Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688378

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

As global markets respond to the recent U.S. election results, with key indices like the small-cap Russell 2000 Index showing significant gains, investors are closely monitoring economic indicators and policy changes that could impact growth sectors such as technology. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to changing regulatory landscapes while benefiting from favorable economic conditions like lower taxes and looser regulations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market capitalization of approximately HK$6.67 billion.

Operations: The company generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Advanced Distribution Operations (CN¥2.51 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion).

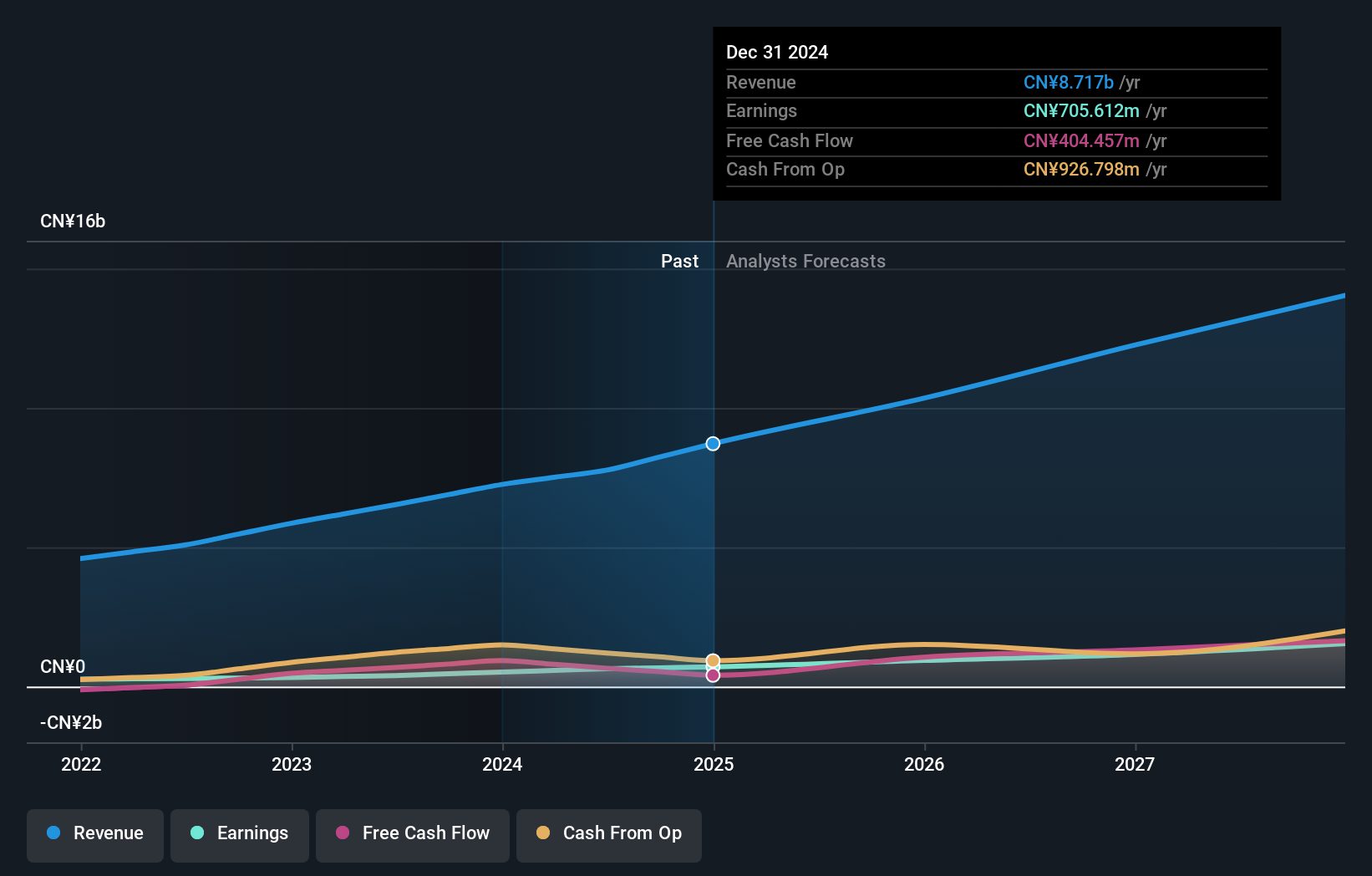

Wasion Holdings has demonstrated a robust growth trajectory, with revenue and earnings surging by 18.8% and 61.9% respectively over the past year, outpacing both the Hong Kong market and its industry benchmarks. This performance is underpinned by strategic expansions and effective cost control measures that led to a significant half-year net profit increase to CNY 331.03 million from CNY 213.82 million previously. Looking forward, the company's earnings are expected to grow at an annual rate of 22.8%, suggesting strong future prospects in a competitive electronic industry landscape where innovation remains critical for maintaining momentum.

- Get an in-depth perspective on Wasion Holdings' performance by reading our health report here.

Review our historical performance report to gain insights into Wasion Holdings''s past performance.

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry, with a market cap of CN¥5.28 billion.

Operations: Jilin OLED Material Tech specializes in the development and commercialization of organic electroluminescent materials and related equipment, catering to China's burgeoning display industry. The company generates revenue primarily through the sale of these advanced materials and equipment.

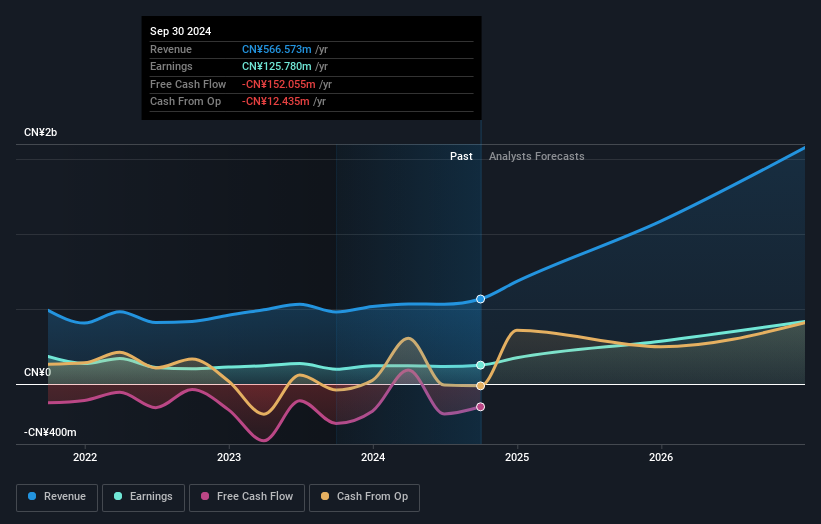

Jilin OLED Material Tech has shown notable performance in the tech sector, with a remarkable revenue growth of 45.3% annually, outstripping the broader Chinese market's growth rate of 14.1%. This surge is bolstered by its strategic focus on OLED materials, a key component in modern displays, which positions it well within the high-demand electronics market. Additionally, the company's earnings have expanded by an impressive 50.2% per year, reflecting robust operational efficiency and market penetration. Despite challenges like share price volatility and one-off gains skewing recent financials—CNY 44.6 million impacting last year's results—the firm invests significantly in R&D to innovate continually within the competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Jilin OLED Material Tech's health report.

Assess Jilin OLED Material Tech's past performance with our detailed historical performance reports.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥285.13 billion.

Operations: SHIFT Inc. generates revenue primarily through software testing-related services, contributing ¥71.34 billion, and software development-related services, which add ¥35.01 billion. The company's focus is on providing specialized solutions in the Japanese market for software quality assurance and testing.

SHIFT's recent strategy in share buybacks, repurchasing 67,400 shares for ¥999.61 million, underscores its commitment to enhancing shareholder value amidst a volatile share price landscape. This move aligns with an impressive projected annual earnings growth of 33.4%, significantly outpacing the Japanese market's average of 9.1%. Moreover, SHIFT is navigating through a tech environment where R&D is pivotal; their investment in this area has been robust, aiming to fuel innovations that keep them competitive despite a challenging past year where earnings dipped by 17.9%. With revenue expected to grow at 18.3% annually, SHIFT is positioning itself strategically within its sector, leveraging both financial maneuvers and technological advancements to potentially reshape its future trajectory in the high-stakes tech arena.

- Click here to discover the nuances of SHIFT with our detailed analytical health report.

Evaluate SHIFT's historical performance by accessing our past performance report.

Summing It All Up

- Click through to start exploring the rest of the 1268 High Growth Tech and AI Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688378

Jilin OLED Material Tech

Engages in the research and development, production, and sale of organic electroluminescent materials and equipment for the new display industry in China.