- China

- /

- Electronic Equipment and Components

- /

- SZSE:002916

High Growth Tech Stocks Including 3 Promising Global Picks

Reviewed by Simply Wall St

As global markets experience mixed performances, with large-cap tech stocks driving gains and smaller-cap indexes facing declines, the focus remains on how economic indicators and central bank decisions influence market sentiment. In this environment, identifying high growth tech stocks involves evaluating companies that can leverage technological advancements like artificial intelligence to maintain a competitive edge and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 36.36% | 39.76% | ★★★★★★ |

| Shengyi TechnologyLtd | 20.11% | 30.49% | ★★★★★★ |

| Fositek | 36.64% | 47.65% | ★★★★★★ |

| Pharma Mar | 26.56% | 44.88% | ★★★★★★ |

| Hacksaw | 26.40% | 37.63% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| CD Projekt | 35.69% | 51.01% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, and sells biologic drugs in China, Hong Kong, and internationally with a market capitalization of approximately HK$2.48 billion.

Operations: The company generates revenue primarily from its surgical and ophthalmology segments, contributing HK$884.30 million and HK$811.46 million respectively, with a smaller portion from the provision of services at HK$22.05 million.

Essex Bio-Technology has demonstrated robust financial health, with earnings growth outpacing the broader Hong Kong market at 19.1% compared to the biotech industry's decline of 4.1%. This performance is bolstered by strategic R&D investments, which have enabled significant advancements in biopharmaceuticals, such as the recent approval of their BLA for HLX04-O targeting wet-AMD—a key growth area in ophthalmic treatments. Additionally, the company's inclusion in the S&P Global BMI Index and proactive share repurchase program reflect a strong commitment to enhancing shareholder value and confidence in its future trajectory.

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions globally, with a market cap of CN¥2.53 billion.

Operations: Beijing Labtech Instruments Co., Ltd. specializes in the production and distribution of laboratory products and solutions worldwide. The company's business model focuses on serving the laboratory industry with a range of innovative products designed to meet diverse scientific needs.

Beijing Labtech Instruments, amidst a challenging market, has managed to sustain an impressive annual revenue growth rate of 27%, significantly outpacing the broader Chinese market's growth of 14.4%. This performance is underscored by a robust annual earnings growth forecast of 39.1%. The company's strategic focus on R&D is evident from its allocation of substantial resources, maintaining R&D expenses which are crucial for its long-term competitiveness in the high-tech instrumentation sector. Recent activities including a notable acquisition by Qingdao Innovation Investment underline Beijing Labtech's ongoing expansion and strategic positioning within the industry.

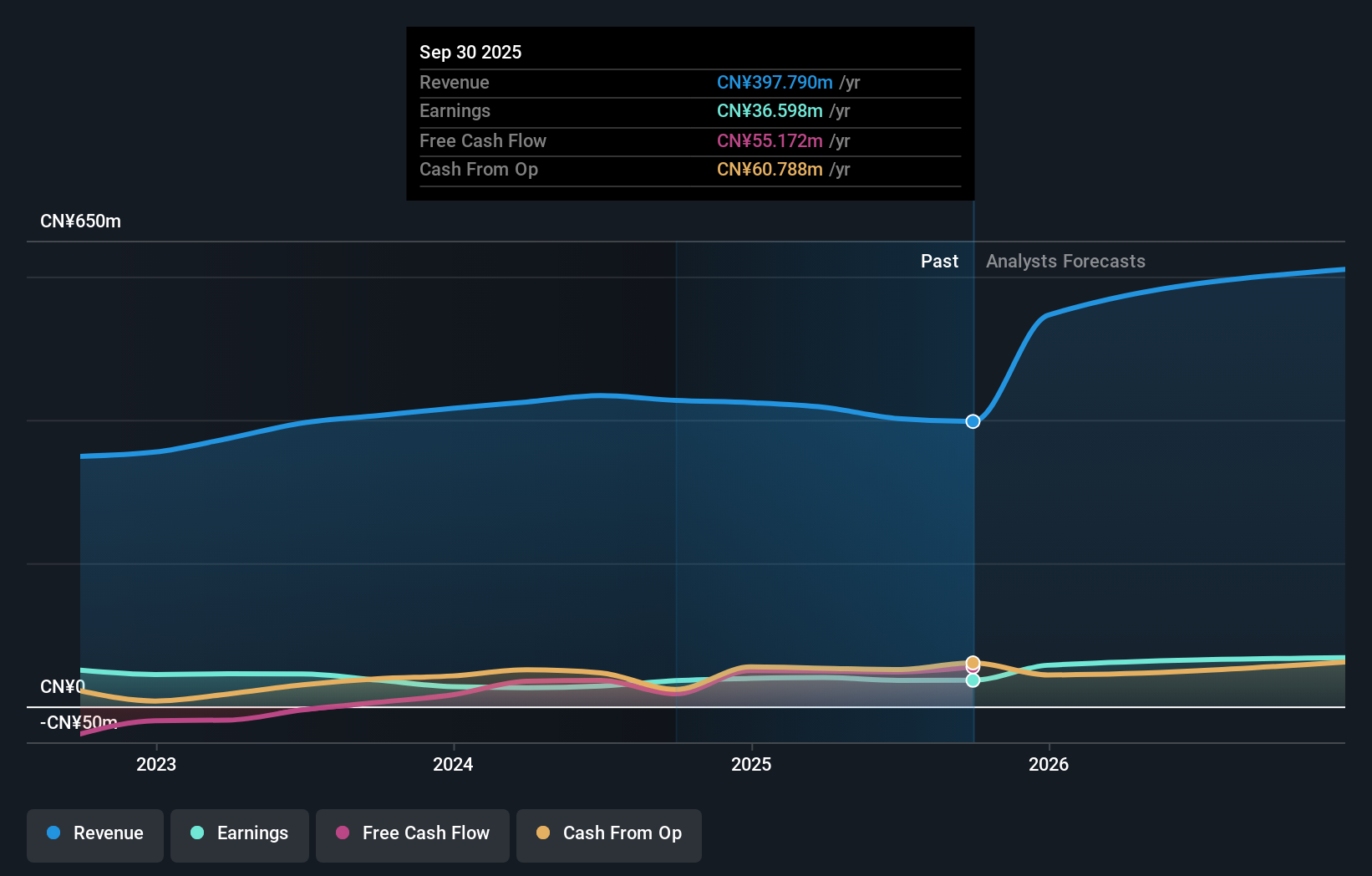

Shennan Circuit (SZSE:002916)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shennan Circuit Company Limited specializes in designing, manufacturing, and selling printed circuit boards, packaging substrates, and electronic assemblies both in China and internationally with a market cap of approximately CN¥153.68 billion.

Operations: Shennan Circuit focuses on the production and distribution of printed circuit boards, packaging substrates, and electronic assemblies. The company operates both domestically in China and internationally.

Shennan Circuit has demonstrated a robust financial trajectory, with revenues soaring to CNY 16.75 billion, up from CNY 13.05 billion year-over-year, and net income climbing to CNY 2.33 billion from CNY 1.49 billion in the same period. This performance reflects a significant annual earnings growth of 37.3%, surpassing the electronic industry's average of 9%. The company's commitment to innovation is evident in its strategic amendments to corporate bylaws, positioning it for sustained growth amidst fierce market competition. These figures underscore Shennan Circuit's potential as a dynamic player within the high-tech sector, despite its earnings forecast growing at a slightly slower pace than the broader Chinese market.

- Click here to discover the nuances of Shennan Circuit with our detailed analytical health report.

Review our historical performance report to gain insights into Shennan Circuit's's past performance.

Make It Happen

- Dive into all 238 of the Global High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002916

Shennan Circuit

Engages in the design, manufacture, and sale of printed circuit boards, packaging substrates, and electronic assemblies in China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives