Stock Analysis

- Japan

- /

- Entertainment

- /

- TSE:5032

High Growth Tech And 2 Other Exciting Opportunities In Innovation

Reviewed by Simply Wall St

In the current global market landscape, major stock indexes have shown mixed results with growth stocks significantly outperforming value stocks, particularly in sectors like consumer discretionary and information technology. This divergence underscores the importance of identifying high-growth opportunities within innovative sectors, where companies that can leverage technological advancements and adapt to changing economic conditions may offer compelling prospects for investors seeking dynamic growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Fujian Torch Electron Technology (SHSE:603678)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fujian Torch Electron Technology Co., Ltd. operates in the electronics industry with a market cap of CN¥14.94 billion.

Operations: The company focuses on the electronics sector, generating revenue primarily from its various electronic components and related products. It has been observed that the net profit margin shows a notable trend, indicating efficiency in managing costs relative to its revenue streams.

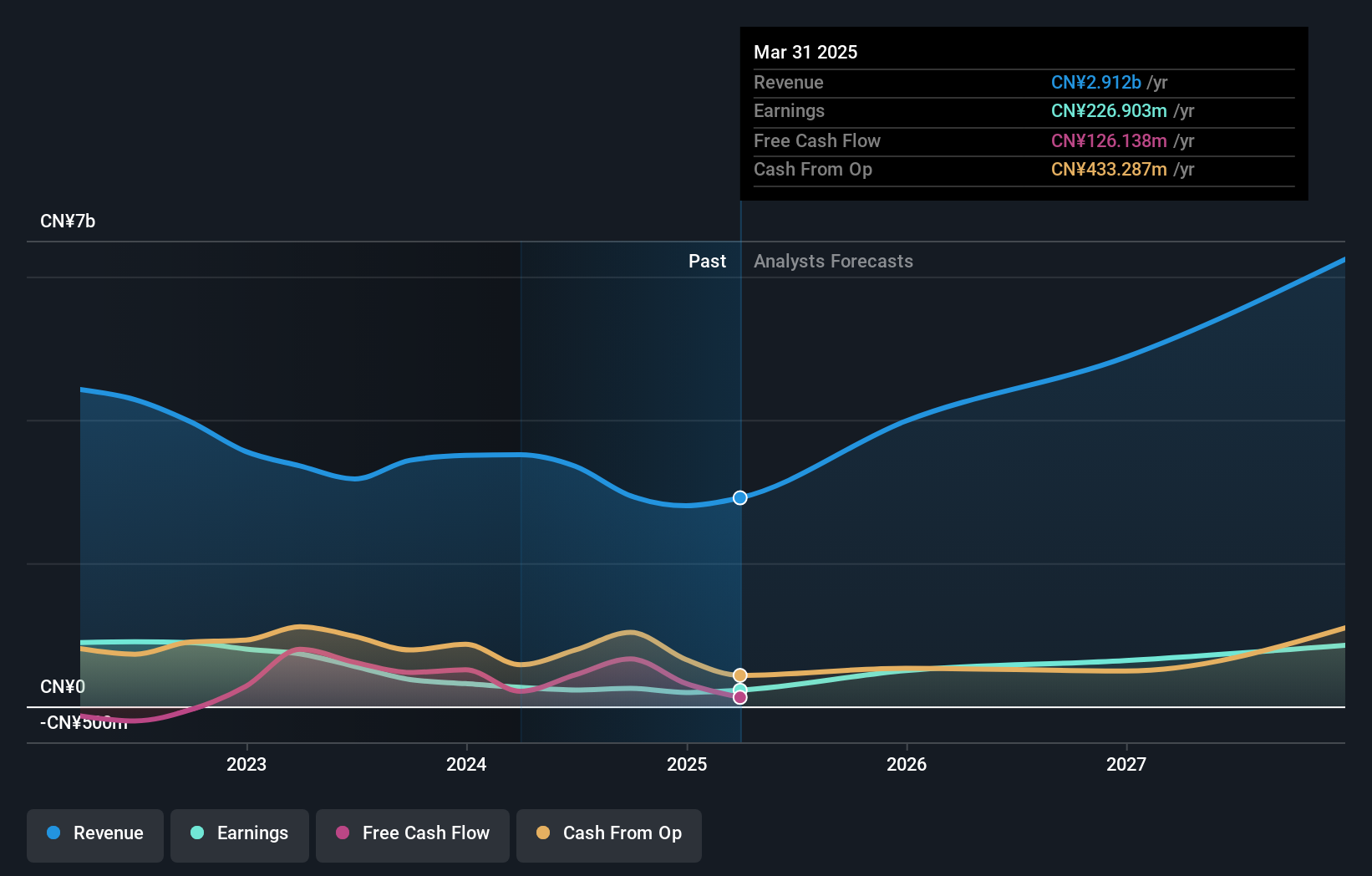

Fujian Torch Electron Technology, amidst a challenging fiscal year with a revenue drop to CNY 2.15 billion from CNY 2.71 billion, still shows promising growth prospects with expected annual earnings growth of 36.5%, outpacing the Chinese market's forecast of 25.9%. This potential is underpinned by an aggressive R&D investment strategy, crucial in maintaining its competitive edge in the fast-evolving tech landscape. Despite recent setbacks reflected in a net income decrease to CNY 225.96 million and lower EPS figures, the company's commitment to innovation and anticipated revenue growth of 21.9% annually could position it well for recovery and future expansion in its sector.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company that operates both in Japan and internationally, with a market cap of ¥145.93 billion.

Operations: ANYCOLOR Inc. generates revenue primarily through its entertainment ventures both domestically and internationally. The company focuses on leveraging its market presence to expand its audience reach and enhance content offerings.

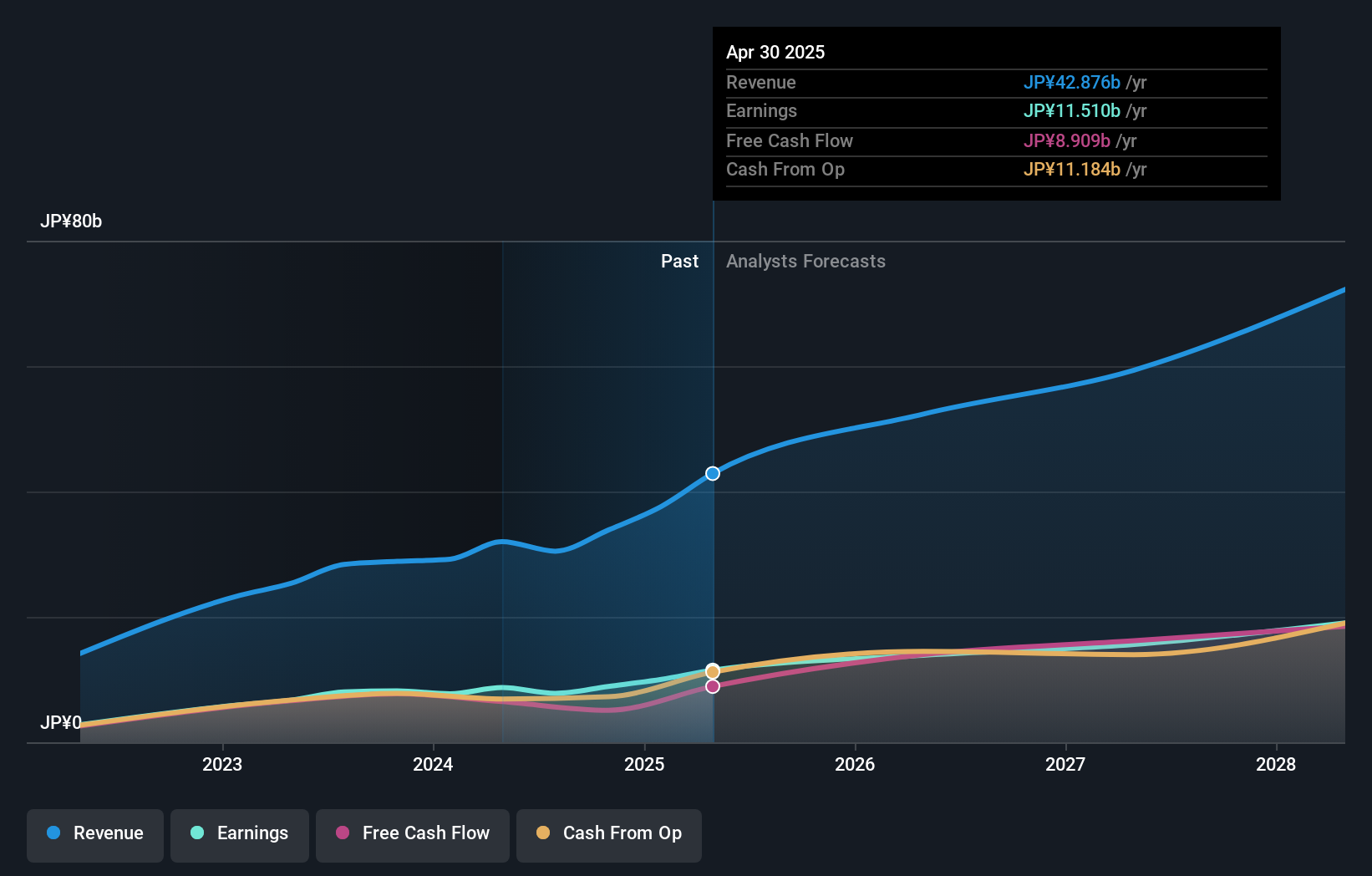

ANYCOLOR is navigating the competitive tech landscape with a strategic focus on R&D, investing 15.6% of its revenue into research initiatives, higher than many peers. This commitment has facilitated a robust projected annual revenue growth rate of 15%, outpacing the Japanese market's average of 4.1%. Despite a recent earnings dip by 2.8%, the firm's forward-looking strategies and strong forecasted earnings growth of 15.58% annually suggest potential resilience and adaptability in evolving markets, underlined by their latest earnings release which might reflect these dynamics moving into Q2, 2025.

- Click to explore a detailed breakdown of our findings in ANYCOLOR's health report.

Review our historical performance report to gain insights into ANYCOLOR's's past performance.

GMO internet group (TSE:9449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GMO Internet Group, Inc. offers a range of internet services globally and has a market capitalization of ¥296.61 billion.

Operations: The company's primary revenue comes from its Internet Infrastructure segment, generating ¥181.34 billion, followed by the Internet Finance Business at ¥46.14 billion. The Internet Advertising and Media Business contributes ¥34 billion to the overall revenue stream.

GMO Internet Group is capitalizing on the tech sector's rapid expansion, with its revenue projected to climb by 7.6% annually, outstripping Japan's market average of 4.1%. This growth is supported by a robust investment in R&D, where the company channels 16.2% of its revenue back into development efforts—indicative of its commitment to innovation and staying ahead in competitive markets. Additionally, GMO has actively repurchased shares worth ¥3.409 billion since February, enhancing shareholder value and reflecting confidence in its financial health and future prospects.

Turning Ideas Into Actions

- Delve into our full catalog of 1289 High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5032

ANYCOLOR

Operates as an entertainment company in Japan and internationally.