- China

- /

- Electronic Equipment and Components

- /

- SZSE:300456

August 2024's Leading Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets continue to recover from recent volatility, hopes for a soft landing in the U.S. economy are growing, buoyed by positive news on inflation and growth. In this favorable environment, identifying growth companies with high insider ownership can be particularly rewarding as insiders often have unique insights into their company's potential and are more likely to act in shareholders' best interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.6% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| HANA Micron (KOSDAQ:A067310) | 20.2% | 97.4% |

Here we highlight a subset of our preferred stocks from the screener.

Phu Nhuan Jewelry (HOSE:PNJ)

Simply Wall St Growth Rating: ★★★★☆☆

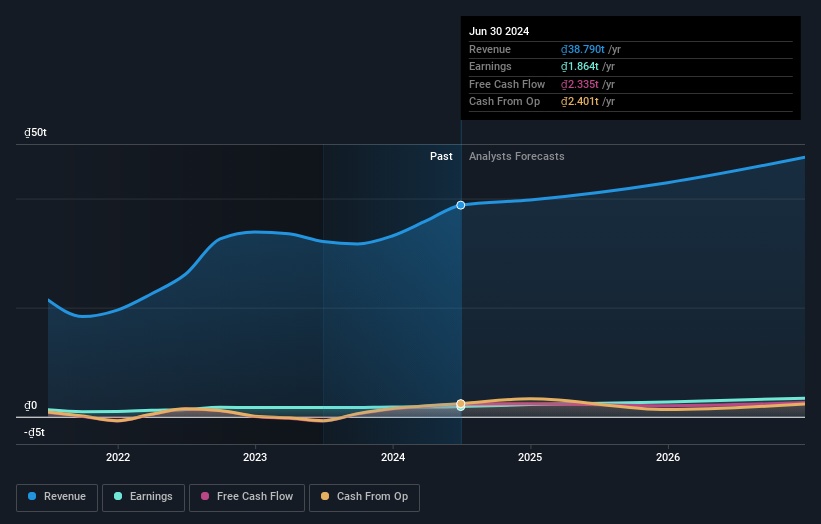

Overview: Phu Nhuan Jewelry Joint Stock Company manufactures, trades, imports, and exports gold, silver, jewelry, gemstones, fashion accessories, and souvenirs in Vietnam with a market cap of ₫32.82 billion.

Operations: Revenue from trading in gold, silver, jewelry, and precious stones is ₫38.79 billion.

Insider Ownership: 27.1%

Earnings Growth Forecast: 20.2% p.a.

Phu Nhuan Jewelry (PNJ) demonstrates strong growth potential with significant insider ownership. Over the next three years, earnings are forecast to grow by 20.23% annually, outpacing the VN market. Recent earnings reports show substantial revenue and net income increases for both Q2 and the first half of 2024, indicating robust financial health. However, revenue growth is expected to be slower than the market average at 8.9% per year.

- Take a closer look at Phu Nhuan Jewelry's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Phu Nhuan Jewelry's share price might be too pessimistic.

Press Metal Aluminium Holdings Berhad (KLSE:PMETAL)

Simply Wall St Growth Rating: ★★★★☆☆

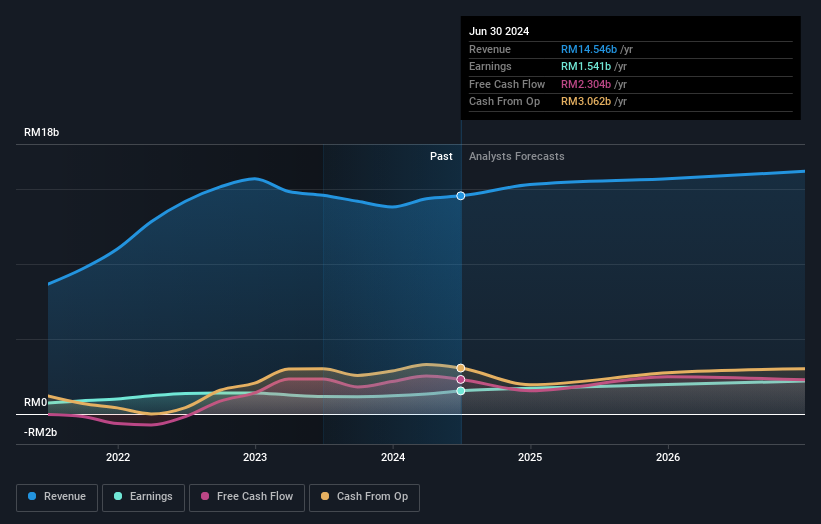

Overview: Press Metal Aluminium Holdings Berhad, with a market cap of MYR41.36 billion, engages in the manufacturing and trading of aluminum, as well as smelting and extrusion products across Malaysia, other Asian countries, Europe, Oceania, and internationally.

Operations: The company's revenue segments include manufacturing and trading of aluminum, smelting, and extrusion products across Malaysia, other Asian countries, Europe, Oceania, and internationally.

Insider Ownership: 23.1%

Earnings Growth Forecast: 15.5% p.a.

Press Metal Aluminium Holdings Berhad shows moderate growth potential with significant insider ownership. Earnings are forecast to grow at 15.49% annually, outpacing the Malaysian market's 12.1%. Recent collaboration with Xi'an Jiaotong University aims to develop economically viable carbon capture methods, enhancing sustainability efforts. The stock trades at a discount of 21.6% below its estimated fair value, and analysts expect a price rise of 23.5%. However, revenue growth is projected to be slower than desired at 6.2% per year.

- Dive into the specifics of Press Metal Aluminium Holdings Berhad here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Press Metal Aluminium Holdings Berhad shares in the market.

Sai MicroElectronics (SZSE:300456)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sai MicroElectronics Inc. develops and sells micro-electromechanical systems (MEMS) products in China with a market cap of CN¥10.76 billion.

Operations: The company's revenue segments are focused on the development and sale of micro-electromechanical systems (MEMS) products within China.

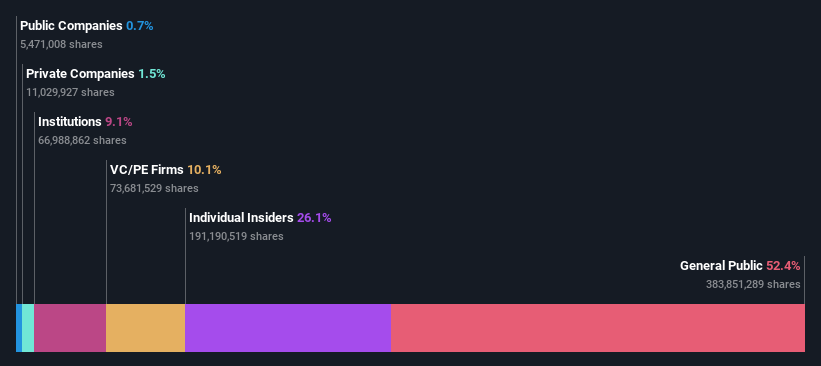

Insider Ownership: 26.1%

Earnings Growth Forecast: 51.6% p.a.

Sai MicroElectronics demonstrates strong growth potential with substantial insider ownership. Earnings are expected to grow significantly at 51.65% annually, surpassing the CN market's 21.9%. Revenue is forecast to increase by 23% per year, also outpacing the market's 13.4%. The company recently became profitable but has large one-off items impacting financial results. Despite a low return on equity forecast of 6.5% in three years, its high growth rates make it noteworthy in this sector.

- Click here to discover the nuances of Sai MicroElectronics with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Sai MicroElectronics shares in the market.

Make It Happen

- Click this link to deep-dive into the 1497 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300456

Sai MicroElectronics

Engages in development and sale of micro-electromechanical systems (MEMS) products in China.

High growth potential with adequate balance sheet.