As Chinese equities experience a modest rise following the Federal Reserve's recent rate cut, the market sentiment appears cautiously optimistic despite some disappointing economic data. With industrial production and retail sales showing slower growth, investors are keenly observing opportunities in smaller-cap stocks that may offer untapped potential. In this environment, identifying good stocks often means looking for companies with strong fundamentals and growth prospects that can weather economic fluctuations. Here are three undiscovered gems in China that could be worth your attention this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Beijing Haohan Data TechnologyLtd | NA | 9.77% | 18.88% | ★★★★★★ |

| Hangzhou Fortune Gas Cryogenic Group | 8.86% | 3.45% | 14.40% | ★★★★★★ |

| ShenZhen QiangRui Precision Technology | 2.29% | 24.35% | -0.93% | ★★★★★★ |

| Hefei Lifeon Pharmaceutical | 4.31% | -9.09% | 14.85% | ★★★★★★ |

| Kangping Technology (Suzhou) | 26.12% | -7.88% | -2.37% | ★★★★★☆ |

| Guangdong Delian Group | 29.25% | 8.50% | -28.27% | ★★★★★☆ |

| Zhejiang Chinastars New Materials Group | 43.19% | -3.60% | 2.29% | ★★★★★☆ |

| Chengdu Tangyuan ElectricLtd | 2.81% | 20.66% | 9.04% | ★★★★★☆ |

| Ningbo Kangqiang Electronics | 50.87% | 5.32% | -0.38% | ★★★★★☆ |

| Shanghai Ace Investment&DevelopmentLtd | 43.95% | 10.89% | 23.28% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Eastern CommunicationsLtd (SHSE:600776)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastern Communications Co., Ltd. operates in the enterprise network and information security businesses, with a market cap of CN¥10.56 billion.

Operations: Eastern Communications Co., Ltd. generates its revenue primarily from the enterprise network and information security sectors, contributing significantly to its financial performance. The company has a market cap of CN¥10.56 billion, reflecting its position in the industry.

Eastern Communications Ltd. has demonstrated resilience despite a challenging year, with earnings growth at -4.2%, lagging behind the industry average of -2%. The company reported half-year sales of ¥1.31 billion, up from ¥1.26 billion last year, and net income rose to ¥88.33 million from ¥70.93 million previously. Basic earnings per share increased to ¥0.07 from ¥0.06 a year ago, reflecting steady performance amidst market pressures and highlighting its potential as an undiscovered gem in China’s communications sector.

Zhejiang Liju Thermal Equipment (SHSE:603391)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Liju Thermal Equipment Co., Ltd. (SHSE:603391) specializes in the production and sale of thermal equipment, with a market cap of CN¥3.30 billion.

Operations: The company generates revenue through the production and sale of thermal equipment. It has a market cap of CN¥3.30 billion.

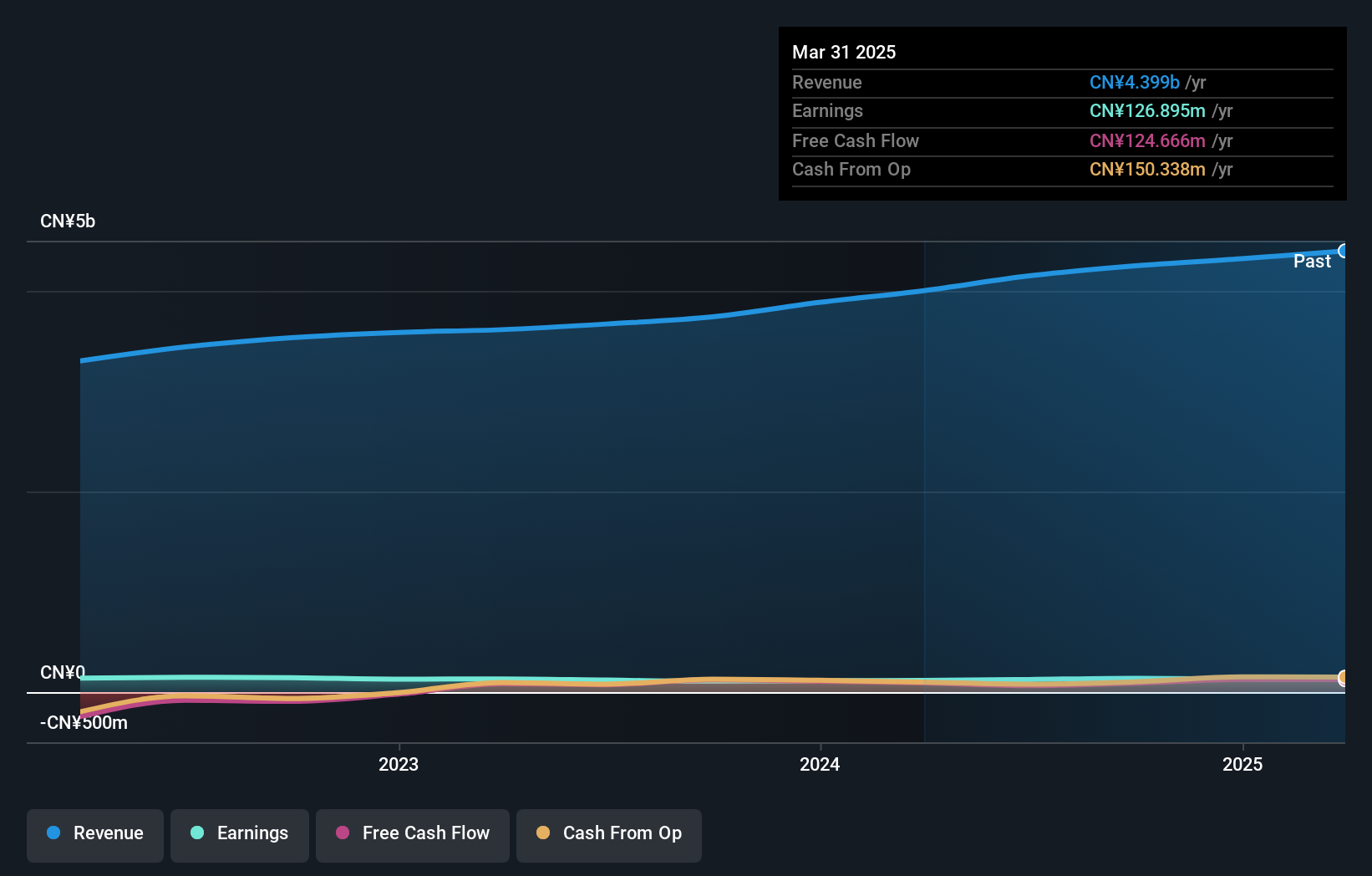

Zhejiang Liju Thermal Equipment has shown impressive growth, with earnings increasing by 33.6% over the past year, outpacing the Machinery industry’s -2.9%. The company reported half-year sales of CNY 457.32 million and net income of CNY 78.03 million, up from CNY 406.19 million and CNY 58.55 million respectively a year ago. Trading at nearly half its estimated fair value suggests potential upside for investors looking for undervalued opportunities in China’s industrial sector.

Shenzhen Farben Information TechnologyLtd (SZSE:300925)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Farben Information Technology Co., Ltd. (SZSE:300925) is a company engaged in the development and distribution of information technology solutions, with a market cap of CN¥7.73 billion.

Operations: Farben generates revenue primarily through the sale of information technology solutions. The company has a market capitalization of CN¥7.73 billion.

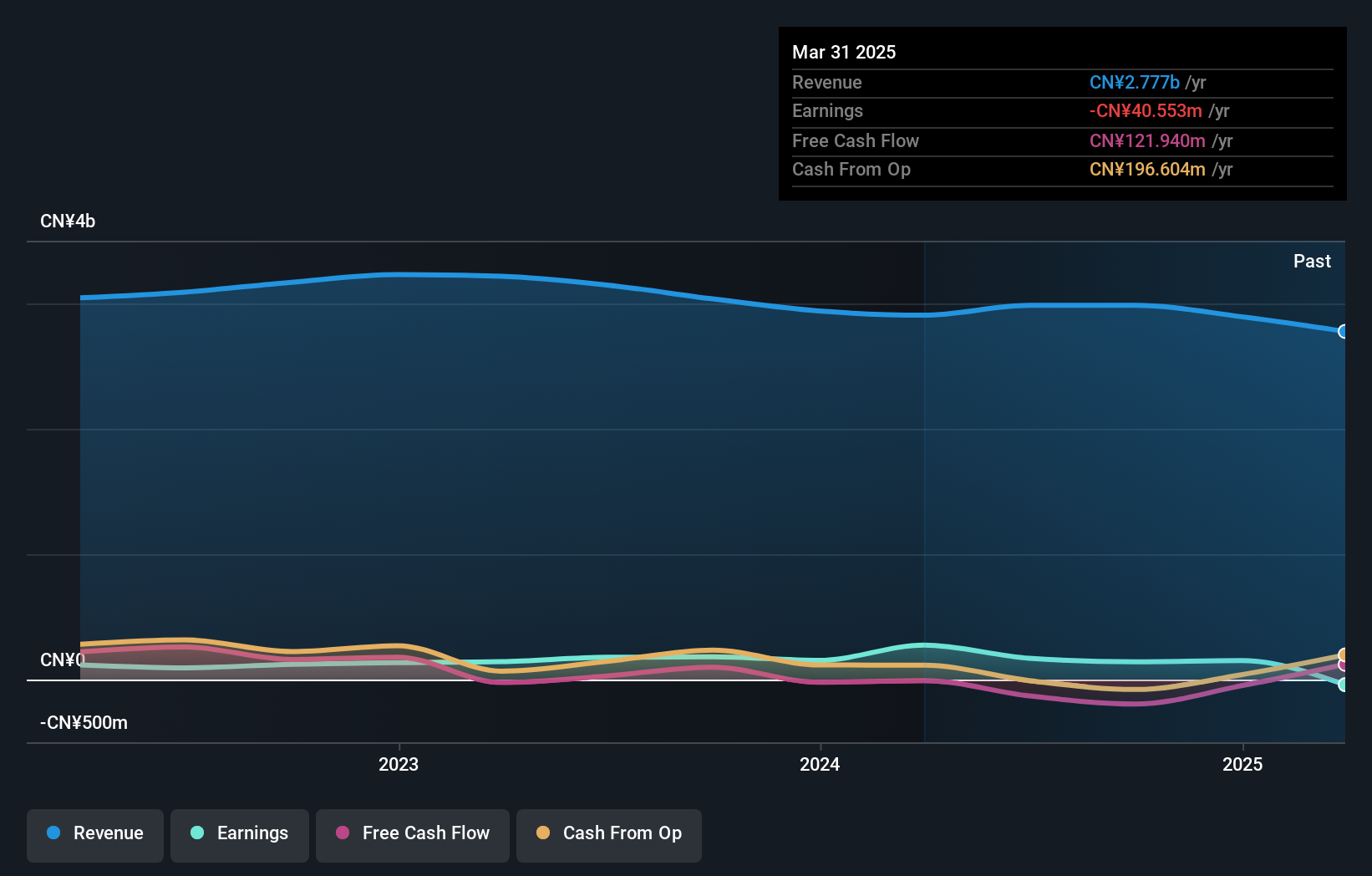

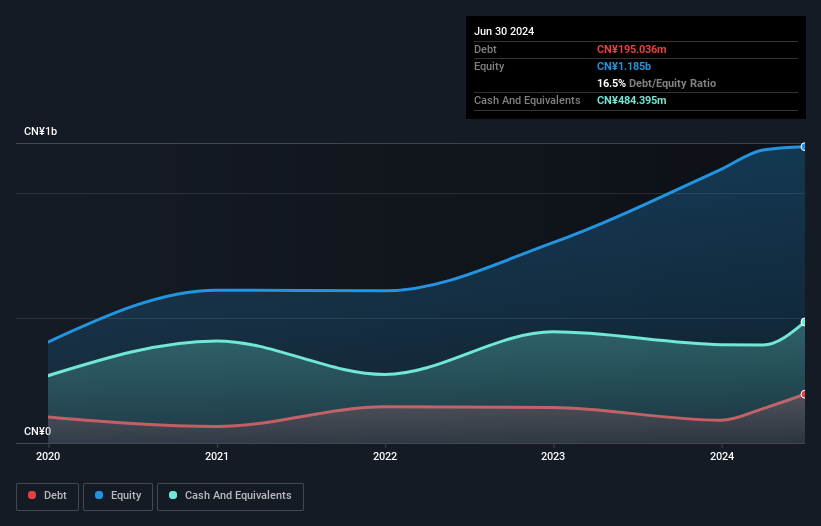

Shenzhen Farben Information Technology Ltd. has seen its debt to equity ratio improve from 12.7% to 6.8% over five years, showcasing better financial health. Recent earnings growth of 4.9% outpaced the IT industry's -11.5%, reflecting robust performance amid sector challenges. The company reported half-year sales of CNY 2,085 million and net income of CNY 74 million, both up from last year’s figures, indicating consistent revenue and profit growth despite a volatile share price recently observed in the market.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Farben Information TechnologyLtd.

Learn about Shenzhen Farben Information TechnologyLtd's historical performance.

Where To Now?

- Take a closer look at our Chinese Undiscovered Gems With Strong Fundamentals list of 930 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300925

Shenzhen Farben Information TechnologyLtd

Shenzhen Farben Information Technology Co.,Ltd.

Flawless balance sheet with proven track record.