- China

- /

- Electronic Equipment and Components

- /

- SZSE:002362

Market Might Still Lack Some Conviction On Hanwang Technology Co.,Ltd (SZSE:002362) Even After 27% Share Price Boost

Hanwang Technology Co.,Ltd (SZSE:002362) shareholders have had their patience rewarded with a 27% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

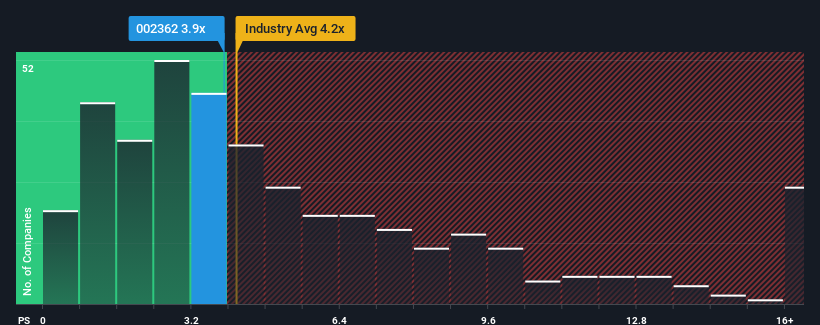

Although its price has surged higher, there still wouldn't be many who think Hanwang TechnologyLtd's price-to-sales (or "P/S") ratio of 3.9x is worth a mention when the median P/S in China's Electronic industry is similar at about 4.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Hanwang TechnologyLtd

How Hanwang TechnologyLtd Has Been Performing

With revenue growth that's inferior to most other companies of late, Hanwang TechnologyLtd has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Hanwang TechnologyLtd will help you uncover what's on the horizon.How Is Hanwang TechnologyLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hanwang TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Still, lamentably revenue has fallen 3.3% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 32% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Hanwang TechnologyLtd is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Hanwang TechnologyLtd's P/S?

Hanwang TechnologyLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Hanwang TechnologyLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about this 1 warning sign we've spotted with Hanwang TechnologyLtd.

If these risks are making you reconsider your opinion on Hanwang TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hanwang TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002362

Hanwang TechnologyLtd

Provides handwriting recognition, optical character recognition, and handwriting input products in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives