As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are closely monitoring economic indicators such as the unexpected drop in U.S. initial jobless claims and strong home sales reports that have driven positive sentiment. In this environment of cautious optimism, identifying high-growth tech stocks involves assessing factors like innovation potential and adaptability to evolving market demands, which are crucial for navigating the current landscape marked by geopolitical uncertainties and monetary policy shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Megacable Holdings S. A. B. de C. V (BMV:MEGA CPO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Megacable Holdings, S. A. B. de C. V., along with its subsidiaries, operates in the cable television, internet, and telephone signal distribution sectors with a market cap of MX$33.11 billion.

Operations: Megacable, through its subsidiaries, focuses on providing cable television, internet, and telephone services. The company generates revenue primarily from subscription fees across these services.

Despite a challenging year with a 9.1% dip in earnings, Megacable Holdings shows promising signs of recovery, projecting an impressive 21.9% annual growth in profits. This anticipated growth outpaces the broader Mexican market's average of 11.5%. Additionally, the company's commitment to innovation is evident from its R&D investments, aligning with industry needs for continuous evolution in media technology. Revenue forecasts also look optimistic at an 8.6% increase per year, surpassing the national market growth rate of 7.2%. While recent quarterly reports indicate a slight decrease in net income and EPS, Megacable's strategic focus on expanding its digital and high-speed internet services could bolster future performance, leveraging growing demand in these sectors to potentially enhance shareholder value over time.

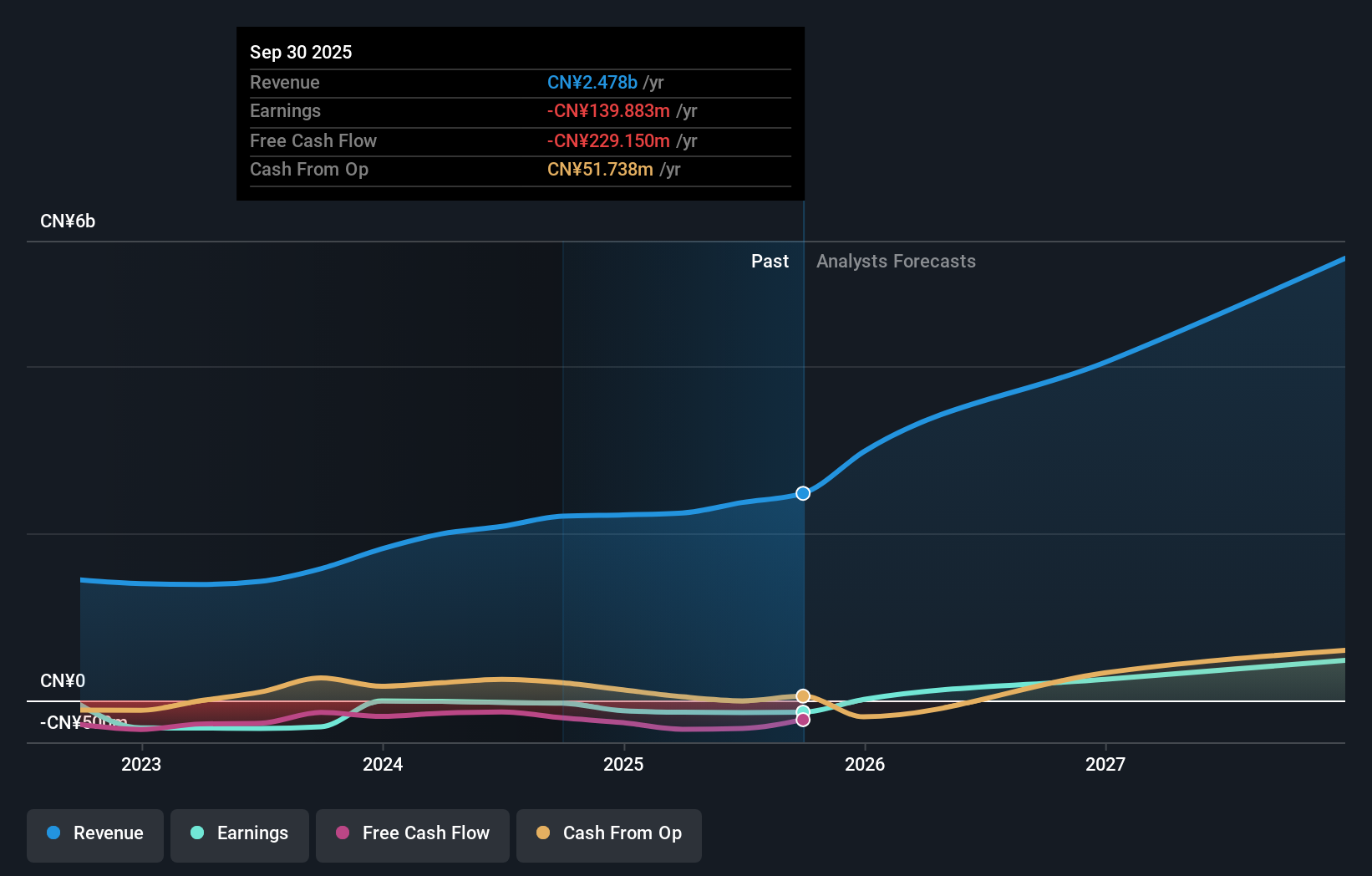

WG TECH (Jiang Xi) (SHSE:603773)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WG TECH (Jiang Xi) Co., Ltd. operates in the photoelectric glass finishing sector in China and has a market capitalization of approximately CN¥5.37 billion.

Operations: WG TECH (Jiang Xi) Co., Ltd. generates revenue primarily from its optoelectronics segment, with reported earnings of CN¥2.21 billion. The company's operations are centered around the photoelectric glass finishing business in China.

WG TECH (Jiang Xi) is navigating a transformative phase, evidenced by its substantial revenue growth of 34.6% year-over-year, outpacing the Chinese market's average of 13.8%. Despite current unprofitability with a net loss widening to CNY 49.42 million from CNY 20.49 million last year, the firm is poised for recovery with expected earnings growth surging by an impressive 103.91% annually over the next three years. This optimism is further bolstered by recent strategic moves including a significant stake acquisition by Shenzhen Zhongjincheng Asset Management, reflecting confidence in WG TECH's future prospects and aligning with broader industry trends towards consolidation and scale enhancement in tech sectors.

- Dive into the specifics of WG TECH (Jiang Xi) here with our thorough health report.

Explore historical data to track WG TECH (Jiang Xi)'s performance over time in our Past section.

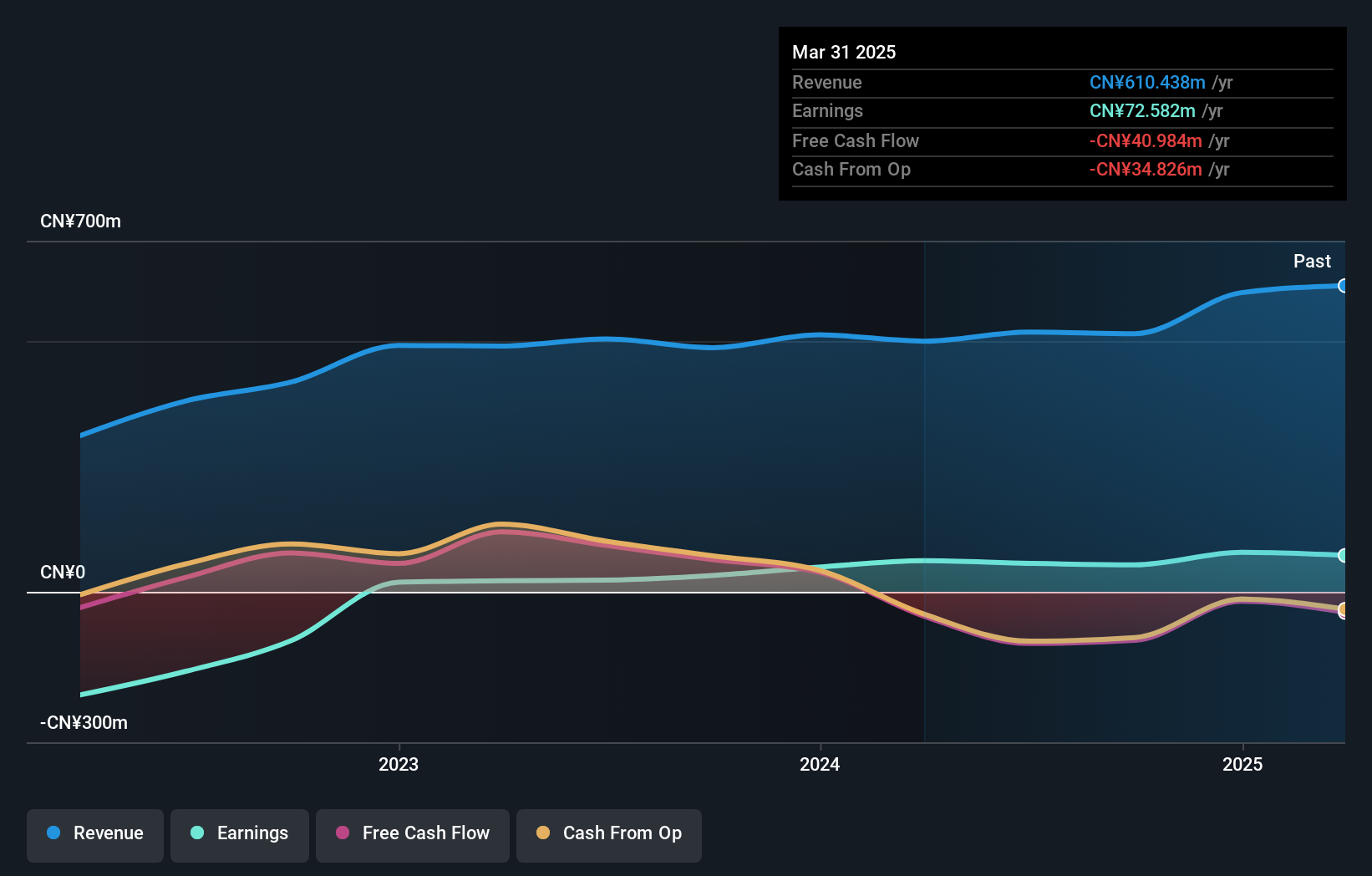

Shenzhen Genvict Technologies (SZSE:002869)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Genvict Technologies Co., Ltd. focuses on the research, development, and industrialization of smart transportation technology in China and has a market cap of CN¥4.93 billion.

Operations: Genvict Technologies, along with its subsidiaries, operates in the intelligent traffic industry, generating revenue primarily from this segment. The company focuses on smart transportation solutions within China.

Shenzhen Genvict Technologies is making notable strides in the tech sector, with a reported 34.9% annual revenue growth, significantly outpacing the broader Chinese market's average of 13.8%. This growth is complemented by an impressive forecast of earnings increasing by 40.2% annually. The company has also demonstrated a commitment to innovation through its R&D investments, which have surged to CNY 50 million this year, accounting for approximately 14.2% of their total revenue. These figures highlight not only Shenzhen Genvict's aggressive expansion strategy but also its potential to capitalize on emerging tech trends and maintain a competitive edge in the industry.

- Navigate through the intricacies of Shenzhen Genvict Technologies with our comprehensive health report here.

Understand Shenzhen Genvict Technologies' track record by examining our Past report.

Taking Advantage

- Click here to access our complete index of 1288 High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:MEGA CPO

Megacable Holdings S. A. B. de C. V

Engages in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems.

Good value with reasonable growth potential.