High Growth Tech Stocks In China Featuring EmbedWay Technologies (Shanghai) And Two More

Reviewed by Simply Wall St

As global markets react to the recent Fed rate cut, Chinese equities have shown resilience with notable gains in key indices despite mixed economic data. This article will explore three high-growth tech stocks in China, featuring EmbedWay Technologies (Shanghai) and two more, highlighting what makes a good stock in this dynamic sector amidst current market conditions.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 32.61% | 31.67% | ★★★★★★ |

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Zhongji Innolight | 32.38% | 31.76% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| T&S CommunicationsLtd | 34.68% | 39.62% | ★★★★★★ |

| Eoptolink Technology | 43.76% | 42.52% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 40.13% | 103.97% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market cap of CN¥7.02 billion.

Operations: The company generates revenue primarily from the manufacturing of computer, communication, and other electronic equipment, totaling CN¥1.09 billion. It focuses on providing network visibility infrastructure and intelligent system platforms in China.

EmbedWay Technologies has demonstrated robust growth, with a notable 72.2% increase in earnings over the past year and expectations of a 29.7% annual profit surge in the coming years. This performance surpasses broader industry trends, where earnings have generally dipped by 2%. The company's strategic focus on R&D is evident from its investment patterns, aligning with revenue growth forecasts at an impressive rate of 18.3% annually, outpacing the Chinese market's average of 13.1%. Recent inclusion in the S&P Global BMI Index underscores its rising prominence within tech sectors, further bolstered by substantial revenue doubling to CNY 635.89 million this half-year from last year’s CNY 318.87 million, showcasing strong operational execution and market acceptance.

SDIC Intelligence Xiamen Information (SZSE:300188)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SDIC Intelligence Xiamen Information Co., Ltd. (SZSE:300188) operates in the technology sector and has a market cap of CN¥10.21 billion.

Operations: SDIC Intelligence Xiamen Information Co., Ltd. generates revenue primarily from its technology-related operations. The company has a market cap of CN¥10.21 billion and focuses on innovative solutions within the tech industry.

SDIC Intelligence Xiamen Information is navigating a challenging landscape with a net loss reduction to CNY 127.59 million from CNY 278.15 million year-over-year, signaling potential stabilization. The firm's commitment to innovation is underscored by its R&D expenses, which are integral to its strategy despite current unprofitability. With revenue growth outpacing the Chinese market average at 21.7% annually, and earnings expected to surge by 64.1%, the company is positioning itself for a robust future in tech, contingent on maintaining this momentum and reversing current losses.

Jiangsu Hoperun Software (SZSE:300339)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Hoperun Software Co., Ltd. is a software company offering products, solutions, and services based on new generation information technology across various regions including China, Japan, Southeast Asia, North America, and internationally with a market cap of CN¥17.44 billion.

Operations: Hoperun Software focuses on providing innovative software products, solutions, and services utilizing new generation information technology. The company operates across multiple regions including China, Japan, Southeast Asia, and North America.

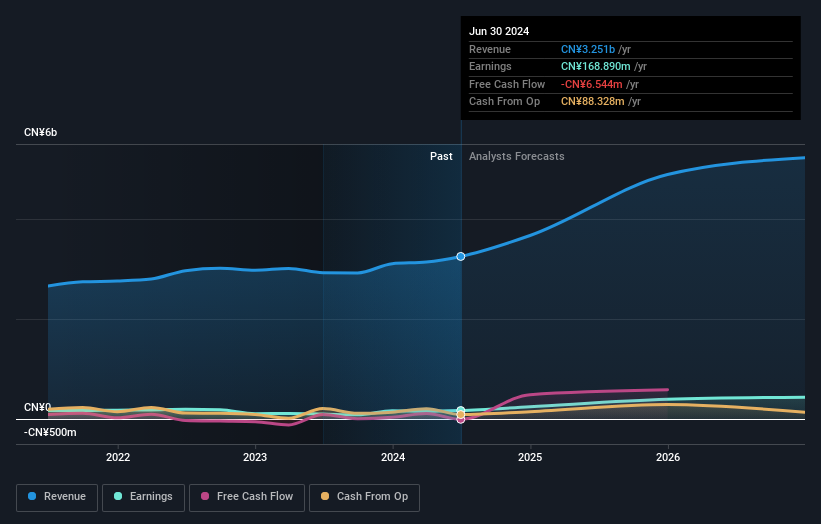

Jiangsu Hoperun Software's recent financial performance underscores its potential in China's high-growth tech sector, with a notable increase in sales from CNY 1.41 billion to CNY 1.56 billion and net income rising to CNY 84.76 million, up from last year’s CNY 79.67 million. The company is outpacing the market with a projected annual revenue growth rate of 20.1% and earnings expected to surge by 36.7% annually, positioning it well above the industry average growth rate of 13.1%. This robust expansion is supported by substantial R&D investments integral to fostering innovation and maintaining competitive edge in software development amidst evolving technological landscapes.

Key Takeaways

- Dive into all 259 of the Chinese High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300339

Jiangsu Hoperun Software

Operates as a software company that provides products, solutions, and services based on new generation information technology in China, Japan, Southeast Asia, North America, and internationally.

High growth potential with excellent balance sheet.