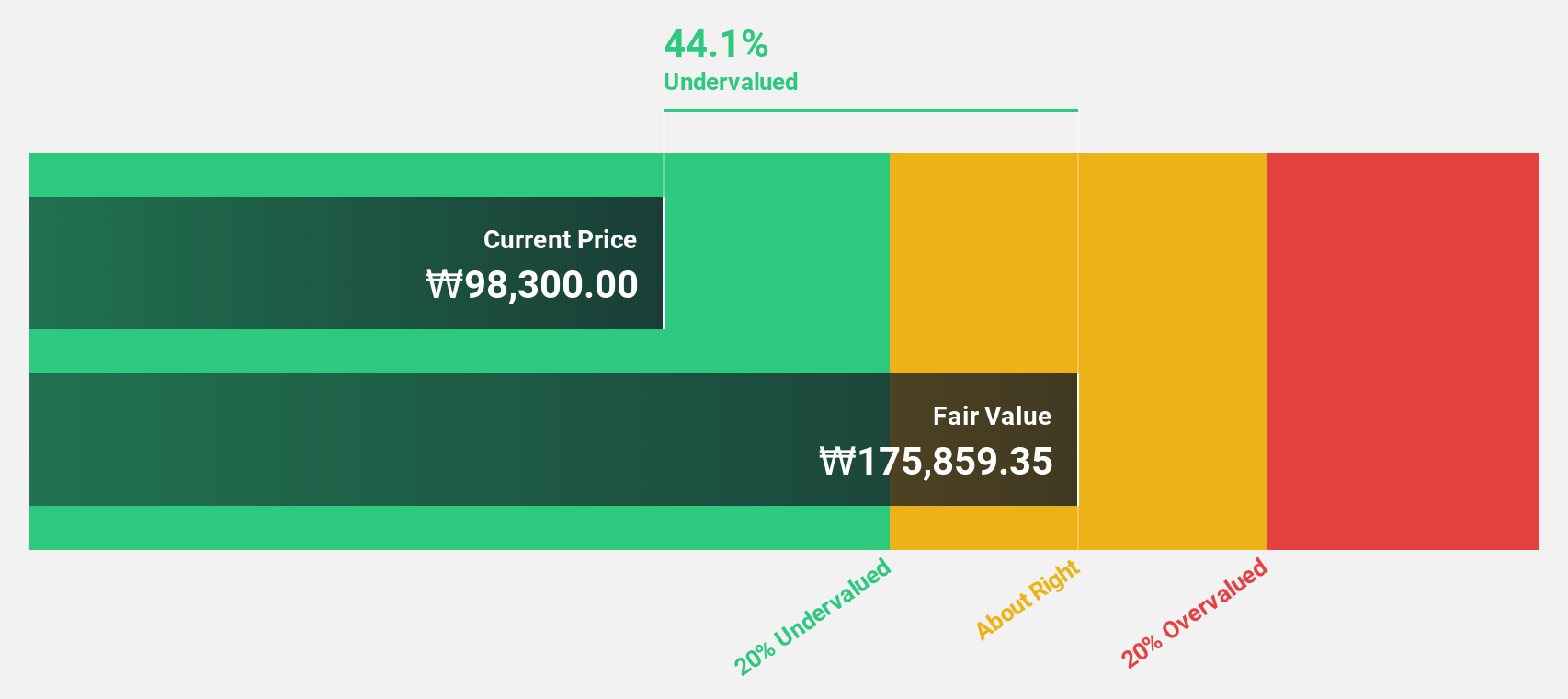

Estimated Discount To Fair Value: 44.7%

SK Biopharmaceuticals is trading at ₩105,000, significantly below its estimated fair value of ₩189,933.83. The company is projected to experience substantial revenue growth at 23.4% annually, outpacing the Korean market's 7.3%. Its earnings are expected to grow by 21.31% per year despite being slower than the market average of 23.3%. With high non-cash earnings and a forecasted return on equity of 30.6%, it presents a compelling case for undervaluation based on cash flows.

- The growth report we've compiled suggests that SK Biopharmaceuticals' future prospects could be on the up.

- Get an in-depth perspective on SK Biopharmaceuticals' balance sheet by reading our health report here.

China Resources Mixc Lifestyle Services (SEHK:1209)

Overview: China Resources Mixc Lifestyle Services Limited, with a market cap of HK$87.60 billion, operates as an investment holding company providing property management and commercial operational services in the People’s Republic of China.

Operations: The company generates revenue from three main segments: the property management business (CN¥10.77 billion), the commercial management business (CN¥6.69 billion), and the ecosystem business (CN¥104.49 million).

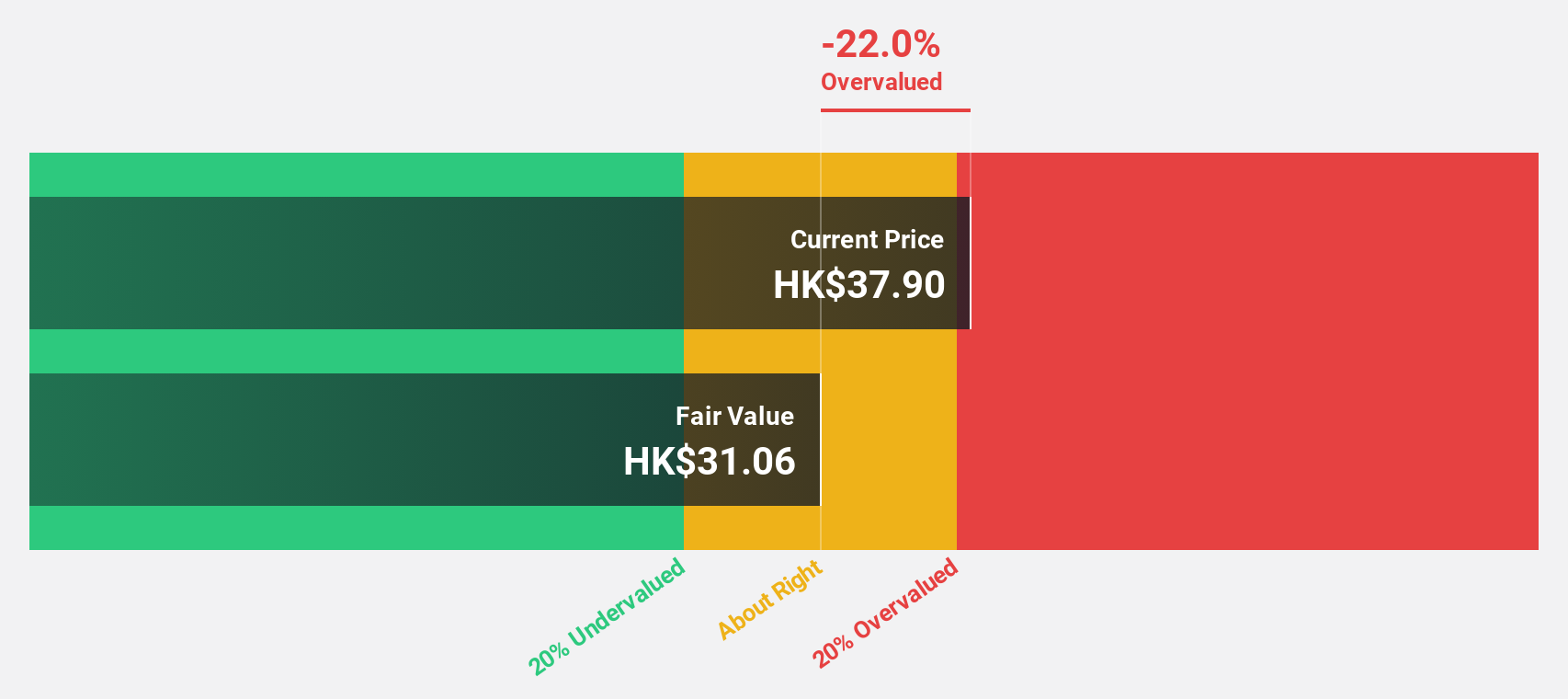

Estimated Discount To Fair Value: 20.1%

China Resources Mixc Lifestyle Services is trading at HK$38.38, below its estimated fair value of HK$48.01, suggesting undervaluation based on cash flows. The company reported net income growth to CNY 2.03 billion for the half year ending June 2025, with earnings expected to grow at 12.47% annually, outpacing the Hong Kong market's average of 12.1%. Despite an unstable dividend track record, recent special and interim dividends highlight strong cash flow management capabilities.

- Our growth report here indicates China Resources Mixc Lifestyle Services may be poised for an improving outlook.

- Dive into the specifics of China Resources Mixc Lifestyle Services here with our thorough financial health report.

Broadex Technologies (SZSE:300548)

Overview: Broadex Technologies (ticker: SZSE:300548) is involved in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥39.53 billion.

Operations: Revenue Segments (in millions of CN¥):

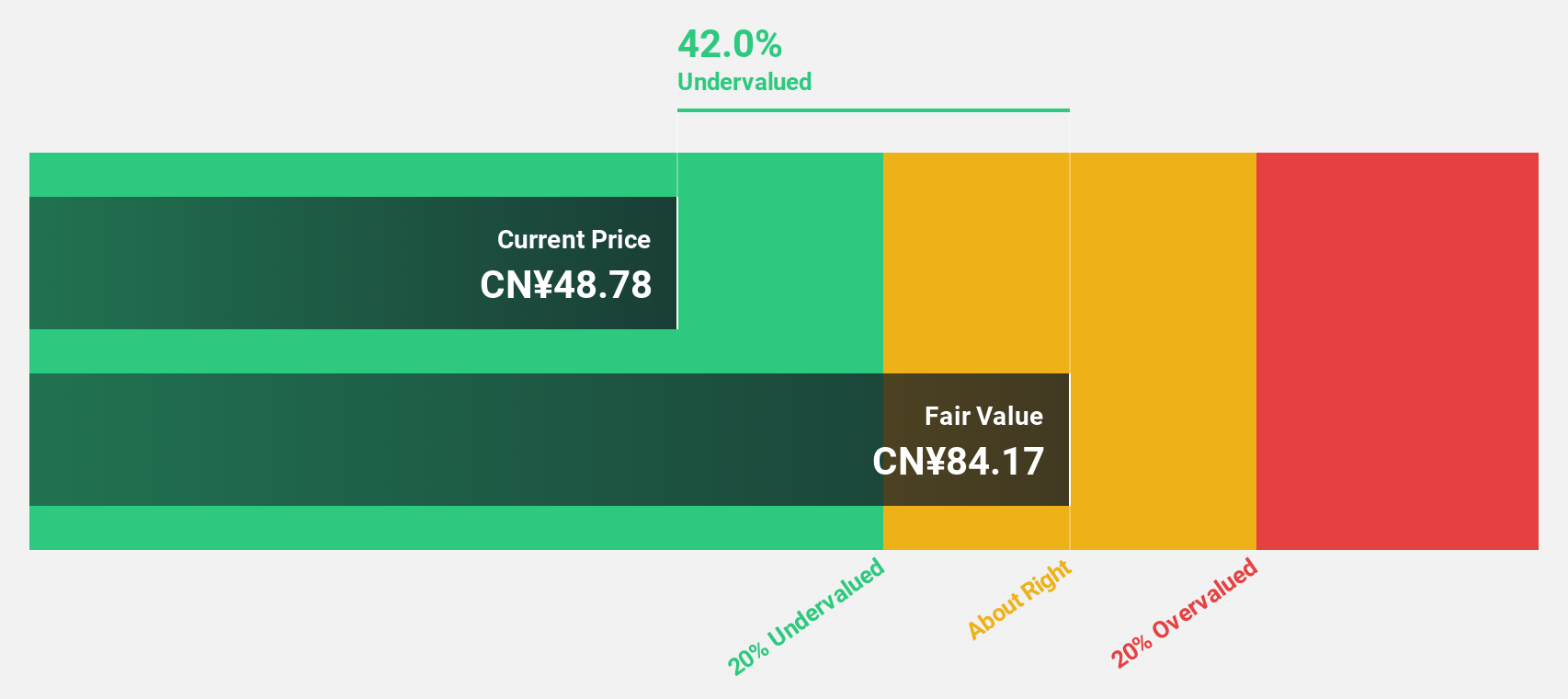

Estimated Discount To Fair Value: 31.2%

Broadex Technologies is trading at CN¥135.79, below its estimated fair value of CN¥197.33, highlighting potential undervaluation based on cash flows. The company anticipates significant earnings growth of 36.3% annually over the next three years, surpassing the Chinese market average of 26%. Despite recent share price volatility and low forecasted return on equity (18.4%), Broadex's robust revenue growth outlook and current valuation offer an intriguing investment opportunity in Asia's tech sector.

- The analysis detailed in our Broadex Technologies growth report hints at robust future financial performance.

- Navigate through the intricacies of Broadex Technologies with our comprehensive financial health report here.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 287 Undervalued Asian Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A326030

SK Biopharmaceuticals

A pharmaceutical company, engages in the research, development, and commercialization of drugs for the treatment of central nervous system disorders.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives