- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

Discover 3 Stocks Including Lingyi iTech (Guangdong) That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by domestic policy shifts and geopolitical developments, investors are increasingly on the lookout for opportunities that may be trading below their estimated value. In this environment of robust market activity, identifying undervalued stocks can be a strategic approach to potentially capitalize on discrepancies between current market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Pan African Resources (AIM:PAF) | £0.3735 | £0.75 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1116.10 | ₹2222.42 | 49.8% |

| Iguatemi (BOVESPA:IGTI3) | R$2.25 | R$4.49 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.50 | SEK122.95 | 50% |

| Adtraction Group (OM:ADTR) | SEK38.40 | SEK76.45 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.66 | US$43.17 | 49.8% |

| Energy One (ASX:EOL) | A$5.30 | A$10.55 | 49.8% |

| Sands China (SEHK:1928) | HK$20.40 | HK$40.58 | 49.7% |

Let's explore several standout options from the results in the screener.

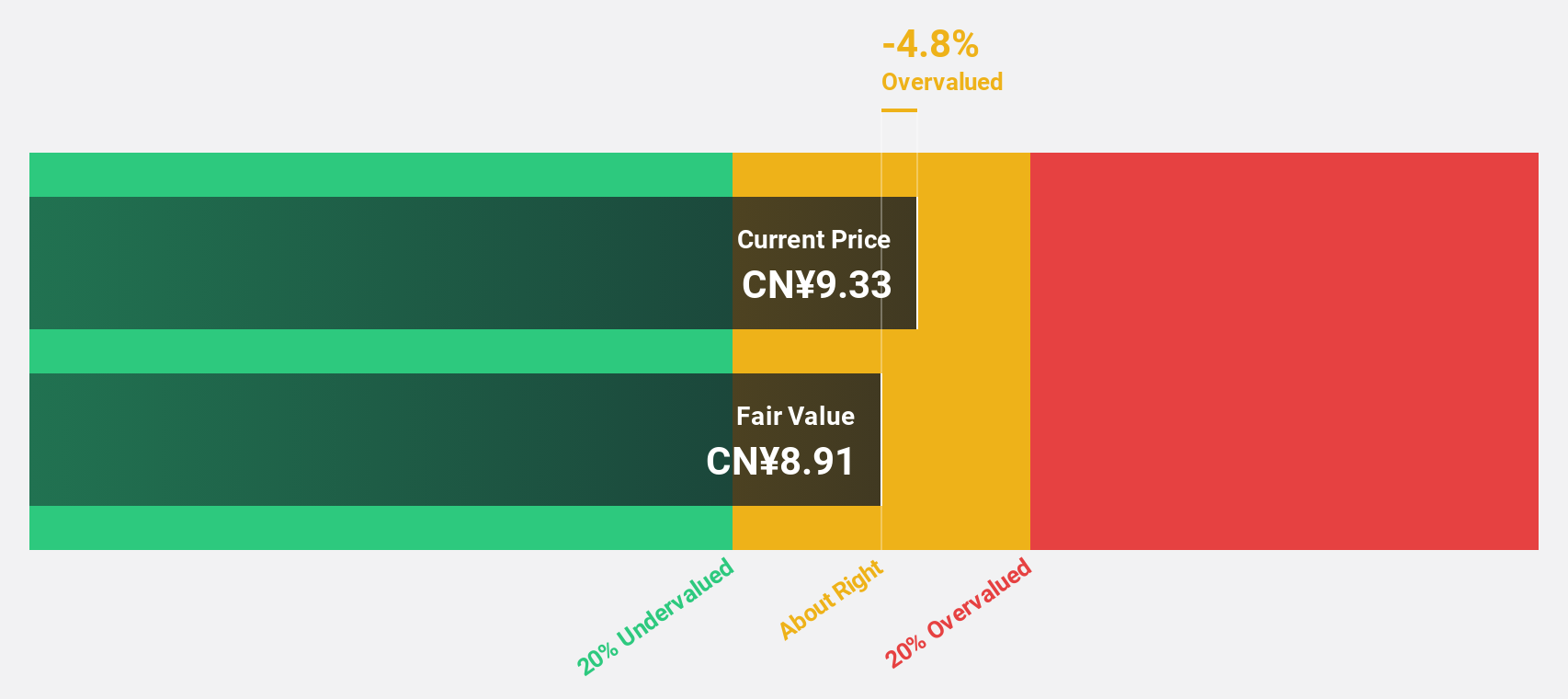

Lingyi iTech (Guangdong) (SZSE:002600)

Overview: Lingyi iTech (Guangdong) Company offers smart manufacturing services and solutions with a market cap of CN¥60.50 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 11.5%

Lingyi iTech's recent financial performance shows increased sales of CNY 31.48 billion, but net income declined to CNY 1.41 billion, reflecting tighter profit margins at 3.9%. Despite this, the stock is trading at CN¥8.67, below its estimated fair value of CN¥9.79, offering a potential undervaluation based on cash flows. Forecasts suggest earnings growth of 28.5% annually over three years and revenue growth outpacing the Chinese market average.

- Our earnings growth report unveils the potential for significant increases in Lingyi iTech (Guangdong)'s future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Lingyi iTech (Guangdong).

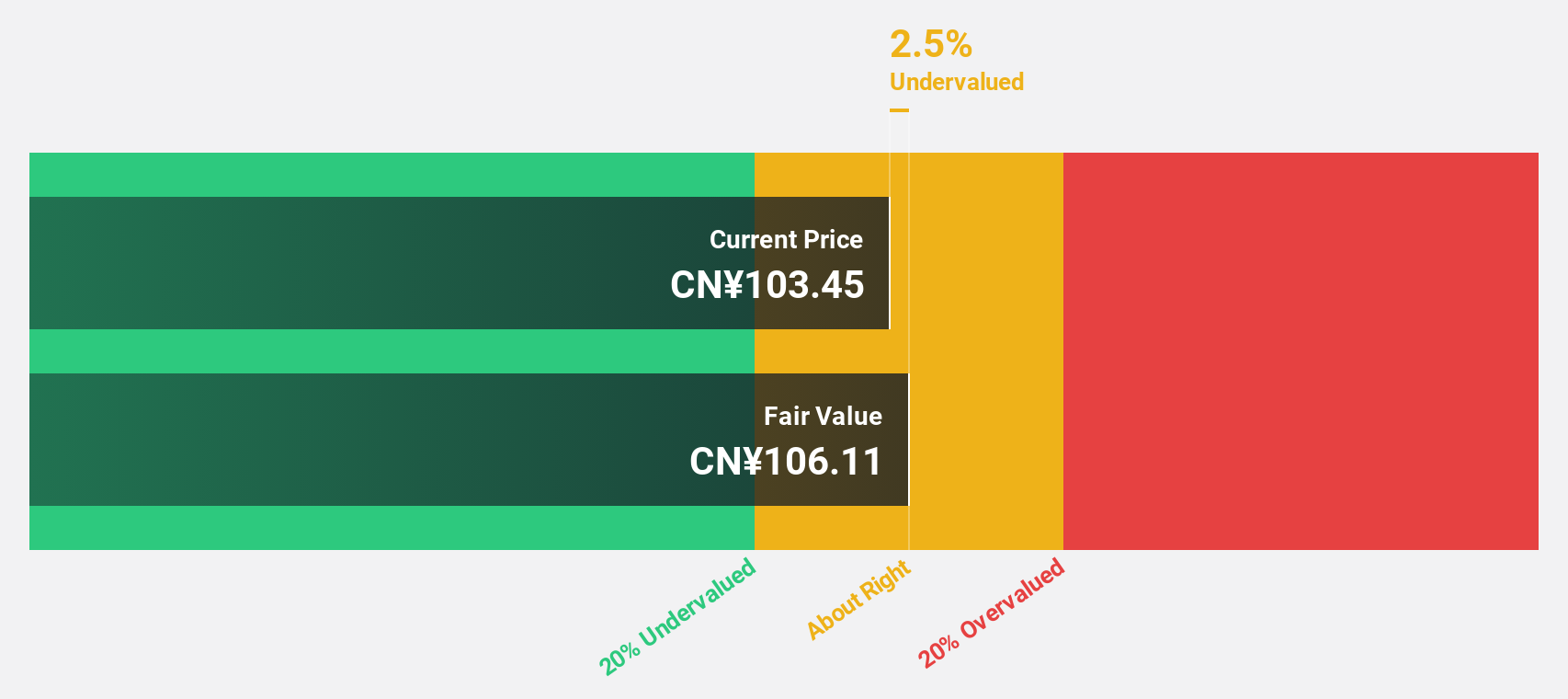

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. is engaged in the research, development, production, and sale of optical communication transceiver modules and optical devices in China with a market cap of CN¥143.61 billion.

Operations: Zhongji Innolight generates revenue primarily from the development, production, and sale of optical communication transceiver modules and optical devices in China.

Estimated Discount To Fair Value: 33.7%

Zhongji Innolight's recent earnings report highlights significant revenue growth to CN¥17.31 billion from CN¥7.03 billion year-over-year, with net income rising to CN¥3.75 billion. Despite high volatility in share price, the stock is trading at CN¥130, considerably below its estimated fair value of CN¥195.94, indicating undervaluation based on cash flows. Forecasts predict robust annual earnings growth of 32.6%, surpassing market averages and signaling strong future performance potential despite past fluctuations.

- Upon reviewing our latest growth report, Zhongji Innolight's projected financial performance appears quite optimistic.

- Dive into the specifics of Zhongji Innolight here with our thorough financial health report.

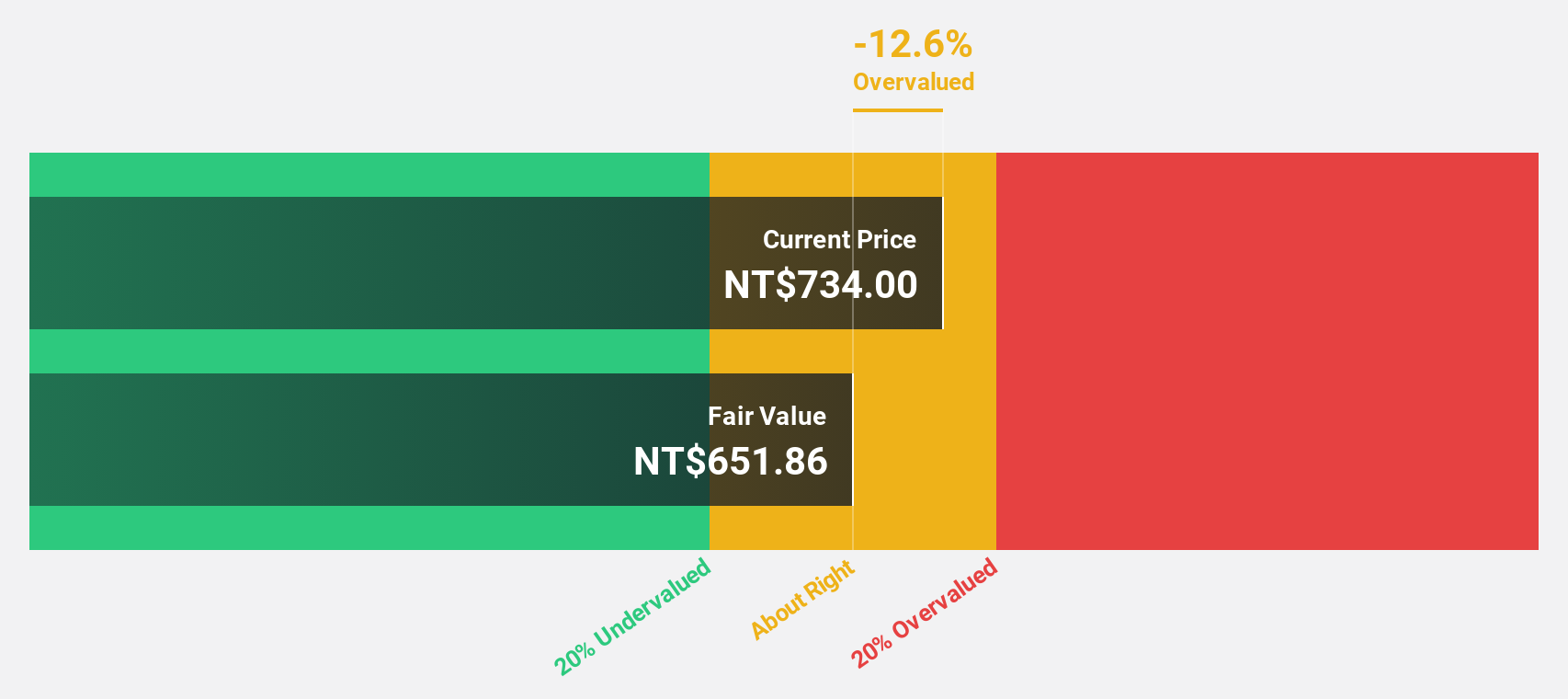

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd. is a company that provides thermal solutions globally, with a market cap of NT$267.17 billion.

Operations: The company's revenue segments include NT$72.11 billion from the Overseas Operating Department and NT$51.58 billion from the Integrated Management Division.

Estimated Discount To Fair Value: 27.2%

Asia Vital Components reported third-quarter sales of NT$19.06 billion, up from NT$15.77 billion year-over-year, with net income rising to NT$2.32 billion. The stock trades at NT$697, significantly below its fair value estimate of NT$957.14, highlighting undervaluation based on cash flows. Earnings are projected to grow annually by 30.3%, outpacing the Taiwan market average of 19.2%. A recent US$150 million syndicated loan aims to strengthen working capital and repay liabilities.

- The growth report we've compiled suggests that Asia Vital Components' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Asia Vital Components.

Turning Ideas Into Actions

- Unlock our comprehensive list of 891 Undervalued Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with outstanding track record.