Stock Analysis

- China

- /

- Communications

- /

- SHSE:688387

High Growth Tech Stocks to Watch in None

Reviewed by Simply Wall St

As global markets experienced a holiday-shortened week with moderate gains, driven initially by large-cap growth stocks, the technology-heavy Nasdaq Composite led the way before seeing a reversal in the latter half of the week. Despite fluctuations, key economic indicators such as consumer confidence and durable goods orders have shown declines, highlighting an environment where identifying high-growth tech stocks requires careful consideration of their resilience and potential to innovate amidst shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

CICT Mobile Communication Technology (SHSE:688387)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CICT Mobile Communication Technology Co., Ltd. operates in the mobile communication technology sector and has a market capitalization of CN¥21.06 billion.

Operations: CICT focuses on the mobile communication technology sector, with its revenue model primarily driven by sales of communication equipment and related services. The company's cost structure includes significant investments in research and development, which impacts its overall profitability.

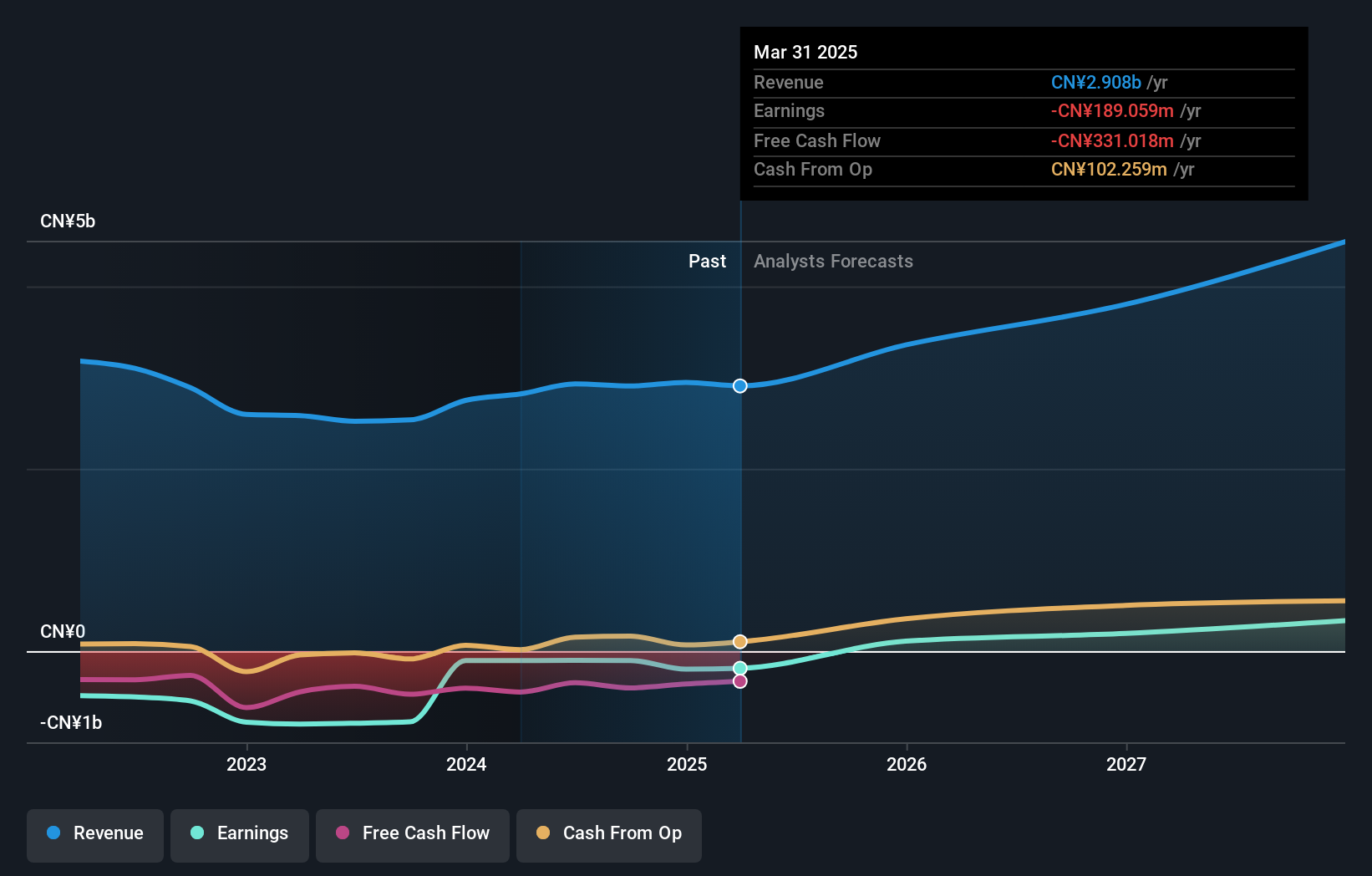

CICT Mobile Communication Technology, amidst a challenging market, reported a narrowing net loss from CNY 202.63 million to CNY 169.83 million year-over-year for the nine months ending September 2024, signaling potential stabilization. Despite a revenue dip to CNY 4,145.96 million from last year's CNY 5,281.4 million in the same period, the company is poised for recovery with expected revenue growth of 15.3% annually, outpacing the Chinese market's forecast of 13.7%. This growth trajectory is bolstered by an impressive projected earnings surge of 116.53% per annum as it edges towards profitability within three years—a robust indicator in an industry grappling with profitability challenges. Moreover, R&D investment remains pivotal for CICT as it navigates through tech innovations and market demands; however specific figures on recent R&D spending were not disclosed in their latest financial reports or meetings including their special shareholders meeting held in November 2024 which focused on strategic discussions rather than financial specifics.

- Delve into the full analysis health report here for a deeper understanding of CICT Mobile Communication Technology.

Learn about CICT Mobile Communication Technology's historical performance.

Beijing Shiji Information Technology (SZSE:002153)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Shiji Information Technology Co., Ltd. operates in the technology sector, focusing on providing software solutions and services, with a market cap of CN¥20.63 billion.

Operations: The company generates revenue primarily through its software solutions and services in the technology sector. With a market cap of CN¥20.63 billion, it focuses on delivering innovative technological offerings to its clients.

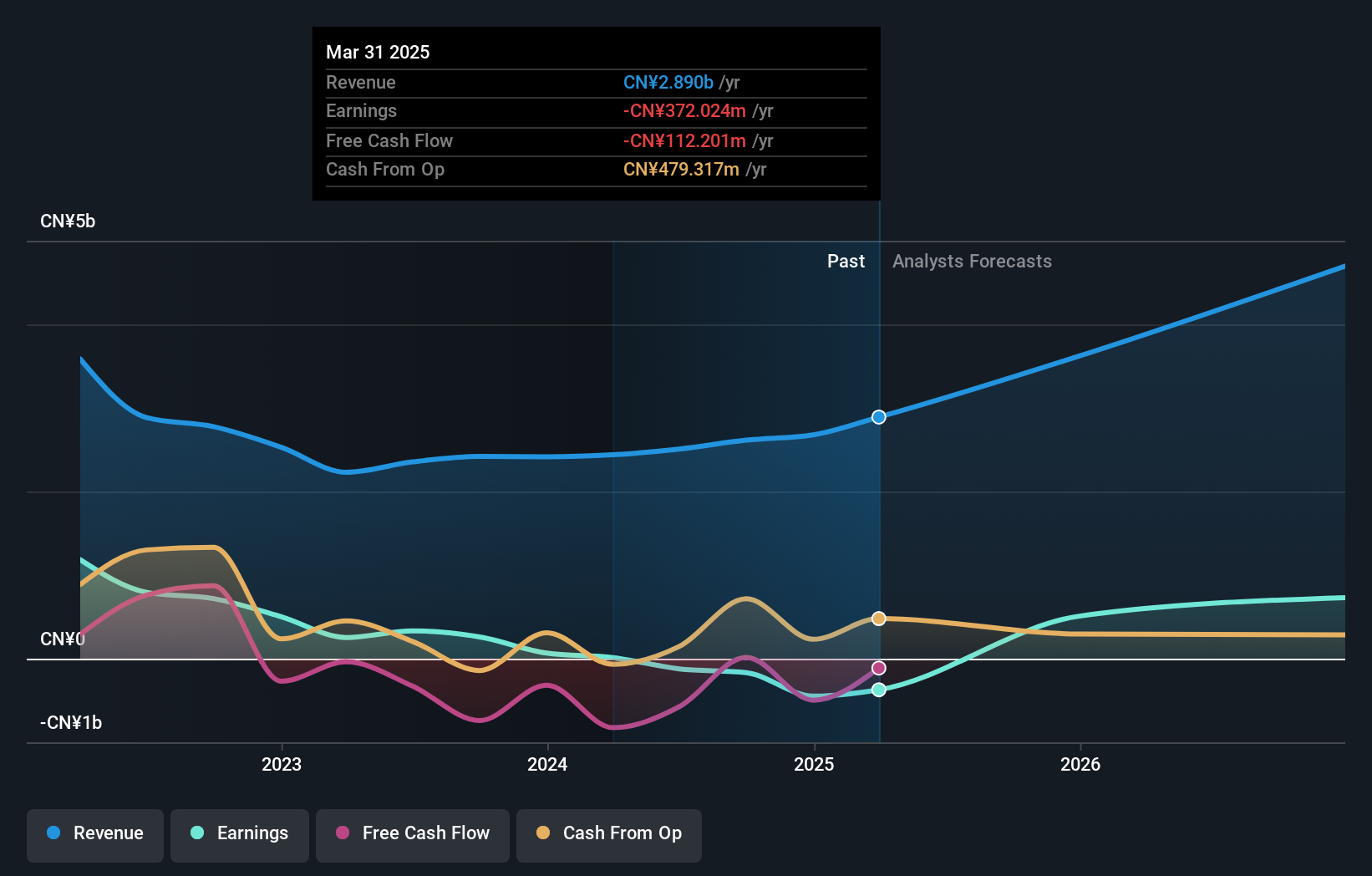

Beijing Shiji Information Technology has demonstrated resilience with a revenue increase to CNY 2,015.57 million from CNY 1,858.38 million year-over-year as of September 2024, alongside a modest rise in net income to CNY 15.88 million from CNY 14.42 million. This growth trajectory is underscored by an impressive annualized revenue growth forecast of 17.3%, outstripping the Chinese market prediction of 13.7%. The company's commitment to innovation is evident in its R&D endeavors, crucial for sustaining its competitive edge in the rapidly evolving tech landscape, although specific recent R&D expenditure figures remain undisclosed. With expectations set for the firm to turn profitable within the next three years and an earnings growth forecast at a robust rate of approximately 95% annually, Beijing Shiji's strategic focus appears well-aligned with industry demands and future profitability prospects.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. specializes in the research, development, production, and sale of infrared thermal imaging technology in Asia with a market cap of CN¥33.27 billion.

Operations: The company focuses on infrared thermal imaging technology, generating revenue through the sale of these products across Asia. Its operations encompass research, development, and production in this specialized field.

Wuhan Guide Infrared has recently reported a revenue increase to CNY 1.81 billion, up from CNY 1.61 billion year-over-year as of September 2024, reflecting a robust annualized growth rate of 26.3%. Despite this revenue surge, net income dramatically reduced to CNY 50.21 million from last year's CNY 285.63 million, indicating challenges in profitability amidst its growth trajectory. The company's commitment to leveraging idle funds for cash management suggests a strategic approach to optimizing financial resources, aligning with its innovative edge in the tech sector and potential for future profitability within three years.

- Take a closer look at Wuhan Guide Infrared's potential here in our health report.

Evaluate Wuhan Guide Infrared's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 1269 High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688387

CICT Mobile Communication Technology

CICT Mobile Communication Technology Co., Ltd.