- China

- /

- Electronic Equipment and Components

- /

- SZSE:002389

High Growth Tech Stocks Global Spotlight On Three Promising Picks

Reviewed by Simply Wall St

Amid easing trade concerns and better-than-expected earnings, global markets have shown resilience with U.S. stocks climbing higher, particularly in technology sectors, as evidenced by the Nasdaq Composite's significant rise. In this climate of cautious optimism, identifying high-growth tech stocks involves focusing on companies that demonstrate strong fundamentals and adaptability to navigate economic uncertainties while capitalizing on technological advancements.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| KebNi | 20.83% | 67.27% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Aerospace CH UAVLtd (SZSE:002389)

Simply Wall St Growth Rating: ★★★★★☆

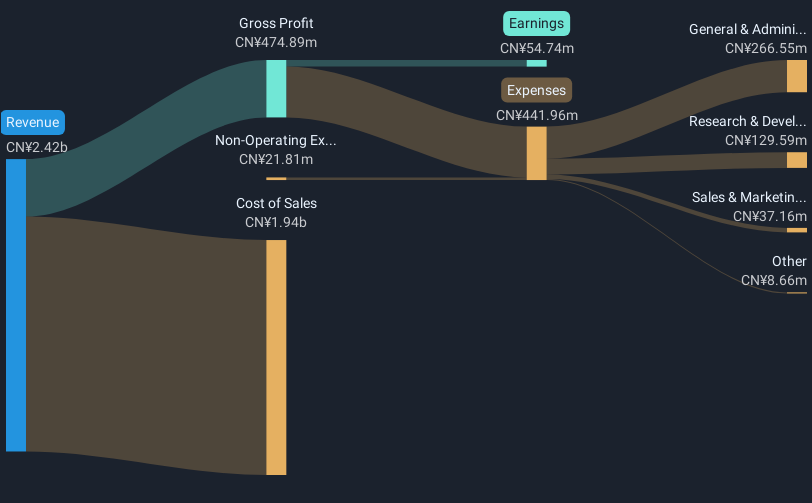

Overview: Aerospace CH UAV Co., Ltd specializes in the research, design, manufacturing, testing, sales, and servicing of drones and onboard mission equipment with a market capitalization of CN¥18.24 billion.

Operations: Aerospace CH UAV Ltd focuses on the development and commercialization of drones and related mission equipment. The company generates revenue through sales and services associated with these products, leveraging its expertise in research, design, manufacturing, and testing.

Aerospace CH UAVLtd, navigating through a challenging fiscal period, reported a significant downturn with Q1 sales dropping to CNY 315.07 million from CNY 463.9 million year-over-year and swinging to a net loss of CNY 30.88 million from a prior net income of CNY 2.55 million. Despite these setbacks, the company's strategic emphasis on R&D and innovation remains robust, aiming to revitalize its market position and respond dynamically to evolving aerospace demands. Recent affirmations of dividends at CNY 0.60 per ten shares underline a commitment to shareholder returns even amidst financial volatilities, reflecting confidence in future recovery and growth prospects driven by advanced technological deployments in unmanned aerial vehicles (UAVs).

AVIC Chengdu Aircraft (SZSE:302132)

Simply Wall St Growth Rating: ★★★★★☆

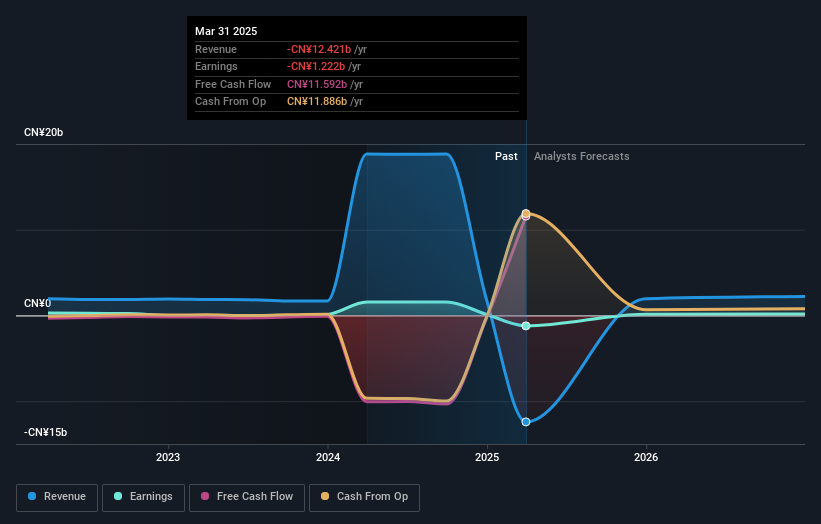

Overview: AVIC Chengdu Aircraft Company Limited offers intelligent measurement and control products for both military and civilian sectors in China and globally, with a market cap of CN¥34.71 billion.

Operations: The company generates revenue through the production of intelligent measurement and control products catering to both military and civilian markets. It serves clients in China as well as international markets, leveraging its expertise in advanced technology solutions.

AVIC Chengdu Aircraft, amidst an evolving aerospace sector, has demonstrated a robust financial trajectory with a reported annual revenue growth of 143.3% and earnings surge by 146.7%. The company's strategic focus on R&D is evident from its substantial investment, aligning with industry shifts towards advanced technological integration in aircraft manufacturing. This approach not only underscores its commitment to innovation but also positions it favorably as the industry pivots to more sophisticated aerospace solutions. Recent dividend affirmations further reflect confidence in sustained growth and shareholder value, despite broader market challenges.

- Click here and access our complete health analysis report to understand the dynamics of AVIC Chengdu Aircraft.

Understand AVIC Chengdu Aircraft's track record by examining our Past report.

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★☆☆

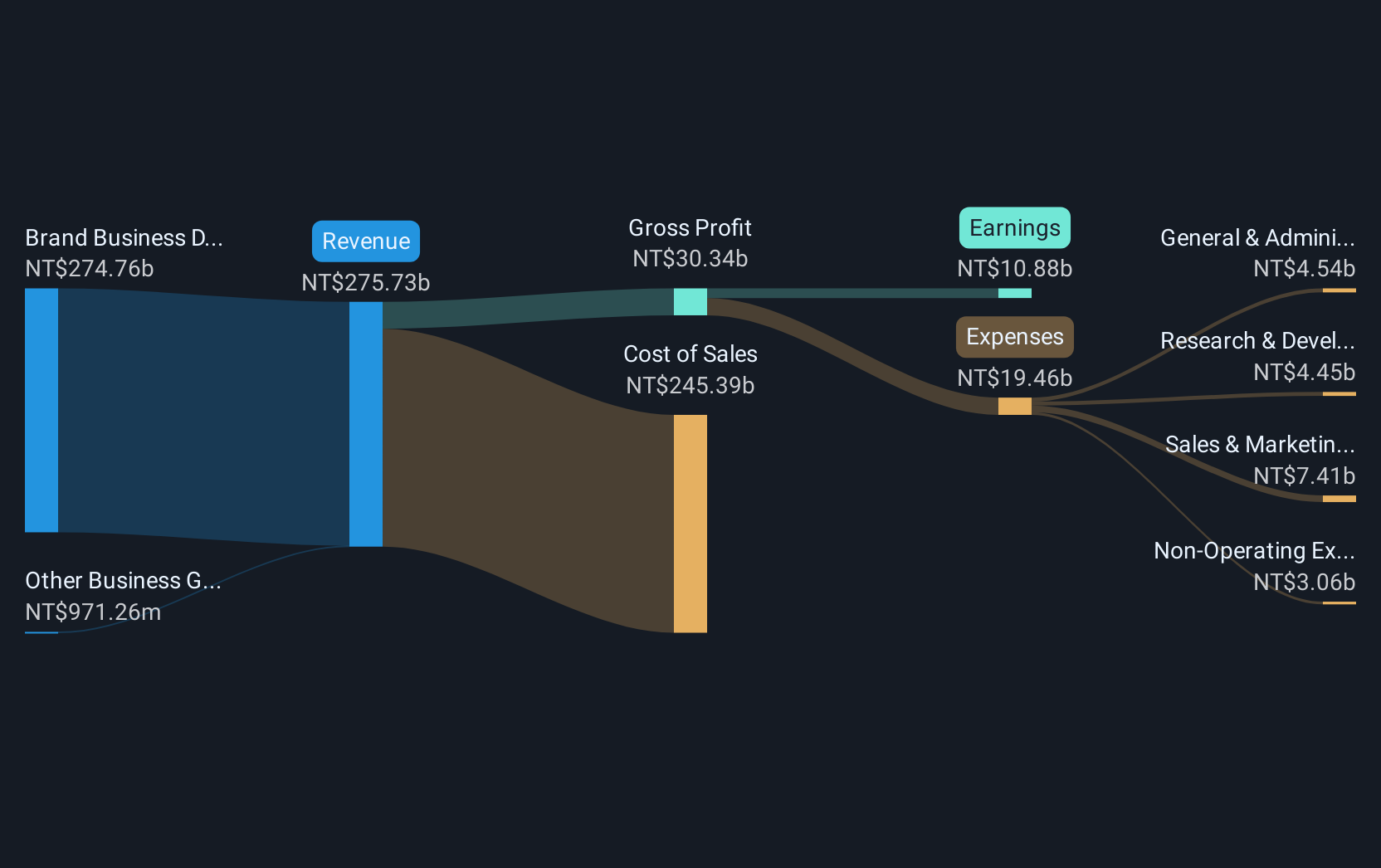

Overview: Giga-Byte Technology Co., Ltd. is a company that manufactures, processes, and trades computer peripherals and component parts globally, with a market capitalization of approximately NT$160.44 billion.

Operations: The Brand Business Division is the primary revenue driver for Giga-Byte Technology, generating NT$264.28 billion, while the Other Business Group contributes NT$870.64 million.

Giga-Byte Technology, amidst a rapidly evolving tech landscape, has demonstrated robust financial and operational growth. In the past year alone, the company's earnings surged by 106.4%, significantly outpacing the broader tech industry's growth of 17.4%. This impressive performance is underpinned by strategic investments in R&D, which have not only fueled innovations like the GeForce RTX™ 5060 series but also enhanced Giga-Byte’s competitive edge in gaming and AI markets. The recent launch of these graphics cards showcases their commitment to balancing cutting-edge technology with efficient cooling solutions, catering to both mainstream gamers and entry-level AI users. Moreover, a dividend increase approved on April 16 reflects confidence in ongoing growth and shareholder value amidst dynamic market conditions.

- Dive into the specifics of Giga-Byte Technology here with our thorough health report.

Gain insights into Giga-Byte Technology's past trends and performance with our Past report.

Taking Advantage

- Access the full spectrum of 737 Global High Growth Tech and AI Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002389

Aerospace CH UAVLtd

Engages in the research and development, designing, manufacturing, testing, sales, and service of drones and its onboard mission equipment.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives