In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with major indices like the S&P 500 and Russell 2000 showing notable gains as investors anticipate potential policy changes that could impact growth and taxation. Amidst these developments, evaluating high-growth tech stocks requires careful consideration of their potential to capitalize on economic conditions such as regulatory adjustments and fiscal policies that may influence corporate earnings growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1278 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Taiji Computer (SZSE:002368)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiji Computer Corporation Limited operates as a software and information technology service company with a market capitalization of CN¥19.78 billion.

Operations: The company generates revenue primarily through its software and information technology services. It operates within a market valued at CN¥19.78 billion, focusing on delivering IT solutions across various sectors.

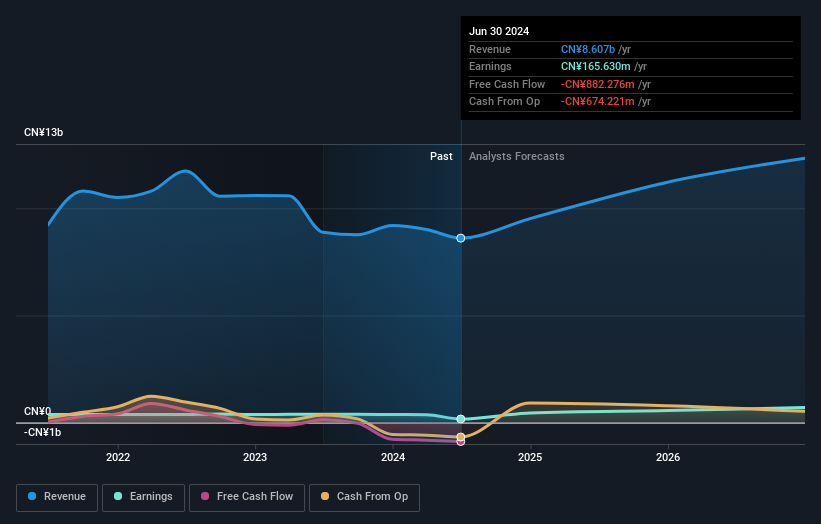

Taiji Computer has demonstrated a robust forecast in revenue and earnings growth, outpacing its domestic market with expected increases of 15.8% and 37.5% per year, respectively, compared to the broader Chinese market's projections of 13.9% and 26.2%. Despite recent struggles marked by a significant net loss of CN¥28.28 million for the nine months ending September 2024, these challenges are juxtaposed against its aggressive R&D spending aimed at innovation—reflecting a commitment to reclaiming its competitive edge in the tech sector. This strategic focus on development is crucial as it navigates recovery amidst fluctuating financial performance highlighted by one-off gains that previously skewed earnings reports. The company's dedication to research has not waned; instead, Taiji Computer continues investing heavily in R&D which constituted a substantial portion of their expenses—evidence of their resolve to foster long-term growth through technological advancements rather than short-term gains. As they streamline operations and enhance product offerings, these investments are pivotal for staying relevant in an ever-evolving industry where technological leadership is paramount for success.

- Click here to discover the nuances of Taiji Computer with our detailed analytical health report.

Gain insights into Taiji Computer's past trends and performance with our Past report.

Fujian Boss Software (SZSE:300525)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Boss Software Corp. offers software products and services in China, with a market capitalization of CN¥14.72 billion.

Operations: The company generates revenue primarily through its software products and services in China. It holds a market capitalization of CN¥14.72 billion, indicating significant scale in the industry.

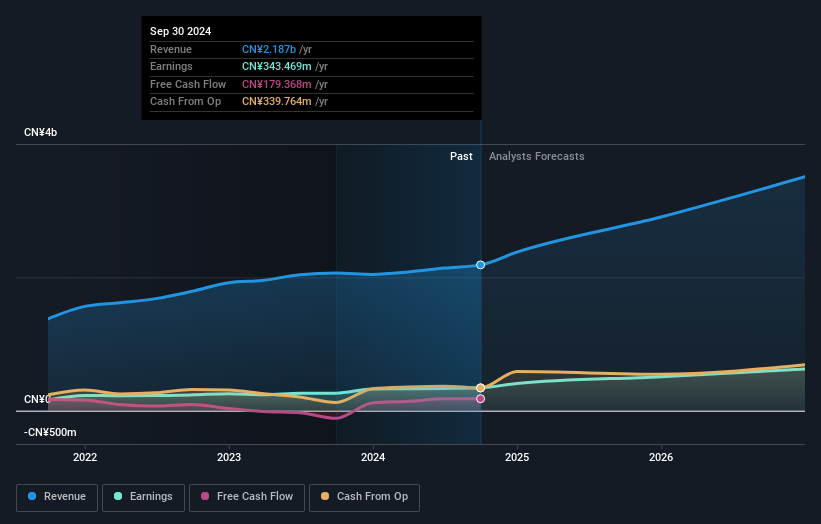

Fujian Boss Software has shown notable financial performance, with revenues climbing to CN¥1.24 billion, a substantial increase from the previous year's CN¥1.10 billion. This growth is complemented by a significant rise in net income to CN¥34.89 million from CN¥18.08 million, reflecting effective operational enhancements and market adaptability. The company's commitment to innovation is evident in its R&D spending, which remains a pivotal aspect of its strategy despite broader economic fluctuations. Moreover, Fujian Boss has actively engaged in share repurchases, completing the buyback of 6,817,900 shares for CN¥77.36 million recently, underscoring confidence in its financial health and future prospects.

- Navigate through the intricacies of Fujian Boss Software with our comprehensive health report here.

Explore historical data to track Fujian Boss Software's performance over time in our Past section.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

Overview: Asia Vital Components Co., Ltd. is a company that specializes in providing thermal solutions on a global scale, with a market capitalization of NT$263.33 billion.

Operations: The company generates revenue primarily through its Overseas Operating Department, which contributes NT$66.65 billion, and its Integrated Management Division, contributing NT$48.87 billion. The focus on thermal solutions positions it as a key player in the global market for these products.

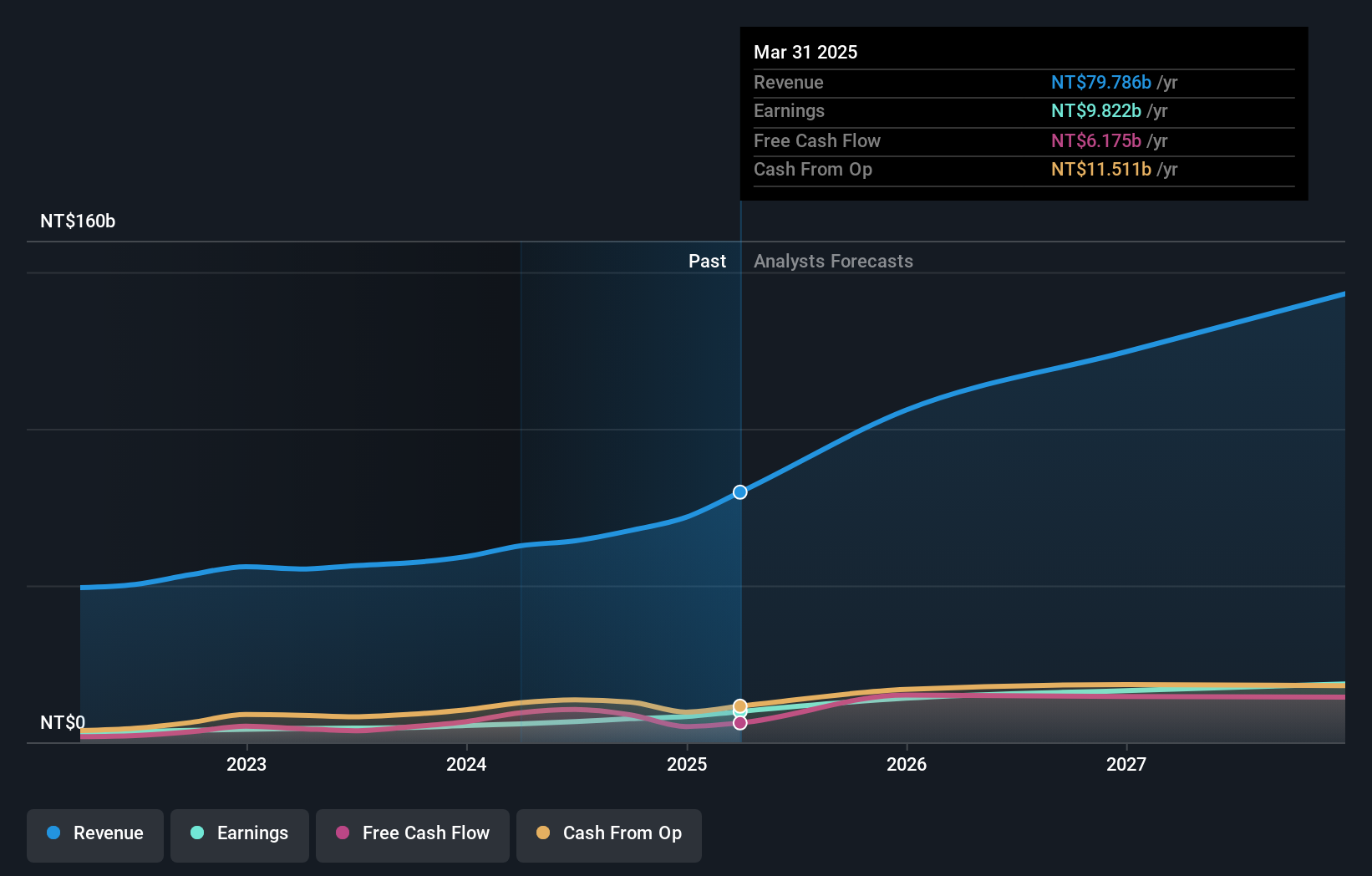

Asia Vital Components has recently secured a significant syndicated loan of $150 million, aiming to enhance its financial stability and support working capital. This move underscores the company's proactive approach in managing its finances amid expanding operations. With an impressive revenue growth forecast at 23.9% annually, AVC is outpacing the TW market average of 12.7%. Additionally, their earnings are expected to surge by 30.34% per year, reflecting robust operational efficiency and market positioning. The firm's dedication to innovation is evident from its R&D expenditure trends which align with its strategic goals for maintaining competitive advantage in the tech sector.

- Get an in-depth perspective on Asia Vital Components' performance by reading our health report here.

Where To Now?

- Take a closer look at our High Growth Tech and AI Stocks list of 1278 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiji Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002368

Taiji Computer

Operates as a software and information technology service company.

Reasonable growth potential with adequate balance sheet.