- China

- /

- Electronic Equipment and Components

- /

- SHSE:688003

Undiscovered Gems with Strong Potential for February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and geopolitical tensions, small-cap stocks face both challenges and opportunities. With the Federal Reserve holding rates steady amid solid economic growth and elevated inflation, investors are increasingly focused on finding resilient companies that can thrive in this environment. In this context, identifying stocks with strong fundamentals and unique market positions becomes crucial for uncovering potential undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China and has a market capitalization of CN¥8.38 billion.

Operations: TZTEK generates revenue primarily through its industrial vision equipment offerings. The company's financial performance is influenced by its gross profit margin, which has shown variability over recent periods.

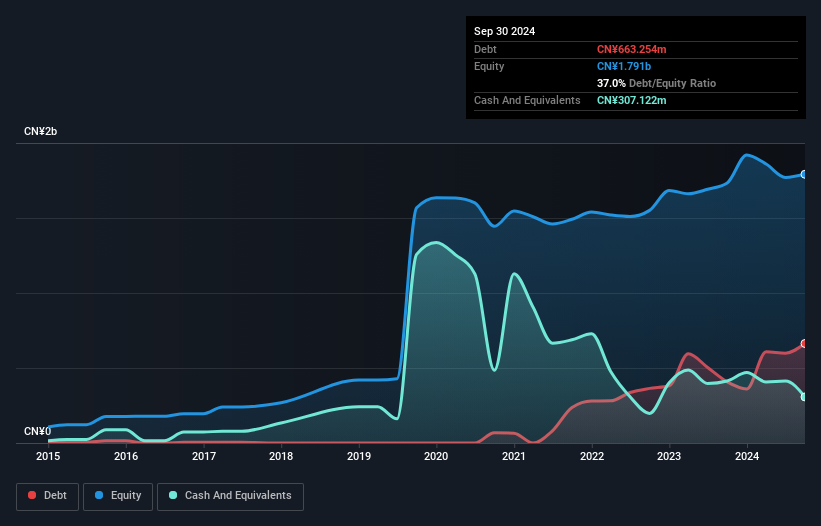

TZTEK, a small tech player, faces challenges with a recent -1.8% earnings growth against the electronic industry's 2.3% average. Despite this, it boasts high-quality past earnings and satisfactory debt management with a net debt to equity ratio of 19.9%. Over five years, its debt to equity ratio climbed from 0% to 37%, which could be concerning for some investors. The company's profitability ensures interest coverage isn't an issue but free cash flow remains negative. Notably, TZTEK completed a share buyback worth CNY 30 million in late 2024, potentially signaling confidence in its future prospects amidst volatile share prices recently observed over the past three months.

- Click here and access our complete health analysis report to understand the dynamics of Suzhou TZTEK Technology.

Evaluate Suzhou TZTEK Technology's historical performance by accessing our past performance report.

Beijing Jingyeda TechnologyLtd (SZSE:003005)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Jingyeda Technology Co., Ltd. offers system integration services and has a market cap of CN¥5.89 billion.

Operations: Jingyeda Technology generates revenue primarily from system integration services. The company's gross profit margin was 35.6% in the most recent financial period, reflecting its ability to manage costs effectively relative to its revenue.

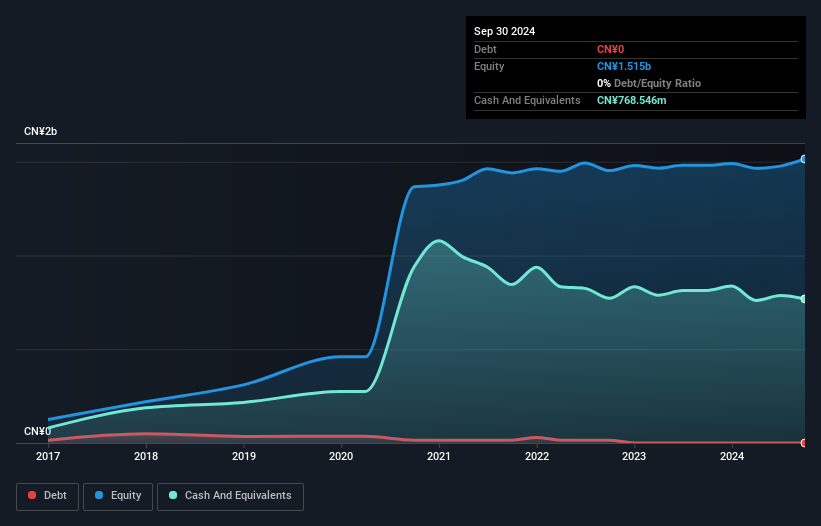

Jingyeda Technology, a nimble player in the tech sector, has shown notable earnings growth of 14% over the past year, outpacing the broader IT industry's -8%. Despite this recent uptick, its earnings have slipped by 44% annually over five years. The company is debt-free now compared to a debt-to-equity ratio of 8.4% five years ago. However, its financial results were influenced by a one-off gain of CN¥5.8M for the year ending September 2024. Recent volatility in share price and being dropped from the S&P Global BMI Index might raise concerns among investors.

- Dive into the specifics of Beijing Jingyeda TechnologyLtd here with our thorough health report.

Understand Beijing Jingyeda TechnologyLtd's track record by examining our Past report.

NSD (TSE:9759)

Simply Wall St Value Rating: ★★★★★☆

Overview: NSD Co., Ltd. is a Japanese company specializing in IT solutions, with a market capitalization of ¥267.37 billion.

Operations: NSD generates revenue primarily through its IT solutions services in Japan. It has a market capitalization of ¥267.37 billion, reflecting its position in the industry.

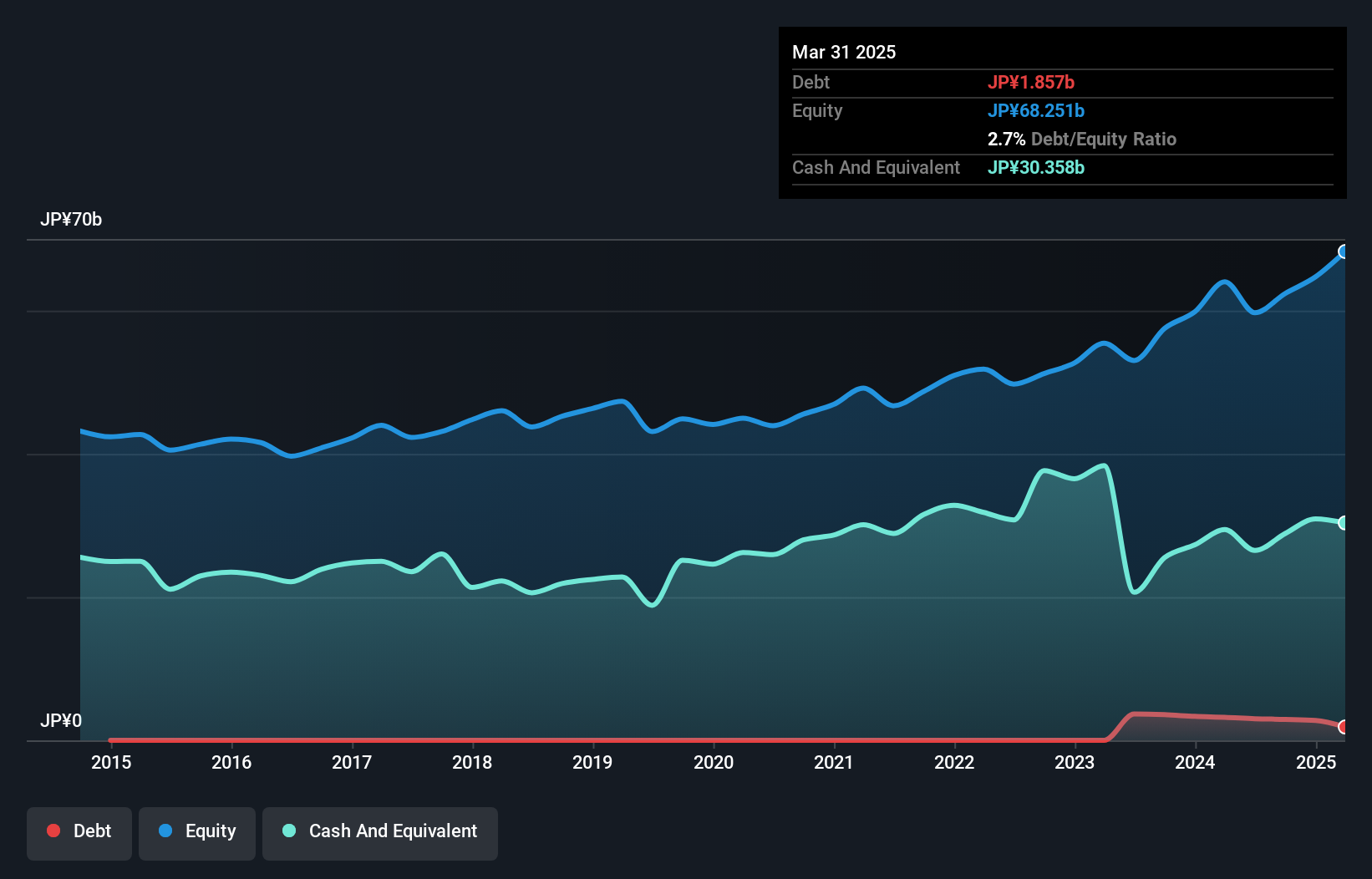

NSD's performance is noteworthy, with earnings growing 16% in the past year, outpacing the IT industry's 10.9%. The company boasts a solid financial footing, holding more cash than its total debt and covering interest payments comfortably. Over five years, its debt to equity ratio rose from 0% to 4.3%, indicating some leverage increase but still manageable given their strong cash position. Recently, NSD repurchased about 289,400 shares for ¥988.59 million as part of a buyback plan announced late last year. With high-quality earnings and positive free cash flow, NSD seems well-positioned for continued growth at an expected rate of 8.65% annually.

- Click to explore a detailed breakdown of our findings in NSD's health report.

Assess NSD's past performance with our detailed historical performance reports.

Key Takeaways

- Access the full spectrum of 4710 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688003

Suzhou TZTEK Technology

Engages in the design, development, assembly, and debugging of the industrial vision equipment in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives