- China

- /

- Electronic Equipment and Components

- /

- SHSE:688320

Insiders Are Betting Big On These Growth Stocks In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing significant shifts across various sectors. With U.S. stocks experiencing fluctuations and interest rates on the rise, identifying growth companies with high insider ownership could provide valuable insights into where corporate confidence lies amid these turbulent times. In this environment, stocks with substantial insider ownership can signal strong internal belief in a company's potential to thrive despite external challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Here we highlight a subset of our preferred stocks from the screener.

Zhejiang Hechuan Technology (SHSE:688320)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Hechuan Technology Co., Ltd. focuses on the research, development, manufacturing, sale, and application integration of industrial automation products and has a market cap of CN¥5.79 billion.

Operations: Zhejiang Hechuan Technology Co., Ltd. generates revenue through the research, development, manufacturing, sale, and application integration of industrial automation products.

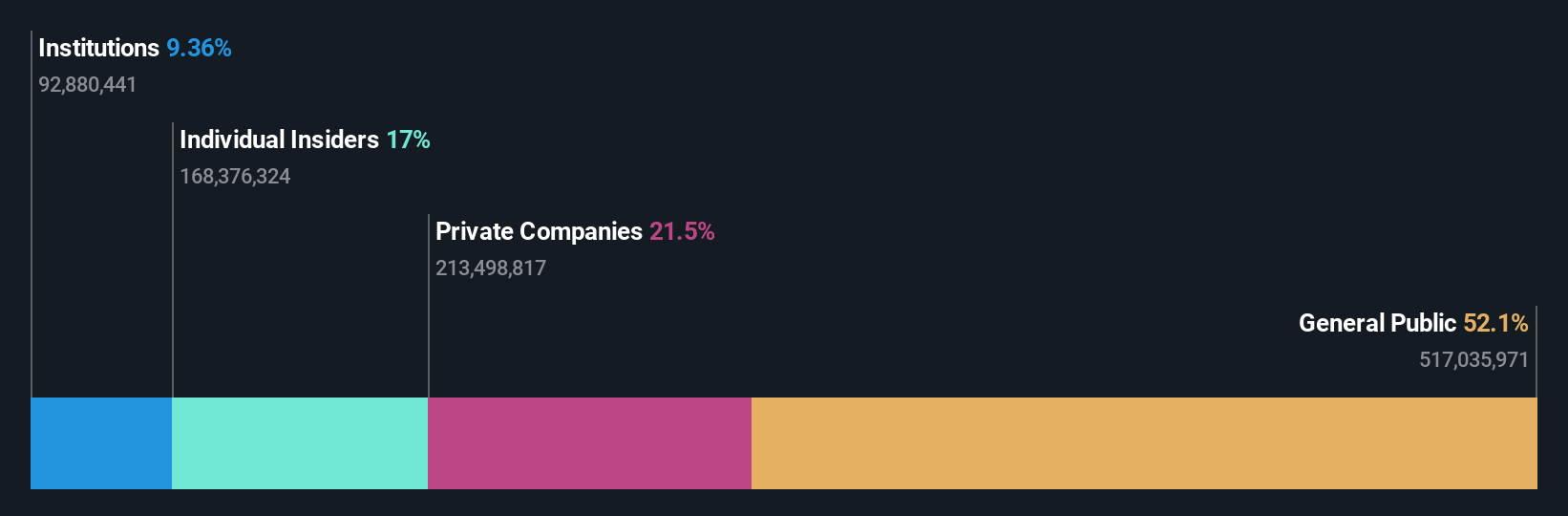

Insider Ownership: 30.8%

Revenue Growth Forecast: 19.8% p.a.

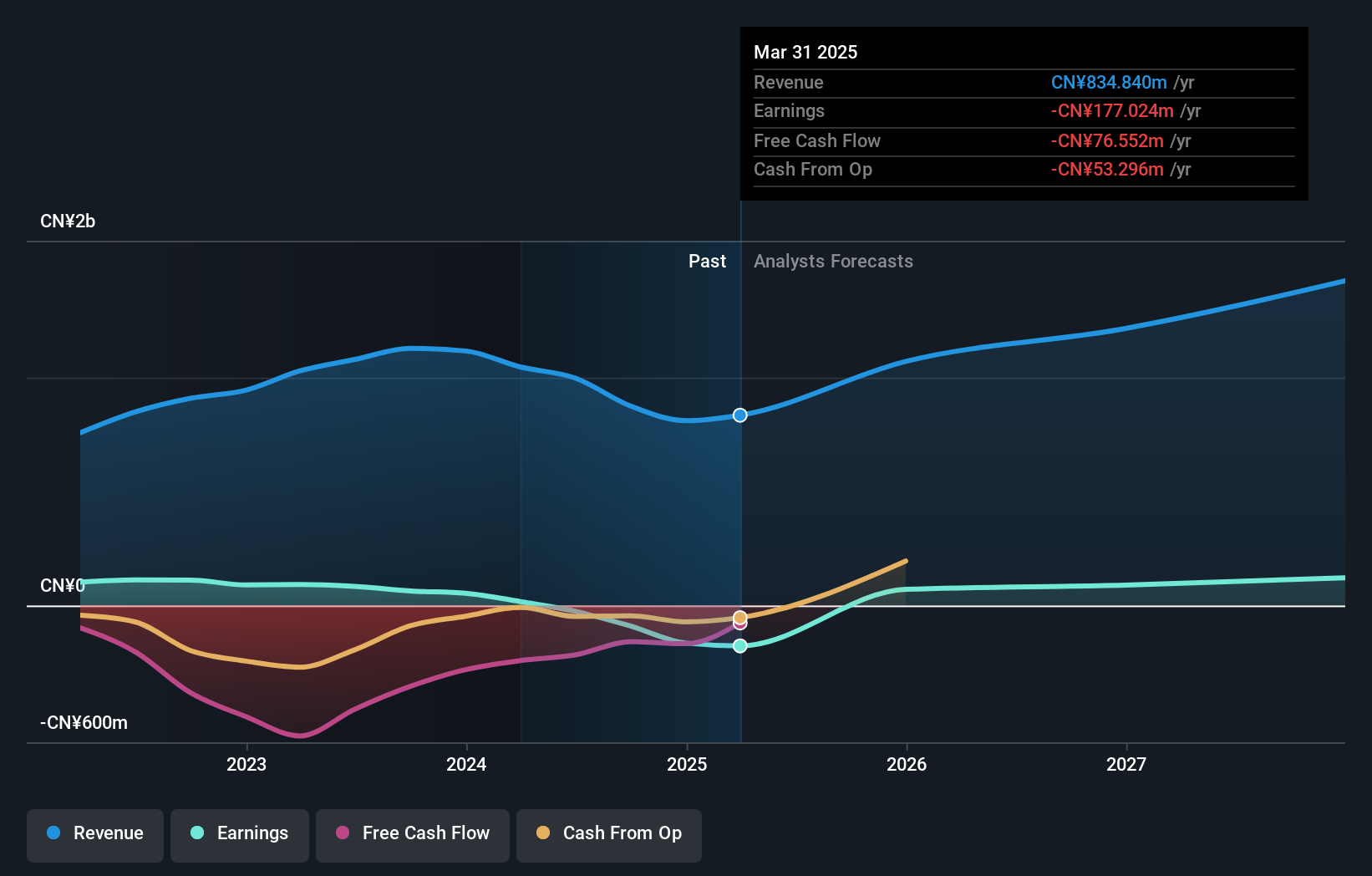

Zhejiang Hechuan Technology is projected to achieve profitability within three years, with earnings expected to grow substantially at 113.08% annually, surpassing the Chinese market's average growth rate. Despite a volatile share price and recent financial setbacks—reporting a net loss of CNY 80.63 million for the nine months ending September 2024—the company demonstrates commitment through share buybacks totaling CNY 62.13 million, indicating confidence in its long-term prospects amidst challenging revenue conditions.

- Get an in-depth perspective on Zhejiang Hechuan Technology's performance by reading our analyst estimates report here.

- Our valuation report here indicates Zhejiang Hechuan Technology may be overvalued.

Baowu Magnesium Technology (SZSE:002182)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baowu Magnesium Technology Co., Ltd. operates in mining and non-ferrous metal smelting and processing both in China and internationally, with a market cap of CN¥11.48 billion.

Operations: The company's revenue primarily comes from its non-ferrous metal smelting and rolling processing segment, which generated CN¥8.15 billion.

Insider Ownership: 17%

Revenue Growth Forecast: 25.2% p.a.

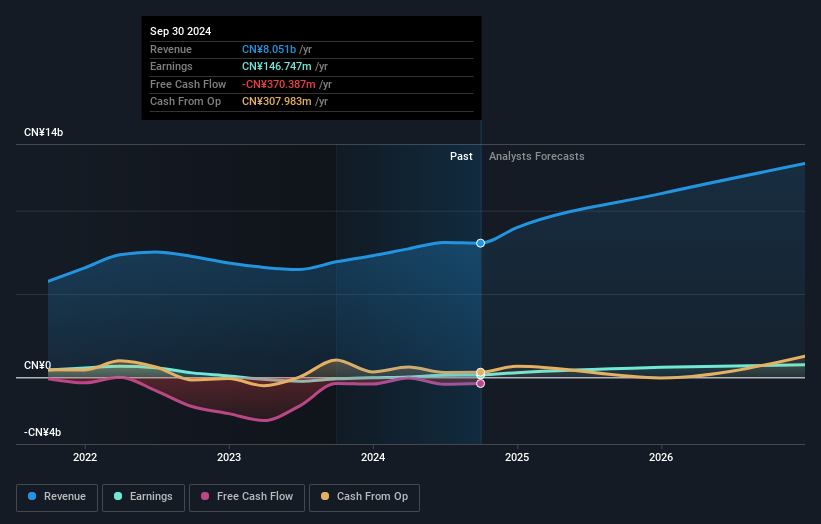

Baowu Magnesium Technology shows potential for growth with forecasted earnings and revenue increases of 61.5% and 25.2% per year, respectively, outpacing the Chinese market averages. Despite a decrease in net income to CNY 153.76 million for the nine months ending September 2024, insider ownership remains high without significant recent trading activity. However, challenges include low return on equity forecasts and debt not well-covered by operating cash flow, which may impact financial stability.

- Unlock comprehensive insights into our analysis of Baowu Magnesium Technology stock in this growth report.

- Our valuation report unveils the possibility Baowu Magnesium Technology's shares may be trading at a premium.

Guangdong Dowstone Technology (SZSE:300409)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Dowstone Technology Co., Ltd. is involved in the production and sale of lithium battery, carbon, and ceramic materials both in China and internationally, with a market cap of CN¥10.13 billion.

Operations: The company's revenue segments include the production and sale of lithium battery materials, carbon materials, and ceramic materials.

Insider Ownership: 27.8%

Revenue Growth Forecast: 20.2% p.a.

Guangdong Dowstone Technology has demonstrated strong growth, with earnings turning positive and net income reaching CNY 147.09 million for the first nine months of 2024. The company's revenue is expected to grow significantly faster than the Chinese market at 20.2% annually, while earnings are forecasted to increase by over 60% per year. Despite these growth prospects, challenges include shareholder dilution and a volatile share price, with debt coverage remaining a concern due to limited operating cash flow.

- Dive into the specifics of Guangdong Dowstone Technology here with our thorough growth forecast report.

- The analysis detailed in our Guangdong Dowstone Technology valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1541 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hechuan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688320

Zhejiang Hechuan Technology

Engages in the research and development, manufacturing, sale, and application integration of industrial automation products.

Reasonable growth potential with mediocre balance sheet.