- China

- /

- Electronic Equipment and Components

- /

- SHSE:600751

The five-year underlying earnings growth at HNA TechnologyLtd (SHSE:600751) is promising, but the shareholders are still in the red over that time

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term HNA Technology Co.,Ltd. (SHSE:600751) shareholders for doubting their decision to hold, with the stock down 34% over a half decade. The last week also saw the share price slip down another 5.6%. However, this move may have been influenced by the broader market, which fell 3.6% in that time.

Since HNA TechnologyLtd has shed CN¥377m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for HNA TechnologyLtd

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

HNA TechnologyLtd became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

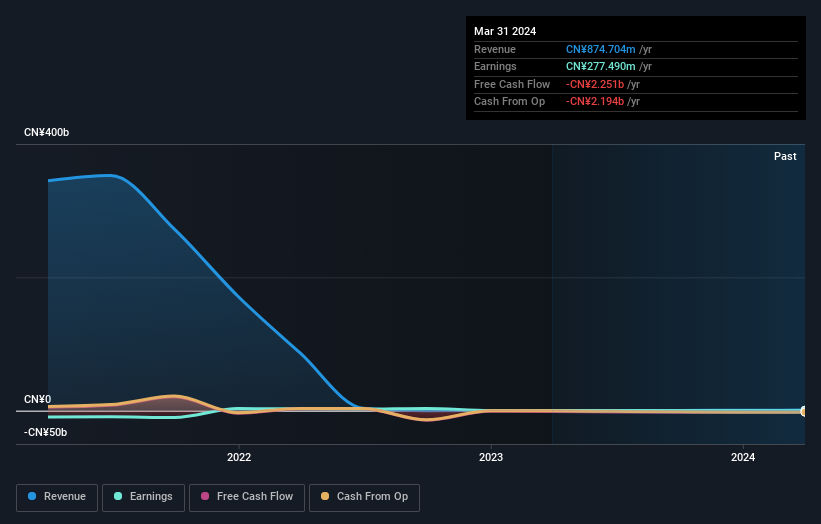

Arguably, the revenue drop of 51% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at HNA TechnologyLtd's financial health with this free report on its balance sheet.

A Different Perspective

While it's certainly disappointing to see that HNA TechnologyLtd shares lost 6.8% throughout the year, that wasn't as bad as the market loss of 14%. What is more upsetting is the 6% per annum loss investors have suffered over the last half decade. While the losses are slowing we doubt many shareholders are happy with the stock. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for HNA TechnologyLtd (1 makes us a bit uncomfortable) that you should be aware of.

Of course HNA TechnologyLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HNA TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600751

HNA TechnologyLtd

Through its subsidiaries, engages in electronic product distribution and shipping businesses in China and internationally.

Flawless balance sheet with acceptable track record.