- China

- /

- Communications

- /

- SHSE:688618

Insider-Favored Growth Companies To Watch In June 2024

Reviewed by Simply Wall St

As global markets exhibit mixed signals with record highs in major indexes and ongoing concerns about economic sectors like manufacturing, investors are navigating a complex landscape. In such an environment, growth companies with high insider ownership can be particularly intriguing, as they often signal strong confidence from those closest to the company's operations and future.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Medley (TSE:4480) | 34% | 28.7% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

| Gaming Innovation Group (OB:GIG) | 13.5% | 36.2% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

| Vow (OB:VOW) | 31.8% | 97.6% |

We're going to check out a few of the best picks from our screener tool.

Maharah for Human Resources (SASE:1831)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Maharah for Human Resources Company offers manpower services to both public and private sectors in Saudi Arabia and the United Arab Emirates, with a market capitalization of SAR 2.73 billion.

Operations: The company generates revenue primarily from its Corporate and Individual segments, amounting to SAR 1.40 billion and SAR 437.42 million respectively, with an additional SAR 119.18 million from Facility Management services.

Insider Ownership: 26.4%

Earnings Growth Forecast: 27.3% p.a.

Maharah for Human Resources is navigating a complex period with recent board and executive committee changes, alongside adjustments to company bylaws and management structures. Despite these shifts, the company's earnings are expected to grow significantly over the next three years, outpacing the broader SA market. However, it faces challenges such as an unstable dividend track record and earnings that barely cover interest payments. This mixed financial health suggests cautious optimism for investors focusing on growth with high insider ownership.

- Dive into the specifics of Maharah for Human Resources here with our thorough growth forecast report.

- According our valuation report, there's an indication that Maharah for Human Resources' share price might be on the expensive side.

Suzhou HYC TechnologyLtd (SHSE:688001)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou HYC Technology Co., Ltd. specializes in industrial testing equipment and turnkey solutions for various sectors including flat panel display, intelligent wearables, semiconductors, and automotive electronics in China, with a market capitalization of approximately CN¥9.37 billion.

Operations: The company generates revenue primarily from industrial testing equipment and turnkey solutions across sectors such as flat panel display, intelligent wearables, semiconductors, and automotive electronics.

Insider Ownership: 14.7%

Earnings Growth Forecast: 57.5% p.a.

Suzhou HYC TechnologyLtd. is expected to experience substantial growth, with revenue and earnings projected to outpace the Chinese market significantly. Despite a challenging recent quarter where revenues fell and a net loss was reported, the company's aggressive buyback strategy indicates confidence from management. However, concerns about cash flow sustainability for dividends persist. This mixed financial outlook highlights both potential and caution for investors interested in growth companies with high insider ownership.

- Navigate through the intricacies of Suzhou HYC TechnologyLtd with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Suzhou HYC TechnologyLtd's share price might be too optimistic.

3onedata (SHSE:688618)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3onedata Co., Ltd. specializes in the research, development, manufacturing, marketing, and servicing of industrial network equipment and solutions, with a market capitalization of approximately CN¥4.36 billion.

Operations: The company generates revenue primarily from the industrial network equipment and solutions sector.

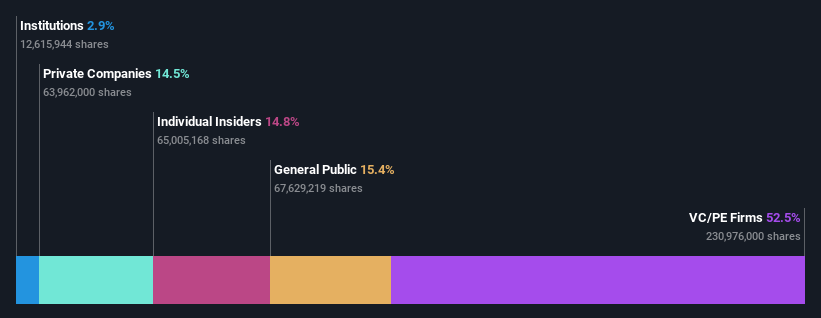

Insider Ownership: 13.5%

Earnings Growth Forecast: 27.5% p.a.

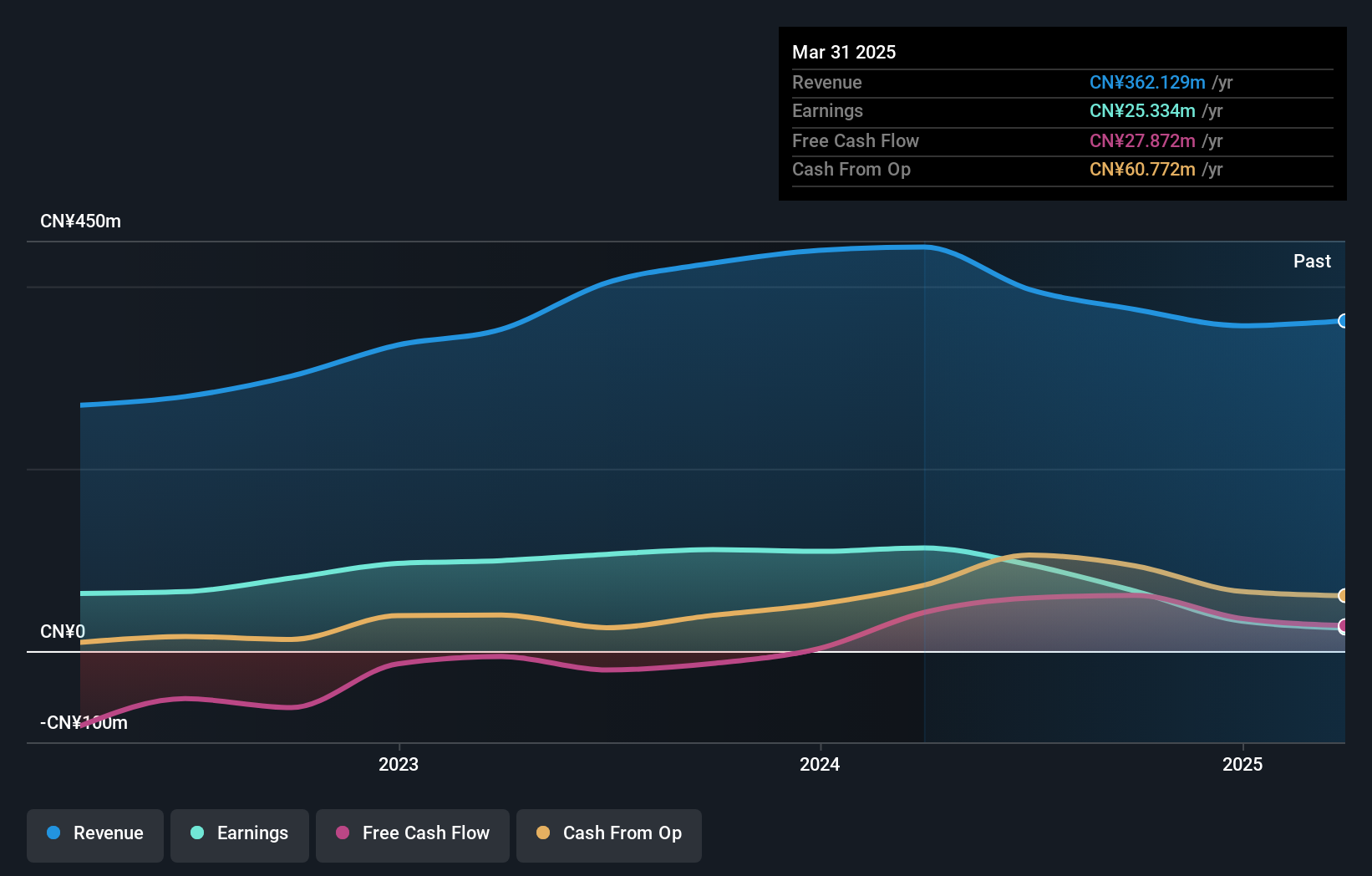

3onedata Co., Ltd. has demonstrated robust financial performance with a significant increase in both revenue and net income in the first quarter of 2024, reporting CNY 75.5 million in revenue and CNY 15.46 million in net income. The company's earnings are expected to grow by 27.51% annually, outpacing the Chinese market's forecasted growth. Despite this strong growth potential and trading at a favorable price-to-earnings ratio of 25.8x, shareholder dilution over the past year and a dividend that is poorly covered by cash flows introduce elements of caution for investors considering this high insider ownership company.

- Take a closer look at 3onedata's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that 3onedata is trading behind its estimated value.

Make It Happen

- Investigate our full lineup of 1478 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if 3onedata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688618

3onedata

Engages in the research and development, manufacturing, marketing, and servicing of industrial network equipment and solutions.

Undervalued with high growth potential.