- China

- /

- Communications

- /

- SZSE:002313

Little Excitement Around Sunsea AIoT Technology Co., Ltd.'s (SZSE:002313) Revenues As Shares Take 29% Pounding

Sunsea AIoT Technology Co., Ltd. (SZSE:002313) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

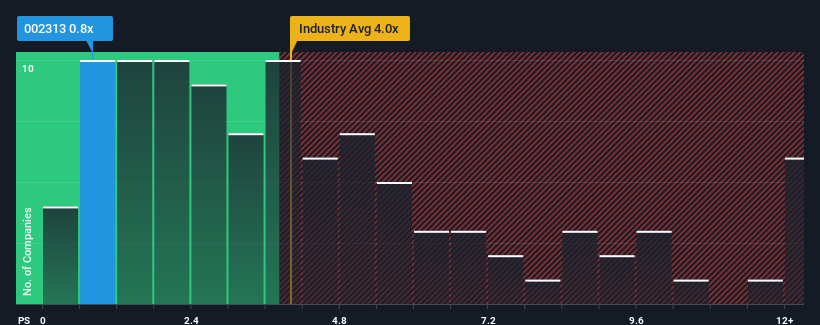

Following the heavy fall in price, Sunsea AIoT Technology may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Communications industry in China have P/S ratios greater than 4x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sunsea AIoT Technology

How Sunsea AIoT Technology Has Been Performing

For instance, Sunsea AIoT Technology's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Sunsea AIoT Technology will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sunsea AIoT Technology will help you shine a light on its historical performance.How Is Sunsea AIoT Technology's Revenue Growth Trending?

Sunsea AIoT Technology's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 4.2% decrease to the company's top line. As a result, revenue from three years ago have also fallen 25% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 45% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that Sunsea AIoT Technology is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Having almost fallen off a cliff, Sunsea AIoT Technology's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Sunsea AIoT Technology confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Sunsea AIoT Technology that we have uncovered.

If these risks are making you reconsider your opinion on Sunsea AIoT Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002313

Sunsea AIoT Technology

Provides Internet of Things products and services to telecom operators, ICT equipment vendors, system integrators, and enterprise customers in China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives