- China

- /

- Electronic Equipment and Components

- /

- SZSE:002436

Exploring Three High Growth Tech Stocks in China

Reviewed by Simply Wall St

China's recent stimulus measures have spurred a rally in global markets, with the Shanghai Composite Index and the blue-chip CSI 300 seeing significant gains. This positive sentiment is particularly beneficial for high-growth tech stocks, which are poised to capitalize on increased economic activity and investor confidence. When evaluating high-growth tech stocks in China, it's crucial to consider companies that can leverage these favorable market conditions through innovative technologies and strong market positioning.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.61% | 31.78% | ★★★★★★ |

| Zhongji Innolight | 32.37% | 31.70% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| T&S CommunicationsLtd | 34.68% | 40.85% | ★★★★★★ |

| Eoptolink Technology | 43.76% | 42.52% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells PCBs in China and internationally, with a market cap of approximately CN¥17.97 billion.

Operations: Fastprint Circuit Tech generates revenue primarily from PCB Printed Circuit Boards (CN¥4.24 billion) and Semiconductor Test Boards (CN¥1.22 billion). The company serves both domestic and international markets.

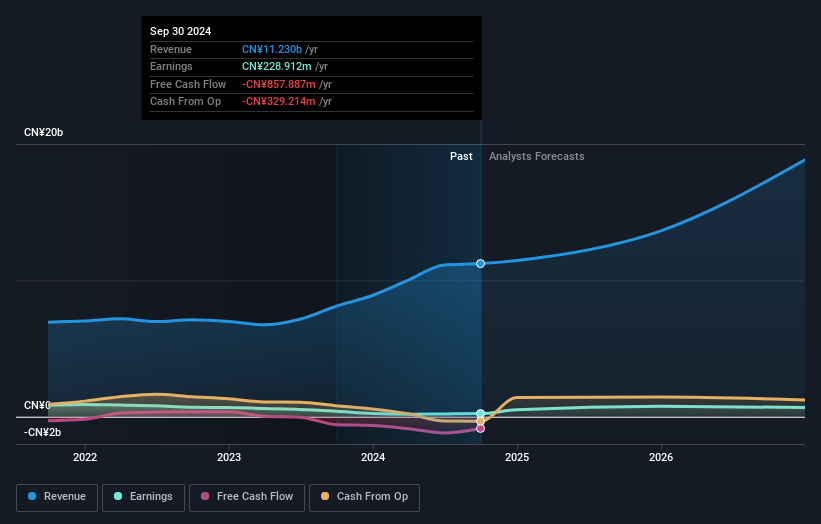

Shenzhen Fastprint Circuit Tech has demonstrated robust growth, with earnings increasing by 15.4% over the past year, outpacing the electronic industry's average decline of 3.7%. This trend is set to continue with projected annual profit growth at a striking rate of 45.6%, significantly higher than China's market forecast of 23.2%. Moreover, R&D investment remains a cornerstone of their strategy, aligning with an impressive revenue forecast increase of 18.8% per year—faster than the broader CN market at 13.2%. Despite challenges in covering debt through operating cash flow, these figures underscore Fastprint’s potential in leveraging high-tech innovations to sustain its competitive edge. Recently, Shenzhen Fastprint announced half-year sales reaching CNY 2.88 billion, marking an increase from CNY 2.57 billion in the previous year and net income rising to CNY 19.5 million from CNY 18.06 million last year—a testament to their enduring financial health amidst volatile markets. Their forthcoming shareholder meeting aims to outline a return plan for the next three years, indicating proactive governance that could further solidify investor confidence and catalyze future growth trajectories within China’s high-tech sector.

Wuhu Token Sciences (SZSE:300088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhu Token Sciences Co., Ltd. focuses on the research, development, processing, manufacture, sale, and service of key touch display device materials in China and has a market cap of CN¥15.22 billion.

Operations: Wuhu Token Sciences generates revenue primarily from the sale of electronic components and parts, amounting to CN¥11.13 billion. The company is involved in various stages of the touch display device materials industry, including research, development, processing, manufacturing, and sales within China.

Wuhu Token Sciences is navigating a challenging landscape with its recent earnings report revealing a dip in net income to CNY 184.59 million from CNY 219.67 million last year, despite a significant revenue jump from CNY 3.37 billion to CNY 5.62 billion. This contrast highlights the pressures on profitability even as sales volumes increase, underscoring the importance of efficient operations and cost management in sustaining growth. The company's commitment to innovation is evident in its R&D spending which remains robust, crucial for maintaining competitiveness in China’s fast-evolving tech sector. Upcoming shareholder meetings will further clarify strategies around new incentive plans, potentially bolstering future governance and operational frameworks essential for long-term success.

- Navigate through the intricacies of Wuhu Token Sciences with our comprehensive health report here.

Gain insights into Wuhu Token Sciences' past trends and performance with our Past report.

TRS Information Technology (SZSE:300229)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TRS Information Technology Co., Ltd. provides software, artificial intelligence, big data, and data security products and services in China with a market cap of CN¥13.23 billion.

Operations: TRS Information Technology Co., Ltd. focuses on delivering software, artificial intelligence, big data, and data security solutions in China. The company generates revenue primarily through its diverse technological offerings tailored to various sectors.

TRS Information Technology is demonstrating resilience in a competitive landscape, with a reported revenue growth of 18.5% per year, outpacing the broader Chinese market's average of 13.2%. Despite a recent dip in net income from CNY 69.64 million to CNY 59.81 million, the firm is aggressively investing in innovation, as evidenced by its R&D expenses which are crucial for sustaining its competitive edge and supporting future growth prospects. This strategic focus on development is underscored by an impressive projected annual earnings increase of 48%, signaling robust potential amidst evolving market demands.

- Take a closer look at TRS Information Technology's potential here in our health report.

Learn about TRS Information Technology's historical performance.

Seize The Opportunity

- Gain an insight into the universe of 255 Chinese High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002436

Shenzhen Fastprint Circuit TechLtd

Manufactures and sells PCBs in China and internationally.

Reasonable growth potential and slightly overvalued.