Stock Analysis

- China

- /

- Communications

- /

- SZSE:300098

High Growth Tech Stocks in China for September 2024

Reviewed by Simply Wall St

In recent weeks, Chinese equities have retreated as investors digested weak corporate earnings and economic data, with the Shanghai Composite Index declining by 2.69%. Despite these challenges, identifying high-growth tech stocks in China can offer promising opportunities for those looking to navigate the current market conditions effectively.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 33.08% | 31.98% | ★★★★★★ |

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Zhongji Innolight | 32.00% | 31.24% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.63% | 28.58% | ★★★★★★ |

| Eoptolink Technology | 40.92% | 36.51% | ★★★★★★ |

| Wanma Technology | 35.58% | 47.75% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 40.72% | 99.87% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Ningbo Yongxin OpticsLtd (SHSE:603297)

Simply Wall St Growth Rating: ★★★★★☆

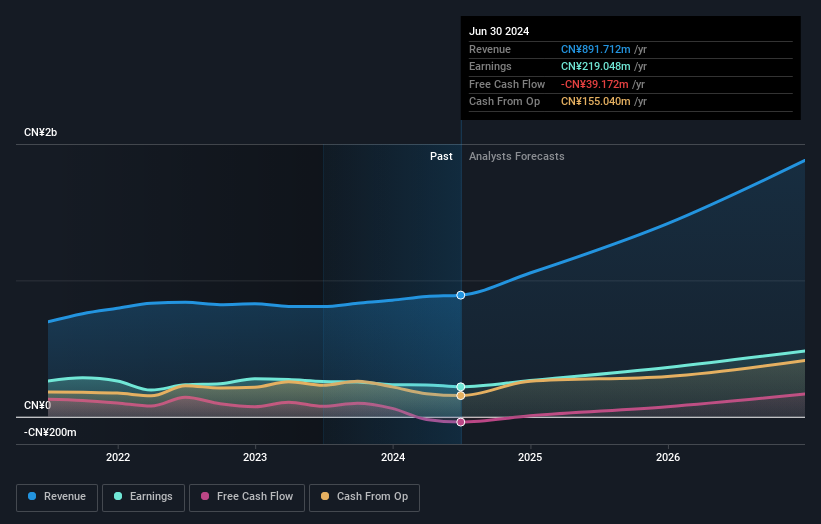

Overview: Ningbo Yongxin Optics Co., Ltd. manufactures and sells precision optical instruments and components in China, with a market cap of CN¥6.18 billion.

Operations: The company generates revenue primarily from the manufacturing of optical products, amounting to CN¥881.87 million. Its business focuses on precision optical instruments and components within China.

Ningbo Yongxin Optics Ltd. is poised for significant revenue growth, with forecasts indicating a 27.6% annual increase, outpacing the broader Chinese market's 13.2%. Despite a challenging past year with earnings contracting by 14.3%, future projections are optimistic with expected earnings growth of 27% annually over the next three years. The company's commitment to innovation is evident in its R&D expenditure, which supports advancements in optics technology crucial for its high-profile clients and industry standing.

Hangzhou Arcvideo Technology (SHSE:688039)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Arcvideo Technology Co., Ltd. offers smart and secure video solutions and video cloud services for media platforms, with a market cap of CN¥2.46 billion.

Operations: Arcvideo Technology specializes in providing advanced video solutions and cloud services tailored for media platforms. The company generates its revenue primarily through these specialized services, contributing to its market cap of CN¥2.46 billion.

Hangzhou Arcvideo Technology, a prominent player in China's high-growth tech sector, reported a 24.6% annual revenue increase, significantly outpacing the broader Chinese market's 13.2%. Despite current unprofitability and a net loss of ¥41.78 million for H1 2024, earnings are forecasted to grow by an impressive 105% annually over the next three years. The company’s substantial R&D investments underscore its commitment to innovation in AI and software solutions, positioning it for future profitability and market leadership within the industry.

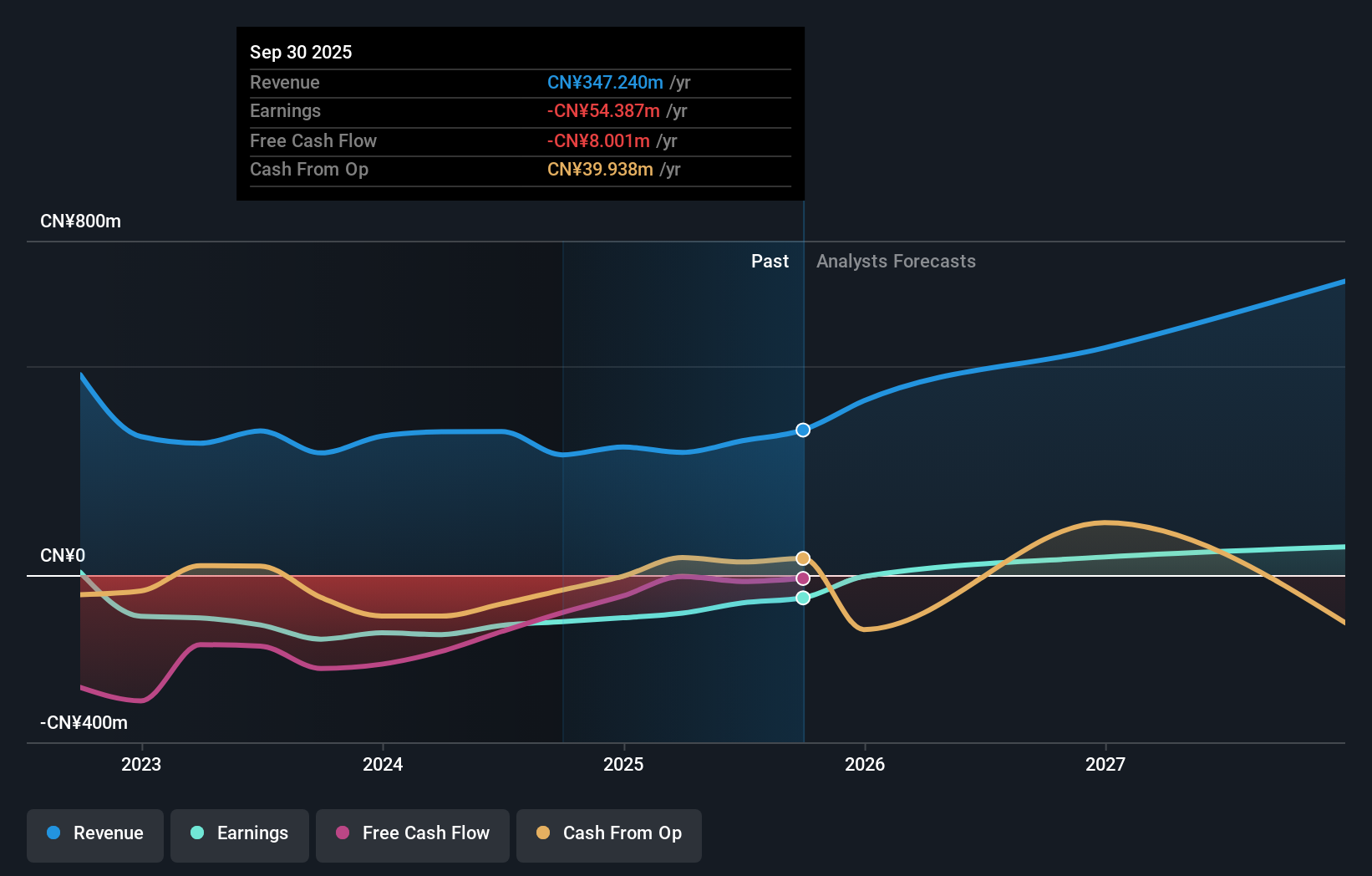

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gosuncn Technology Group Co., Ltd. provides IoT products and services in China, with a market cap of CN¥6.90 billion.

Operations: Gosuncn Technology Group focuses on IoT products and services within China. The company's revenue streams are primarily derived from its IoT offerings, with a notable gross profit margin of 36.5%.

Gosuncn Technology Group, a significant player in the tech sector, reported a 77.04% annual earnings growth forecast and expects revenue to grow at 14.2% per year, outpacing the broader Chinese market's 13.2%. Despite a net loss of ¥4.51 million for H1 2024, this is an improvement from the previous year's ¥48.03 million loss. The company has repurchased 3,395,300 shares for ¥15.4 million under its buyback program announced in October 2023, demonstrating confidence in its future prospects.

- Delve into the full analysis health report here for a deeper understanding of Gosuncn Technology Group.

Gain insights into Gosuncn Technology Group's past trends and performance with our Past report.

Key Takeaways

- Dive into all 256 of the Chinese High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300098

Gosuncn Technology Group

Provides IoT products and services in China.