As global markets navigate the complexities of rising oil prices due to Middle East tensions and unexpected job gains in the U.S., investors are closely monitoring economic indicators that could influence market sentiment. In this environment, high growth tech stocks stand out as potential opportunities for those seeking innovation-driven growth, particularly as these companies often demonstrate resilience by leveraging cutting-edge technologies to adapt to changing market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 43.81% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1272 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Apex Software Co., LTD is a professional platform software and information service provider company in China with a market capitalization of CN¥8.52 billion.

Operations: Apex Software generates revenue primarily from its application software service industry, amounting to CN¥730.07 million. The company's business model focuses on providing specialized software and information services within China.

Fujian Apex Software Co., LTD has demonstrated resilience in a competitive market, with its earnings growth of 23% per year outpacing the industry's average. Despite a slight dip in sales to CNY 266.79 million from CNY 280.63 million year-over-year, the company maintains robust revenue forecasts, expected to grow at 17.5% annually—faster than China's market average of 13.4%. This growth is underpinned by significant R&D investments, aligning with industry shifts towards software as a service (SaaS) models that promise recurring revenue streams. Moreover, Fujian Apex's focus on enhancing non-cash earnings and maintaining a high forecasted Return on Equity at 20.4% signals strong future prospects amidst evolving tech landscapes.

- Delve into the full analysis health report here for a deeper understanding of Fujian Apex SoftwareLTD.

Gain insights into Fujian Apex SoftwareLTD's past trends and performance with our Past report.

MLOptic (SHSE:688502)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MLOptic Corp. is a precision optical solutions company serving both China and international markets, with a market capitalization of CN¥6.55 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, which accounts for CN¥460.02 million.

MLOptic, a participant in the competitive tech landscape, has demonstrated robust revenue growth at 23.6% annually, outpacing the broader Chinese market's average of 13.4%. This growth is supported by substantial R&D investments which are crucial as the company navigates through recent earnings fluctuations, with net income dropping to CNY 15.57 million from CNY 28.6 million year-over-year despite a slight increase in sales. Moreover, MLOptic's strategic share repurchases underscored its commitment to shareholder value, buying back shares worth CNY 26.92 million this past year while also being added to the S&P Global BMI Index—a nod towards its expanding market presence and investor confidence.

- Click here and access our complete health analysis report to understand the dynamics of MLOptic.

Evaluate MLOptic's historical performance by accessing our past performance report.

Shenzhen Sunline Tech (SZSE:300348)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunline Tech Co., Ltd. specializes in offering banking software and technology services to financial institutions globally, with a market capitalization of CN¥11.17 billion.

Operations: Shenzhen Sunline Tech Co., Ltd. generates revenue by providing specialized software and technology services tailored for the banking and financial sectors on a global scale. The company focuses on delivering innovative solutions to enhance operational efficiency and customer engagement for its clients in the financial industry.

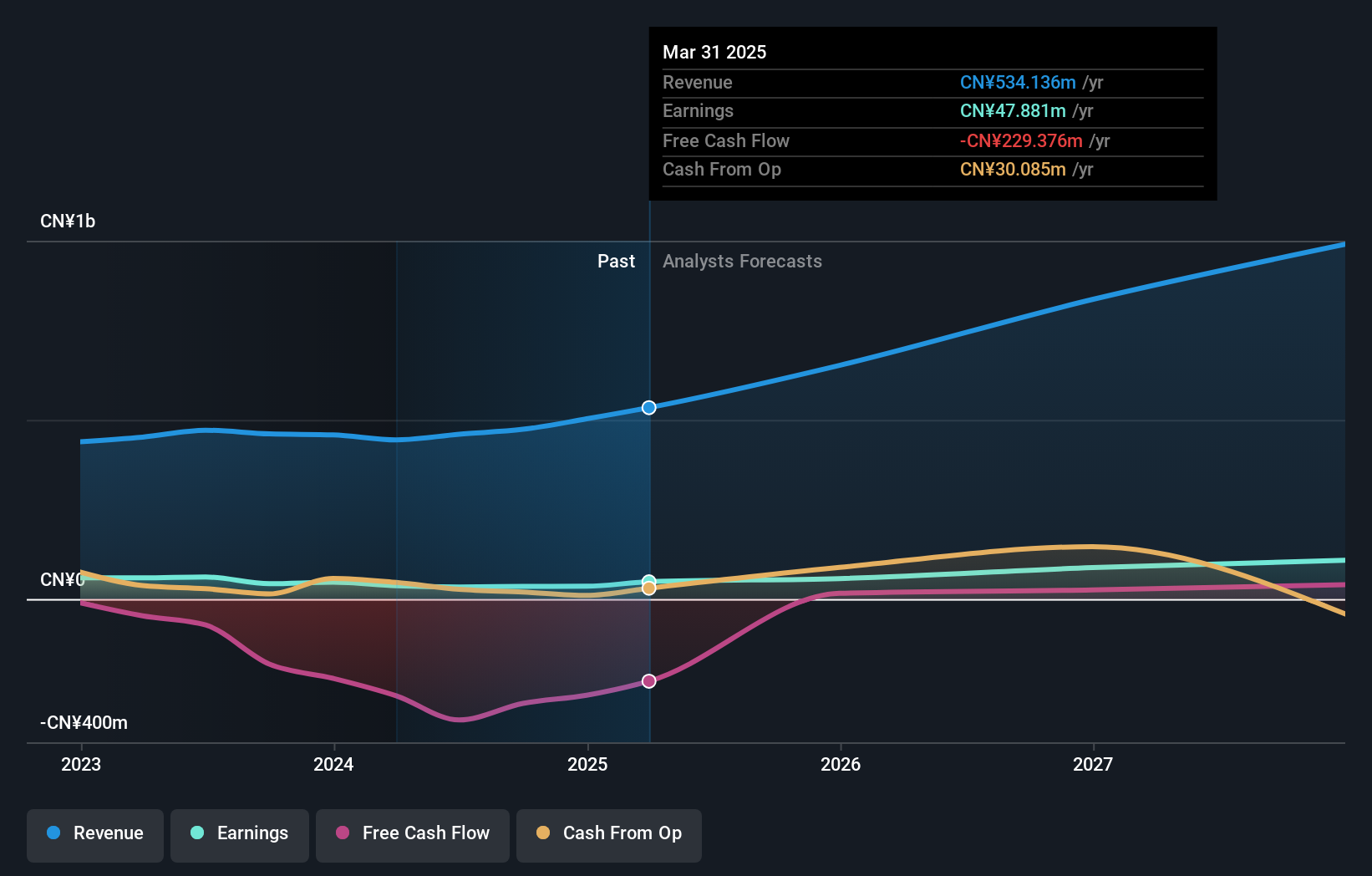

Shenzhen Sunline Tech has pivoted effectively within the tech sector, evidenced by a remarkable earnings growth of 662.3% over the past year, outperforming its industry's average decline of 11.5%. This surge is underpinned by a robust R&D commitment, with expenses significantly contributing to the innovative strides seen in its product offerings. Despite a volatile share price in recent months, the company's strategic decisions are reflected in its revenue forecast to grow at an impressive rate of 16.6% annually, faster than China's market average of 13.4%. Additionally, Shenzhen Sunline Tech has demonstrated resilience with a turnaround from a net loss to reporting net income of CNY 1.84 million for the first half of 2024—a stark contrast to last year’s figures. Looking ahead, Shenzhen Sunline Tech’s trajectory suggests continued upward momentum with earnings expected to expand by an annual rate of 37%, positioning it well above broader market forecasts. The company’s ability to harness significant R&D investments—translating into tangible product advancements—supports this optimistic outlook despite external market volatilities and internal challenges such as shareholder dilution over the past year. As it convenes for an extraordinary shareholders meeting later today, stakeholders are likely keen on strategies that will maintain this growth amidst shifting tech landscapes.

Make It Happen

- Explore the 1272 names from our High Growth Tech and AI Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300348

Shenzhen Sunline Tech

Provides banking software and technology services to banking and finance customers worldwide.

High growth potential with excellent balance sheet.