- China

- /

- Communications

- /

- SHSE:688618

High Growth Tech Stocks To Explore In November 2024

Reviewed by Simply Wall St

In the wake of a significant political shift in the U.S., global markets have experienced notable movements, with major indices like the S&P 500 and Russell 2000 showing impressive gains driven by expectations of policy changes that could spur economic growth. As investors navigate these dynamic conditions, high-growth tech stocks present intriguing opportunities, especially those well-positioned to benefit from potential regulatory easing and tax reforms.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1283 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Kexing Biopharm (SHSE:688136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kexing Biopharm Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs and microbial preparations both in China and internationally, with a market cap of CN¥3.56 billion.

Operations: Kexing Biopharm generates revenue primarily through its pharmaceutical manufacturing segment, which accounts for CN¥1.33 billion. The company's focus on recombinant protein drugs and microbial preparations underpins its core business operations.

Kexing Biopharm has shown a remarkable turnaround, as evidenced by its latest earnings report where net income shifted from a CNY 54.31 million loss to a CNY 17.18 million profit year-over-year. This improvement is underpinned by a significant revenue increase to CNY 1,038.26 million, up from CNY 969 million, reflecting growth of about 7%. The company's commitment to innovation is evident in its R&D spending trends which are crucial for sustaining long-term growth in the competitive biotech sector. With earnings expected to surge by an impressive 103.25% annually and revenue projected to grow at 27.9% per year—outpacing the Chinese market average of 13.9%—Kexing Biopharm appears well-positioned for future expansion despite current profitability challenges and cash flow concerns.

- Take a closer look at Kexing Biopharm's potential here in our health report.

Examine Kexing Biopharm's past performance report to understand how it has performed in the past.

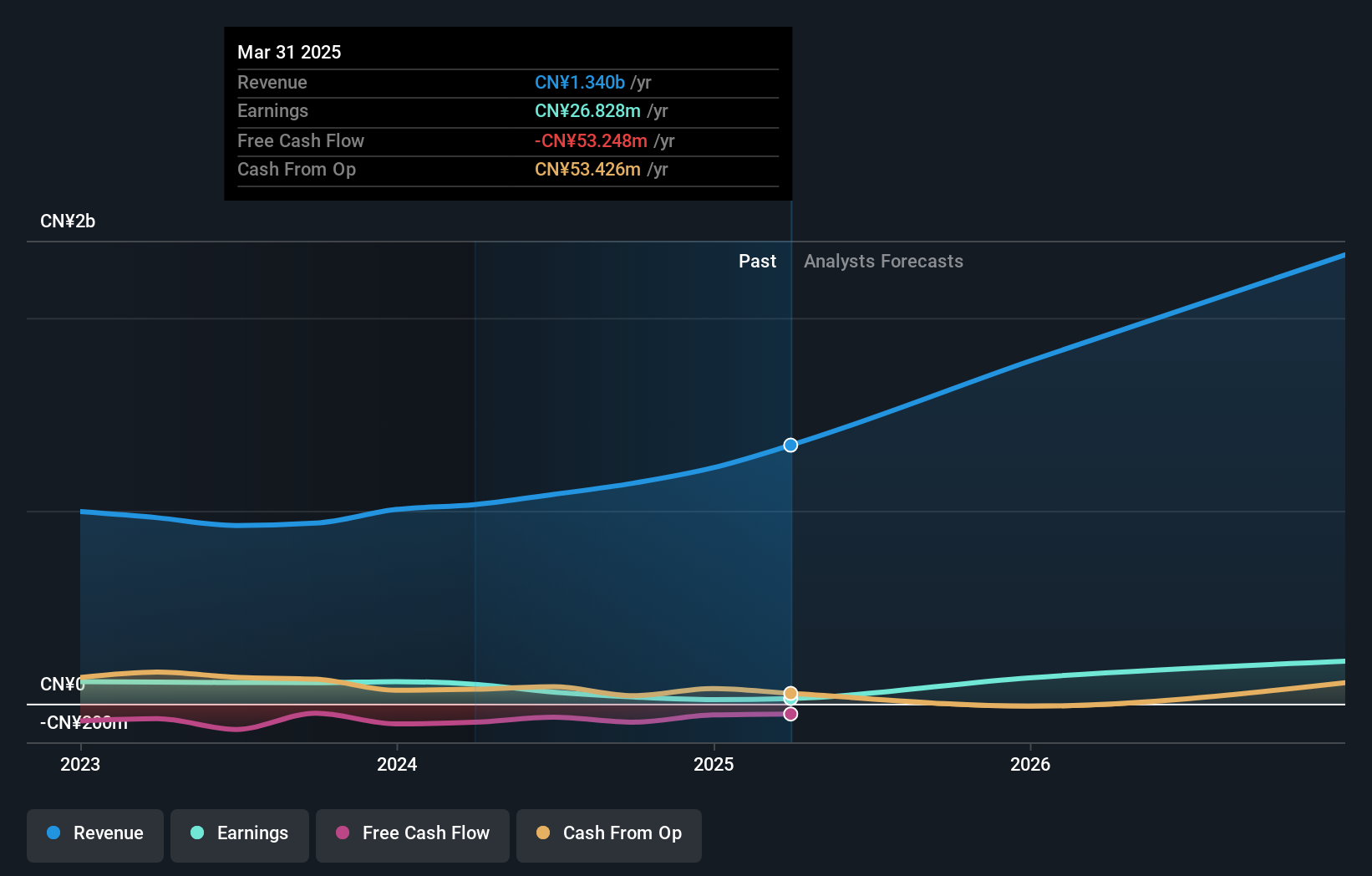

3onedata (SHSE:688618)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3onedata Co., Ltd. focuses on the research and development, manufacturing, marketing, and servicing of industrial network equipment and solutions, with a market capitalization of CN¥2.66 billion.

Operations: Specializing in industrial network equipment and solutions, the company generates revenue through its comprehensive R&D, manufacturing, marketing, and service operations. With a market capitalization of CN¥2.66 billion, it is positioned within the industrial technology sector.

Despite recent setbacks in earnings and sales, as reported for the nine months ending September 2024, with a significant drop from CNY 309.32 million to CNY 244.54 million year-over-year, 3onedata remains poised for robust future growth. The company's revenue is expected to surge by an impressive 35.7% annually, outpacing the Chinese market average of 13.9%. This growth trajectory is supported by a forecasted annual profit increase of 45.9%, signaling potential recovery and expansion ahead. Moreover, the firm’s dedication to innovation is reflected in its strategic R&D investments aimed at sustaining long-term competitive advantages within the tech sector—crucial moves that could shape its trajectory in upcoming years despite current volatility in performance figures and market conditions.

- Delve into the full analysis health report here for a deeper understanding of 3onedata.

Gain insights into 3onedata's historical performance by reviewing our past performance report.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Bromake New Material Co., Ltd. focuses on the research, development, production, and sale of consumer electronics protective and functional products with a market cap of CN¥3.60 billion.

Operations: The company generates revenue primarily from its electronic components and parts segment, which contributes CN¥1.14 billion.

Despite a challenging fiscal year marked by a net income drop to CNY 7.41 million from CNY 87.35 million, Shenzhen Bromake New Material has maintained robust sales growth, escalating from CNY 705.14 million to CNY 841.36 million. This resilience underscores the company's capacity to expand revenue by an impressive 40.5% annually, outstripping the Chinese market's average of 13.9%. Furthermore, with an anticipated surge in earnings growth at a rate of 92.7%, Bromake demonstrates potential for significant financial recovery and advancement in its sector, supported by strategic R&D investments which are crucial for maintaining competitive edge and fostering innovation in new materials technology.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Bromake New Material.

Gain insights into Shenzhen Bromake New Material's past trends and performance with our Past report.

Key Takeaways

- Reveal the 1283 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3onedata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688618

3onedata

Engages in the research and development, manufacturing, marketing, and servicing of industrial network equipment and solutions.

High growth potential with excellent balance sheet.