High Growth Tech Stocks To Watch In China This September 2024

Reviewed by Simply Wall St

As Chinese stocks faced declines amid weak inflation data and concerns about a downward price-wage spiral, the broader tech sector remains a focal point for investors seeking high growth opportunities. In this environment, identifying strong candidates involves looking at companies with robust fundamentals and innovative potential to thrive despite broader economic challenges.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Suzhou TFC Optical Communication | 33.08% | 31.98% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Zhongji Innolight | 32.38% | 31.76% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.63% | 28.58% | ★★★★★★ |

| Eoptolink Technology | 44.39% | 42.88% | ★★★★★★ |

| Wanma Technology | 35.58% | 47.75% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 40.13% | 103.97% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Wuhan Dameng Database (SHSE:688692)

Simply Wall St Growth Rating: ★★★★☆☆

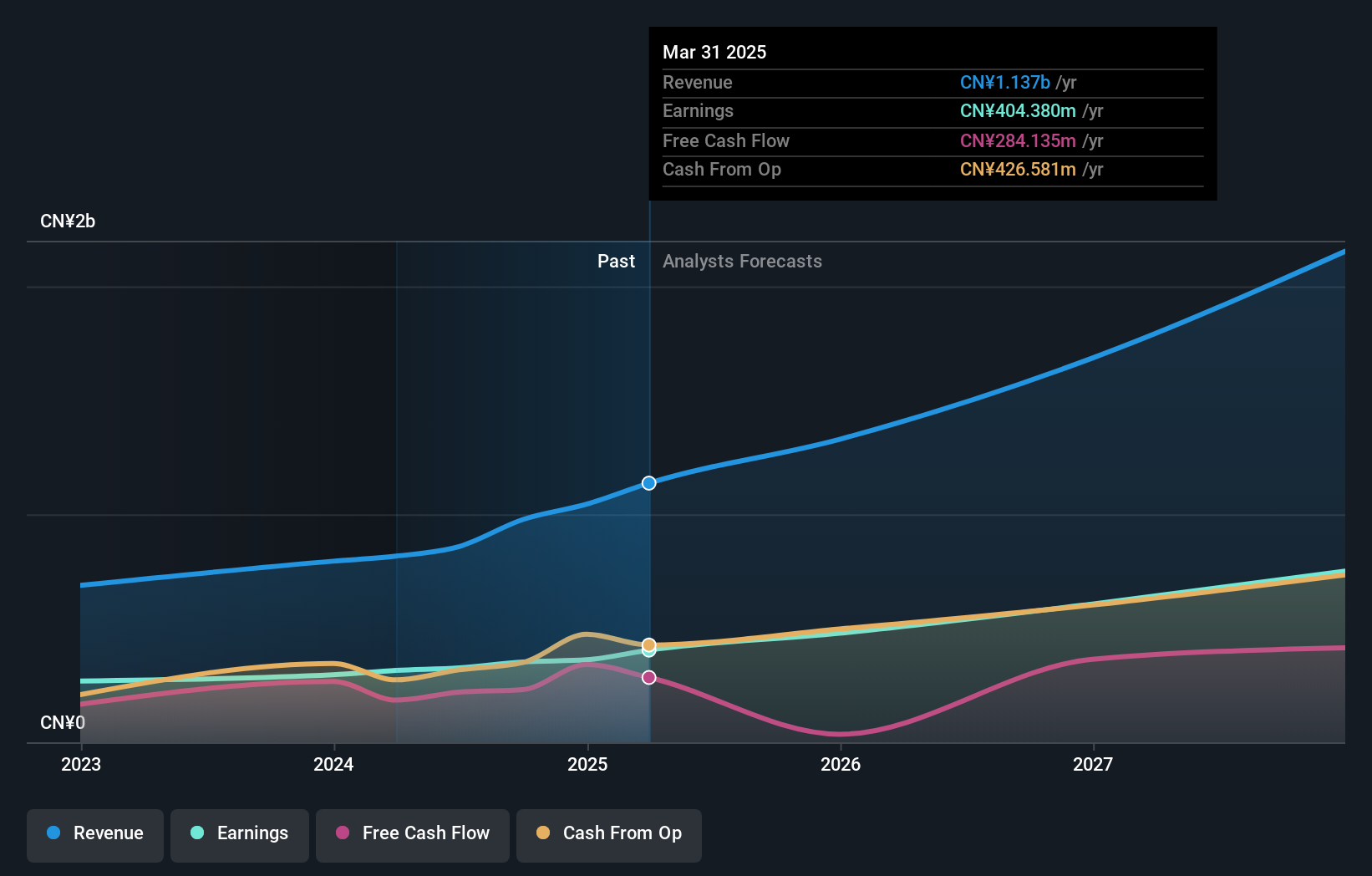

Overview: Wuhan Dameng Database Company Limited specializes in database product development services in China and has a market cap of CN¥18.99 billion.

Operations: The company generates revenue primarily from data processing services, amounting to CN¥858.72 million.

Wuhan Dameng Database's revenue surged by 20.2% annually, outpacing the Chinese market's 13.2% growth rate. Their earnings grew by 15.4%, significantly higher than the software industry's -13.9%. For the first half of 2024, sales reached ¥351.9 million, up from ¥287.47 million a year ago, with net income rising to ¥103.19 million from ¥73.35 million previously reported; basic EPS also increased to ¥1.81 from ¥1.29. Investing heavily in R&D, Wuhan Dameng Database has allocated substantial resources to innovation and development—key drivers for future growth in tech sectors like AI and software solutions where they operate extensively—ensuring sustained competitive advantage and market relevance as their earnings are forecasted to grow at an impressive annual rate of 21%.

- Click here and access our complete health analysis report to understand the dynamics of Wuhan Dameng Database.

Assess Wuhan Dameng Database's past performance with our detailed historical performance reports.

Taiji Computer (SZSE:002368)

Simply Wall St Growth Rating: ★★★★☆☆

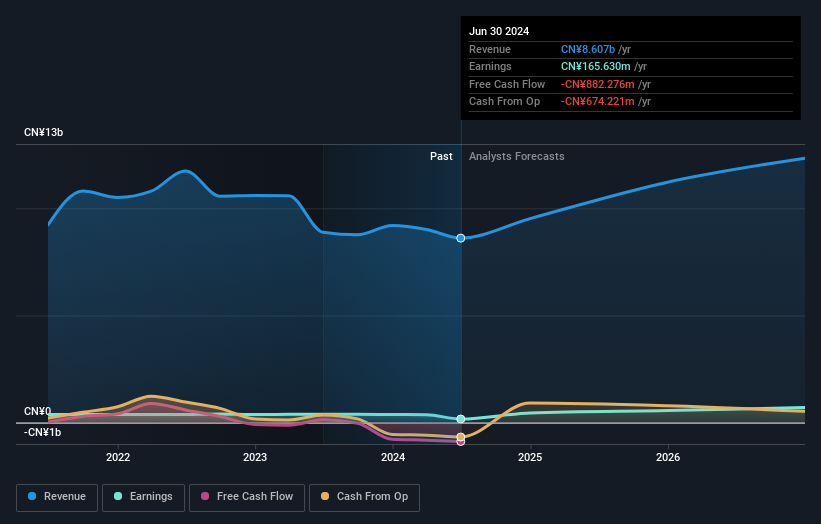

Overview: Taiji Computer Corporation Limited operates as a software and information technology service company with a market cap of CN¥9.24 billion.

Operations: The company generates revenue primarily through software development and IT services. Key cost components include research and development, personnel expenses, and operational overheads. Gross profit margin stands at 23.45%.

Taiji Computer's recent earnings report showed a net loss of ¥158.85 million for the first half of 2024, contrasting sharply with last year's net income of ¥50.76 million. Despite this setback, the company’s revenue is expected to grow at an annual rate of 14.6%, outpacing the Chinese market's 13.2% growth rate. Allocating substantial resources to R&D, Taiji spent ¥1 billion in 2023 alone, highlighting their commitment to innovation in AI and software solutions—key areas driving future growth and maintaining competitive advantage in a rapidly evolving tech landscape.

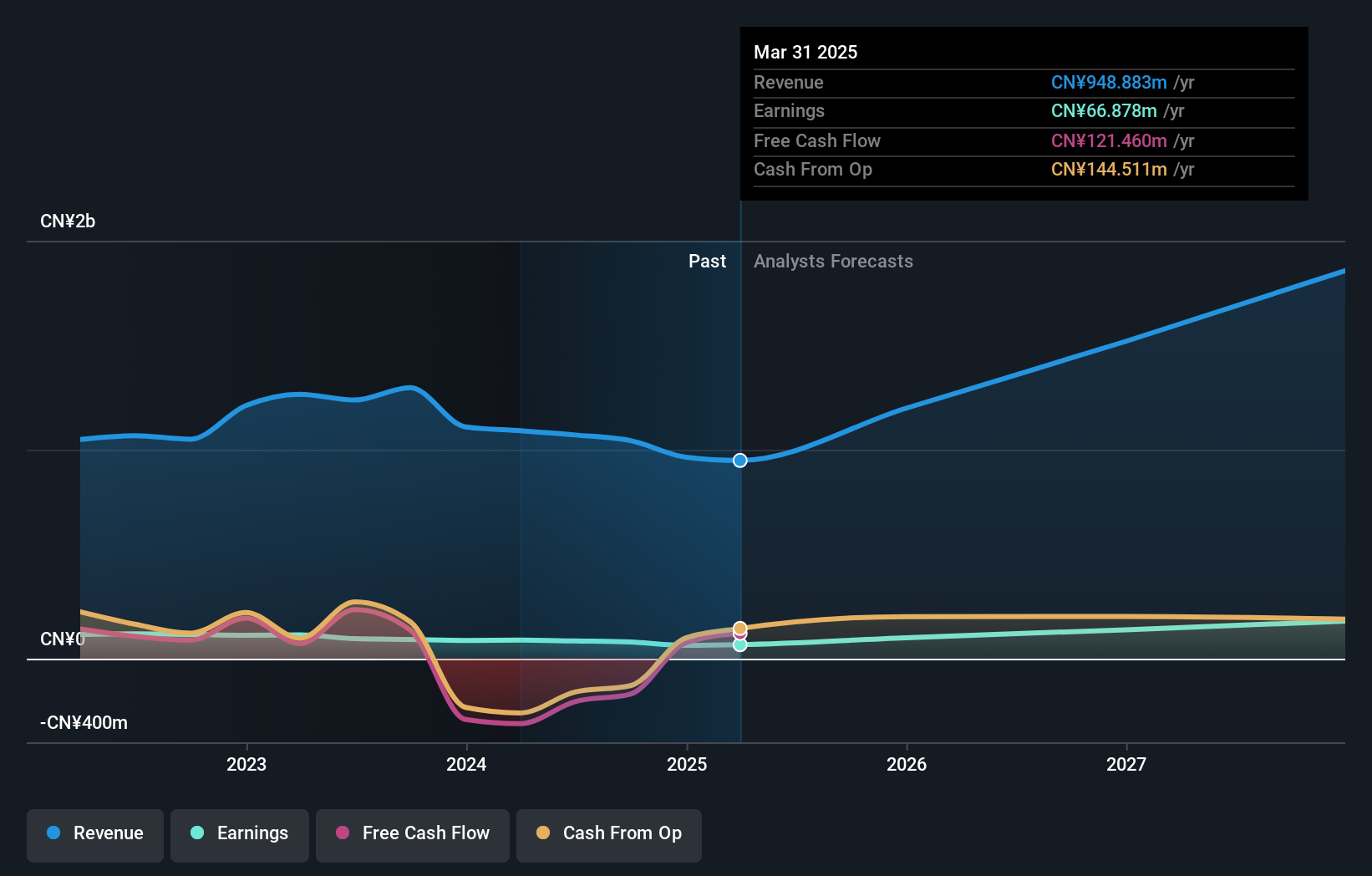

Chengdu Spaceon Electronics (SZSE:002935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Spaceon Electronics Co., Ltd. engages in the research and development, design, production, and sale of time-frequency and satellite application products in China and internationally, with a market cap of CN¥5.46 billion.

Operations: Chengdu Spaceon Electronics generates revenue primarily from the Computer, Communications, and Other Electronic Equipment Manufacturing segment, which brought in CN¥1.07 billion. The company focuses on time-frequency and satellite application products for both domestic and international markets.

Chengdu Spaceon Electronics reported a 7.3% decline in revenue to ¥378.57 million for the first half of 2024, alongside a net income drop to ¥15.46 million from ¥17.91 million last year. Despite these setbacks, the company's earnings are projected to grow at an impressive annual rate of 33.1%, significantly outpacing the Chinese market's expected growth of 23.1%. With R&D expenses totaling ¥1 billion in 2023, their commitment to innovation remains strong, particularly in AI and software solutions—key drivers for future growth and competitive edge in China's tech sector.

Key Takeaways

- Delve into our full catalog of 258 Chinese High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiji Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002368

Taiji Computer

Operates as a software and information technology service company.

Reasonable growth potential with adequate balance sheet.