- China

- /

- Electronic Equipment and Components

- /

- SHSE:600745

Wingtech TechnologyLtd (SHSE:600745) stock falls 4.4% in past week as three-year earnings and shareholder returns continue downward trend

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of Wingtech Technology Co.,Ltd (SHSE:600745) have had an unfortunate run in the last three years. Unfortunately, they have held through a 69% decline in the share price in that time. And more recent buyers are having a tough time too, with a drop of 39% in the last year. Furthermore, it's down 27% in about a quarter. That's not much fun for holders.

With the stock having lost 4.4% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Wingtech TechnologyLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

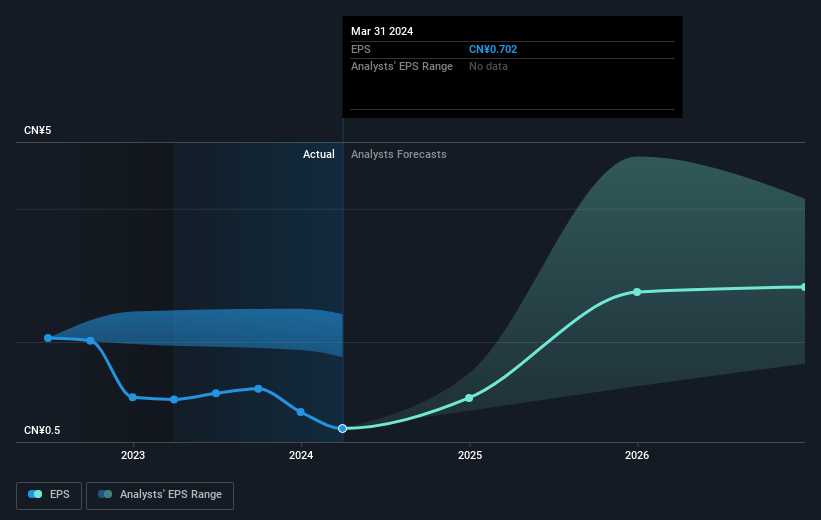

Wingtech TechnologyLtd saw its EPS decline at a compound rate of 30% per year, over the last three years. This change in EPS is reasonably close to the 32% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Wingtech TechnologyLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 10% in the twelve months, Wingtech TechnologyLtd shareholders did even worse, losing 39% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Wingtech TechnologyLtd , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wingtech TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600745

Wingtech TechnologyLtd

Engages in the research and development and manufacturing of intelligent terminal products in the fields of consumption, industry, and automobiles.

Flawless balance sheet with moderate growth potential.