In an exceptionally busy week for global markets, major indices like the Nasdaq Composite and S&P MidCap 400 reached record highs before experiencing a sharp pullback, with growth stocks generally underperforming their value counterparts. Despite this volatility, small-cap stocks have shown resilience compared to large-caps, highlighting the importance of identifying high-growth potential in technology companies that can navigate such fluctuating market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.43% | 41.52% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Chengdu Olymvax Biopharmaceuticals (SHSE:688319)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Olymvax Biopharmaceuticals Inc. focuses on the research, development, production, and sale of human vaccines with a market capitalization of CN¥4.37 billion.

Operations: Olymvax Biopharmaceuticals specializes in developing and commercializing human vaccines. The company generates revenue through the sale of these vaccines, with a focus on research and production activities.

Chengdu Olymvax Biopharmaceuticals, amidst a challenging fiscal year, reported a notable revenue upswing to CNY 386.65 million, marking an increase from the previous year's CNY 352.3 million. Despite this growth, net income significantly dropped to CNY 4.03 million from CNY 30.28 million as R&D expenses surged, reflecting the company's strategic emphasis on innovation in biotechnology—a sector where research intensity often preludes profitability. The firm's commitment is evident in its R&D spending trends which align with its forecasted earnings growth of an impressive 76.1% annually over the next three years, positioning it potentially ahead of many peers in biotech innovation and market readiness.

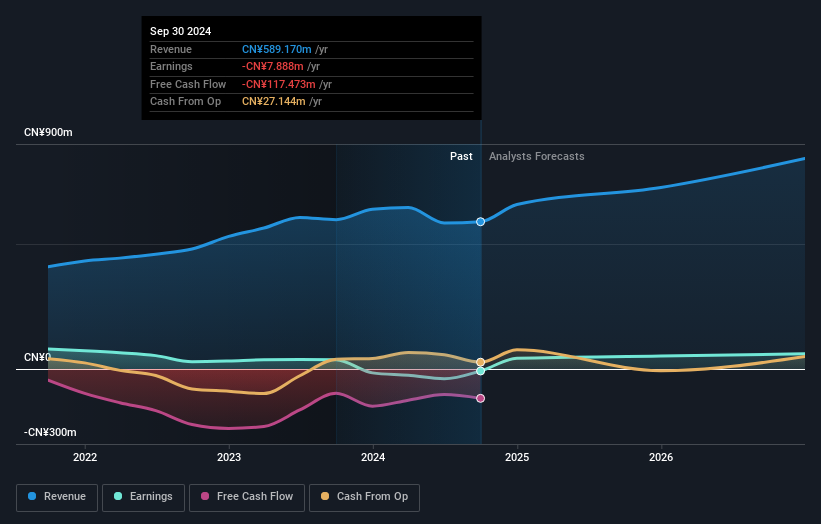

Dnake (Xiamen) Intelligent Technology (SZSE:300884)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dnake (Xiamen) Intelligent Technology Co., Ltd. operates in the field of intelligent technology solutions, with a market capitalization of CN¥2.75 billion.

Operations: The company focuses on providing intelligent technology solutions. Its revenue streams are primarily derived from various technology-related products and services, contributing to its overall market presence.

Dnake (Xiamen) Intelligent Technology has navigated a challenging year with a revenue dip to CNY 519.14 million from last year's CNY 624.21 million, reflecting broader market conditions. Despite this, the firm's commitment to innovation is clear with substantial R&D investments aimed at future growth; however, net income fell to CNY 17.56 million from CNY 66.67 million previously. The company also actively repurchased shares worth CNY 43.18 million, underscoring confidence in its strategic direction amidst financial volatilities and a competitive tech landscape marked by rapid changes and evolving consumer demands.

- Take a closer look at Dnake (Xiamen) Intelligent Technology's potential here in our health report.

Learn about Dnake (Xiamen) Intelligent Technology's historical performance.

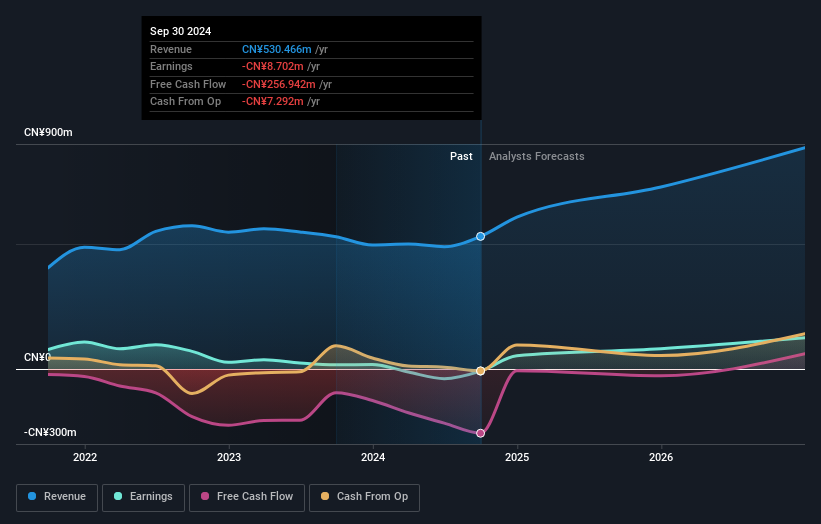

Wuhan Kotei InformaticsLtd (SZSE:301221)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuhan Kotei Informatics Co., Ltd. focuses on delivering integrated software solutions for intelligent networked vehicles in China, with a market capitalization of approximately CN¥4.69 billion.

Operations: The company generates revenue primarily through its Software & Programming segment, which accounts for CN¥584.11 million. This focus on software solutions for intelligent networked vehicles highlights its specialization within the automotive technology industry.

Wuhan Kotei Informatics has demonstrated resilience with a notable turnaround in net income to CNY 10.96 million from CNY 3.38 million year-over-year, despite a revenue drop to CNY 341.76 million from CNY 391.38 million in the same period. This improvement aligns with their strategic inclusion in the S&P Global BMI Index, reflecting broader market recognition. The company's commitment to growth is further evidenced by an aggressive R&D focus, crucial for maintaining competitive edge in the swiftly evolving tech landscape where innovations lead market trends.

Taking Advantage

- Explore the 1287 names from our High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Kotei InformaticsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301221

Wuhan Kotei InformaticsLtd

Provides integrated software solutions for intelligent networked vehicles in China.

Excellent balance sheet with reasonable growth potential.