Investors three-year losses continue as Sangfor Technologies (SZSE:300454) dips a further 6.2% this week, earnings continue to decline

It is a pleasure to report that the Sangfor Technologies Inc. (SZSE:300454) is up 38% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Indeed, the share price is down a tragic 68% in the last three years. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

If the past week is anything to go by, investor sentiment for Sangfor Technologies isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Sangfor Technologies

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

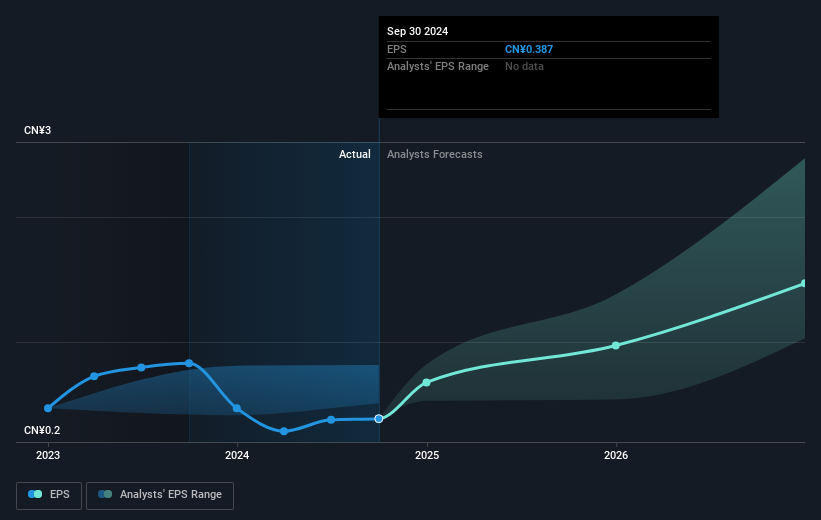

During the three years that the share price fell, Sangfor Technologies' earnings per share (EPS) dropped by 36% each year. This change in EPS is reasonably close to the 31% average annual decrease in the share price. So it seems like sentiment towards the stock hasn't changed all that much over time. In this case, it seems that the EPS is guiding the share price.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Sangfor Technologies' earnings, revenue and cash flow.

A Different Perspective

Sangfor Technologies shareholders are down 26% for the year (even including dividends), but the market itself is up 7.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Sangfor Technologies (1 is concerning) that you should be aware of.

Of course Sangfor Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300454

Sangfor Technologies

Provides IT infrastructure solutions in China and internationally.

Fair value with moderate growth potential.