Stock Analysis

- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

Three High Growth Tech Stocks To Watch Closely

Reviewed by Simply Wall St

As global markets continue to experience broad-based gains, with smaller-cap indexes outperforming large-caps and the S&P 600 for small-cap stocks showing resilience, investors are closely watching economic indicators such as jobless claims and home sales that suggest positive sentiment. In this environment of cautious optimism, identifying high-growth tech stocks becomes crucial, as these can offer potential opportunities for growth in a market where technology continues to drive innovation and demand.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.88% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that specializes in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩17.64 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 billion. It focuses on developing innovative biotechnological products such as long-acting biobetters and antibody biosimilars.

Alteogen's recent strategic partnership with Daiichi Sankyo, granting exclusive rights to develop and commercialize a subcutaneous version of ENHERTU using Alteogen’s Hybrozyme Technology, underscores its innovative approach in the biotech sector. This deal not only brings an upfront payment but also potential milestone payments and tiered royalties, which could significantly impact future revenues. With revenue growth projected at 64.4% annually, far surpassing the Korean market's 9.1%, and earnings expected to surge by 128.5% per year, Alteogen is positioning itself as a formidable player in biotechnology innovation despite current unprofitability. This growth trajectory is supported by their substantial investment in R&D, crucial for maintaining competitive edge and fostering groundbreaking therapies.

- Click here to discover the nuances of ALTEOGEN with our detailed analytical health report.

Review our historical performance report to gain insights into ALTEOGEN's's past performance.

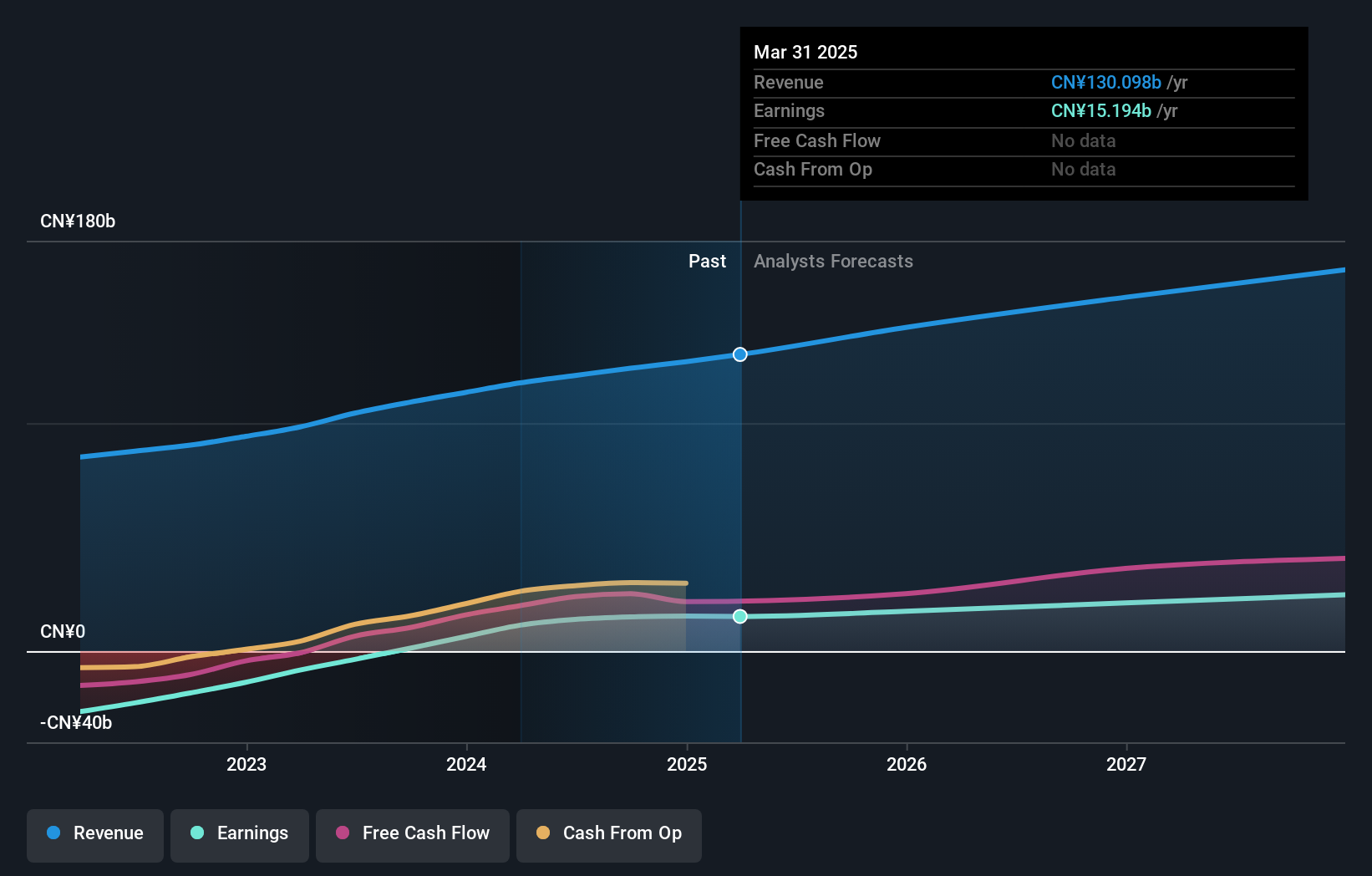

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in China, with a market capitalization of HK$199.51 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations, amounting to CN¥119.83 billion, with a smaller contribution from overseas markets at CN¥4.25 billion. The company focuses on live streaming and online marketing services in China.

Kuaishou Technology's recent earnings report reveals a robust financial performance, with third-quarter sales rising to CNY 31.13 billion, up from CNY 27.95 billion the previous year, and net income more than doubling to CNY 3.27 billion. This surge reflects a strategic emphasis on innovation and market adaptation in the competitive tech landscape of Hong Kong. Notably, R&D investments have been pivotal in driving these results; despite broader industry challenges, Kuaishou has managed to outpace average industry growth rates significantly. With earnings expected to grow by 17.6% annually and revenue projections at an 8.7% increase per year, the company is well-positioned for sustained growth amidst shifting digital media dynamics.

- Unlock comprehensive insights into our analysis of Kuaishou Technology stock in this health report.

Evaluate Kuaishou Technology's historical performance by accessing our past performance report.

Huagong Tech (SZSE:000988)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Huagong Tech Company Limited is engaged in the manufacturing and sale of laser equipment, hologram products, optical communication devices, and electronic components both domestically in China and internationally, with a market capitalization of CN¥35.52 billion.

Operations: The company generates revenue through the manufacturing and sale of laser equipment, hologram products, optical communication devices, and electronic components. Its operations span both domestic and international markets. Notably, Huagong Tech has observed fluctuations in its net profit margin over recent periods.

Huagong Tech has demonstrated robust financial growth, with a significant 23% increase in yearly revenue, outpacing the broader Chinese market's average. This surge is supported by a strategic focus on R&D, which not only underscores its commitment to innovation but also aligns with a 28.3% forecasted annual earnings growth—indicative of its potential in the competitive tech sector. The company's recent earnings underscore this trajectory, reporting a substantial rise in net income to CNY 937.6 million from CNY 813.96 million year-over-year, reflecting operational efficiency and market adaptability despite global economic fluctuations.

Summing It All Up

- Discover the full array of 1292 High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.