- China

- /

- Electronic Equipment and Components

- /

- SHSE:688205

Revealing Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets continue to reach new heights, with the Russell 2000 Index hitting record levels, small-cap stocks are drawing increased attention amid a backdrop of robust consumer spending and geopolitical developments. In this dynamic environment, identifying promising opportunities requires a focus on companies that demonstrate resilience and potential for growth despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. specializes in the development and manufacturing of optoelectronic devices, with a market capitalization of CN¥8.47 billion.

Operations: Wuxi Taclink Optoelectronics Technology generates revenue primarily through its optoelectronic device offerings. The company has a market capitalization of CN¥8.47 billion.

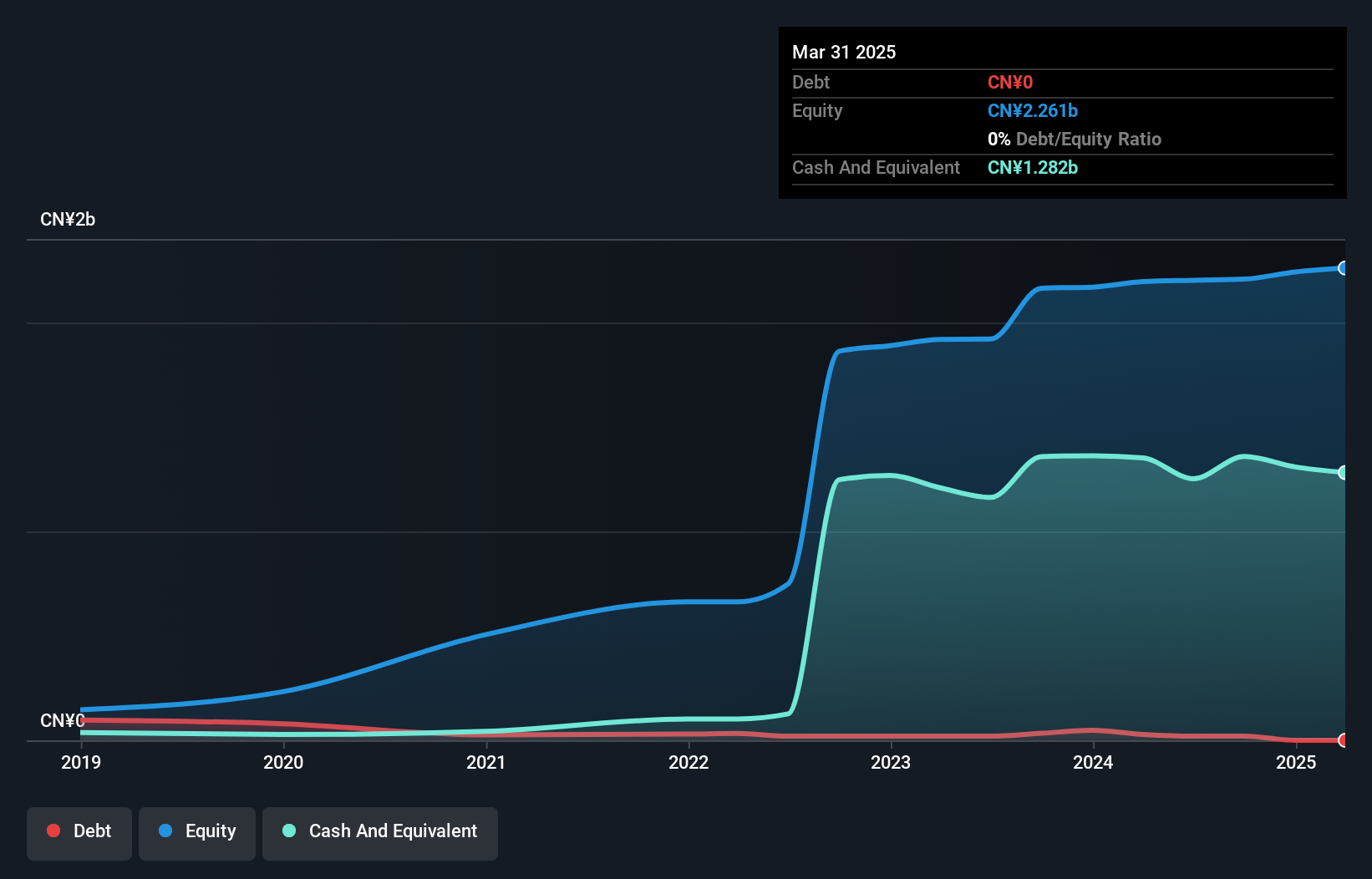

Wuxi Taclink Optoelectronics Technology, a nimble player in the electronics sector, has shown promising growth. Over the past year, earnings surged by 19%, outpacing the industry average of 1.8%. The company reported sales of CNY 600.68 million for nine months ending September 2024, up from CNY 548.8 million in the previous year, with net income rising to CNY 76.29 million from CNY 66.32 million. Despite recent share price volatility, its reduced debt-to-equity ratio from 39.8% to a mere 0.9% over five years highlights financial prudence and positions it well for future growth opportunities within its niche market segment.

- Click here and access our complete health analysis report to understand the dynamics of Wuxi Taclink Optoelectronics Technology.

Learn about Wuxi Taclink Optoelectronics Technology's historical performance.

Beijing UniStrong Science&TechnologyLtd (SZSE:002383)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing UniStrong Science & Technology Ltd, with a market cap of CN¥7.61 billion, specializes in providing satellite navigation products and services.

Operations: UniStrong generates revenue primarily from its Satellite Navigation System segment, which reported CN¥1.34 billion. The company's gross profit margin is 36.5%.

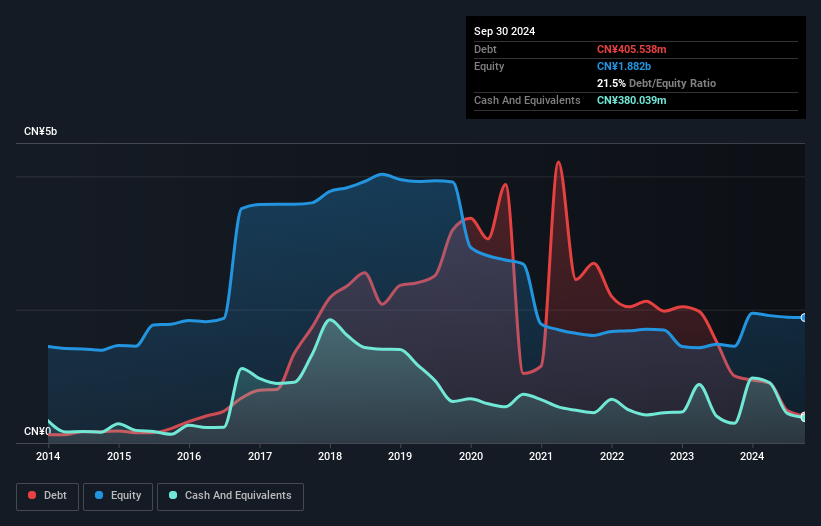

UniStrong, a tech player in the communications sector, has shown notable financial shifts recently. With a price-to-earnings ratio of 18.3x, it's positioned below the broader CN market's 36.3x, suggesting potential value for investors. The company's net debt to equity ratio stands at a satisfactory 1.4%, having reduced from 81.7% over five years, indicating effective debt management despite reporting a net loss of CNY 63.73 million for the first nine months of this year compared to CNY 2.66 million last year, reflecting challenges in profitability amidst industry volatility and high non-cash earnings levels contributing to its financial profile stability.

- Click to explore a detailed breakdown of our findings in Beijing UniStrong Science&TechnologyLtd's health report.

Understand Beijing UniStrong Science&TechnologyLtd's track record by examining our Past report.

Shanghai Wisdom Information Technology (SZSE:301315)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Wisdom Information Technology Co., Ltd. operates in the technology sector, focusing on providing advanced information solutions and services, with a market cap of CN¥5.14 billion.

Operations: Shanghai Wisdom Information Technology generates revenue primarily through its advanced information solutions and services. The company's financial data does not provide a detailed breakdown of revenue segments or cost structures.

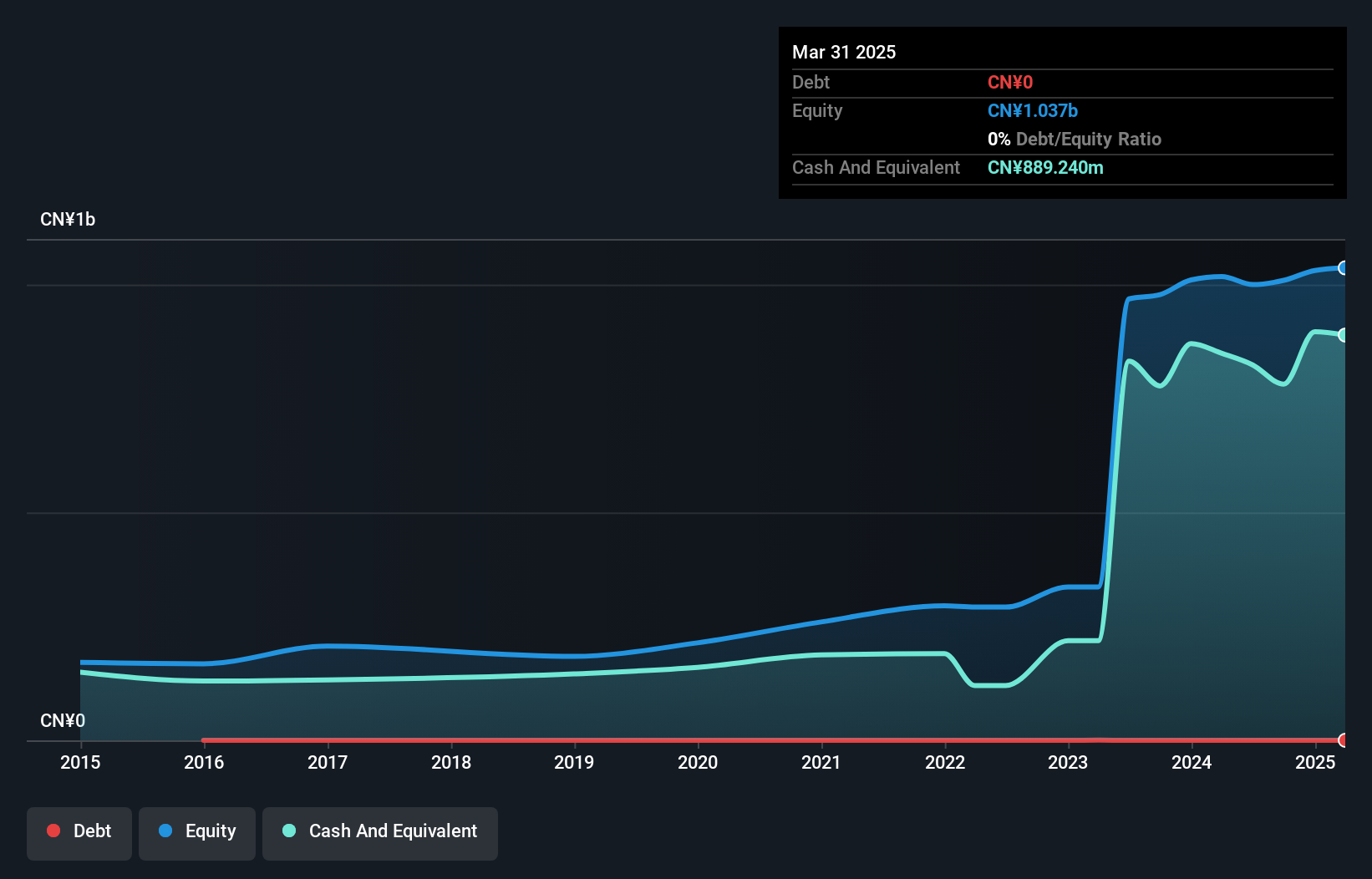

Shanghai Wisdom Information Technology, a nimble player in the IT sector, showcases a robust financial profile with debt-free operations and high-quality non-cash earnings. Despite its small size, it achieved a commendable 10.9% earnings growth over the past year, outpacing the industry average of -8.1%. However, recent volatility in its share price suggests some market uncertainty. The company's latest earnings report for nine months ending September 2024 indicates net income of CNY 29.97 million on sales of CNY 179.63 million, reflecting resilience amidst challenges as it was added to the S&P Global BMI Index recently.

Taking Advantage

- Access the full spectrum of 4637 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Taclink Optoelectronics Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688205

Wuxi Taclink Optoelectronics Technology

Wuxi Taclink Optoelectronics Technology Co., Ltd.

Flawless balance sheet with high growth potential.