Exploring High Growth Tech Stocks Including Zhejiang Jiecang Linear Motion TechnologyLtd

Reviewed by Simply Wall St

As global markets continue to experience notable gains, with indices such as the S&P 500 and Russell 2000 reaching record highs, investor sentiment remains buoyed by domestic policy developments and economic indicators like rising personal income and spending. In this environment of optimism, high growth tech stocks, including Zhejiang Jiecang Linear Motion Technology Ltd., are drawing attention for their potential to capitalize on technological advancements and robust market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 22.02% | 28.64% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Zhejiang Jiecang Linear Motion TechnologyLtd (SHSE:603583)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Jiecang Linear Motion Technology Co., Ltd. specializes in the production and development of linear motion systems and has a market capitalization of approximately CN¥10.51 billion.

Operations: Jiecang Linear Motion Technology generates revenue primarily from the linear drive industry, with reported earnings of approximately CN¥3.50 billion. The company's focus on this sector highlights its specialization in linear motion systems.

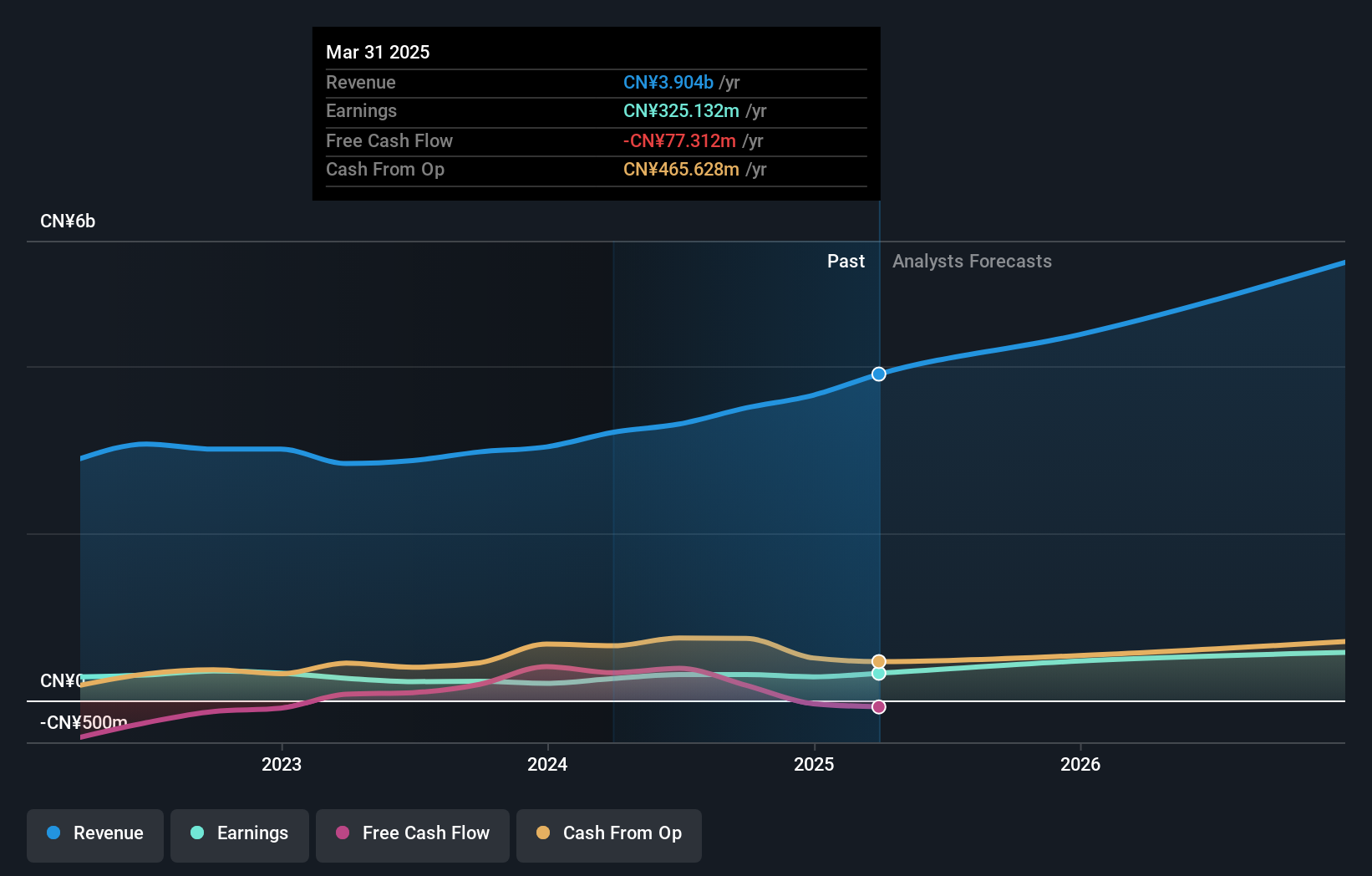

Zhejiang Jiecang Linear Motion Technology Ltd. has demonstrated robust growth, with revenue and earnings outpacing the broader Chinese market. Its revenue is expected to grow at 17.2% annually, surpassing the market average of 13.9%, while its earnings are forecasted to increase by an impressive 27.7% each year, compared to the industry's 26.3%. This performance is highlighted by a significant year-over-year earnings increase of 35.3%, which notably exceeds the electronic industry's growth rate of just 1.8%. The company's commitment to innovation and development is evident in its latest financial reports for the nine months ending September 30, 2024, where it reported a substantial rise in sales to CNY 2,567.98 million from CNY 2,101.38 million in the previous year and an increase in net income to CNY 293.2 million from CNY 188.43 million. Despite these strong figures, Zhejiang Jiecang’s projected Return on Equity (ROE) stands at a modest forecast of only about11 .1% over three years time , suggesting potential challenges in sustaining higher profitability levels relative to equity . However , given their current trajectory and ongoing investments into expanding their product lines within linear motion technology , there remains a cautiously optimistic outlook for their continued relevance and performance within this niche yet critical segment of high-tech industries .

Geovis TechnologyLtd (SHSE:688568)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geovis Technology Co., Ltd focuses on the research, development, and industrialization of digital earth products for various sectors in China and has a market cap of CN¥34.07 billion.

Operations: Geovis Technology Co., Ltd specializes in developing digital earth products, catering to government, enterprise, and public sectors in China. The company leverages its expertise in research and development to industrialize these products across diverse applications.

Geovis TechnologyLtd has shown a compelling growth trajectory, with revenue expected to surge by 29.2% annually, outstripping the broader Chinese market's growth of 13.9%. This robust expansion is complemented by an anticipated earnings increase of 37% per year. Notably, the company's R&D investment aligns with its aggressive growth strategy; for instance, in the recent nine-month financial period ending September 30, 2024, Geovis reported a substantial R&D expenditure which constituted approximately {rd_expense_string} of its total revenue. These investments are pivotal in sustaining its technological edge and driving future innovations in a competitive landscape marked by rapid technological advancements and shifting market demands.

Hebei Sinopack Electronic TechnologyLtd (SZSE:003031)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hebei Sinopack Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market capitalization of CN¥25.67 billion.

Operations: Hebei Sinopack Electronic Technology Co., Ltd. is engaged in the electronic technology industry, focusing on specific revenue segments within this sector. With a market cap of CN¥25.67 billion, the company leverages its expertise to cater to various technological needs and demands.

Hebei Sinopack Electronic TechnologyLtd. is navigating the competitive tech landscape with a notable focus on R&D, investing 29.6% of its revenue back into research and development, a strategy that's not only ambitious but critical for staying ahead in innovation. This investment has propelled an impressive forecasted annual earnings growth of 29.63%, significantly outpacing the broader Chinese market's projection of 26.3%. Moreover, their recent financials reveal a resilient performance with net income rising to CNY 369.19 million from CNY 343.49 million year-over-year, underscoring robust operational efficiency despite slight dips in revenue and earnings per share figures from previous periods.

Key Takeaways

- Dive into all 1286 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688568

Geovis TechnologyLtd

Engages in research, development, and industrialization of digital earth products for government, enterprises, and special and public fields in China.

High growth potential and good value.